If you are a newcomer to the Forex market, the process of learning obviously should start from the question who are the brokers and what functions do they fulfill in the financial markets. The broker is a financial company which offers the possibility to trade currency tools, metals, raw materials and stocks. Brokers perform all trading activities of their clients called traders whose essence consists in buying or selling the financial instruments. To choose the broker is the first dilemma which is faced by beginning traders on their way to profitable Forex trading.

So, to choose a Forex broker follow these steps:

Step 1. Define the most profitable characteristics for you

Minimum deposit.

To start trading trader has to possess a certain minimum amount of money on the trading account. Many broker companies have such requirement, but the tendency shows a decrease or complete cancellation of the starting amount needed for the client to start a trading activity. Therefore, a low minimum deposit or its absence can play an important role in the broker's choice.

Spread and commissions.

These are two types of rewards which brokers receive from each transaction made by their clients. The spread is a difference between a purchase price and a selling price of a currency pair or other asset. Spreads are divided into fixed and floating. The fixed spread is set by the broker and its value is always invariable, the size of floating spread is created depending on the current market conditions and can repeatedly change throughout the day. Some brokers establish commission assignments which aren't connected with spreads and are paid separately (as a rule, it is fixed payment for each transaction). If you don't want to increase the expenses due to higher spreads and commissions, choose brokers with the lowest spreads and without additional commissions.

Leverage.

In Forex market trading, traders often use service of capital borrowing from brokers in order to increase the income from transactions made by them. The service of crediting provided by brokers allows traders to place the orders much higher than a current trading capital. The leverage 1:100 means that the broker gives to the trader opportunity to perform transactions by 100 times exceeding the size the amount on his trading account. Some brokers provide to the clients the maximum leverage up to 1:1000 and above that allows increasing transaction amount, but risk level increases in the same proportion.

Minimum order size (lot).

The standard lot is usually equal to 100 000 currency units (for example, American dollars if you have an account in USD). If in broker's trading conditions is specified the size of the minimum transaction of 1 lot, it means that the transaction amount on the customer account can't make less than 100 000 units of currency. One unit of currency is 0,0001 lots. Thus, if the minimum lot of the broker is equal to 0,0001, the minimum transaction will constitute 10 units of currency, if 0,001 - 100 units, 0,01 - 1000 units, 0,1 - 10 000 units. Take into account this point while choosing a broker.

Account types.

The account types provided by brokers deserve a thorough examination. Usually, the standard set includes demonstration accounts, standard real accounts with Instant execution/Market execution modes and the ECN accounts created for the professional market speculators. For newcomers will be especially important availability of cent accounts (mini or micro accounts). Their peculiarity consists in possessing absolutely the same trading conditions and parameters of orders execution, as on standard accounts with the base currency of the trading account nominated in US dollars, transition to the cent nomination of base currency reduces possible risks for the beginning traders exactly by 100 times (1 USD = 100 Cent). Using this kind of accounts, beginners has an opportunity to master trading skills and working methods on Forex without large financial losses.

Withdrawal of funds from the account.

Many traders stop on the specific broker only convincing that funds withdrawal corresponds to their requirements and expectations. The broker becomes more attractive to the traders if he provides several methods of withdrawal. Pay the attention, if the broker offers funds withdrawal on bank cards, through payment system accounts and by means of bank transfer - a variety in this question will never be superfluous.

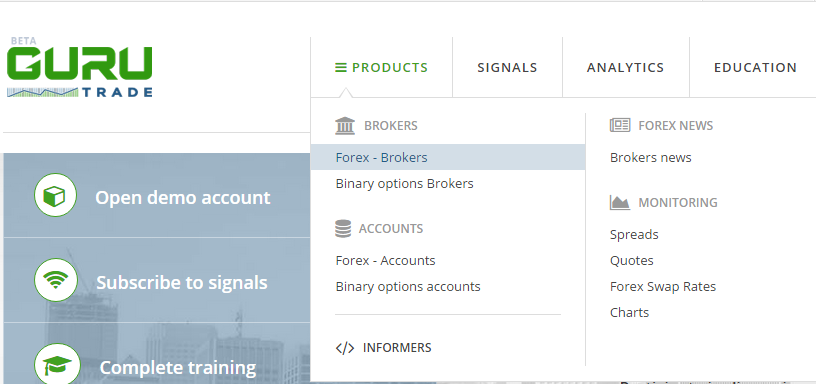

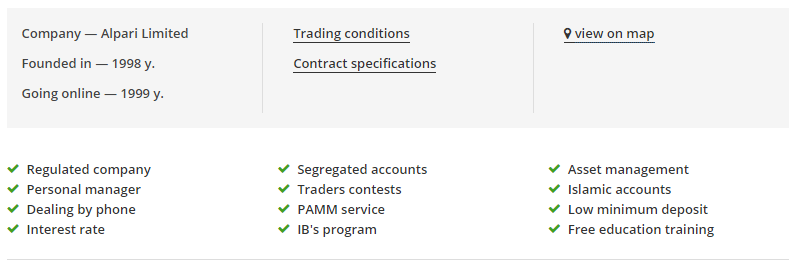

You learn these and other brokers' characteristics in the GuruTrade catalog of Forex brokers. It is worth to be mentioned that the Rating of brokers is arranged by GuruTrade team considering a set of indicators including all above-named characteristics. The higher rating owes a broker, the higher place he occupies in our catalog.

Step 2. Find out, what regulating authority controls broker's activity

Choosing a broker pay attention, whether companies are controlled by the relevant regulating organizations. It is necessary to be sure that the broker executing trading orders according to all requirements of regulating authority. In the GuruTrade Forex brokers catalog regulated brokers are marked out by a green tick in the column “Regulation”. Most of the European brokers are regulated by such structures as Financial Conduct Authority (FCA, Great Britain), German Federal Financial Supervisory Authority (BaFin, Germany) and Cyprus Securities and Exchange Commission (CySEC).

In case of the disputable situations arising between the broker and the trader, it will be simpler to protect the client's rights, relying on broker company activities controls by official financial regulators.

Step 3. Learn if the broker has a good reputation? Discover other traders' opinion about the broker

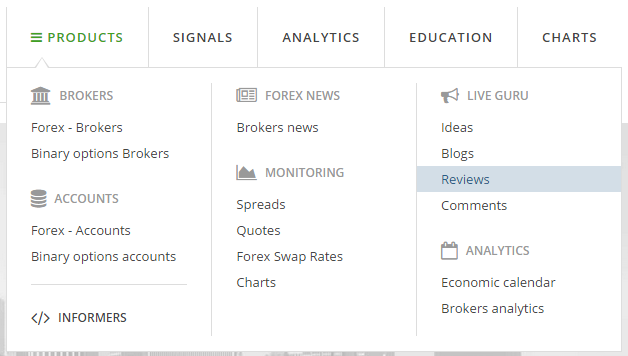

The reputation of the broker depends on the quality of the services provided by the company. Such parameters as a speed of order execution, quality of communication, time of funds deposit/withdrawal strongly influence clients' opinion as have an essential impact on the obtained profit. Before starting the collaboration with the broker, study his clients' opinions expressed in comments. You can read and leave reviews about brokers on GuruTrade as in the section “Reviews”, so directly in the profile of each broker.

Step 4. Learn the broker's level of software and security

If the broker doesn't require confirming your personality at registration, using one of the existing verification methods, you should place a question mark over his reliability. Especially it is important when you open a real trading account. Also, it should be noted that the reliable broker to guarantee the safety of funds withdrawal demand to confirm at least your phone number and to send the scan copy of the document proving your identity.

Before a final choice of the broker, it is necessary to find out, on what trading platforms, it will be possible to trade and whether to exist their mobile versions. Also, you should check if the broker offers to trade through a browser application, without downloading and installing on the computer of any additional software.

To find out about mobile trading and platforms provided by the broker, visit the broker's personal profile on our site. To learn what points gathered broker in rating, go to the broker's card, the specification is available after clicking the rating points. For visitors' convenience, here is presented the user Rating, broker's trading conditions and links for opening demo and real accounts.

Step 5. Specify, whether the broker gives support to the clients

Make sure that you will always have an opportunity to address in the Support service of your company by several various methods. The reliable broker always has support specialists knowing several foreign languages and capable of consulting the client on English, Chinese, Russian, German and other languages, widespread in the world. On the site of the broker, there shall be registration number and contact information: legal and actual addresses of the central office, contact phone number, and E-mail. Live chat and personal manager for every client will be a great virtue.

This information can be found in the profile of a specific broker on GuruTrade directly under information on trading accounts.

Step 6. Compare brokers if you have doubts

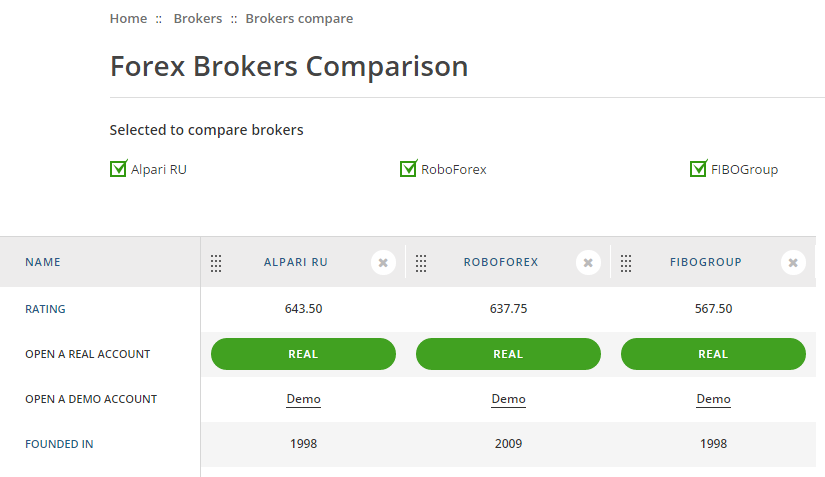

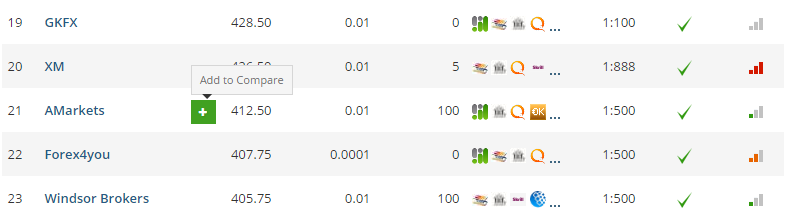

After research, you can select several brokers. The GuruTrade unique option of brokers comparison will help you to make a final choice. To compare brokers, it is enough to click the button “Add to compare” opposite to the name of the broker in the table.

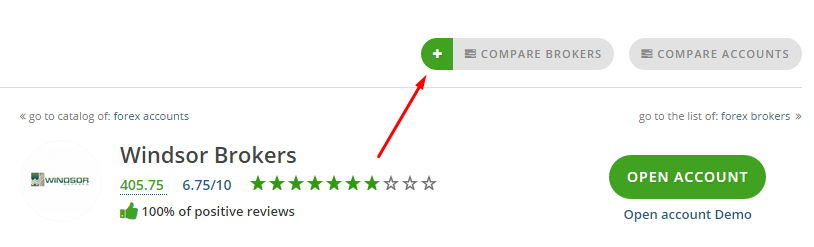

You can click on the “+” button to add the broker to the comparison right on the brokers profile page:

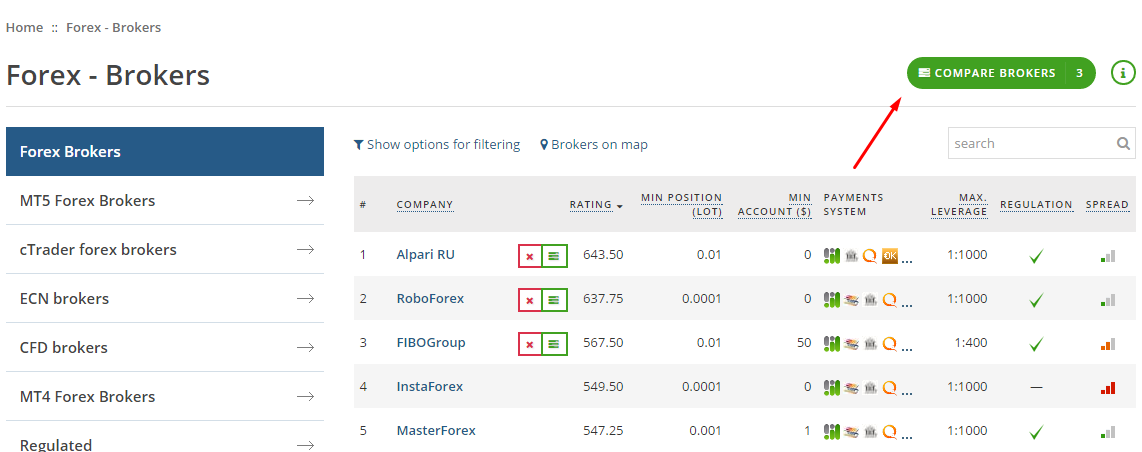

Pressing the button “Compare brokers” you will be sent to the page where will be compared brokers chosen by you.

On the opened page you can change the position of brokers' cards, delete or add brokers, without leaving the page: