We wrote yesterday about today’s Bank of Japan meeting and how there could be a possible shift in policy which would have big implications for the yen.

But we didn’t expect this to happen until potentially after Governor Kuroda’s term had expired in April next year.

So, while the market was drifting into a festive slumber, this morning’s tweak by the BoJ is a seismic surprise, to say the least!

What did the BoJ say? And how did markets respond?

The bank announced it was lifting the 10-year yield curve cap to /-0.50% from /-0.25%.

It also said it would increase its bond purchases to JPY9 trillion a month compared to the current JPY7.3 trillion in the first quarter of next year.

The shock decision sent waves through financial markets.

Japanese stocks fell around 2.5% though it clawed back some losses. US equity futures also sank into the red with yield-sensitive growth and tech stocks hurt the most.

Global bond yields inevitably jumped with the widely watched 10-year US Treasury pushing up above 3.66%.

Gold has climbed with bugs eyeing up recent highs above $1820.

Policy tweak has wider implications?

Today’s change by the Bank of Japan essentially allows higher interest rates in the current inflationary environment.

This is despite the bank still officially targeting 0.00% as the outright target.

Governor Kuroda warned markets in his press conference that the yield curve control tweak is not a rate hike. He pushed back strongly against such speculation and said a further widening of the yield band is not needed.

But the timing of this change may encourage markets to see this as laying the foundation for more policy normalisation under a new governor when their term starts in April.

The uber-dovish Bank of Japan has been the chief outlier among major central banks this year and the main reason for yen weakness.

Investors will be assessing if this tweak heralds a wider change in policy at the bank which could then spill over into global bonds and stock markets.

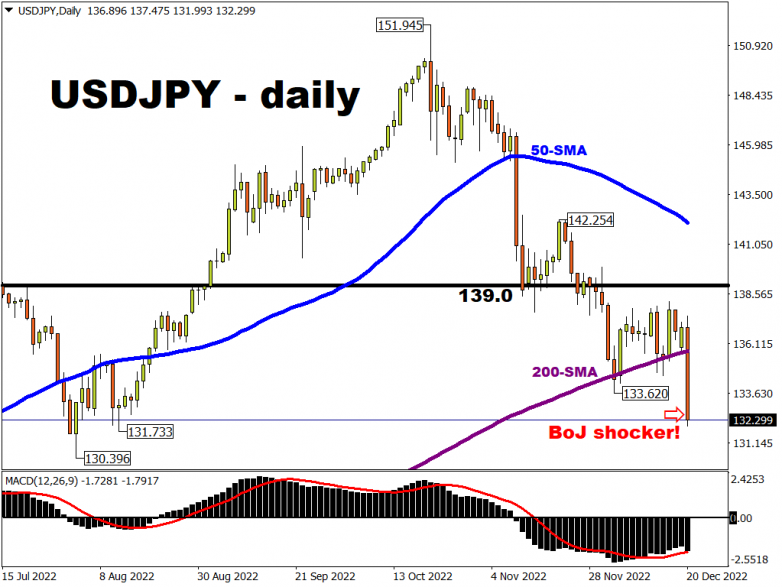

USDJPY sinks to lowest since August

For now, yen pairs have dropped over 3% with USD/JPY touching four-month lows.

The 200-day simple moving average at 135.73 had been acting as support recently. But today’s plunge has taken the major through that and also the cycle and December low at 133.62.

The midway point of this year’s rally is around 132.70 so today’s close could be significant if it prints below here as well.