Rates as of 05:00 GMT

Market Recap

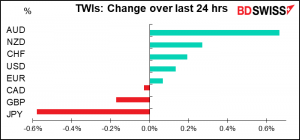

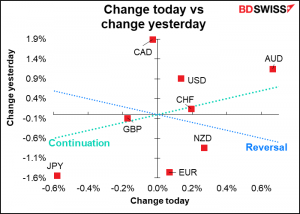

A major “risk-on” day in the FX market, as you can tell from the fact that AUD is at the top of my list and JPY is at the bottom.

How did this happen when stock markets were generally lower, including -0.7% for the S&P 500 and most Asian markets in the red this morning?

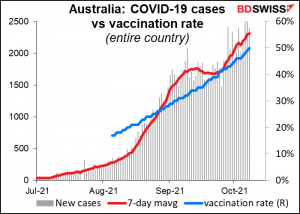

First, AUD. The economy is likely to get a boost – and the Reserve Bank of Australia could start to normalize policy – as the country gradually exits lockdown. New South Wales (NSW), the largest state in the country by population, started its phased reopening Monday for fully vaccinated people as the state passed its 70% double vaccination target. The second phase of its reopening plan will probably begin in the next week or two after the vaccination rate exceeds 80%. Victoria is also likely to start reopening later this month.

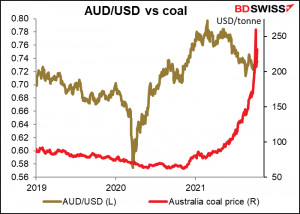

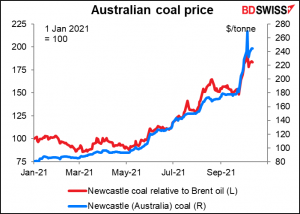

Moreover, with the price of Australian coal going vertical, the FX market can hardly ignore the improvement in the country’s terms of trade. Australian coal futures were up 12% and coal futures jumped by a similar amount in China yesterday (plus another 6.4% today) to a record high on reports that heavy flooding in Shanxi had closed 60 of the 682 coal mines in the province. (Shanxi accounts for some 30% of China’s coal supply). China has taken a number of steps to increase coal production but faces a potential shortfall of 30mn-40mn tons in Q4 regardless, according to Citic Securities. That’s a great opportunity for Australia.

Coal had been in the doldrums because of environmental concerns, but desperate times call for desperate measures. Coal has appreciated much more this year than oil has.

Coal had been in the doldrums because of environmental concerns, but desperate times call for desperate measures. Coal has appreciated much more this year than oil has.

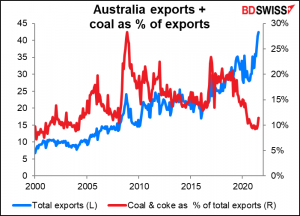

Coal has lost out to iron ore as Australia’s largest export by value, but still accounts for over 10% of total exports.

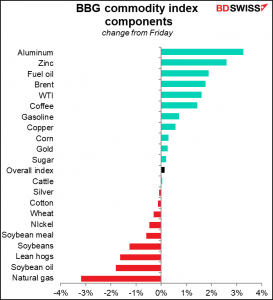

Coal was hardly the only commodity to gain. Energy and industrial metals gained further, making it harder for central banks to maintain that the current bout of inflation is only temporary.

There was one point of respite though: natural gas prices retreated further. Dutch natural gas, which seemed to be channeling the spirit of Dutch tulips from long ago, is now down an astonishing 47% from the intraday high that it hit on Oct. 6th (EUR 155.0 MWh

Source: BDSwiss