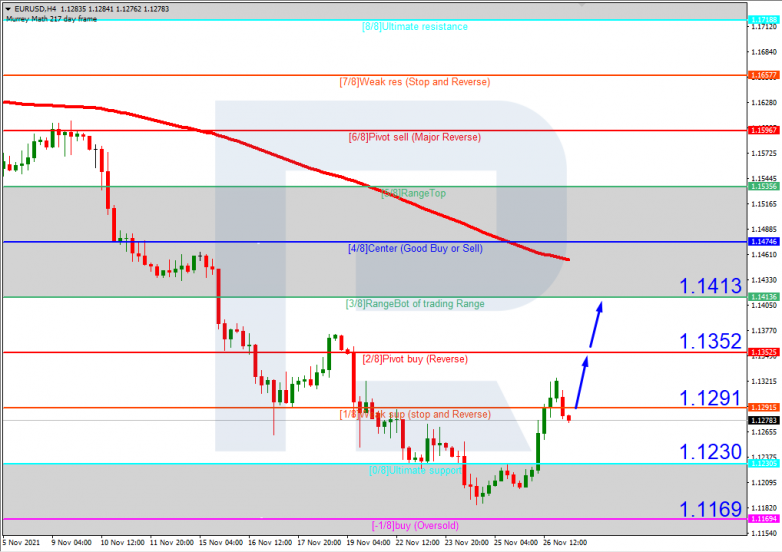

EURUSD, “Euro vs US Dollar”

In the H4 chart, after breaking 0/8 to the upside and leaving the “oversold area”, EURUSD is expected to break 1/8 and then continue growing to reach the resistance at 3/8. Since the current trend is descending, this upward movement should be considered as a correction. Still, this scenario may no longer be valid if the price breaks 0/8 to the downside. After that, the instrument may fall towards the support at -1/8.

As we can see In the M15 chart, the pair has broken the upside line of the VoltyChannel indicator and, as a result, may continue its growth.

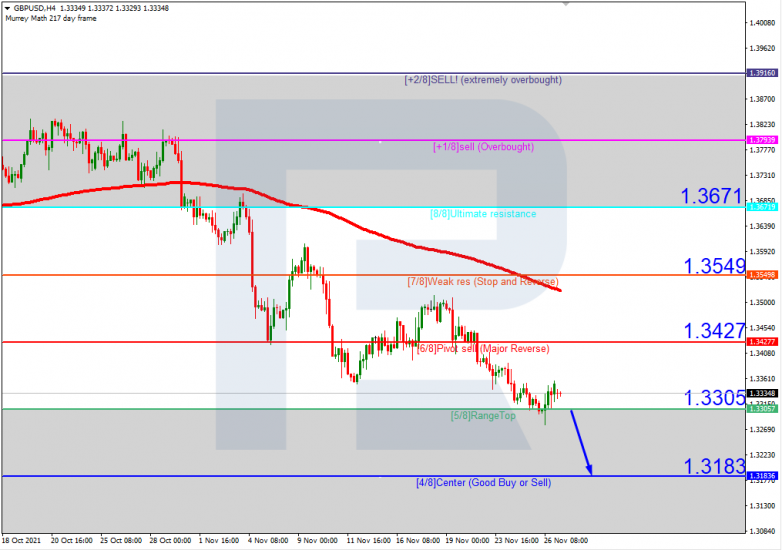

GBPUSD, “Great Britain Pound vs US Dollar”

In the H4 chart, GBPUSD is trading below the 200-day Moving Average, thus indicating a descending tendency. In this case, the price is expected to re-test 5/8, break it, and then continue falling towards the support at 4/8. However, this scenario may no longer be valid if the price breaks 6/8 to the upside. After that, the instrument may correct to reach the resistance at 7/8.

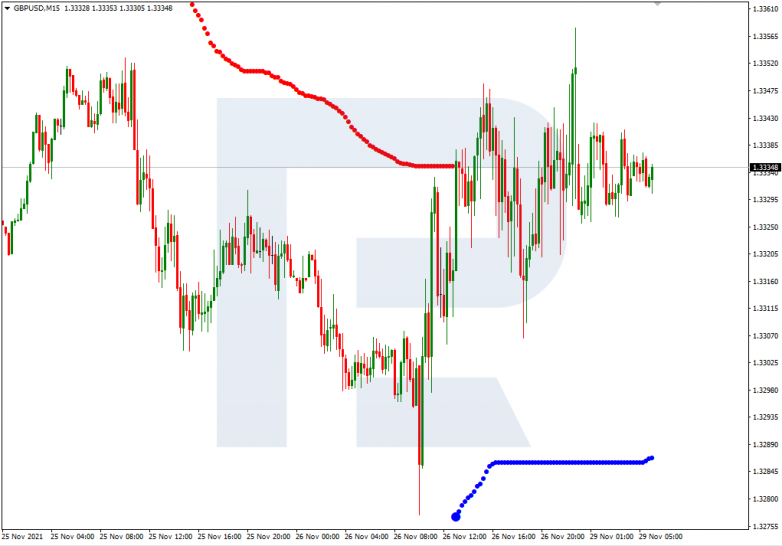

As we can see in the M15 chart, the downside line of the VoltyChannel indicator is pretty far away from the price, that’s why the pair may resume trading downwards only after breaking 5/8 in the H4 chart.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.