Previous Trading Day’s Events (21.03.2024)

- The Swiss National Bank surprised the markets with an interest rate cut by 25 basis points to 1.50%. The SNB’s loosening of monetary policy suggests inflation is under control. The rate cut was the Swiss Central Bank’s first in nine years

After the Federal Reserve projected a less restrictive policy stance than expected on Wednesday, risk assets worldwide soared, as did the outlook for investment flows to the U.S.

“The flow of currency into the United States remains essentially unstoppable at this point given the optimism around where the U.S. economy is headed,” said Karl Schamotta, chief market strategist at Corpay in Toronto.

Fed Chair Jerome Powell said on Wednesday that recent high inflation readings had not changed the overall story of slowly easing U.S. price pressures.

“The big question from here for the dollar will be: does the pace of inflation that we saw in January and February sustain or does it start to slow down?” said Brian Daingerfield, head of G10 FX strategy at NatWest Markets in Stamford, Connecticut.

The differential in U.S. interest rates and those of other major economies also helped the dollar.

Source: https://www.reuters.com/markets/currencies/dollar-slips-fed-stays-course-aussie-jumps-jobs-data-2024-03-21

- Britain’s economy is “moving in the right direction” for the Bank of England to start cutting interest rates, Governor Andrew Bailey said.

The BoE’s rate-setters voted 8-1 to keep borrowing costs at their 16-year high of 5.25% on Thursday, as the two officials who had previously called for higher rates changed their stance.

Recent communications suggest the MPC is gaining confidence that inflation will fall sustainably back to the 2.0% target.

Source: https://www.reuters.com/markets/rates-bonds/view-bank-england-interest-rate-decision-2024-03-21/

______________________________________________________________________

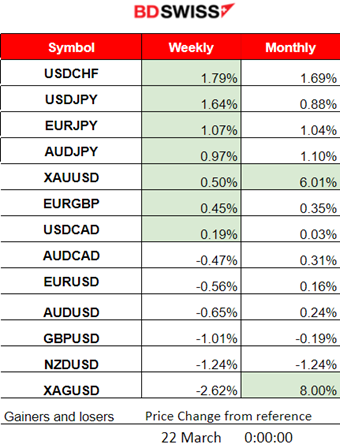

Winners vs Losers

USDCHF leads with 1.79% this week as the dollar strength has fully reversed and the CHF lost ground after the SNB decided to cut rates yesterday.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (21 Mar 2024)

Server Time / Timezone EEST (UTC 02:00)

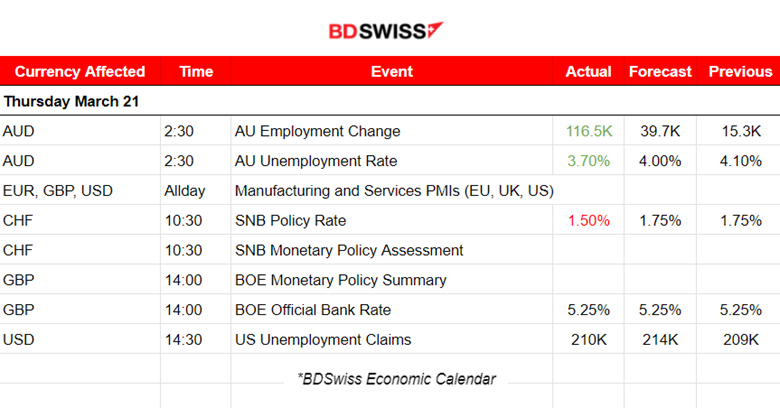

- Midnight – Night Session (Asian)

Employment data for Australia were reported at 2:30. Australia’s Employment: 116.5K change against the expected 39.7K! This caused AUD appreciation but the jump in the AUDUSD was roughly 30 pips this morning, it obviously continued higher after the event. As the U.S. dollar is currently strengthening the pair reverses to the downside again.

- Morning–Day Session (European and N. American Session)

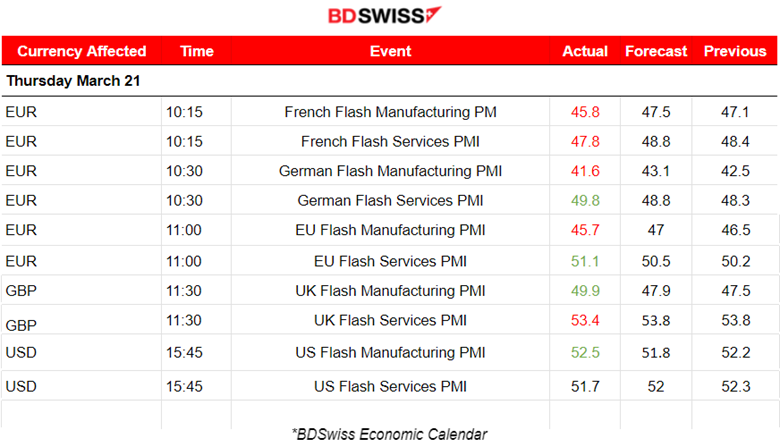

PMIs:

Eurozone:

Eurozone:

In France: Both PMIs fell beyond expectations. The French private sector business activity seems to fall at a slightly faster pace according to the report, remaining in contraction territory at the end of the first quarter. The faster fall in output came amid a quicker deterioration in demand for French goods and services, with this also contributing to a renewed decrease in employment.

The PMI report in Germany shows that the economy eased slightly in March. Business activity in the country’s service sector came close to stabilising. Business confidence towards future activity continued to improve. The manufacturing PMI was reported at 41.6 points. The Services PMI improved to 49.8 points.

In the Eurozone, the economy is close to stabilising in Marcha amid price pressures easing. A modest recovery of service sector output gained momentum, accompanied by a softening in the rate of manufacturing output decline. Services selector PMI in expansion with the figure at 51.1 points.

U.K. PMIs:

U.K. private sector output continues to rise at a solid pace in March, largely reflecting increasing business activity in the service economy. The Services PMI remains close to 53 points in expansion while the manufacturing PMI remains very close to 50 points, the level that separates expansion from contraction.

U.S. PMIs:

U.S. business activity continued to rise amid a marked upturn in manufacturing production. The manufacturing sector expanded by the most since mid-2022 as production and factory employment growth accelerated. Manufacturing output growth was the strongest since May 2022, driven by improving demand both at home and abroad. The PMI in manufacturing shows 52.5 points, even above the Services sector PMI figure. Both in expansion indicating the U.S. sustainable strong business conditions.

At 10:30, Switzerland surprised with a rate cut. The Swiss National Bank (SNB) announced that they decided to ease monetary policy and lower the SNB policy rate to 1.5%. We have interest rate cuts! SNB sees 2024 inflation at 1.4%, 2025 at 1.2% and 2026 at 1.1%.

On the other hand, at 14:00, the Bank of England (BOE) announced its decision to keep rates unchanged. BOE will probably want to see April and May inflation data before doing anything, and that pitches June as the earliest date for the first rate cut. Notable to say that one member preferred to reduce the Bank Rate by 0.25 percentage points, to 5%.

General Verdict:

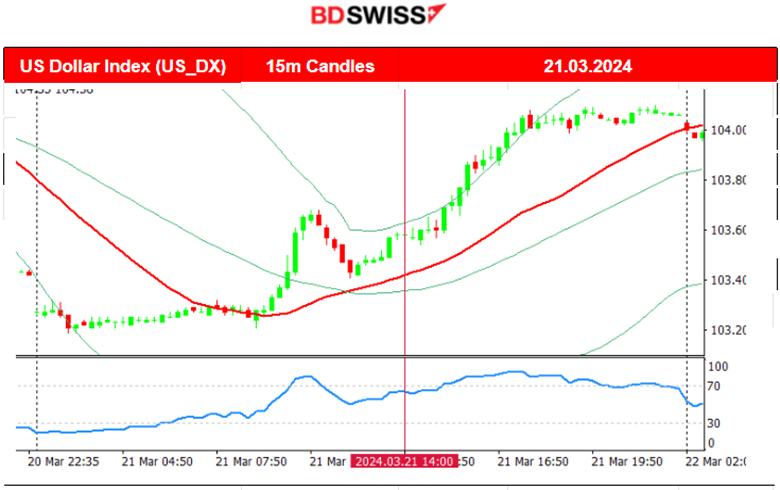

- Volatile FX market. USD strengthening, reversing from the downside.

- Gold moved to the downside due to dollar appreciation.

- Crude oil dropped.

- U.S. indices kept rising with US30 gaining the most.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

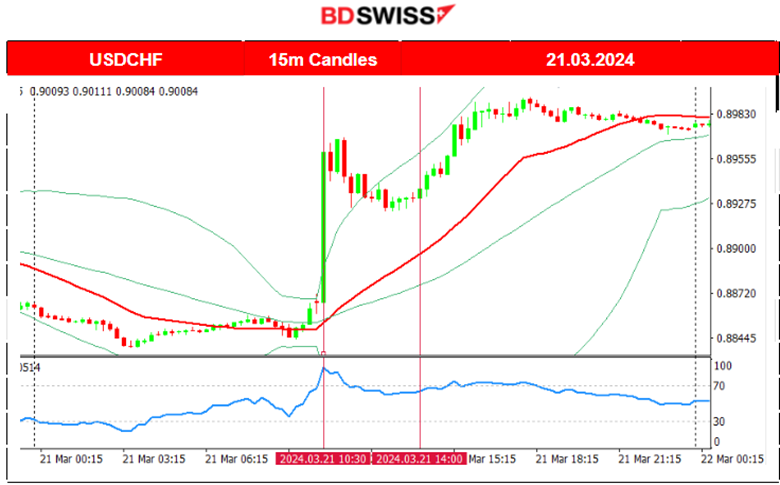

USDCHF (21.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 02:00)

Price Movement

The SNB has surprised the market with the interest rate cut, causing CHF to weaken, and with the U.S. dollar gaining back its strength, the pair has been on an uptrend since yesterday.

GBPUSD (21.03.2024) 15m Chart Summary

GBPUSD (21.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 02:00)

Price Movement

The pair was moving sideways during the Asian session but that changed when the European session was near. After it started the pair moved to the downside rapidly since the USD was experiencing strong appreciation against other currencies. The BOE decided to keep rates unchanged and the market expects that August could be the month of a first move interest rate cut. Since the news was released the GBP started weakening causing a further drop for the pair.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 4H

Server Time / Timezone EEST (UTC 02:00)

Price Movement

Bitcoin suffered losses recently dropping from the peak at 74K, moving below the 30-period MA of the H4 chart and continuing downwards until the FOMC event. After the news and during the press conference, Bitcoin saw a rise, returning back to the mean.

It currently settles near 67K USD.

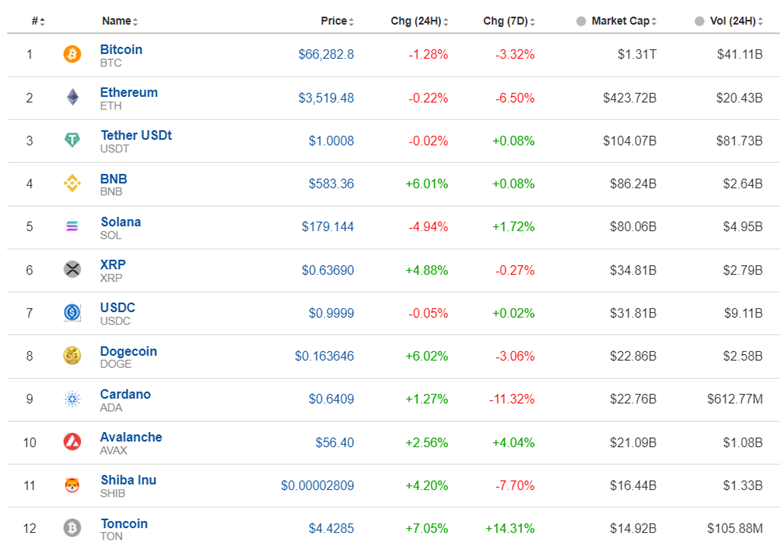

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Crypto assets finally see some halt after a long downtrend and seemingly retracement. It seems that the market is sideways for now and could see an uptrend if aggressive inflows start to take place.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 02:00)

Price Movement

On the 18th of March, the index moved rapidly upwards and then retraced again to the MA. On the 19th of March, it moved sideways as mentioned in our previous analysis. After the FOMC event, all U.S. indices saw a jump. The market expects now that borrowing costs will lower soon or as expected this year, sparking this upward movement and resilience to the downside. The Dow Jones moved even higher and all three benchmark indices are now stable at high levels despite dollar’s surprising strengthening.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 02:00)

Price Movement

Crude oil remains on the downside under the 30-period MA. It found a peak at 83 USD/b on the 19th of March and then retraced to near 80 USD/b. It could be the case that it moves above the MA and reaches the next resistance at 82 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 02:00)

Price Movement

FOMCE: Powell decided yesterday to ignore the inflation data and their statements gave even a hint that rate cuts will proceed as expected. Gold Jumped near 65 USD as the USD depreciated heavily during the press conference. Currently, the dollar shows abnormal strength causing Gold to wipe out the gains since the FOMC news.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (22 Mar 2024)

Server Time / Timezone EEST (UTC 02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The U.K. Retail sales had no increase as the change was reported with a figure 0%. Sales volumes in clothing and department stores grew because of new collections but falls in food stores and fuel retailers offset this growth. The market reacted little to this release. The GBPUSD pair moves to the downside due to strong USD appreciation.

Canada’s retail sales figures are reported at 14:30. They are expected to be reported lower, with a decline. However, this decline might not be as great as in the case of U.K. retail sales. CAD pairs might be affected but the impact should be minimal in such market conditions.

General Verdict:

- Volatility continues today as the dollar continues to gain traction. The FX market is experiencing a drop in major pairs with the dollar as a quote currency. Other assets such as Gold are also affected. Highlights from sources: “The U.S. dollar was set for a second week of broad gains on Friday, with even a rate hike in Japan unable to halt its march, and a surprise cut in Switzerland highlighting the gap between the Federal Reserve and global peers in interest rate settings.” The Fed also stated one more time that it will not start moving until it has more confidence that inflation is sustainably falling toward 2%. When looking for explanations of why the dollar keeps strengthening we can find many, however looking at the Fedwatch tool and the probability for a cut in June to remain close to 70%, It would be safe to conclude that the above reasons related to interest rate gap suffice for explanation of this market reaction.

- Gold falls.

- Crude oil closed lower.

- U.S. indices stabilised higher for now.

______________________________________________________________

Source: BDSwiss