Bitcoin is up 9% over the past week, ending at around $41,700. Ethereum is up 15%. Altcoins also woke up from hibernation and grew stronger than the market: from 5.8% (Binance Coin) to 17.3% (Solana).

Over the same period, the total capitalization of the crypto market, according to CoinGecko, grew by 11.2%, up to $1.99 trillion.

The primary growth of the crypto market last week came on Friday when bitcoin at the end of the day soared by 10% in a few hours. The increase was not prevented even by strong data on the US labour market, which came out a couple of hours before the jump.

It is worth noting that the Nonfarm Payrolls can force the Fed to move faster to tighten monetary policy. Against this background, the yield of 10-year Treasuries jumped above 1.93%, hitting new two-year highs, and this could soon lead to sales in the stock market. If cryptocurrencies manage to resist and continue to grow, this will be a serious trend reversal order. Just like on Friday, when investors decided to buy BTC in order to protect investments from inflation.

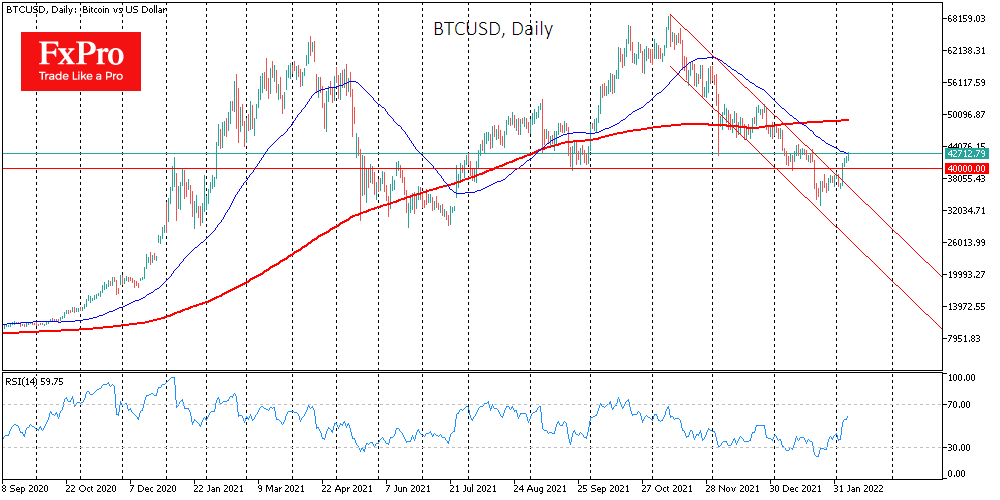

Since then, Bitcoin has already added 17%, moving into a phase of an active uptrend. Technically, the first cryptocurrency broke the resistance of the descending corridor. Accelerating growth and steady buying throughout the weekend indicate a strong bullish momentum. Cautious investors are now looking at the test of the 50-day moving average. Previously, repeatedly fixing above this line preceded a multi-month uptrend.

Potentially, this will also be lost now. Therefore, some players consider this impulse as an important first signal of a recovery in demand for risky assets, despite fears of a rate increase.

Meanwhile, billionaire Ray Dalio has warned that a number of governments could outlaw cryptocurrencies. The government of the Russian Federation is considering introducing a tax on miners of at least 15%. In the meantime, the Fed has presented the Digital Dollar White Paper, but the issue of its future launch has not yet been resolved.

Источник: FXPro