Previous Trading Day’s Events (09.05.2024)

- The Bank of England: start interest rate cuts as soon as next month and Governor Andrew Bailey said there could be more reductions than investors expect.

The BoE’s Monetary Policy Committee kept rates at a 16-year high of 5.25%. After cutting rates in March 2020 as the coronavirus pandemic swept the world, the BoE began raising borrowing costs in December 2021 to counter high inflation which peaked at 11.1% in October 2022.

The central bank remains on guard as there is still strong growth in wages and services prices which it expects to temporarily push inflation above 2% later this year.

Bailey: “We need to see more evidence that inflation will stay low before we can cut interest rates,” he said. “I’m optimistic that things are moving in the right direction.”

Source: https://www.reuters.com/markets/europe/bank-england-clears-path-its-first-rate-cut-since-2020-2024-05-09

- The number of Americans filing new claims for unemployment benefits rose last week to the highest level in more than eight months, further evidence that the labour market is cooling.

Initial claims for state unemployment benefits increased by 22,000 to a seasonally adjusted 231,000 for the week ended May 4, the highest level since the end of last August.

It follows reports last week which showed the economy added the fewest jobs in six months in April while job openings dropped to a three-year low in March.

Expectations for an interest rate cut from the Federal Reserve at its September policy meeting rose slightly to 50% after the release of weekly jobless claims according to the CME FedWatch tool.

Source: https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-more-than-expected-2024-05-09/

______________________________________________________________________

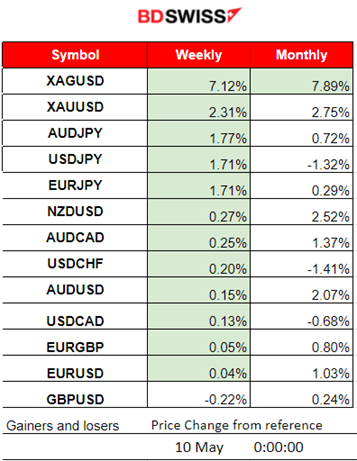

Winners vs Losers

Metals turn to the upside. Silver and Gold are on the top of the week’s gainer’s list with 7.12% and 2.31% respectively. JPY pairs (JPY as a quote) follow as JPY is still weakening heavily against other currencies. The dollar suffered depreciation due to higher-than-expected unemployment claims in the U.S.

______________________________________________________________________

______________________________________________________________________

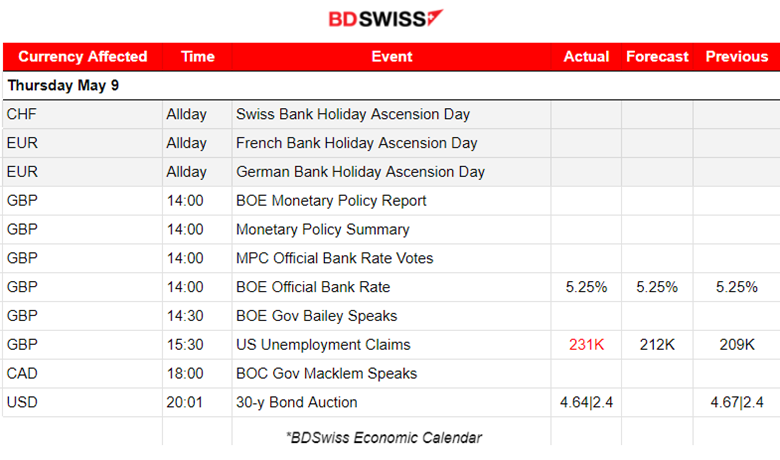

News Reports Monitor – Previous Trading Day (09.05.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

The Bank of England (BoE) decided to keep rates steady. At its meeting ending on 8 May 2024, the MPC voted by a majority of 7–2 to maintain the Bank Rate at 5.25%. This decision was taken after taking into account that inflation is over 3% but it is slowing down. The labour market shows stability instead of significant cooling. BoE’s Governor Bailey said that they will likely need to cut the bank rate over the coming quarters and is confident that inflation will reach the target level in the coming months. The GBP depreciated at the time of the decision release but the effect was not great.

U.S. Unemployment claims surprised the markets with a way higher than expected figure at 231K versus the previous 209K triggering expectations that the labour market is cooling significantly recently. These new figures coincide with the recent and quite low NFP numbers that suggest the labour market is cooling. Since these data add to the possibility that inflation might lower in the future, the market reacted with USD depreciation after the release and the effect lasted until the end of the trading day with continuous dollar weakening.

General Verdict:

- Moderate volatility in FX with GBP and USD currencies to be affected greatly by the news.

- Gold moved to the upside overall, partly due to the dollar weakening.

- Crude oil experienced moderate volatility and closed slightly higher as well.

- U.S. indices returned to the upside and closed higher.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

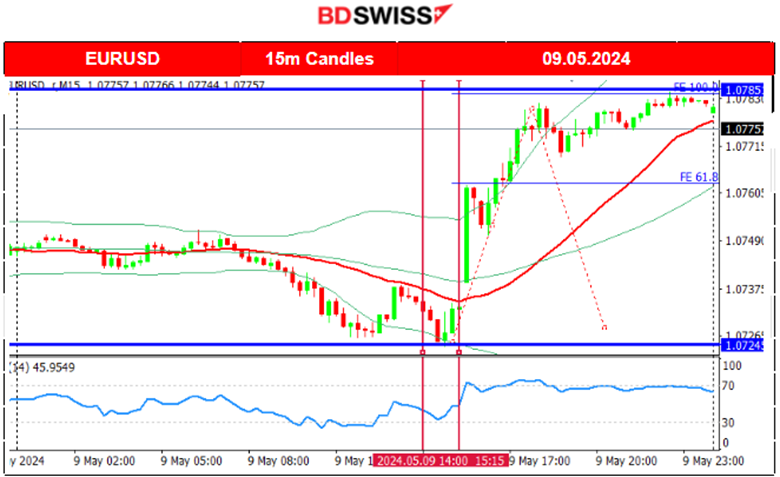

EURUSD (09.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair was moving with low volatility around the 30-period MA but moved eventually to the downside greatly until the next support at near 1.07245. The news that greatly affected the USD took place at 15:30. The high unemployment claim figure released at that time shook the markets and caused the dollar to weaken. The EURUSD jumped near 50 pips and settled higher near the resistance at 1.0785. No retracement took place and it is apparent that the dollar is the main driver of the price path.

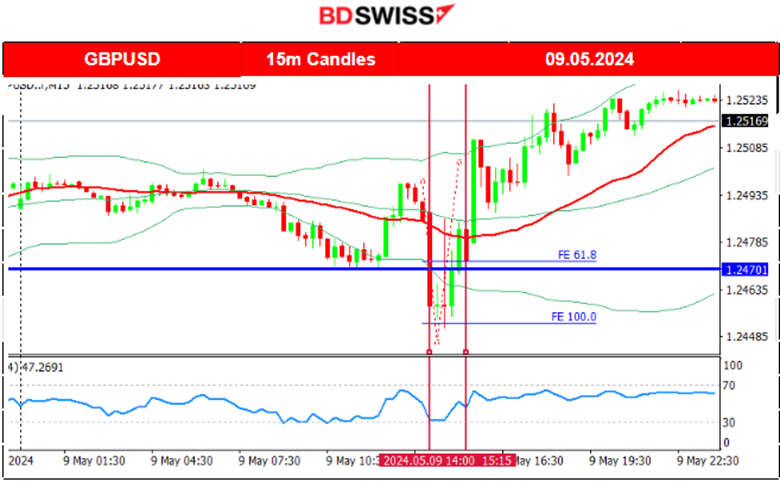

GBPUSD (09.05.2024) 15m Chart Summary

GBPUSD (09.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Similar path for the EURUSD before the news. The pair moved to the downside reaching the lower band of the 50-period Bollinger Bands as volatility levels started to increase and reversed to the 30-period MA. During the BoE rate decision event, the GBP depreciated against other currencies. GBPUSD dropped near 40 pips before retracing to the MA and the 61.8 Fibo level. It remained close to 1.24700 but that changed with the U.S. unemployment claims figure release. The USD depreciated heavily causing the pair to jump and maintain a steady upward movement to the resistance at near 1.25235.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Bitcoin remained below 65.5K USD these past days and does not show any significant signs of moving to the upside at all.

A triangle formation was breached on the 7th of May and this caused its price to drop to near 62K. This downside movement was a retracement to the 61.8% of the rapid large movement that started on the 2nd of May and from the support at near 56.5K USD.

A clear downward channel for Bitcoin and possible triangle formation has been broken on the 9th causing the price to jump to around 63K.

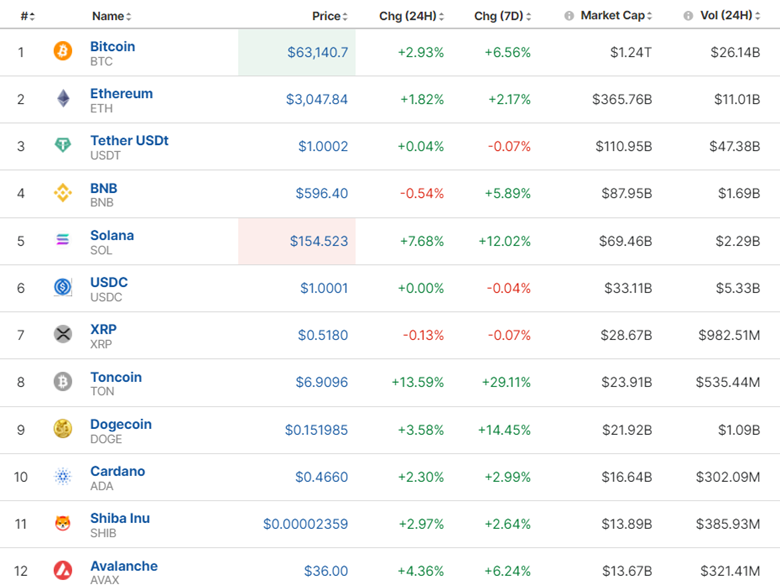

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market stays volatile with a notable recent correction to the upside. That might indicate a sideways progression for now.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

After testing the intraday highs, the index started to move upwards remaining above the 30-period MA and kept breaking resistance levels. A clear uptrend. On the 7th of May, the RSI indicated a slowdown and bearish divergence. The slowdown was confirmed and the index moved sideways. A triangle formation is apparent when moving into the 9th of May. That triangle formation has broken as the price moved to the upside after the U.S. Unemployment claims figure release, causing indices to experience a jump.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

It seems that Crude oil was following a downward channel while moving around the 30-period MA. That channel broke with the next support being reached on the 8th of May at near 76.70 USD/b. The price reversed remarkably on the same day to the upside breaking the channel to the upside. The upward movement continued but found resistance at near 79.5 USD/b. An upward wedge is currently formed and its breakout to the downside might cause the price to drop rapidly to 78.8 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The price on the 6th of May jumped until the resistance at near 2,330 USD/oz before eventually reversing to the MA and the 2,305 USD level. A strong consolidation phase is quite apparent, formed by a sideways and quite volatile price movement. The range is between 2,320 USD/oz and the 2,305 USD/oz level. That consolidation had broken yesterday after the U.S. unemployment claims figure release. Gold’s price jumped after USD depreciation took place and broke the consolidation, reaching the resistance of 2,330 USD/oz as predicted in our previous analysis. Later that resistance broke as well causing the price to jump further to the upside.

______________________________________________________________

______________________________________________________________

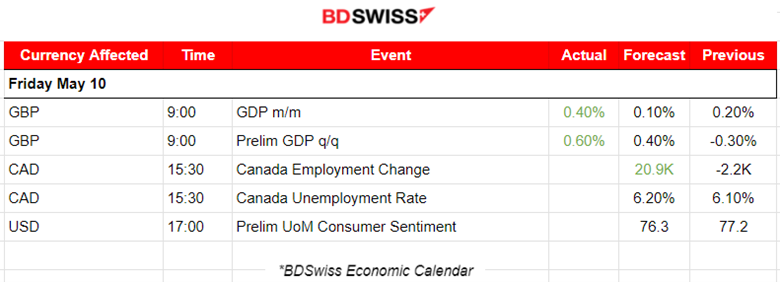

News Reports Monitor – Today Trading Day (10 April 2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

The monthly real gross domestic product (GDP) in the U.K. is estimated to have grown by 0.4% in March 2024, following growth of 0.2% in February 2024 (revised up from 0.1% growth in our previous publication) and an unrevised growth of 0.3% in January 2024. Real GDP is estimated to have grown by 0.6% in the three months to March 2024, compared with the three months to December 2023. On a quarterly basis, this gives growth of 0.6% in Quarter 1 (Jan to Mar) 2024, following declines of 0.3% in Quarter 4 (Oct to Dec) 2023 and 0.1% in Quarter 3 (July to Sept) 2023. The market reacted with GBP appreciation at that time. GBPUSD jumped near 24 pips before retracement took place.

General Verdict:

- Moderate volatility in the FX market. Friday mood. GBP has already been greatly affected by the news. The dollar shows signs of testing the lows and probably continuing with its downside movement.

- Gold is moving upwards aggressively.

- U.S. oil is volatile and currently reverses from the intraday upside movement.

- U.S. indices are showing signs that they will continue with the short-term uptrend.

______________________________________________________________

Source: BDSwiss