PREVIOUS TRADING DAY EVENTS – 28 July 2023

- The Bank of Japan (BOJ) left rates unchanged again, BOJ Policy Rate remained at -0.10%. The Policy Board decided to conduct yield curve control with greater flexibility, surprising the market with a yield curve control tweak.

While the BOJ kept interest rates at ultra-low levels, it said the tweak to its bond yield curve control scheme (YCC) would allow it to respond “nimbly” to risks including rising price pressures.

BOJ maintained guidance allowing the 10-year yield to move 0.5% around the 0% target, but said those would now be “references” rather than “rigid limits”.

The BOJ said it would offer to buy 10-year Japanese government bonds at 1.0% in fixed-rate operations, instead of the previous rate of 0.5%, signalling that it would now tolerate a rise in the 10-year yield to as much as 1.0%.

“Although the BOJ left the cap unchanged at ‘around 0.50%’, the subtle changes in language suggest that they are gearing up, or at least open to, tweaking the YCC target at a future date, provided that conditions are supportive,” said Carlos Casanova, senior Asia economist at UBP in Hong Kong.

In its quarterly outlook report, the BOJ revised this year’s core consumer inflation forecast to 2.5% from 1.8% projected in April.

Source: https://www.reuters.com/markets/rates-bonds/boj-seen-keeping-ultra-low-rates-may-debate-tweak-yield-cap-2023-07-27/

- Annual U.S. inflation is slowing further and could push the Federal Reserve closer to ending its fastest interest rate hiking cycle since the 1980s. The personal consumption expenditures (PCE) showed a lower figure of 0.20% than the previous 0.30%. The employment cost figure also showed a lower, 1% increase. The data show that labour costs posted their smallest increase in two years in the second quarter as wage growth cooled significantly. Together with labour market resilience pushed away and thinking of recession.

“The inflation outbreak is winding down quicker and with less pain for the labour markets than economists could have imagined just a year ago,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “This means policymakers can most likely skip a rate hike at the upcoming September meeting.”

The U.S. central bank on Wednesday raised its policy rate by 25 basis points to the 5.25% – 5.50% range, a level last seen just prior to the 2007 housing market crash.

“The slowing trends in inflation and wages, and the slowdown in spending we expect, support our expectation that this week’s rate hike was the last,” said Ellen Zentner, chief U.S. economist at Morgan Stanley in New York.

Source: https://www.reuters.com/world/us/us-annual-inflation-slows-june-consumer-spending-solid-2023-07-28/

______________________________________________________________________

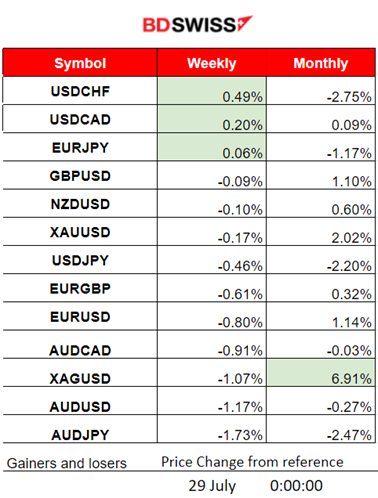

Winners vs Losers

- USDCHF remained on the top of the week’s winners this week as the USD had appreciated greatly last week, with 0.49% gains.

- Silver (XAGUSD) is leading this month so far with 6.91% gains.

______________________________________________________________________

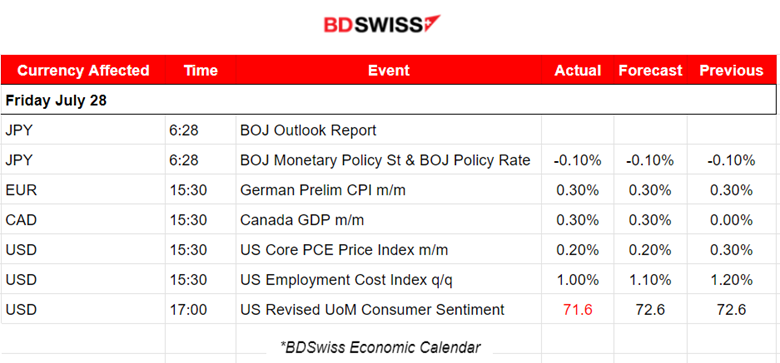

News Reports Monitor – Previous Trading Day (28 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No change in the BOJ rate; it remains still at -10%. The Bank of Japan (BoJ) published its quarterly outlook report, following its July policy meeting where it highlighted that risk to inflation skewed to the upside for fiscal year 2023-2024. Japan’s economy is moderately recovering and inflation expectations are showing signs of heightening again. JPY appreciation was observed at the time of the release, causing the JPY pairs to experience a high shock. USDJPY fell more than 140 pips but soon retraced back to the mean.

- Morning – Day Session (European)

At 15:30, we had the release of important scheduled figures for Canada and the U.S. Canada’s monthly GDP change was reported higher as expected. The CAD pairs were not affected much by this figure. As expected, the U.S. Core PCE Price index figure was also lower, coinciding with the latest low inflation data. No important shock was recorded at that time for USD pairs. The Employment Cost Index figure was also reported lower but more than expected.

The Revised UoM Consumer Sentiment report released at 17:00 was reported lower, having a moderate impact on the USD at that time causing some USD depreciation.

General Verdict:

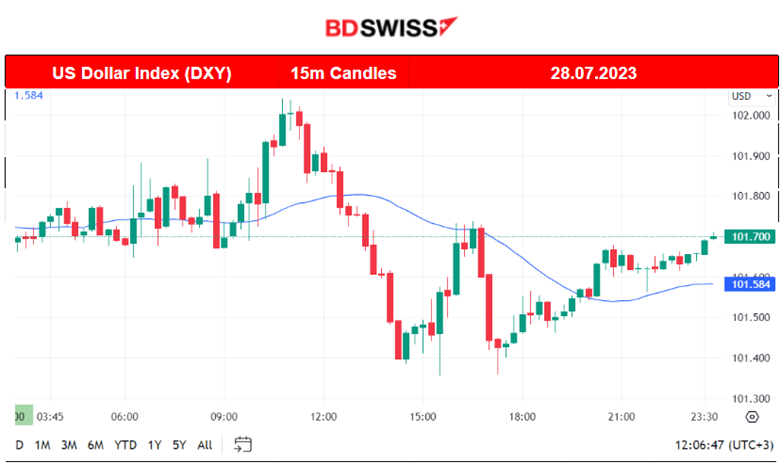

- DXY sideways path on a Friday but more volatile than typical.

- U.S. stocks reversed completely since the fall recorded the previous day, reaching high levels again.

- Retracement of Gold and Silver.

- Oil moved higher again.

____________________________________________________________________

FOREX MARKETS MONITOR

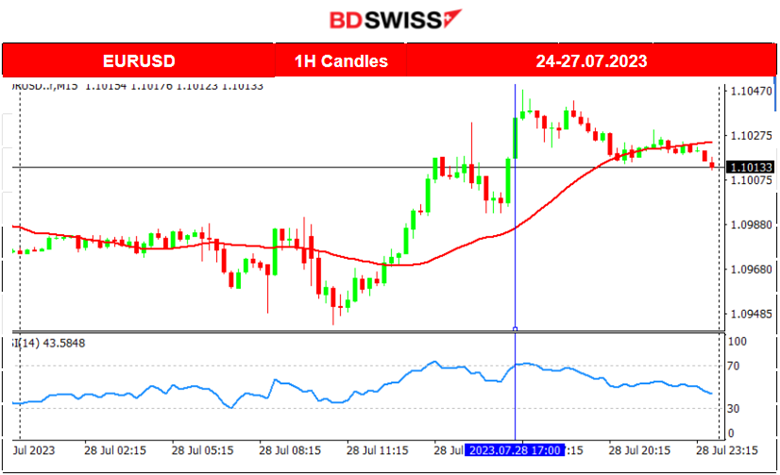

EURUSD (28.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair experienced more volatility after the European session started as usual. It moved to the upside during that session because of USD depreciation, moving upwards while being over the 30-period MA. The scheduled released figures affected the pair upon release but not so much, no major shocks took place. Some USD depreciation occurred during the releases enough for the pair to remain on the upside and close higher for the trading day.

___________________________________________________________________

EQUITY MARKETS MONITOR

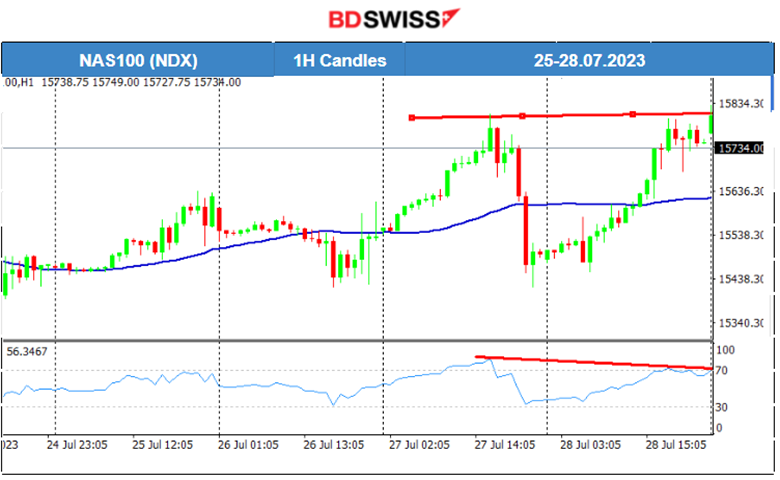

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The long and recent upward movement of the NAS100 index was interrupted. In the last couple of days, the index moved sideways with high volatility around the mean. It showed actual signs of recovering from the previous downward movement as it was moving steadily to the upside breaking resistances. Yesterday, during the ECB press conference, the Dollar was gaining remarkable strength but the U.S. benchmark indices kept moving to the upside steadily. Only after the NYSE opening, the U.S. Stock market suffered an intraday crash, reversing heavily from the upside, crossing the MA and staying below the mean. The biggest drop was observed after 20:00. The next day, the 28th of July, the index reversed fully. A quite resilient market as it seems. An upcoming retracement after the rapid upward path is possible.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

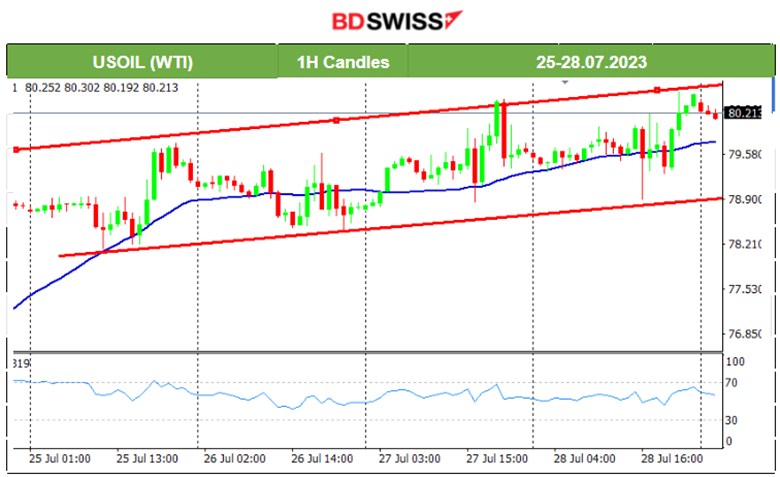

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude is moving steadily with moderate volatility within an upward channel as it seems. It remains on the trend and moves while being above the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The Gold price crossed the 30-period MA, on its way up and remained on the upside. It seemed to be in an upward channel with low volatility. The RSI indicated that there is a bearish divergence that would cause the end of this upward path. Apparently, it has. However, the drop that happened on the 27th is attributed to the USD strengthening that took place after the ECB rate decision, causing the Gold price to drop since it is denominated in USD. Retracement followed after the price found strong support near 1942 USD/oz. The next day on the 28th of July, retracement followed and the price settled around the mean near 1955 USD/oz/.

______________________________________________________________

News Reports Monitor – Today Trading Day (31 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

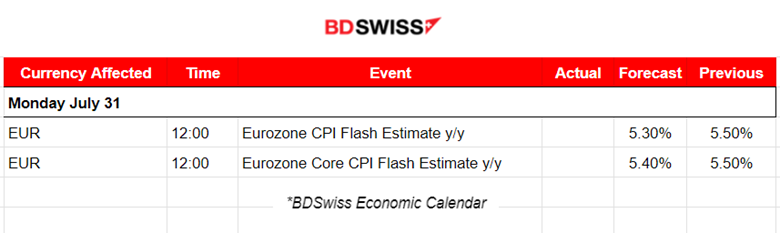

- Morning – Day Session (European)

At 12:00 when the CPI Flash estimate figures are released, some activity might take place but not expecting high-level shocks intraday for the EUR pairs.

General Verdict:

- Monday mood.

- Low volatility with steady moves on one side and more sideways paths around the mean.

______________________________________________________________

Source: BDSwiss