PREVIOUS TRADING DAY EVENTS – 11 April 2023

Announcements:

- In China, the yuan-denominated loans issued to consumers and businesses during the previous month rose to 3.89 trillion yuan, exceeding forecasts, while the previous figure was reported only at 1.81 trillion yuan.

This signals that the central bank is looking to increase liquidity in the economy and support bank lending so investing activity can take place. New corporate mid and long-term loans jumped from a year ago.

Lending and financing activities were recorded quite high this year, as the government increased its activities on issuing bonds, and corporate credit demand increased with the abandonment of Covid restrictions.

Local authorities have announced plans to raise spending on major construction projects by 17% this year.

“If the trend in credit growth extends into April and May, it would translate into significant support for the economy’s recovery through investment financing,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd.

“The figures show firms are making greater use of the government’s loan support. They also show a recovery in household demand for mortgages — another sign that the property market slump is starting to ease. We see credit growth continuing to climb in 2Q, albeit gradually, supported by a looser policy stance and a broader recovery in demand”, the economist Eric Zhu reported at Bloomberg.

Source: https://www.bloomberg.com/news/articles/2023-04-11/china-s-credit-grows-faster-than-expected-following-rrr-cut#xj4y7vzkg

- During the meeting yesterday, the 11th of April, the IMF said that in 5 years, the global growth rate is expected to be around 3%, bringing down the growth forecasts. It said that the global economy is heading for the weakest growth since 1990, the lowest medium-term forecast in a World Economic Outlook for over 30 years. This will be the case considering that recent financial sector stresses are contained.

In the short term, global growth is expected to be 2.8% this year and 3% in 2024.

“The world economy is not currently expected to return over the medium term to the rates of growth that prevailed before the pandemic,” the Fund said.

The IMF forecasts an expanding United States economy, by 1.6% this year, and a growing Eurozone by 0.8%. However, they are looking at a state of a contraction by 0.3% for the United Kingdom.

“The major forces that affected the world in 2022 — central banks’ tight monetary stances to allay inflation, limited fiscal buffers to absorb shocks amid historically high debt levels, commodity price spikes and geoeconomic fragmentation with Russia’s war in Ukraine, and China’s economic reopening—seem likely to continue into 2023. But these forces are now overlaid by and interacting with new financial stability concerns,” the IMF warned.

Regarding inflation concerns, it expects global headline inflation to drop from 8.7% to 7% this year, but core inflation to stay sticky, taking longer to fall. Headline inflation is not expected to return to its target levels before 2025.

Source: https://www.cnbc.com/2023/04/11/imf-world-economic-outlook-april-2023-weak-growth-forecasts-inflation-high-until-2025.html

- This year, U.S. stocks showed remarkable resilience against critical factors, such as the recent banking crisis, rising recession fears and economic data supporting slow economic growth. With an economic picture wording further, it is likely that the market will come down in the coming months, according to Chris Harvey, head of the equity strategy at Wells Fargo & Co bank.

“In our view, equity downside will be driven by worsening economic conditions, a function of aggressive monetary policy; potential capital/liquidity issues catalysed by the bank crisis; and a consumer that is increasingly reliant upon credit to sustain spending,” Harvey and his team of strategists said in a note to clients on Tuesday.

“If we assume the Fed tightening cycle ended in March (that’s still a coin toss), the near-term relief rally appears already reflected in stocks,” Harvey wrote. “Typically, the market continues to rally over a three-month period; however, it may not be a fair comparison because the tightening cycle may not be over and margin compression is expected to outweigh a Fed pivot.”

Source: https://www.bloomberg.com/news/articles/2023-04-11/wells-fargo-s-harvey-warns-s-p-500-is-set-for-a-10-correction?srnd=premium-europe#xj4y7vzkg

______________________________________________________________________

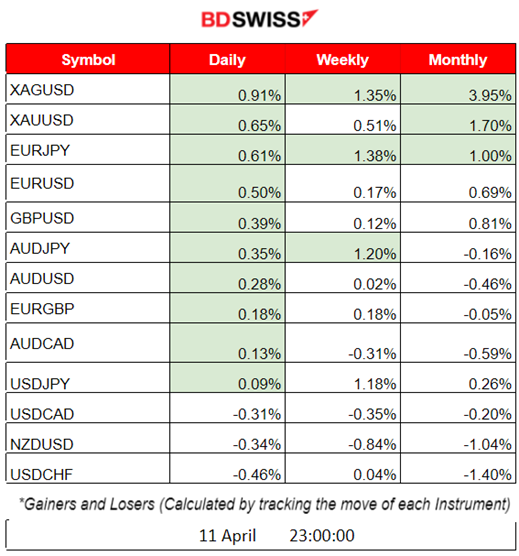

Summary Daily Moves – Winners vs Losers (10 April 2023)

- Yesterday, Silver (XAGUSD) went higher with a 0.91% change followed by Gold (XAUUSD) with a 0.65% change. JPY pairs with JPY as quote currency seem to dominate, showing JPY depreciation.

- This week, EURJPY is on the top followed by Silver with 1.38% and 1.35% respectively.

- Metals and EURJPY dominate the winners list this month.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (11 April 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news. No important scheduled releases.

- Morning – Day Session (European)

The markets for major pairs experienced low volatility. Dow Jones (US30) moved higher. USD depreciated. Chinese banks extended 3.89 trillion yuan (US$565 billion) in new yuan loans in March. No significant intraday impact on majors.

General Verdict:

- Low volatility as expected. USD moved downward in general without experiencing intraday shocks.

- US30 moved higher while the other U.S. indexes experienced a fall.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Mainly driven by the USD, the pair has been showing high volatility the past few days. It is highly affected by reports affecting USD, such as related announcements or scheduled releases of important figures. It gained on the 10th of April, as the Fed stated that it is probably going to proceed with rate hikes in May during the early European session. It reversed later during the trading day, continuing the upward movement to the next day as well, crossing the 30-period MA and moving above it. The reversal was more than 90 pips.

____________________________________________________________________

EQUITY MARKETS MONITOR

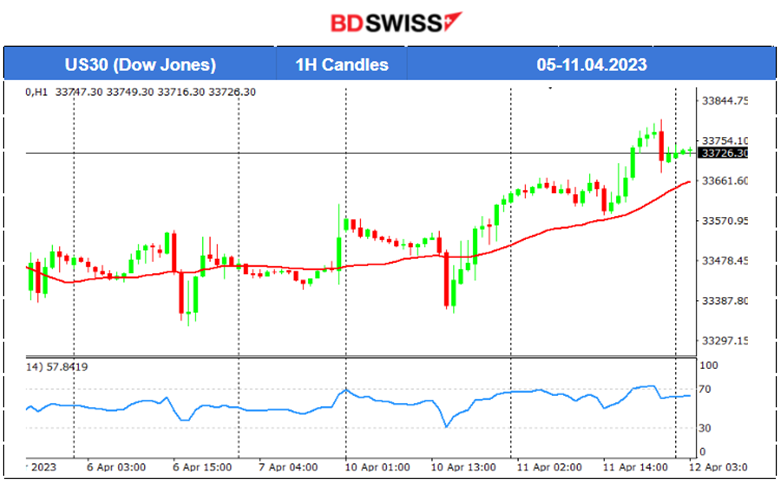

US30 (Dow Jones) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

US30 moved higher yesterday as USD depreciated. U.S. stocks showed extreme volatility in the past few days with an overall sideways path. Despite the many reasons to drop, they continued their resilience, especially the blue-chip companies that show remarkably their intention to move upwards, above the 30-period MA. However, economists expect that this rise is only temporary.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude’s price has finally deviated significantly from the 30-period MA yesterday. Its price reversed greatly at around 16:00 with a jump of over 2 USD. This significant move took place after 5 days of the price moving around the mean near 80.5 USD, reaching higher now at nearly 81.5 USD.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold was also moving higher yesterday following an upward trend, moving above the 30-period MA. After a 2-day-downward movement below the MA, it eventually reversed yesterday, crossing the MA and moving upwards. Today, it is still rising. This signals mixed expectations amid the U.S. inflation-related reports, with investors preferring Gold. According to DXY, the dollar is extending its depreciation further today.

Trading Opportunities

RSI shows divergence signals on the 6th-10th of April with Price: Lower Lows RSI: Higher Lows while it was in the oversold area. Price eventually moved upwards.

______________________________________________________________

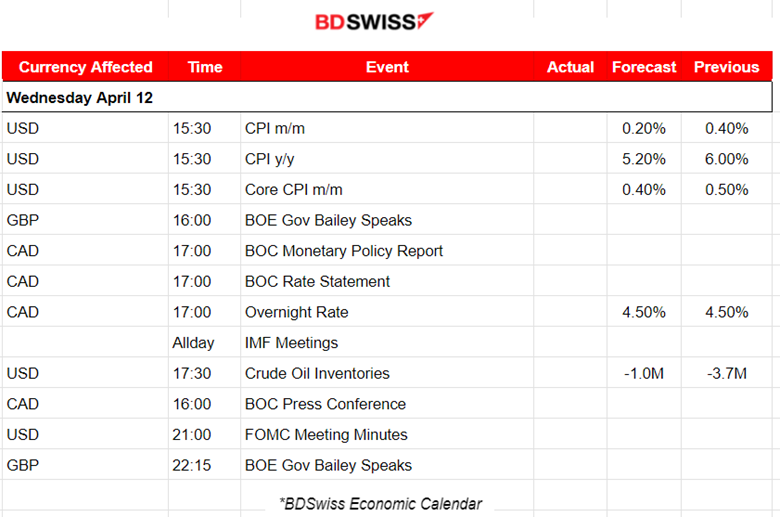

News Reports Monitor – Today Trading Day (12 April 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news. No important scheduled releases.

- Morning – Day Session (European)

Important figure releases start at 15:30, with U.S. inflation-related data (i.e. Core CPI). U.S. price changes are expected to drop from last month.

The Bank of England (BOE) governor is speaking at 16:00 about the resilience of the global financial system at an online event hosted by the Institute of International Finance. GBP intraday volatility is expected. Watch out for long steady movements and intraday trends. He is also speaking at 22:15 in Washington DC about financial and price stability at the International Monetary Fund Spring Meetings.

The Bank of Canada (BOC) will release its monetary policy report and rate statement, communicating with investors about monetary policy, and the outcome of their decision on interest rates. BOC is not expected to raise rates. Canada’s economy was supposed to be slowing down but is actually speeding up, making it difficult for the central bank as it prepares to hold its policy rate at 4.5% for a second straight decision. CAD pairs will probably experience an intraday shock in any case, surprise change or not.

The U.S. Crude Oil inventories report is being released at 17:30. The change is expected to be negative. Since the 20th of March, the price of oil started climbing. It was on March 29th when the Energy Information Administration (EIA) reported -7.5M barrels in inventories and continued reporting negative numbers until now, showing less supply and resilient demand, in line with the rise in oil prices. The impact on the FX markets will probably not be significant intraday. Prices increased yesterday amid this report.

- Evening – Night Session (N. American)

FOMC: The month’s most important statement regarding future monetary policy and the financial conditions that influenced their vote on where to set interest rates. It is about to be released today at 21:00 and it is expected to have a great impact on the USD pairs. Deviations from the mean are expected to be high. Retracement opportunities are tricky due to the fact that the North American session might not boost prices enough after resistance was identified.

General Verdict:

- Significant scheduled releases during the European and N. American sessions.

- BOC statements and FOMC will probably have a great impact and cause intraday shocks.

- GBP will probably deviate from the mean and create retracement opportunities. The size of the deviation will depend on what the BOE governor will state.

______________________________________________________________

Source: BDSwiss