The cryptocurrency market is adding 0.2% in the last 24 hours to $1.63 trillion, experiencing some pause or rebound after a prolonged drawdown. Buyer interest in cryptocurrencies came at the expense of a rebound in US equities, where selloff hunters thought their time had come.

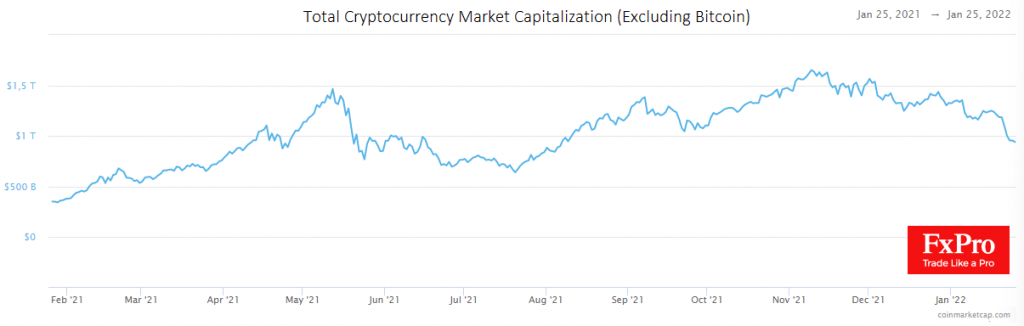

The cryptocurrency market capitalisation without Bitcoin became less than 1 trillion last Saturday, and this round level now acts as near-term resistance.

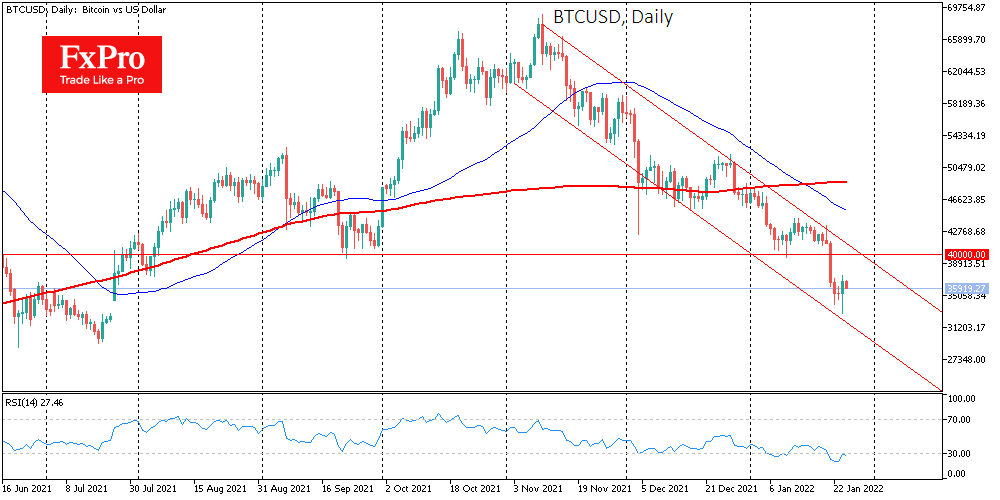

At one point on Monday, Bitcoin was down to $33K, but at the late US session, and now trades near $36.4K. Yesterday’s drawdown almost closed the gap in July and also came from the lower boundary of the downward channel. The latter indicates that despite the prevalence of bears, the market is not yet ready to accelerate the decline.

Bitcoin is gaining 2.8% in 24 hours, but most altcoins are losing ground. So, yesterday’s rebound in bitcoin and the positive dynamics of the crypto market are more correctly attributed to technical factors: crypto investors are exiting altcoins to more liquid BTC, forming temporary bounces, but nothing more.

The nearest target for BTC downside is $32.3K to close the gap entirely. However, it is worth being prepared to retest the July lows of $29.5-30K. Without support from the stock markets, these levels may not hold for long either.

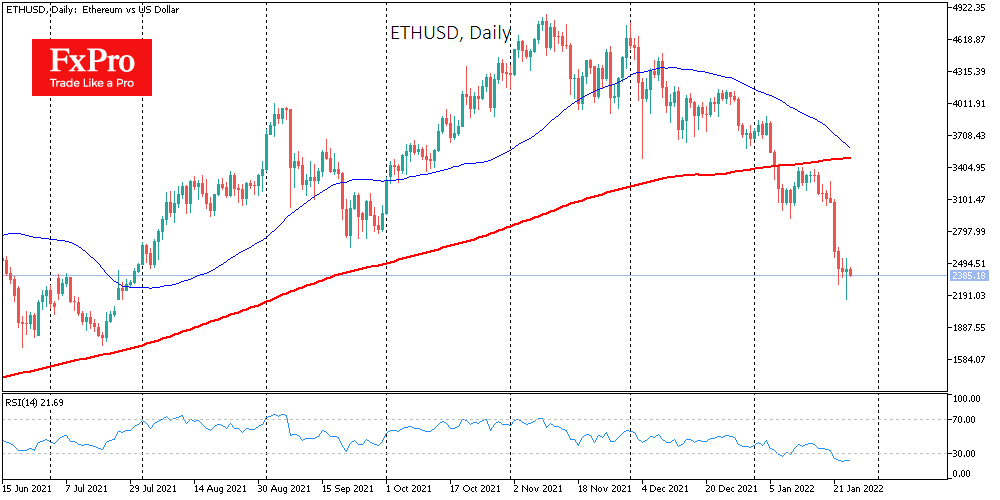

Ether also saw a bounce yesterday towards the end of the day, making it clear that the market is far from surrendering. After seven days of collapse, the primary altcoin managed to close Monday with a tiny gain. Nevertheless, there are no signs of breaking the downtrend yet. Moreover, a death cross is also forming over the ether, as the 50-day moving average is now only a couple of days away from crossing the 200-day from the top down. This signal is often followed by a new bearish attack.

Source: FXPro