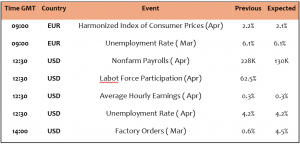

EURUSD

EURUSD traded slightly higher today at $1.1319, waiting for inflation figures in EZ later today. EUR kept falling for the last three trading sessions and has not benefited from the contraction in US economy in Q1/2025, EURUSD is still down by -0.40% on weekly basis. EZ economy grew by 0.4% in 1st quarter 2025, stronger than the estimates & higher than Q4/2024 driven by strong domestic demand. Keep an eye on US nonfarm payrolls & its consequences on USD later today.

USDJPY

For the last three trading sessions, USDJPY gained more than 1%, trading slightly weaker today at 145.12, still at the highest in three weeks. What happened yesterday was mainly driven by the improved risk appetite & reluctance to bet on safe-haven currencies, that’s why USD gained vs Yen. BoJ downgraded its growth forecasts which means that hiking the rates may remain unlikely. Keep an eye on the US bond yields’ performance, US job numbers will remain the most important catalyst. This currency pair remains highly correlated to US yields.

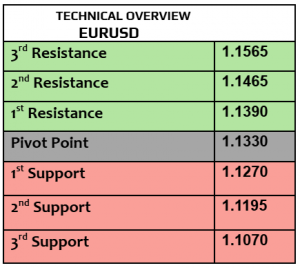

GBPUSD

GBPUSD traded slightly higher today at $1.3288, waiting for US job market numbers later today. According to markets’ expectations, BoE will be more cautious than peers in reducing the interest rates, such a policy will support GBP. Last April was the best monthly performance in GBPUSD since November 2023 as GBP gained 3.2% vs USD. In the meantime, traders should closely watch the developments of Trump’s tariffs, and how he will deal with UK, closest ally to America in economics & politics.

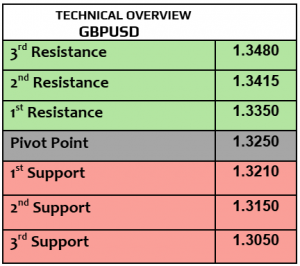

GOLD

Aggressive volatility continued in gold market, gold lost -2% on weekly basis, trading higher today at $3258 per ounce after three consecutive days of loss, the worst week in over two months. US economy contracted in Q1/2025 and US PCE remained flat in March. Remember that weaker interest rates will support gold, and inflation remained sticky even if PCE remained flat as US inflation remained higher than 2%, which was the target set by the Fed. If Trump decides to lower tariffs on China & starts easing the tensions, gold may remain under further pressure. Keep an eye on US nonfarm payrolls & wages growth later today. Stronger US job market may support USD, however wage’s growth matters, so it is not only the jobs that created last month. The expectations indicated to 130K jobs in April , weaker than March of 228K.

$3230 and $3200 remained important support levels. $3310 will be the next target, price action is still heading higher.

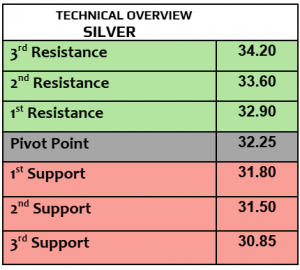

SILVER

Silver traded higher today by 0.25% & advanced to $32.51 per ounce, after losing more than 1% on Thursday. China NBS manufacturing fell in April to the lowest level in 16 months, below 50, while manufacturing PMI slightly improved to 50.4 in April, weaker than March 51.2, manufacturing & demand for silver from China remain crucial. Silver’s performance remained positively correlated to gold, silver lost -1.6% in a week, still up by 2% on monthly basis ( gold 4.6%) . ISM manufacturing PMI from the US slightly improved in April to 48.7, still below 50 which is officially considered as a sign of contraction.

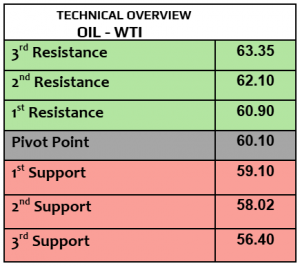

Oil-WTI

Crude oil prices fell on Friday, WTI $58.96PB, Brent $61.87PB. Between the supply chain disruptions due to Trump’s tariffs, global economy outlook & OPEC policy, oil prices will remain under huge pressure. According to EIA, US crude oil inventories dropped by -2.6 million barrels last week, higher than the estimates of 600K barrels. According to many sources, Saudi Arabia may advocate for higher oil output at upcoming May meeting. Oil prices lost -6% in a week, worst weekly losses in a month.

Price action is still showing bearish behavior, targeting $58 . $59.80 is resistance.

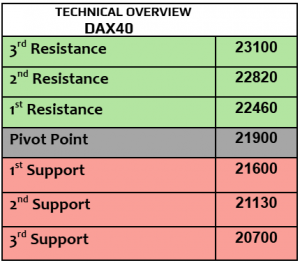

DAX40

German DAX index traded strongly higher on Friday & gained more than 1.5% at 22800, the highest level since March 26th , supported by earnings & optimism about the trade talks between China & the US. Germany’s manufacturing PMI improved in April, while GDP grew by 0.2% QoQ in Q1/2025 after the contraction by -0.2% in Q4/2024. Airbus rose 4.4%, after posting quarterly results that topped the estimates, Daimler 0.65%, Adidas 1.29%, and German auto makers gained as well. DAX index gained 2.7% on weekly basis, outperforming FTSE100 1.6%, France 2.2%, & Spain -0.06%.

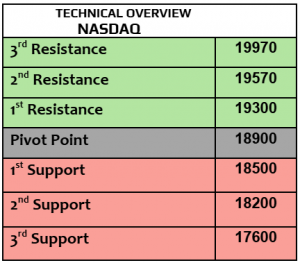

NASDAQ

Big day ahead from America with nonfarm payrolls, wages’ growth & unemployment rate for the month of April. The estimates showed that US job market may create 130K jobs in April, lower than March of 228K. US economy unexpectedly contracted by -0.3% in Q1/2025, that’s going to be pivotal numbers in any future rate cut by the Fed. Yesterday, Dow Jones rose 0.2%, SPZ 0.63% and Nasdaq jumped 1.5% , supported by strong earnings from Meta & Microsoft. US stock futures traded higher today as well. Keep an eye on US bond yields.

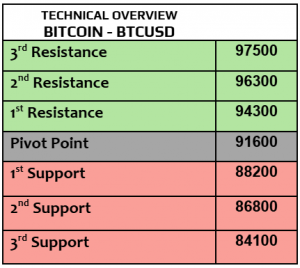

BITCOIN

For the second day in row, BTC traded higher & advanced to $96800, the highest since February 20th , Eth traded at $1826, Cardano $0.7072, and XRP slightly fell to $2.2102. Bitcoin’s gains sent crypto market cap above $3 trillion again, Bitcoin dominants market cap by almost 64%, followed by 7.3% in Eth, and 29% in other cryptocurrencies. In the meantime, Bitcoin rose 3.2% in the last seven days & 3% in Eth. Easing the tensions between US & China is likely to support risk-appetite which may result in higher bets on cryptos.

Source: BDSwiss