PREVIOUS TRADING DAY EVENTS – 24 July 2023

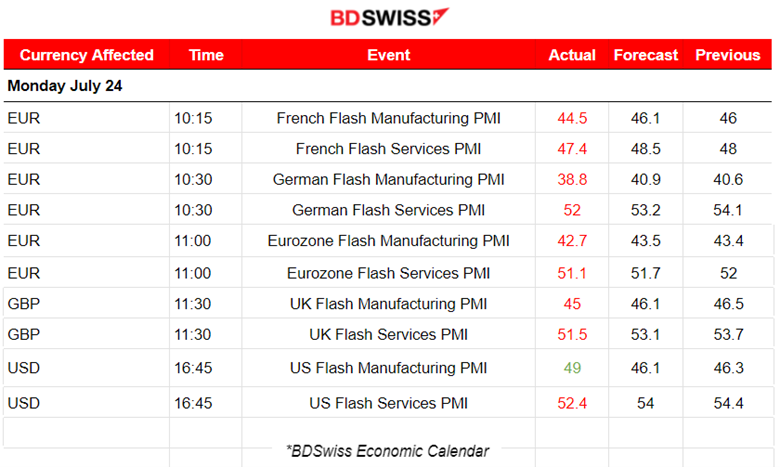

- PMI releases yesterday: Eurozone and U.K. PMIs were all reported weak during the morning across Europe. German Manufacturing in particular was at 38.8, which is the worst figure since May 2020! U.K. Manufacturing remains firmly in contraction at 45.0 vs. 46.5 last time and Services at 51.5. The U.S. PMIs were also reported weak. The manufacturing beat expectations but remained in contraction.

The survey suggested that Eurozone business activity shrank in July as services demand declined while factory output fell at the fastest pace since COVID-19. Germany and France are both in contractionary territory and the figures raise recession fears. The figures for both countries were worse than predicted.

Activity in Germany especially, Europe’s largest economy, contracted in July, increasing the likelihood of a recession in the second half.

“There is an increased probability that the economy will be in recession in the second half of the year,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said of Germany. “Over the last few months, we have seen a jaw-dropping fall in both new orders and backlogs of work, which are now declining at their fastest rates since the initial Covid wave at the start of 2020. This doesn’t bode well for the rest of the year.”

“The weakness was widespread across all sectors, but it was the manufacturing sector that posted another bad reading,” said Paolo Grignani at Oxford Economics. “Today’s print confirms the deterioration in macroeconomic conditions is well underway and spreading from manufacturing to other sectors. In our baseline case, we expect subdued growth for the second half of the year, but today’s data suggest the risk of a small contraction in eurozone GDP in Q3 is increasing.”

The European Central Bank is about to hike and will announce its decision on the 27th of July. This move is expected to have a further impact on these numbers. Some economists in a Reuters poll expect another hike in September.

“The data signal a noticeable cooldown of the economy, showing the sharpest reduction of business activity since November 2020, which preceded a contraction in GDP” in France, said Norman Liebke, an economist at Hamburg Commercial Bank.

Source: https://www.reuters.com/markets/europe/euro-zone-business-downturn-deepens-far-more-than-thought-july-pmi-2023-07-24/

https://www.bloomberg.com/news/articles/2023-07-24/france-germany-flash-pmi-data-give-recession-warning-signals#xj4y7vzkg

______________________________________________________________________

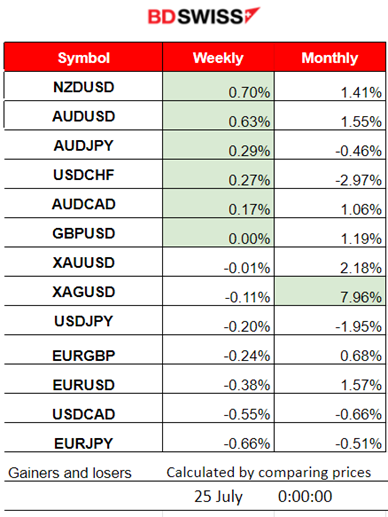

Winners vs Losers

- NZDUSD reached the top of the week’s winners’ list with 0.7% gains.

- Silver (XAGUSD) is still on top this month, with gains at 7.96%, This figure gets lower and lower as time passes due to the recent dollar strengthening.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (24 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any major scheduled releases.

- Morning – Day Session (European)

PMI releases:

France: Business activity in France declines at the fastest rate since November 2020 as contractions worsen in the Services and Manufacturing sectors.

German: Lower than expected also PMIs for Germany pushing it into the contraction area in July. The Manufacturing figure is quite low, at 38.8.

Eurozone: PMI suggests worsening economic conditions. The survey suggests that demand in the Eurozone is falling for both goods and services.

U.K.: A slowdown in business activity growth across the U.K. private sector economy. The Manufacturing sector has 45 points and the Services sector just over 50, with 51.5 points.

U.S.: The Manufacturing sector improves but is still in contraction with 40 points while the Service sector growth slows in July. The Services sector is still in expansion with 52.4 points.

General Verdict:

- The effects of hikes on inflation, labour market, growth and economic activity, in general, are reflected in these figures. Economies are slowing down.

- In the Eurozone, Germany has shown a significant loss of business activity, especially in manufacturing.

- Intraday shocks took place at the time of the PMI releases, EUR took a hit especially after the German PMI releases and the Dollar strengthened at the same time. The DXY moved upwards after the PMI releases and continued the strengthening.

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (24.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The EURUSD dropped during the European session when the PMI releases took place. The German PMI played a great role in the pair’s downward movement. This intraday shock soon faded with retracements taking place back to the mean. The Fibo tool could be used to identify the 61.8 Fibo level as depicted on the chart.

GBPUSD (24.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair experienced a drop at the time of the PMI releases, mainly from USD appreciation during the European session but also due to GBP depreciation caused by the low PMI figures. Same as with the EURUSD case, retracements took place during the trading day, several times as the pair found significant support levels and completed an intraday bullish divergence.

___________________________________________________________________

EQUITY MARKETS MONITOR

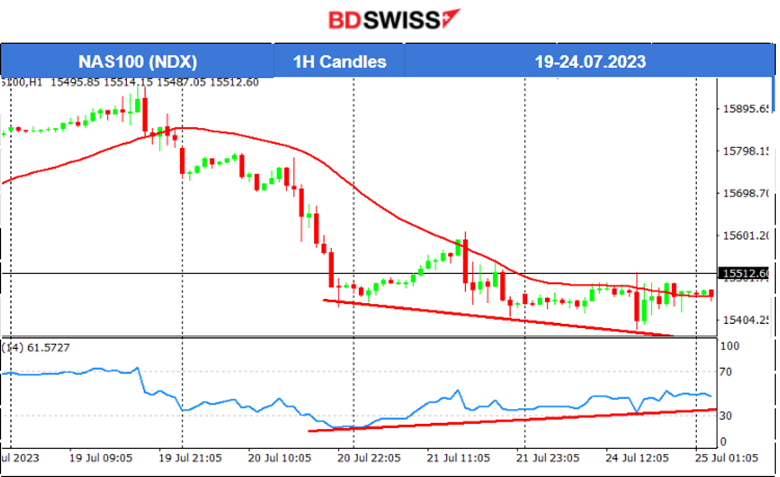

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The index reversed from a long upward trend and recently experienced a downward movement that seems to fade out. This is supported by the RSI which shows higher lows, while the price is showing lower lows. A bullish divergence is still on the table. As for the other side, the downside, 15400 is an important support. If it breaks it seems that the market conditions and expectations have changed dramatically. The U.S. is waiting for the Fed’s rate confirmation of an increase of 25 basis points that will take place tomorrow at 21:00. After the release, the market’s reaction will show its updated expectations.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude continues the upward movement steadily with lower volatility as days pass. It is currently moving above the 30-period MA as it is on a short-term uptrend. Considering the recent path, it is not expected that we will see high deviations from the mean, at least until the Fed’s Interest Rate Decision on Wednesday, 26th of July. On the 24th, Crude experienced a rapid upward movement after the weak PMI releases. It broke the 77 USD/b resistance and the upward barrier of the apparent wedge on its way up, reaching the next resistance level near 79 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The Dollar is currently gaining strength and that is a major driving factor. The downward movement continued while the index was below the MA, on the 21st of July, and remained on that path. Gold tested the resistance at 1968 USD/oz without success and reversed back to the downside on the 24th of July. That day, the Flash Manufacturing PMI showed some improvement that might have caused the Dollar to appreciate more thus breaking the support at 1958 USD/oz.

______________________________________________________________

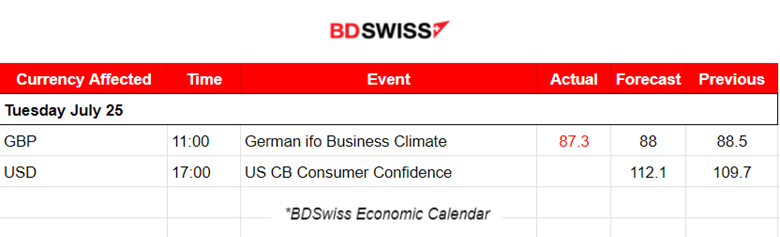

News Reports Monitor – Today Trading Day (25 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any major scheduled releases.

- Morning – Day Session (European)

Less volatility than normal is expected because of the PMI release. Shocks might take place at the time of the releases. High deviations from the MAs would take place, probably during the German PMI and U.S. PMI release.

General Verdict:

- Less volatility than normal due to the absence of important scheduled releases.

- Dollar strengthening might continue as the Fed rate release approaches causing some movement for USD pairs. An intraday shock is expected at 17:00. Quick retracements back to the mean might follow.

______________________________________________________________

Source: BDSwiss