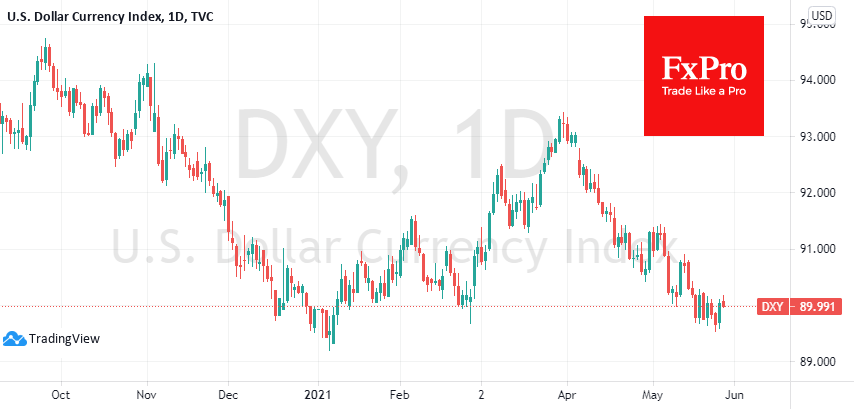

At the moment, this sentiment is benefiting the dollar, whose weakening has paused near this year’s lows. Moreover, the DXY has managed to bounce back above 90, a crucial round level that might be an attempt to form a double bottom and become the basis for a pullback.

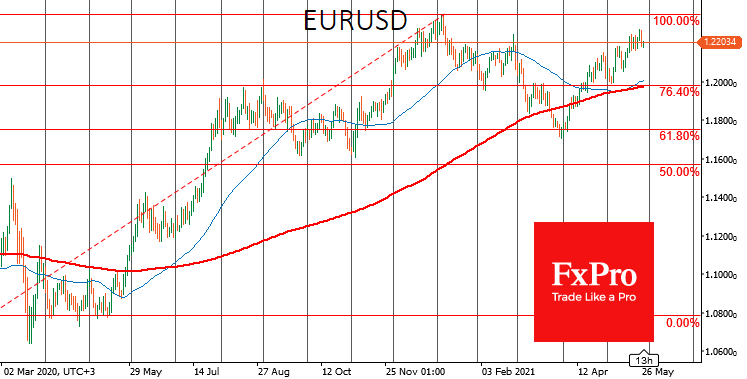

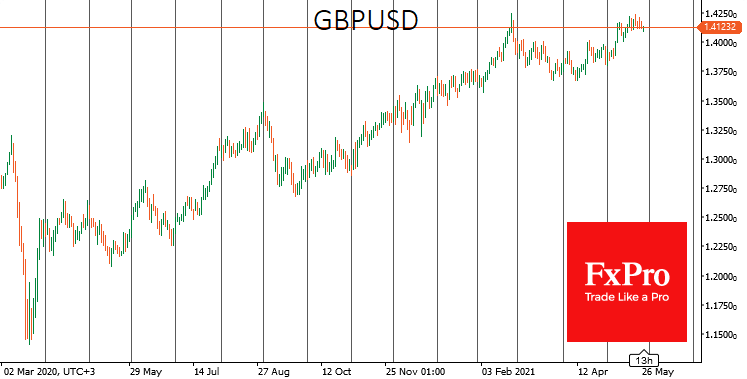

EURUSD on this backdrop came back under 1.2200, and GBPUSD rolled back below 1.4100, temporarily dropping to two-week lows. This seems like a tug of war at an important milestone or an attempt to gather strength before a final move.

While the Dollar got some support yesterday and the market’s ascent came to a halt, it is worth separating that the behaviour and sentiment of the Reserve Bank of New Zealand (set to raise rates in 2022) and Bank of Canada (unwinding QE) does not guarantee the same action from the Fed.

Further adding to the contrast is that the RBNZ and BoC represent commodity-exporting countries like Russia, where the Central Bank has already started raising rates.

The ECB, the Fed and the Bank of England are on the other side of the barrier. They hardly benefit from the recent commodity price boom and multi-year highs in global manufacturing activity. Perhaps even the opposite. The pandemic is hitting the service sector the hardest, and this sector represents a large portion of the GDP of developed economies, up to 80%.

They have suffered substantial job losses, and high commodity prices are further slowing down the recovery. Soft monetary policy, in this case, compensates for the tightening of financial conditions for business, supporting the recovery.

Simply put, this time, monetary policy cycles may differ significantly from country to country. At the same time, in the USA, Fed officials have emphasised that they are in no hurry to tighten policy. So after a period in which the bears gather their strength, pressure on the USD could intensify.

Source: FXPro