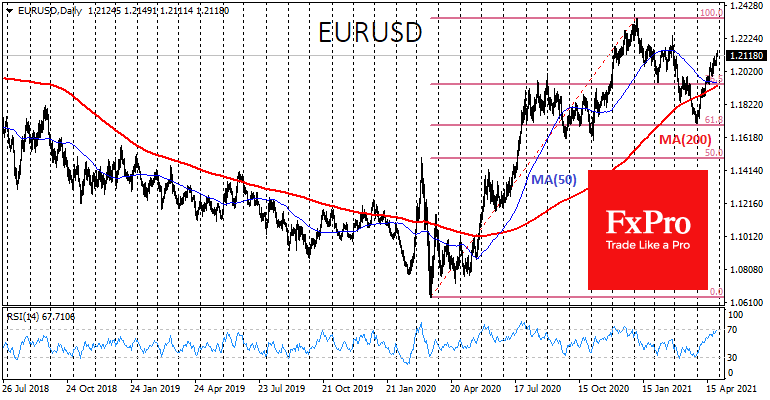

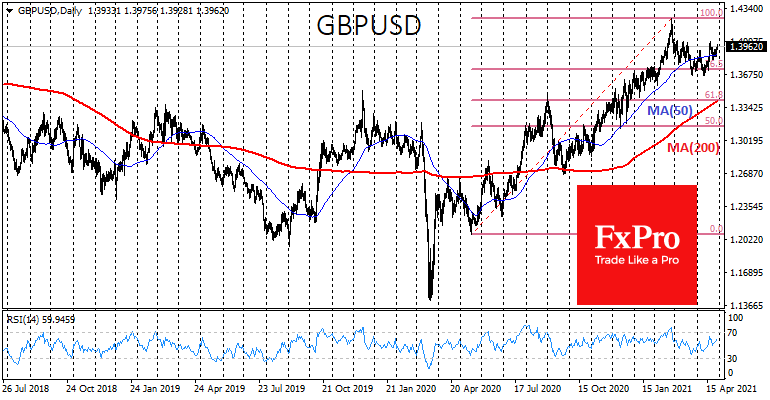

The US dollar returned to moderate weakness on these statements. EURUSD went back above 1.21, reaching highs since late February. GBPUSD is once again flirting with 1.4000, a major round level.

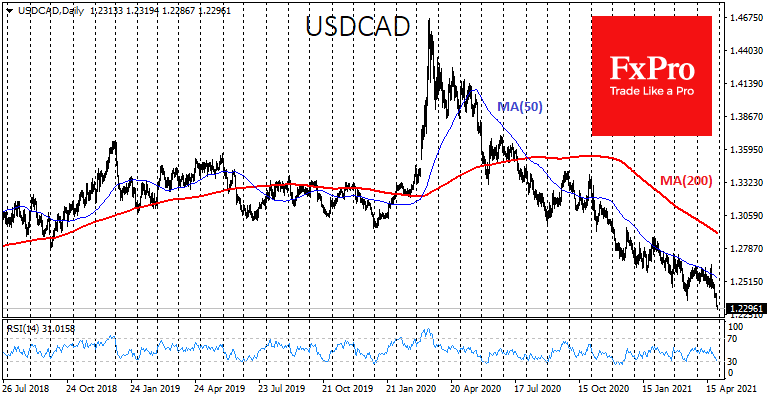

USDCAD collapsed to 1.2300, the lowest since January 2018. Demand for the Canadian dollar against the US dollar is supported by the apparent contrast in monetary policy in the neighbouring countries. The Bank of Canada has completed its corporate bond purchases in recent weeks and cut government bonds purchases on the balance sheet while the Fed keeps most of its pandemic-driven measures.

Amongst other things, Fed easing is supporting the prices for commodities and energy on the financial markets. Brent is back above $67, and WTI is above $64, close to six-week highs. Rising oil is further feeding demand for commodity currencies, including the Canadian dollar.

Fed policy softness makes the dollar a funding currency in the markets and causes trade deficits to widen. Fresh data marked new records for the goods deficit in March, reaching 90.6 billion.

The good thing about the growing US deficit is that it is often a companion to the accelerated growth of emerging market economies and markets.

Previously, we said that this was the most likely scenario, pointing out that markets were wary of a more rapid normalisation of Fed policy. However, Powell and Co did not scare the markets. The lack of signs of an imminent unwinding of asset purchases and rate hikes supports the momentum in equities and commodities at the expense of moderate pressure on the dollar.

In our view, yesterday’s weakening of the USD against its peers was clouded by the traditional end-of-month demand and the short-term profit-taking after a notable rise in equities and declining USD during April. Dollar support from monthly capital flow cycles should retreat by the end of next week, exposing the full potential for pressure on the US currency.

Source: FXPro