Market observers are once again cautiously waiting for a change in the tone of commentary following solid labour market data, record growth in manufacturing activity and a boom in house prices. Analysts persistently assume that the Fed will start to roll back QE in the coming months.

In our view, such expectations are misguided. The current growth of the US economy is driven by injections of relief programs and constant flooding of financial markets with liquidity from the Fed.

The economy often needs new stimulus after the first wave of improvement wears off. Some demand, and therefore jobs, could be lost for years to come.

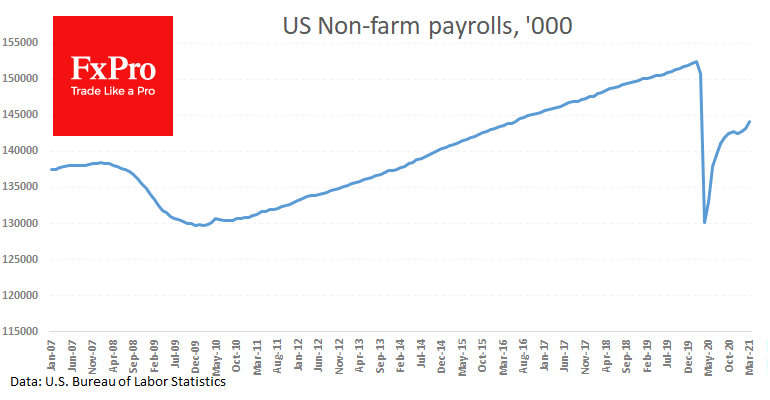

The US labour market added 916K new jobs in March. However, total jobs are 8.4 million fewer than in February 2020 and 11 million below what it might have been had the labour market had maintained its pre-pandemic growth momentum.

We would suggest that the Fed will not stop until it catches up with the normal trend or is convinced that the economy can do so on its own.

Thus, at today’s meeting, we should be prepared to hear confirmation of a soft Fed policy for the foreseeable future, despite recent solid indicators. This is unlikely to cause a fierce sell-off, as markets will not receive any new information.

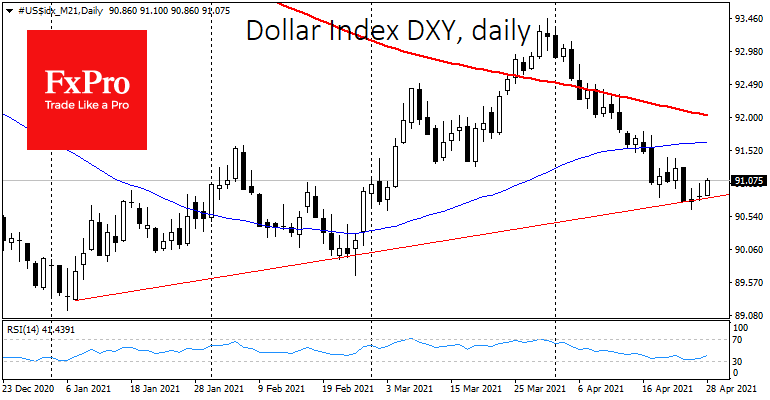

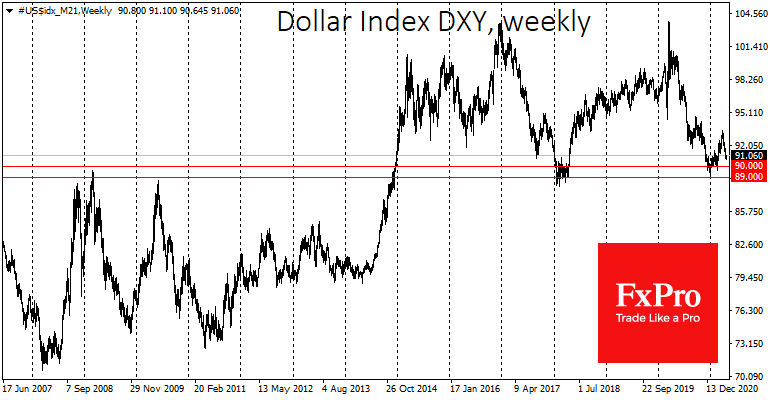

However, it is a negative factor for the US currency in the medium term, capable of breaking the mini gains of recent days and the uptrend support from January. This can open the way for the Dollar Index to move from the current 91 to 90 (February lows) and further to 89 – the lows at the start of the year, close to the area of 2018 lows.

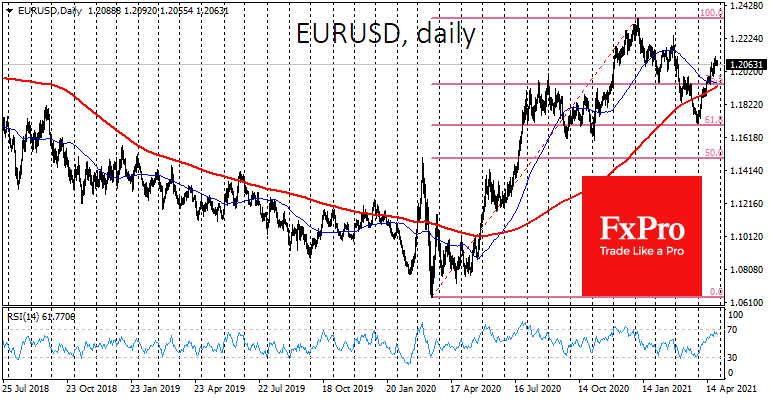

For EURUSD, this means upside potential at 1.2200 and new attempts to rewrite the year’s highs at 1.2350.

The break of the medium-term USD trend and the approach to multi-year lows could also trigger an important psychological effect, reinforcing bearish USD bets and an increased global risk appetite. Fed easing and a weaker USD is bullish news for stock and commodity markets that could add force to an already extended rally in commodities.

Source: FXPro