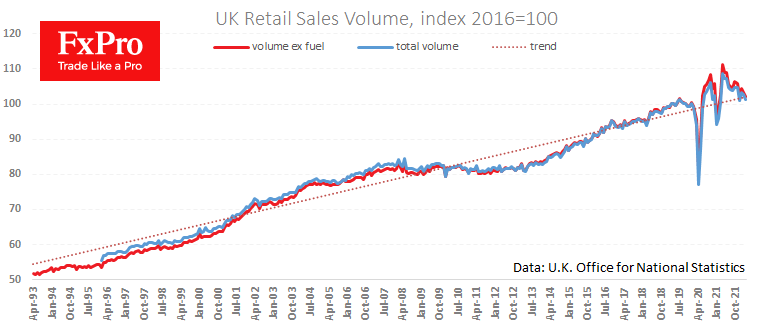

ONS reports a 1.4% drop in total sales for March after a 0.5% decline a month earlier. Sales excluding fuel fell 1.1% after 0.9% in February and showed a year-on-year decrease of 0.6% – a clear signal of the severity of the current economic situation.

We see that rising prices and wages have little impact on retail activity so far, which may prove to be a complication for the Bank of England in further tightening monetary policy.

Sales returned to their long-term trend level in March after a significant pullback in the second half of 2020. Consumer demand is migrating from retail to services.

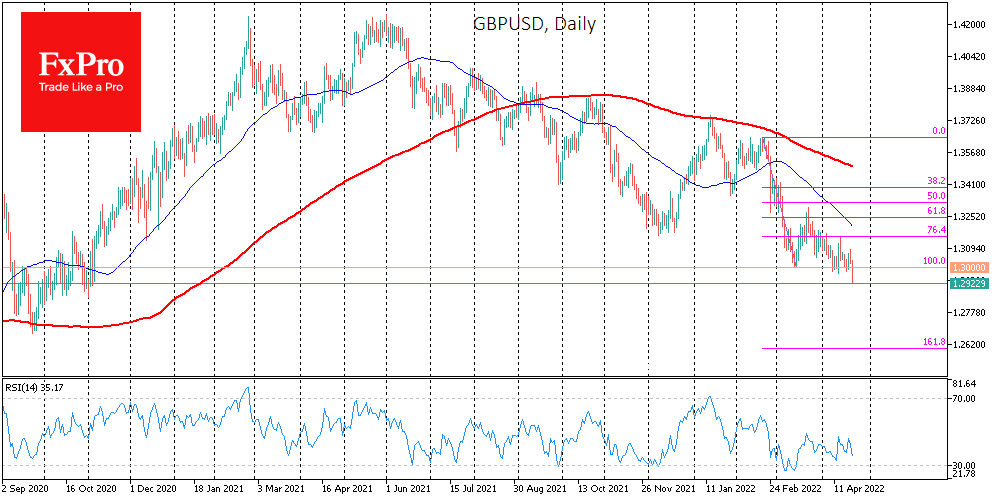

Weak sales data interrupted the Pound’s consolidation above the 1.3000 area, hoping that the UK economy could digest decisive rate tightening.

GBPUSD is renewing multi-month lows, building on the momentum formed a month ago when a rebound in the pair was interrupted.

According to the Fibonacci model, the next major stop could be near the 1.26 area, where the 161.8% mark from the initial decline from February to March passes.

Source: FXPro