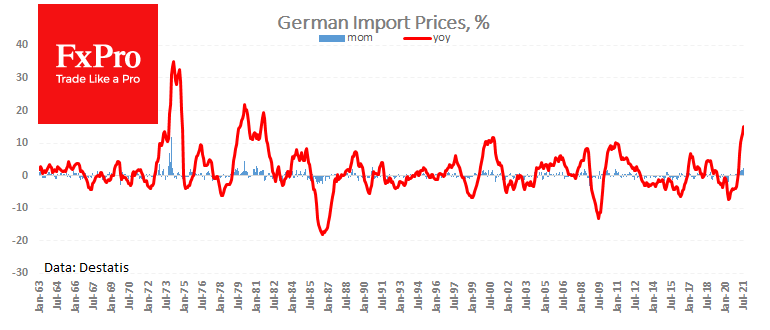

This is more than a low-base effect and is already causing some discomfort among Germans, whose fear of inflation is ingrained in their DNA. In Germany, physical demand for gold is highest since at least 2009, says Bloomberg, citing the World Gold Council data.

However, we see more risks from monetary policy surprises than bullish signals for gold.

The hawkish wing of the ECB under German leadership may unfold in full force shortly, which promises to change attitudes to the euro. If not, the single currency runs the risk of coming under severe pressure because of investors’ worries about capital preservation. In 2010-2011, it turned out to be a sell-off in European debt markets and pulled down the euro.

Source: FXPro