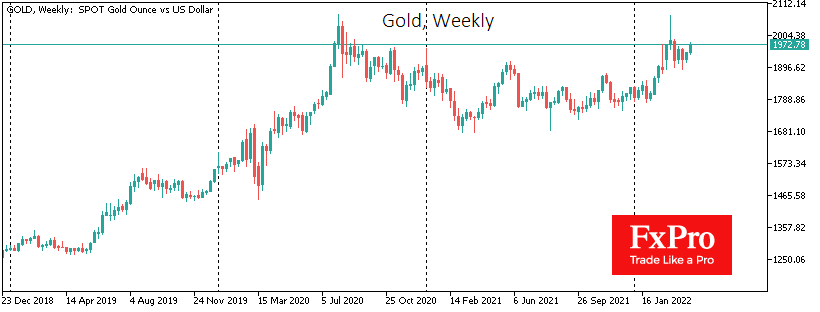

The correlation between the Dollar and Gold is easily explained by the flight of investors away from the conflict. The pull into Gold is more like a knee-jerk reflex. Much of it is speculation that investors will buy Gold as protection against inflation, financial system weakness or geopolitical instability.

However, it is worth realising that the alternative to traditional finance now is not Gold, but cryptocurrencies, which have no storage costs and are better shareable and transferable.

In modern finance, Gold often gets a role of a commodity asset. In other words, we could see this correlation break down as early as the next few days.

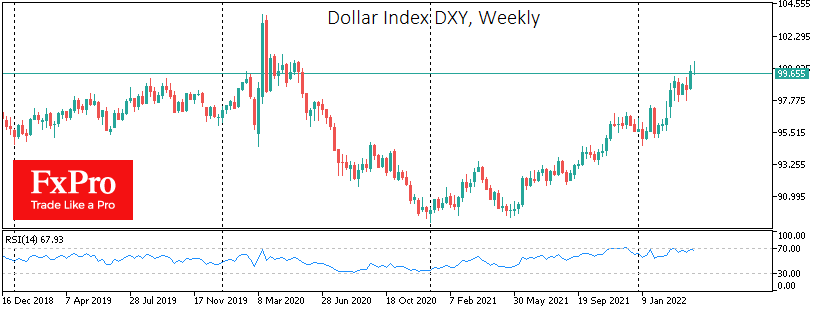

And from the fundamental point of view, the chances are higher that the dollar offensive might be renewed in the coming days. On Wednesday and Thursday, we see typical profit-taking before the long weekend after the rally. Behind the Dollar are expectations of extremely hawkish moves by the Fed, as FOMC members are fuelling the idea of a one-time 50-point rate hike in early May and are not ruling out one or two more such moves at subsequent meetings. So far, the economy has allowed the screws to tighten and is even “begging for it”.

At the same time, we should not forget that markets, especially the currency markets, are a waiting game. The Dollar climbed so high on a wave of extreme expectations. Their easing has the potential to trigger a reversal.

The dollar index hit bottom at the end of May last year. And we wouldn’t be surprised if, at the end of the May 4 meeting or after the next employment release on May 6, the Dollar hits the ceiling, as investors will gradually lock in profits and roll back expectations. The Dollar’s reversal may push Gold prices to new historic highs above $2100 by the end of this quarter and exceeds $2500 before this year ends.

Source: FXPro