PREVIOUS TRADING DAY EVENTS – 31 August 2023

- U.S. consumer spending increased and is on track to drive third-quarter GDP growth. According to the release yesterday, The Real (inflation-adjusted) Personal Consumption Expenditures (PCE) spending jumped 0.6% in July. Real Disposable Personal Income (DPI) declined 0.2%. Other reports brought to light that there was a decline in first-time applications for unemployment benefits last week.

The slowing monthly inflation rates cemented expectations that the Federal Reserve would keep interest rates unchanged next month.

“Americans keep spending,” said Jennifer Lee, a senior economist at BMO Capital Markets in Toronto. “The ‘soft landing’ view still holds, but there are some warning signs coming from the consumer as the savings rate continues to tick down.”

Inflation as measured by the personal consumption expenditures (PCE) price index rose 0.2% last month, matching June’s gain.

“But make no mistake, the monthly sequential momentum around 0.2% is exactly what Fed policymakers are looking for to get inflation back toward the 2% target,” said Gregory Daco, chief economist at EY-Parthenon in New York.

Since March 2022, the Fed has raised its policy rate by 525 basis points to the current 5.25%-5.50% range. Financial markets expect the U.S. central bank will leave its benchmark overnight interest rate unchanged at its Sept. 19-20 policy meeting.

“The Fed has to see substantial disinflation in core services before it can consider letting its guard down on inflation,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

Undeniably, the labour market is cooling, with job openings dropping to their lowest level in nearly 2-1/2 years in July, and conditions remain tight.

“While signs of looser labour markets are emerging, the jobless claims data are a reminder that the cooling in labour market conditions is being accompanied by very few layoffs,” said Nancy Vanden Houten, lead U.S. economist at Oxford Economics in New York.

Source: https://www.reuters.com/markets/us/us-consumer-spending-july-surges-weekly-jobless-claims-fall-2023-08-31/

______________________________________________________________________

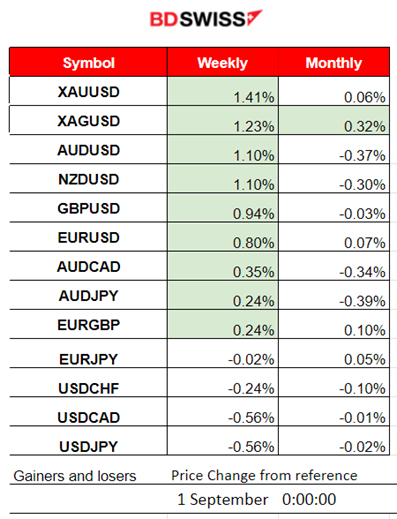

Winners vs Losers

- Metals are still leading. Gold is on the top of the winners list with 1.41% gains and Silver follows with 1.23% gains.

- Silver is the top winner this month so far with just 0.32% gains.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (31 August 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No special news announcements or important scheduled figure releases.

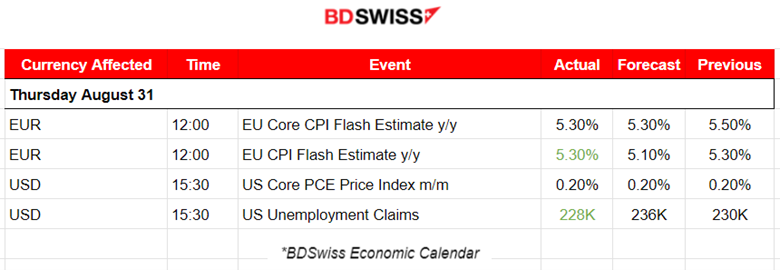

- Morning–Day Session (European and N. American Session)

The annual CPI Flash estimates for the Eurozone by Eurostat were released at 12:00. Headline annual inflation remained unchanged at 5.3%. Core inflation slowed less than expected and core services price inflation is proving that it is more stubborn. Euro-area flash annual inflation dropped to 5.3% in August, unchanged from July and higher than expected. Core inflation dropped to 5.3% in August, down from 5.5% in July. The effect on the EUR pairs was not great but the EURUSD moved steadily on the downside.

The monthly Core PCE Price index change was reported unchanged at 0.20%. This PCE data coincides with the latest inflation reports. This key measure continues to grow at the same pace and troubles the Fed. It is, however, stable. The unemployment claims for the U.S. were reported lower than expected. That was a surprise. Despite this fact, there was no major response from the market participants. The impact was minimal and the FX pairs remained on their current path. Some volatility was observed but minimal.

General Verdict:

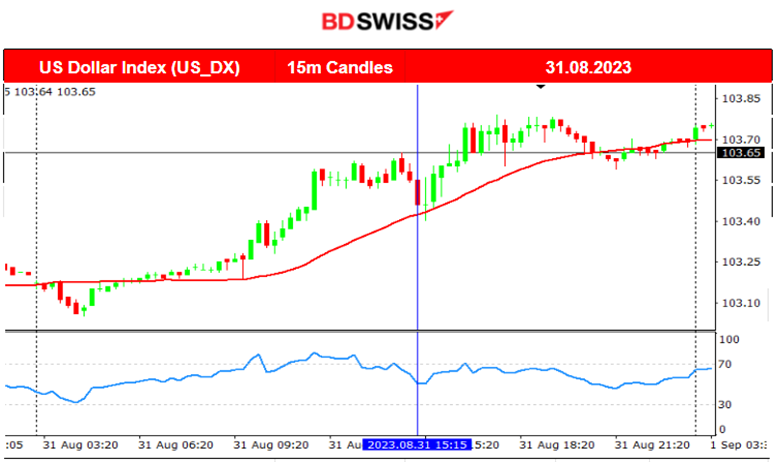

- The USD strengthened and the news had no effect on the DXY path that started the early upward steady movement. It is obvious that the market participants wait for the NFP report to react.

- U.S. Indices have indeed experienced some more volatility after the NYSE opening and moved to the upside again, even though not significantly.

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (31.08.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair started early, since the Asia session, to move steadily to the downside. It is clear that the path was driven by the USD since it started to gain strength early. More activity kicked in at the start of the European session and the pair moved more rapidly to the downside. It remained below the 30-period MA even though scheduled releases affecting the USD were taking place after 15:30. These had minimal impact. The market waits for the true market movers, the NFP and Unemployment Rate figures. No shock was observed and since there was no shock or significant rapid movement, no retracement has taken place.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

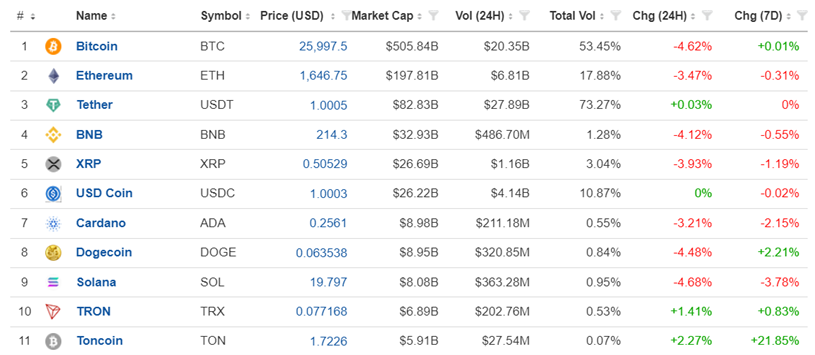

While Bitcoin was retracing from the jump it experienced on the 29th of August, it experienced a huge drop yesterday after the release of the U.S.-related figures. The PCE Price index and Unemployment claims. In general, the USD was driving most of the movement and since the USD strengthened much overall, Bitcoin weakened, going below 26K USD/btc.

Crypto sorted by Highest Market Cap:

It is clear that Bitcoin has been losing much ground in the past 24 hours and so have many of the other cryptos on this table such as Ethereum, BNB, XRP, Dogecoin and Solana.

Toncoin remains a winner for the last 24 hours and for the past 7 days, with overall 21.8% gains so far in that period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

All the benchmark indices are on an uptrend. Yesterday, despite some volatility, the indices remained in consolidation. Since yesterday they have been moving sideways on a steady path waiting for the scheduled releases to take place. The RSI shows lower highs but we cannot rely on technicals at the moment since we have the NFP and Unemployment rate figures to be released today. The price direction depends on the market reaction to the figures and at this stage, it is quite uncertain. Especially for indices.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude price remarkably continues the upward trend. It recently formed a rising wedge that was eventually broken yesterday to the upside. This pushed the price to move even higher and pass the 83 USD/b threshold. The RSI shows signs of the price slowing down but it is not clear yet if we have a bearish divergence here.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold price was moving to the upside as the USD weakened this week. Since the 30th of August, it started to slow down and eventually entered a state of consolidation. It is currently following a sideways path and moves around the 30-period MA waiting for the NFP. After the release today, the USD is probably going to be affected greatly and we will see a shock that would probably break that consolidation boundary. 1938 USD/oz serves as a support while 1948 USD/oz serves as a resistance.

______________________________________________________________

News Reports Monitor – Today Trading Day (01 Sept 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No special news announcements or important scheduled figure releases.

- Morning–Day Session (European and N. American Session)

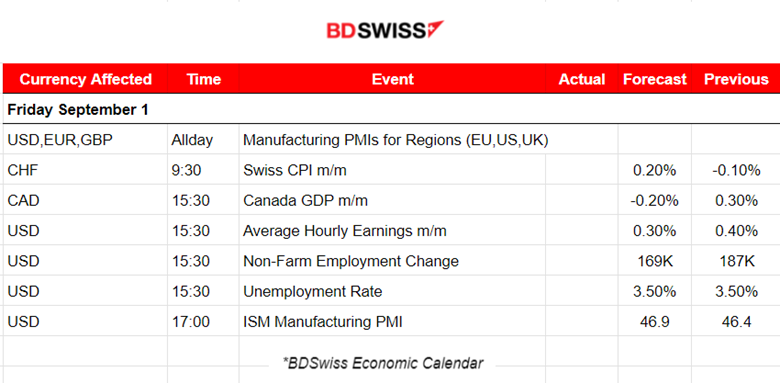

The Manufacturing PMI will cause more volatility to FX pairs, higher than a typical Friday. These data are essential for policymakers since they give a good picture of the most recent business conditions of each region. The manufacturing sector in all regions in general was in the contraction area. We do not expect something to change dramatically soon since rate hikes continue.

At 15:30, we have the release of many important figures. Monthly GDP for Canada and the most important labour market data for the U.S. The average hourly earnings are expected to be reported lower, and the NF Employment change lower as well, coinciding with the figures from the latest ADP report for private employment and the unemployment rate which is expected to remain stable. The NFP figures are quite low, never going below 200K this year, a strong indication of the labour market cooling significantly. Will the Fed pause the rate hikes for now? Let’s see. We expect an intraday shock for USD pairs when the releases take place and will probably also affect the indices as well.

The ISM Manufacturing PMI figure might also have an effect but not expected to be so great. The effect will be on the USD pairs if it happens. The expectation is an improvement of the index but is still in contraction.

General Verdict:

- High volatility at 15:30. Shocks are expected with big deviations from the 30-period MAs. Opportunities for retracements after the market calms.

- PMIs play their part currently causing volatility and prices to deviate early from the MAs.

- NYSE opening will probably cause volatility. Expecting the Indices to move in one direction significantly after these important scheduled releases affecting the U.S.

______________________________________________________________

Source: BDSwiss