Rates as of 05:00 GMT

Market Recap

Another day of limited movement in financial markets. US stocks were even more becalmed than the FX market – the S&P 500 was down a tiny 0.18% and NASDAQ off a mere 0.09%.

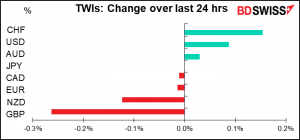

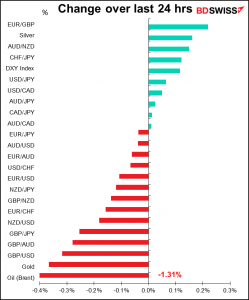

GBP was the main mover in the FX world as the first post-Brexit meeting of the EU-UK Partnership Council didn’t go especially well. The Partnership Council is a committee of EU and UK representatives that is supposed to iron out issues related to the EU–UK Trade and Cooperation Agreement (TCA), the agreement that set the terms for the EU-UK relationship after Brexit. They’re discussing – still – the Irish Border, which was always the insoluble problem facing Brexit. In quantum mechanics something can be in two places or two states at the same time, but at the macro level it just doesn’t work. Certainly, at the country level it’s not possible for a place to be both in the EU and out of the EU simultaneously.

The problem is that the UK has unilaterally suspended checks on some goods moving from Britain to Northern Ireland. The checks are required under the terms of the Northern Ireland protocol, part of the TCA that ensures a special trading status for the province. Britain wants to extend this grace period but the EU doesn’t want them to.

The two sides had what the UK representative called a “frank and honest discussion,” which is diplomatic terminology for “didn’t agree on anything.” The EU warned that it would respond “swiftly, firmly and resolutely,” up to and including reimposing tariffs and quotas for UK goods into the EU.

The ridiculousness of the situation was summed up by a comment from the UK negotiator, David Frost, who said, “What we really now need to do is very urgently find some solutions which support the Belfast Good Friday Agreement, support the peace process in Northern Ireland, and allow things to return to normal.” Doesn’t Mr. Frost realize that things can never “return to normal” now that Britain has left the EU?

The never-ending dispute outweighed comments by outcoming Bank of England Chief Economist Haldane, who said that the UK economy is “going gangbusters.” He also published an opinion piece in The New Statesman saying that noting that “the risk of inflation means this is the most dangerous moment for monetary policy for decades.”. These remarks helped to support GBP a little, but his views are well known and anyway he’s leaving the Bank of England at the end of the month, but the Irish border problem is here to stay.

The pound has successfully weathered Brexit so far – GBP/USD rose from 1.3672 on Jan. 1st to a high of 1.4212 on May 31st as the race between the virus and the vaccine took center stage. I wonder though if once the pandemic begins to fade as a market factor – which it may once the UK reopens later this month – will Brexit concerns come to dominate GBP again? Certainly many of the problems that the “Remain” side expected with regards to trade with Europe are becoming evident, and a whole lot of other unforeseen consequences are appearing as well. For example, Australia’s trade implied he is prepared to walk away from a free trade agreement with the UK if Australian agricultural exporters are not granted sufficient access to the British market. This suggests that Britain’s aim to replace trade with the dull, bureaucratic EU with dynamic, vibrant trade relations with other countries is not going as smoothly as some had hoped. (Although tomorrow morning’s UK indicators could be positive for the currency – see below.)

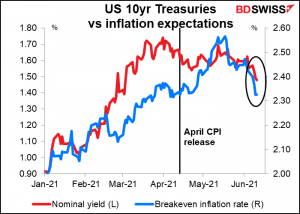

Elsewhere, the trend I pointed to yesterday morning – Treasuries shaking off inflation worries — continued during Wednesday’s market. Ten-year Treasury yields fell 4 bps to 1.49%, the first time they’ve been below 1.50% in over three months. Ten-year breakeven inflation expectations also fell 4 bps to 2.33%, the same as they were the day the April CPI was released.

Today’s market

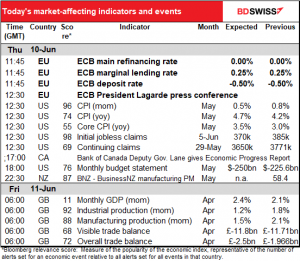

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

A really big day today, with the European Central Bank (ECB) meeting and the US consumer price index (CPI) coming out, not to mention the weekly US jobless claims.

For those who are really, really interested in such matters, I wrote a separate Market Insight piece on each of those events.

ECB: to taper or not to taper (or to taper operationally)?

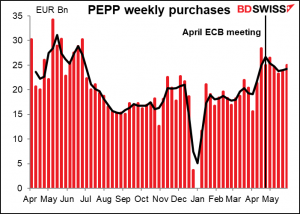

The big issue to be decided at today’s ECB meeting is the pace of bond purchases in their Pandemic Emergency Purchase Programme (PEPP). At the April meeting, they said they expect “purchases under the PEPP over the current quarter to continue to be conducted at a significantly higher pace than during the first months of the year.” And indeed since the April meeting, purchases have averaged EUR 24.6bn a week, vs EUR 18.4bn a week in January – March.

This month they’re going to decide whether to continue buying bonds at this pace or to slow down their purchases, which could be considered “tapering.”

The decision is finely balanced, in my view.

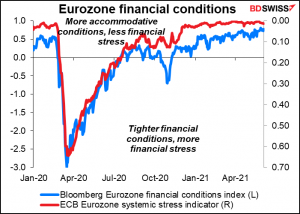

Note that the Council mentioned “financing conditions and the inflation outlook” in their decision to increase the purchases. Financing conditions are extremely loose. Cutting back the purchases would probably not disrupt things that much even if it were interpreted as the beginning of “tapering,” much like the Bank of Canada did at its April meeting.

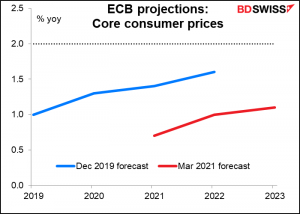

On the other hand, the inflation outlook is not yet to their liking. The inflation forecasts were revised down at the March meeting; the ECB staff now expects that it will take until 2023 to reach the inflation rate that they had expected to reach last year (1.3%), which is still far below their 2% target.

I suspect that the Euro will be the determining factor. Last September, when EUR/USD was trading around 1.18, the ECB made a big fuss about how the currency is important for the inflation outlook. Now EUR/USD is close to 1.22. (Although I should note that the ECB’s nominal trade-weighted index is actually about 1% below where it was then, so they really have nothing to complain about.) The Governing Council is surely aware of what happened to the Canadian dollar when the Bank of Canada cut back its purchases (hint: CAD appreciated).

If they decide to continue purchases at the current pace, I think EUR/USD would probably weaken a bit. It’s not a change in policy so it’s not cause for a major rethink of the outlook for the currency, but it would remove one risk.

The main reason I could be wrong is the new staff forecasts. The ECB staff will issue a new set of forecasts that is likely to have a faster growth and higher inflation profile. That could be a reason for trimming the bond purchases. They perhaps could portray it as an operational decision rather than a strategic one, as the Bank of England did when it slowed the pace of its bond purchases back in May.

Market reaction: limited

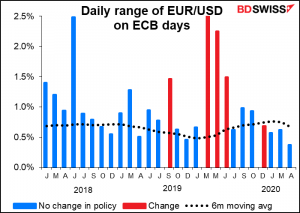

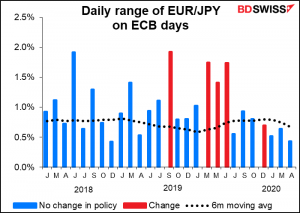

The range of EUR/USD and EUR/JPY has been below-normal recently on ECB days when there wasn’t any change in policy. Today there could be more activity, because someone is bound to be surprised or disappointed: some people will expect them to taper and they don’t, or some people will expect them not to taper and they do. But in general, no taper would be no change in current policy and therefore no need to reassess the stance of monetary policy. That means no change in the currency rate is necessary, either. I think the risk is that if they do decide to reduce their purchases that could have a notable positive impact on EUR.

Given that the main question facing the financial markets nowadays is whether inflation is coming back, today’s US CPI is perhaps the most important indicator so far this year. This is a summary, with additional commentary on the market implications.

The US CPI is not the Fed’s preferred inflation gauge – the Fed has been framing its inflation forecasts in terms of the personal consumption expenditure (PCE) deflator since 2000. However, it is the market’s preferred inflation gauge, making it a crucial data point every month.

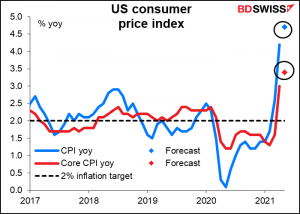

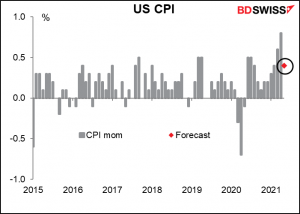

In any case, following April’s eye-popping 4.2% yoy print for the headline number, this month the market is expecting a jaw-dropping 4.7% yoy increase. That would the fastest yoy rate of increase since September 2008. The expected 3.5% yoy increase in core inflation would be the highest rate of increase since April 1993.

An argument could be made – and I’m sure will be made by some officials – that this is largely due to base effects. If we look at the mom rate of change, the expected 0.4% mom increase is nothing unusual. It would be down sharply from 0.8% mom in April and 0.6% mom in March.

The figure isn’t necessarily as important as how officials spin it. This week is difficult in that respect, because Fed officials are in their “purdah” period when they’re not allowed to talk to the press ahead of the Federal Open Market Committee (FOMC) meeting next week. So, we won’t get any reassuring comments from Fed officials to soothe the furrowed brows of traders. Perhaps Treasury Secretary Yellen will weigh in once again instead.

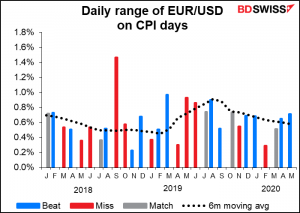

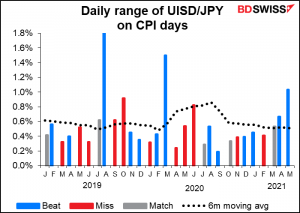

Likely market response: so far the market hasn’t been that volatile on CPI days, but that could change from now. It seems particularly dull for USD/JPY.

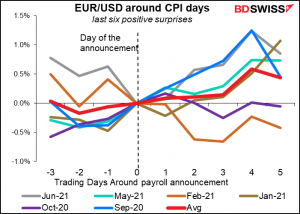

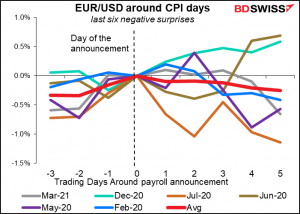

The subsequent movement of the dollar after the CPI is baffling. Following positive surprises – i.e. when the CPI comes in higher than expected – the dollar has tended to depreciate (EUR/USD moved higher).

But when the CPI missed estimates and came in lower than expected, EUR/USD tended to move lower, i.e., the dollar strengthened – although for the first few days after the announcement it was 50-50.

I find this pattern counter-intuitive. A higher-than-expected figure should tend to make people revise up their estimates of when the Fed might begin normalizing rates. That should cause the dollar to appreciate. Furthermore, earlier expectations of Fed tightening would tend to provoke a “risk-off” environment. The dollar usually appreciates in a risk-off environment.

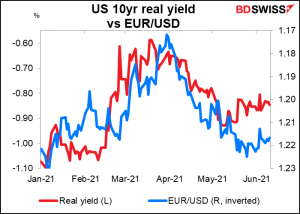

The only thing I can think of is that perhaps the new “average inflation targeting” (AIT) regime has caused markets to go back to pricing in inflation the way they used to before inflation targeting became the norm. It used to be that higher inflation was bad for a currency, because of course inflation is by definition the loss of purchasing power of a currency. That all changed as central banks around the world began targeting inflation. Under the new standard practice, higher inflation meant not a loss of purchasing power but rather higher interest rates, which made a currency more attractive. But now under AIT, higher inflation won’t necessarily trigger higher interest rates. So as inflation rises but interest rates don’t, real interest rates decline. That could be the reason why a higher-than-expected CPI caused the dollar to weaken: expectations of lower real interest rates.

In fact, we have seen EUR/USD tracking real US interest rates recently, so this seems to be the most logical answer.

What does this mean for today? I think for the immediate reaction, it’s most likely that the dollar will perform as one would expect: higher-than-expected CPI should be positive for the dollar, and vice-versa. But over the next few days it’s not so certain. Much will depend on how the Treasury market and inflation outlook respond.

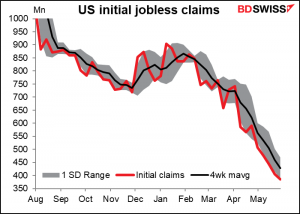

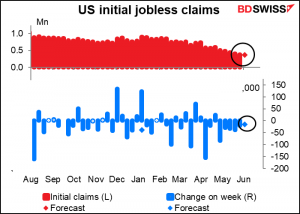

With all this excitement, we shouldn’t forget the usual weekly US initial jobless claims. Claims are falling at an accelerating pace.

This week’s figure is expected to be down 15k, which would be about half the recent average decline (-31k for the last four weeks). This is par for the course; recently economists have been consistently forecasting declines of around that level and the data have consistently beaten the forecast.

Before the pandemic began, claims averaged around 212k a week. Now they’re down to 385k. So not that much further to go. At the current pace, it should be only 5 or 6 weeks before we’re back to a normal level of initial jobless claims.

Then tomorrow morning, bright and early, we get UK short-term indicator day.

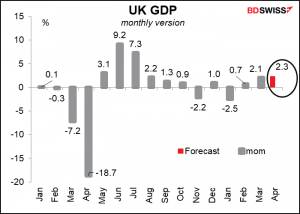

UK GDP is expected to be up 2.3% mom, the third consecutive rise and at an accelerating pace.

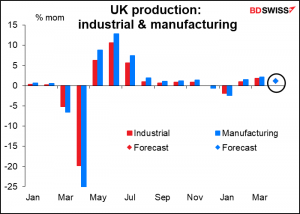

Both industrial and manufacturing production are expected to be up 1.2% mom, which is why you can only see one dot in this graph. That should bring them both back almost to pre-pandemic levels (-0.6% and -0.7%, respectively).

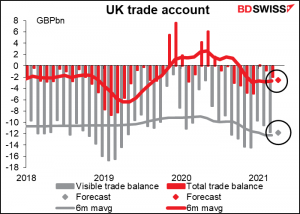

The trade deficit is expected to widen slightly, but not significantly.

All told the UK data should confirm Haldane’s comments about the UK economy “going gangbusters.” That might be positive for GBP.

Source: BDSwiss