PREVIOUS TRADING DAY EVENTS – 24 April 2023

Announcements:

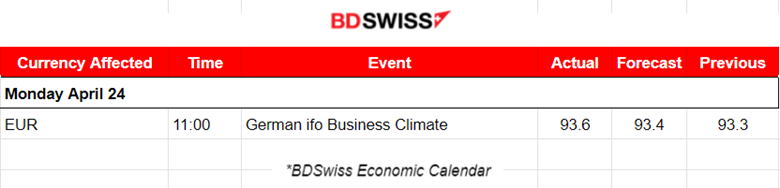

- According to the German ifo Business Climate Index, German business has somehow improved. The Index rose to 93.6 points in April, up from 93.2 points (seasonally adjusted) in March. This was due to an improvement in companies’ expectations. While companies’ expectations improved, they assessed their current situation as slightly worse, the institute said.

“German business worries are abating, but the economy is still lacking momentum,” Ifo’s president Clemens Fuest said.

Economic momentum in Germany is likely to remain weak for the time being, said Ulrich Wortberg, senior economist at German bank Helaba. “At least a recession should be avoided, and we expect a gradual recovery in the course of the year,” he added.

Source: https://www.reuters.com/markets/europe/german-business-sentiment-improves-slightly-april-2023-04-24/#:~:text=BERLIN, April 24 (Reuters),a survey showed on Monday.

______________________________________________________________________

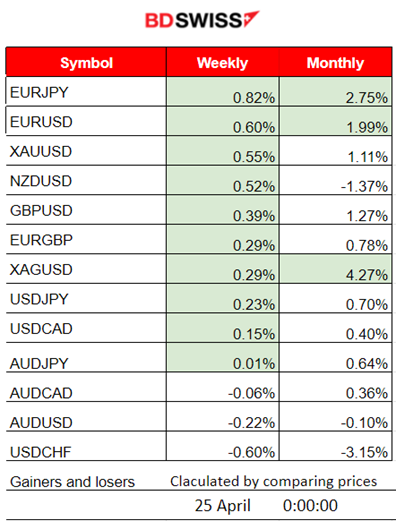

Summary Daily Moves – Winners vs Losers (24 April 2023)

- The top gainer this week is EURJPY with a 0.82% price change, followed by EURUSD with 0.60%.

- Silver is leading again this month with a 4.27% change so far, followed by EURJPY having 2.75% this month.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (24 April 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

The sentiment in German business has slightly improved. The German ifo Business Climate Index rose to 93.6 points in April, up from 93.2 points (seasonally adjusted) in March. The EUR pairs with EUR as base currency started to move upwards around that time after the release.

General Verdict:

- Some intraday short trends formed after the European Markets opening. EUR was affected by the news with some appreciation. The USD has depreciated against other currencies overall as per the US Dollar Index (DXY).

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (24.04.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

EURUSD moved higher yesterday. No intraday shocks took place as expected. After 11:00, the pair started to move on an upward path, moving above the 30-period MA. This move was driven mainly by the German ifo Business Climate Index release and the steady intraday depreciation of the USD.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

A clear downward channel for NAS100. U.S. Stocks have finally shown good signals of reversing downwards. This goes for NAS100 and S&P500, not for US30 (Dow Jones). US30 is showing more resistance. As the price was moving around the mean, the index jumped yesterday to higher levels. It is clear that higher volatility is governing these price paths and it is very hard to identify if the market is starting to form a trend or even mark the end of a trend. The current expectation for the future of the U.S. economy is a recession. Let’s see.

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

After a long period of moving downwards, Crude has finally found resistance near 77 USD/barrel and reversed. As per the RSI: Higher Lows while Price: Same lows, the bullish divergence showed signs that the price will reverse. The price nearly reached a peak of 79.1 USD yesterday.

Related Analysis on TradingView:

https://www.tradingview.com/chart/USOIL.F/Hu8MmJmr-USOIL-Reverses-21-04-2023/

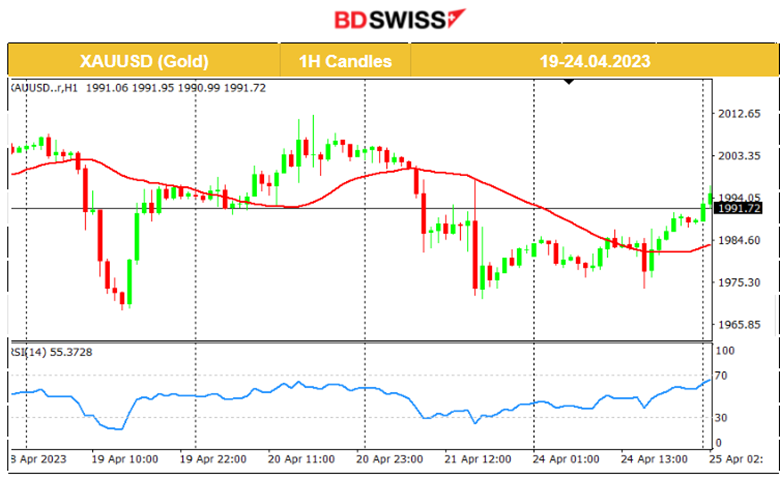

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold is currently moving with low volatility since no major figure releases have taken place yet this week. In addition, demand and supply forces do not have much of an impact. Investors did not shift their preferences significantly. We see that more risky assets, such as stocks, are still preferred. The price moves around the 30-period MA these last few days with deviations of max near 20 USD.

______________________________________________________________

News Reports Monitor – Today Trading Day (25 April 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

At 17:00, intraday shocks are expected due to the release of the U.S. CB Consumer Confidence survey and the other scheduled figures released at that time. Consumer expectations about future prices have an impact.

General Verdict:

- More volatility to be observed after 17:00. Slow day since a number of banks are closed due to holidays.

_____________________________________________________________

Source: BDSwiss