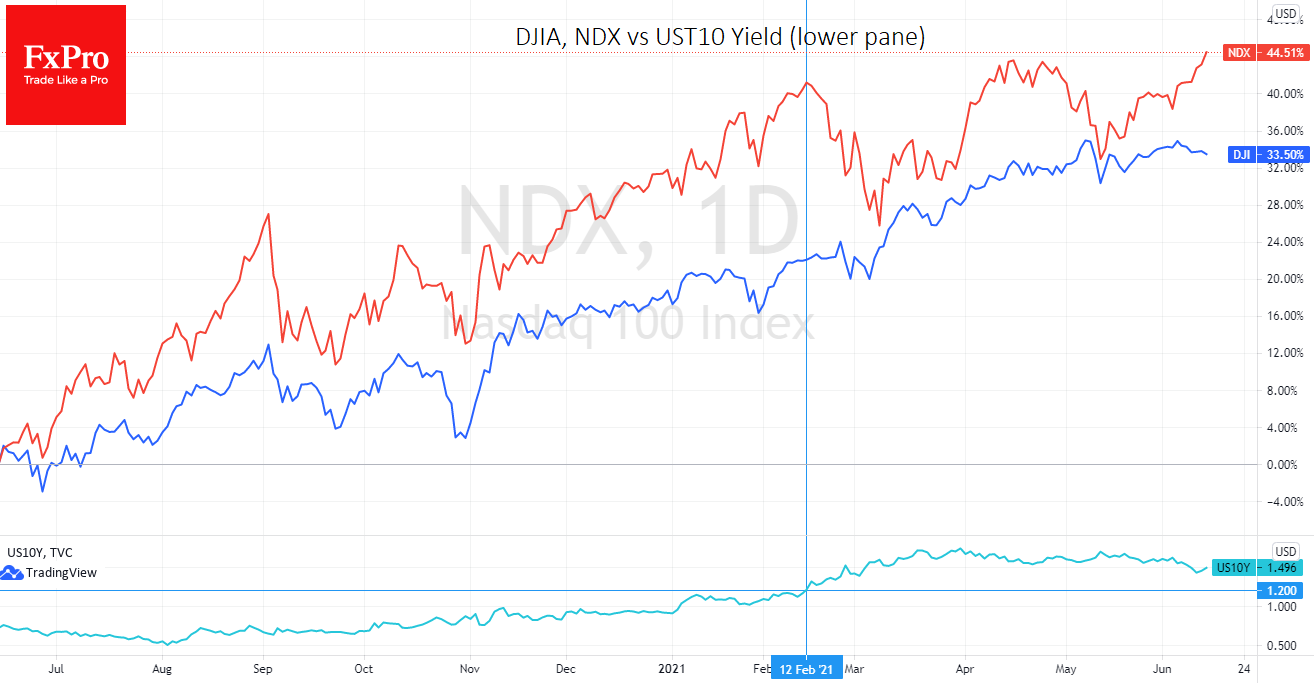

Thus, in the stock market, we see a speculative reversal of the trend at the beginning of the year, where we have seen a rotation in shares, causing the Dow Jones to rise to the detriment of the Nasdaq. If we are stepping back from specific indices, we see the current situation looks like the end of a rotation from growth to value stocks and a return to last year’s trend with the outperformance of younger and high-tech companies.

The background to what is happening is a decline in long-term US bond yields, which have fallen from a peak of 1.76% for 10-years to 1.44% earlier this month. Interestingly, earlier this year, growth stocks started shaking as soon as yields exceeded 1.20% in February.

The big question for investors is whether the observed rotation is evidence of a strengthening economy and a favourable outlook for young companies or temporary profit-taking in dividend or matured companies near and of the second quarter?

In our view, the latest upswing in tech stocks is driven by speculative expectations that the Fed will reaffirm its stance. This speculation looks justified given recent comments from FOMC members and the desire to support the recovery. The Fed may live up to these expectations.

However, there is still a risk that the US central bank appears ready to start discussing a tapering and, together with a rise in the economic and inflation forecasts, will signal an imminent withdrawal of stimulus and an earlier rate hike than the markets are currently laying down. Such an approach risks triggering a correction in the markets, cooling the enthusiasm of optimists, and bringing buyers back into the dollar.

Source: FXPro