Rates as of 05:00 GMT

Market Recap

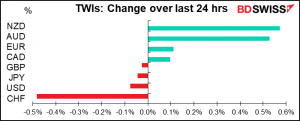

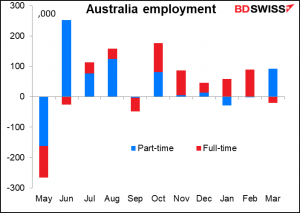

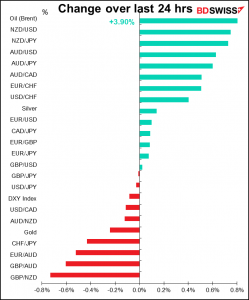

Well, as usual I’m right but unfortunately the market doesn’t agree. NZD continued to appreciate despite my coruscatingly brilliant argument that yesterday’s Reserve Bank of New Zealand (RBNZ) statement didn’t warrant it. To make matters worse, even though there was a blowout Australia employment report (unemployment rate falls to 5.6% from 5.8% vs 5.7% forecast, employment rises 70.7k or double the 35.0k forecast, and a rise in the participation rate to 66.3% vs forecast of unch @ 66.1%) the market latched onto the fact that full-time jobs fell, and all the increase was in part-time jobs as an excuse to sell AUD after the report came out. So although AUD moved higher during yesterday’s trading day, as I expected, it’s currently headed down.

As a result AUD/NZD, which I thought was a “buy” at 1.0815 yesterday, is currently trading at 1.0794. Oops! Not the best call I’ve ever made, although unfortunately not the worse either, I’m embarrassed to admit.

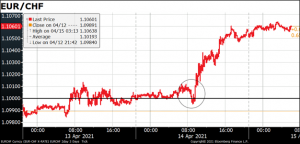

The other big move was in CHF. I suspect the reason is technical: EUR/CHF was trading below 1.10 on Monday, it recovered that level late in the day and was trading above it on Tuesday. Traders made some attempts to push EUR/CHF back below 1.10 and it didn’t work, so if you don’t make money selling, try making money buying.

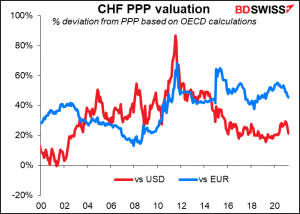

I would just note that as of December last year, the OECD estimated that the purchasing-power-parity rate for USD/CHF at 1.1438, vs the actual rate of 0.9233 today, so in my view the grossly overvalued CHF should be falling every day, particularly as my wife & daughter still live there and I’m paying their rent etc. But CHF is structurally overvalued; it’s been overvalued for years and will probably continue to be overvalued for years, so saying where it “should’ trade is like saying your two-year-old “should” sit quietly and listen to Mommy.

The FX market has been largely ignoring the problems in Northern Ireland – I guess the view must be that troubles there are just “business as usual”– but there’s now talk of a deal that might ease trade checks in Northern Ireland if the UK agrees to align its food standards with those of the EU. While the disruption to trade doesn’t seem to have disrupted the pound that much, I think a solution that promised a better future could help the currency. Especially, with the local elections in Scotland on May 6th that could increase the power of the separatist Scottish National Party (no simlar elections in Northern Ireland, though).

Although JPY has been gaining vs USD, that seems to be more of a function of a weak USD rather than a strong JPY. JPY has weakened somewhat vs EUR.

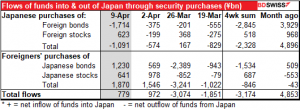

Today’s data on securities investment abroad, reflecting the first full week of the new fiscal year, may explain that weakness vs EUR: JPY 1.7tn in Japanese purchases of foreign bonds! This is however being offset by foreign purchases of JPY 1.2tn in Japanese bonds and 641bn in Japanese stocks, meaning that there’s still a net inflow of funds into Japan.

Otherwise, I’d just like to link to the Eurosystem report on the public consultation on a digital euro that ECB Executive Board member Fabio Panetta presented to the European Parliament yesterday. Although the report says that “It will serve as important input for the ECB’s Governing Council when it decides in mid-2021 whether to launch a formal investigation phase in view of a possible launch of a digital euro,” Panetta didn’t seem to be in much doubt as to whether the launch would take place. “We will do our best to ensure that a digital euro meets the expectations of citizens highlighted in the public consultation,” he said. The expectations or more accurately hopes highlighted in the consultation were: privacy (43%), security (18%), the ability to pay across the euro area (11%), no additional costs (9%) and offline usability (8%).

I think a digital euro is coming, and if there’s going to be a digital euro, there will have to be a digital dollar, too. And once you have a digital euro and dollar that can be used for international payments, what’s the rationale for Bitcoin and other cryptocurrencies to exist? What function will they provide better & more securely? Especially if the authorities do manage to crack the “privacy” issue. That’s the main difference I see between a potential digital euro and the digital yuan that China is already experimenting with. I don’t think anyone imagines that privacy for the user is going to be a major goal of the Chinese government.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

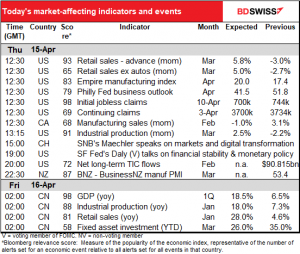

Not much going on during the European day, but when North America wakes up, things get going real fast.

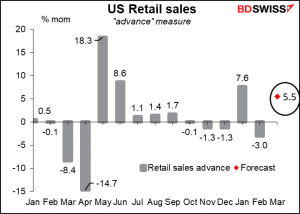

The most important of the indicators out today is probably the US retail sales. A combination of payback from bad weather in February plus $1,400 stimulus checks hitting people’s bank accounts is expected to result in a surge in sales. This could be the start of a series of relatively high retail sales figures as the economy gradually opens up and people who’ve been hibernating for a year with nowhere to go and nothing to spend their money on gradually leave their lairs and spend, spend, spend. The figure should help to cement the “risk-on” mood and therefore perhaps be good for stocks but negative for the dollar.

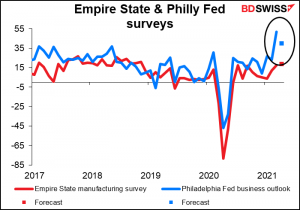

The Empire State manufacturing survey is expected to rise a bit while the Philadelphia Fed business outlook survey is expected to fall a bit – but not too much — from its record high. In either case, they should both confirm the strength of the US manufacturing sector.

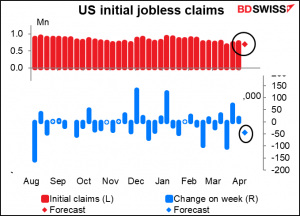

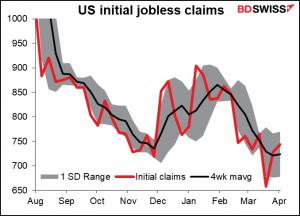

Initial jobless claims show that “hope springs eternal.” Once again the market is forecasting a decline of 44k even though last week the market was looking for a decline of 39k and instead there was a rise of 25k. It’s what we in the business call the “stopped clock theory of forecasting” – a stopped clock is right twice a day, and as long as you keep forecasting the same thing eventually you’ll be right.

People used to watch the four-week moving average of continuing claims. That seems to have bottomed out for now. Meanwhile, the figures are quite volatile – notice how wide the one-standard-deviation band is around the average.

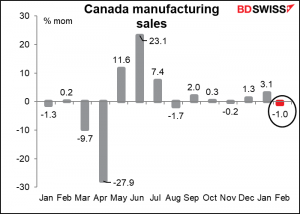

Canada’s manufacturing sales are expected to be down somewhat, based on weak export figures. I wouldn’t be too worried about the February figure because a) the US is running a record trade deficit, which is only going to get wider, and b) 12% of US imports come from Canada, the #4 country (if we define the European Union as one country — #3 if we don’t.) Rather, I would look at the leap in January and expect to see that again when the March figures are released.

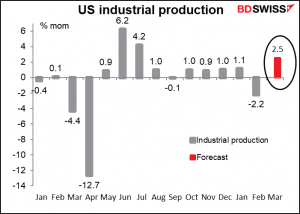

US industrial production for March is expected to leap ahead with the biggest jump since June, when the economy was still recovering from the March/April COVID plunge. Part of that is just a rebound from the low level of production in February, when the weather disrupted output around the country (especially in Texas, if you remember). This figure should just reinforce the message from the Philly Fed and Empire State indices earlier in the day that US output is roaring back.

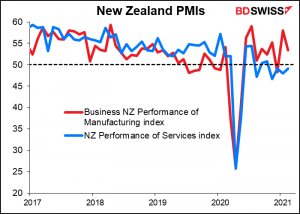

There’s no forecast for the BNZ – BusinessNZ Performance of Manufacturing Index (PMI) but here’s a graph anyway as it seems to be significant for the markets.

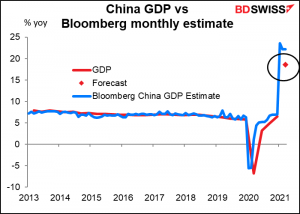

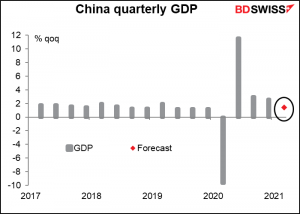

Although China has passed the baton of global growth engine to the US this year (pardon my mixed metaphor), it’s still important for the outlook for the world economy. Today we get the Big Four indicators from the country: retail sales, industrial production, fixed-asset investment, and the all-important GDP.

As I’ve pointed out several times this week, the yoy comparison involves what was happening a year ago, and of course Q1 2020 activity in China was uniquely abnormal – that was when COVID-19 was discovered in Wuhan and people’s doors were being welded shut so that they couldn’t go out. It’s not surprising then that the yoy rate of change in the economy is expected to be abnormally high. The market consensus is currently 18.5% yoy. That’s well below the Bloomberg monthly China GDP estimate, which puts it at 22.2% yoy.

The strong figure isn’t all just a matter of the low base. On a quarter-on-quarter basis, the figure is still expected to be a respectable 1.5% qoq. That’s in line with the average 1.7% qoq growth seen before 2020 (data from 2011).

The other figures – retail sales, industrial production, and fixed asset investment — will be similarly distorted. Worse, only yoy figures are available, not mom, so we won’t be able to see the recent performance of the economy just by looking at the headline numbers. I’m not going to bother with a graph of them because they’d just show the usual “hockey stick” picture that we got used to back in June and July.

Source: BDSwiss