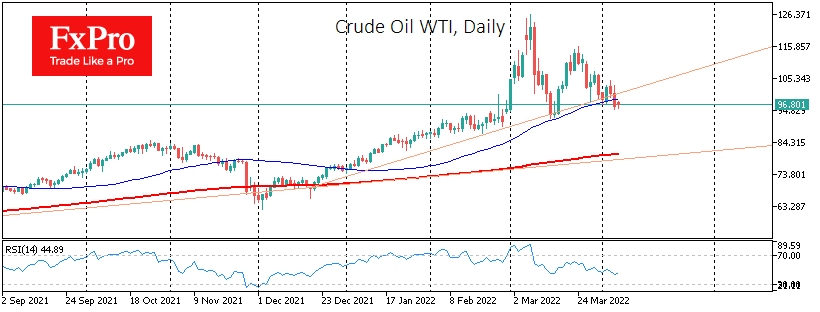

The WTI price ended Wednesday below $100 and below the support line of the rising trend through the lows since December. Over the last two weeks, the downtrend in oil has brought the price back to the area of the March lows and below the 50-day moving average.

A further downward move would signal the breaking of the last momentum that culminated in a price flight in the first eight days of March. We consider the impulse in early March to be the final point of the oil rally. That capitulation of buyers in April 2020 took some contracts into negative territory, becoming the last chord of the multi-year bear market in oil.

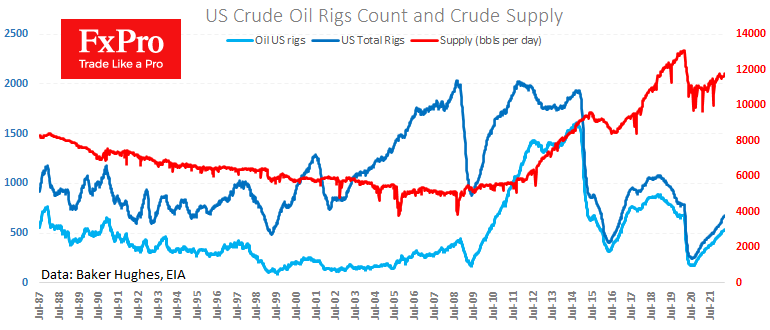

The latest US statistics package is also fueling the cautious outlook for oil. Weekly data published in the evening showed a rise in production to 11.8m BPD. Since January, this is a repeat of the highs and does not suggest a surge in drilling activity, but it is still a step towards increasing oil supplies on the market.

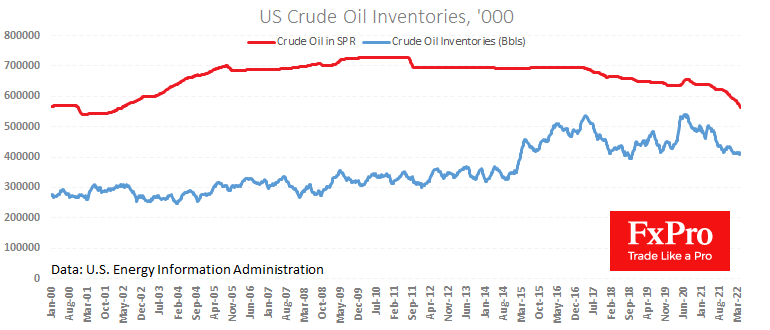

Last week’s reduction in the Strategic Petroleum Reserve (-3.7M) outpaced the increase in commercial stockpiles ( 2.4M). We have seen 3-4M barrel sales from SPR over the past three weeks, which looks enough to stop the depletion of commercial reserves and stabilise the oil price.

We simultaneously see a slowdown in oil demand due to high prices, a slowing economy, and a build-up in supply. In addition, Russian oil is not yet far out of the market but only redirected (albeit at a significant discount) to Asia. Furthermore, OPEC continues to raise quotas, which should also work to restore inventory levels.

It is doubtful that oil prices will return to “normal” levels of 2019 when the price of a barrel hovered around $60. It is much more likely that over the next year or two, prices will find balance in a range with the lower end of $75-85 and the upper end around $100. Dips towards the lower end of the range will spur demand and suppress upstream investment while approaching the psychological upper bound will provoke new interventions by consuming countries and stimulate competition for market share among producers.

Source: FXPro