The last-minute Brexit deal swept away investors’ worst fears of a messy divorce and put an end to years of political wrangling, leading the pound to jump about 2% into the end of 2020. But rather than pave the way for further gains, the resolution has brought to the foreground a host of concerns that risk undermining sterling. “With sterling having failed to rally materially on the back of the Brexit deal — versus the euro — we are now inclined to see it underperform,” said BlueBay’s Chief Investment Officer Mark Dowding, who oversees $70 billion for the firm. He offloaded bets on the pound against the euro in December.

This week, Prime Minister Boris Johnson sent England into a third lockdown, dealing a fresh blow to an economy already forecast to stutter along well below potential. For the longer term, speculation is growing that Scotland, which voted to remain in the bloc in 2016, could seek to leave the U.K, ushering in a new chapter of political turbulence.

And since the trade deal doesn’t extend to services or the City of London, key questions about the locomotive of growth will remain unanswered for months, a drag on investor confidence. Money markets have brought forward bets that the Bank of England will be forced to slash borrowing costs again, to 0% in August, leaving open the specter of negative rates.

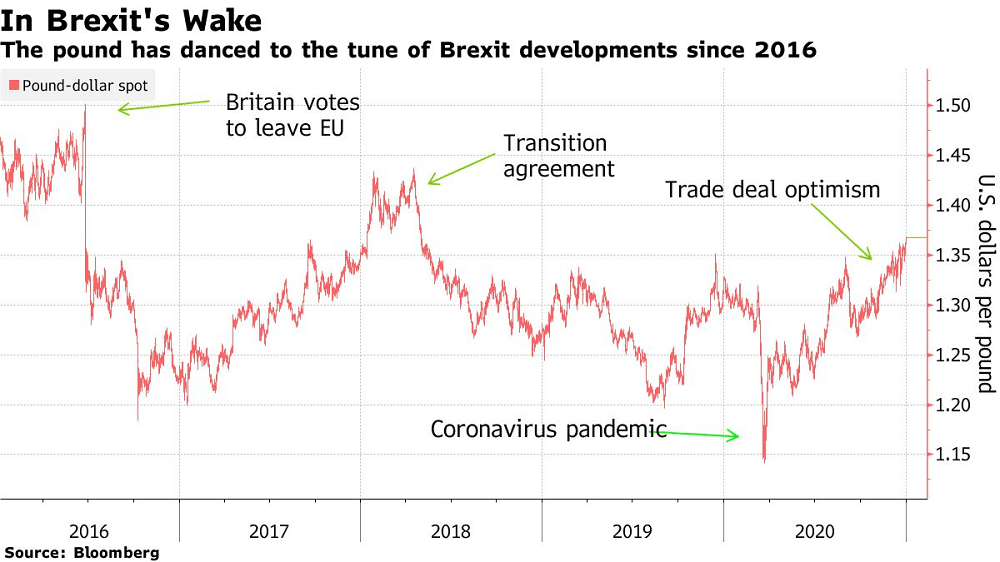

Sterling rose 10% against the dollar in the second half of 2020 as speculation on a deal intensified, extending a rebound from its lowest level in over three decades touched in March. Yet since the start of the year, it has fallen around 1% against the euro, and is among the only major currencies to lose ground against the greenback.

Source: FXPro