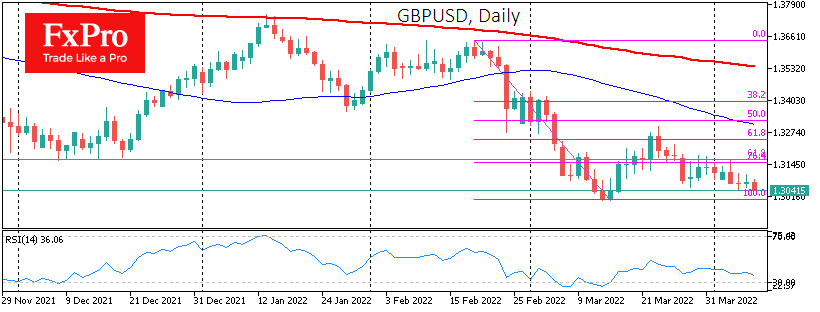

After a corrective bounce from March 15th to the 23rd, GBPUSD has returned to the downside. Most worryingly, this decline is coming very evenly. It is no longer a speculative flight of capital to safe havens in response to frightening news.

The flat downtrend with a succession of lower local highs indicates a capital flight out of European countries.

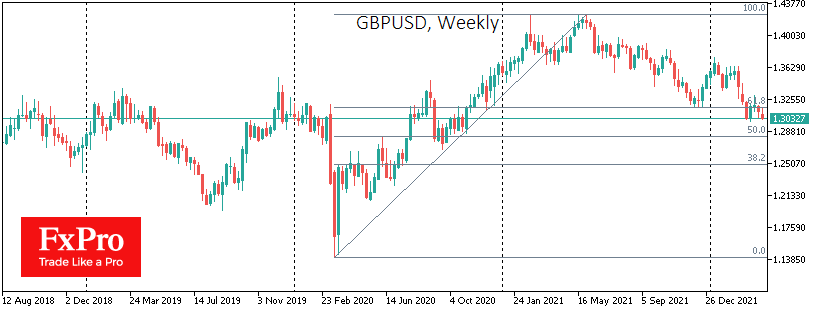

Britain is much less dependent on energy supplies from Russia but still bears an evident loss of economic growth due to the current situation. In addition, as the money hub for Europe, the UK is taking a hit due to worsening business sentiment and tighter financial conditions.

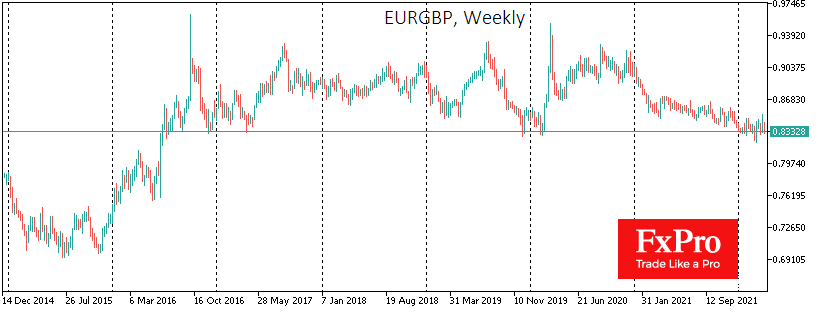

The Bank of England’s more determined move to raise the bank rate and cut QE is fueling the Pound’s rise against the euro. The EURGBP pair is close to 0.8300, near the lower bound of an almost 6-year trading range. And so far, it isn’t easy to find a reason to reverse the trend.

In the meantime, the Pound still has too little strength to withstand a rising Dollar, whose economy is much less affected by the war in Europe.

The inability of GBPUSD to develop a rebound above 1.3160 (61.8% of covid amplitude) sets up for further drawdown with near-term support near 1.2830 (50% of the rally) with the potential for a more profound decline at 1.2500 in the next few weeks.

Source: FXPro