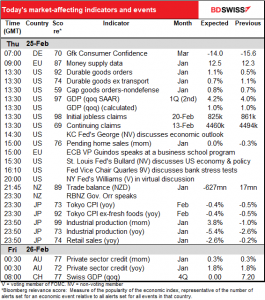

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

It’s “risk-on” time again! Stocks were up across the continent in Europe yesterday, in the Americas (except for Mexico), and this morning in Asia. What song would this go with? The Rolling Stones sang “Paint it Black,” which fits my P&L nicely, but the screen is green, not black, and anyway the lyrics don’t fit the mood. Lorde’s “Green Light” has a suitable title, but the words don’t fit at all, either. Same with NF’s “Green Lights,” which also doesn’t seem appropriate. Any suggestions? Maybe there’s a suitable tune in Korean, where the KOSPI index was the global leader, up 3.1%.

Perhaps I was too blasé about Fed Chair Powell’s comments, because he seemed to be the spark that ignited this optimism. Most of what he said yesterday was just a continuation of his reassuring comments that the Fed would keep policy accommodative for some time to come. The key point was that he said it could take more than three years before the Fed reached its inflation goal of 2%. Since he also emphasized the importance of witnessing “actual progress” (as opposed to “forecast progress”) in determining the appropriate stance of policy, as they’ve stressed before, this implies a long long time before they begin even “thinking about thinking about” normalizing policy. (Remember too that they’ve switched to an average inflation framework, meaning they’re planning on letting inflation run above 2% for some time.)

Fed Gov. Brainard echoed Powell’s words when she said “Transitory inflation…was not the kind of inflation that monetary policy would react to” and, like Powell, stressed that “the assessment of shortfalls from broad-based and inclusive maximum employment will be a critical guidepost for monetary policy” (i.e., even if headline unemployment falls, we’re not going to start tightening policy until minority unemployment has fallen, too.)

We’ll know a lot more about the Fed’s thinking in three weeks, when the March 17th Federal Open Market Committee (FOMC) meeting takes place and they release their new quarterly Summary of Economic Projections. This will contain the Committee’s updated inflation forecasts.

Powell’s remarks led to a sharp turnaround in risk sentiment, with the S&P 500 moving from an intraday low of -0.6% shortly after the opening to end up 1.1%, the strongest daily performance for the index in over three weeks.

The big question facing the FX market now is whether the Fed is correct about inflation. If they are and inflation remains tame, then US real yields could remain high and the dollar could benefit. If on the other hand they’re wrong and inflation rises, then real yields are likely to fall and the dollar weaken.

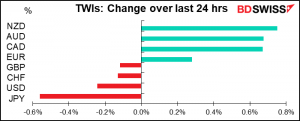

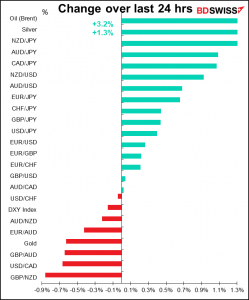

The FX market reaction was exactly as one might have predicted: the three commodity currencies up, JPY, USD and CHF down. Interesting though that today it was NZD on top, not AUD (barely). NZD continued to rally during the day after the Reserve Bank of New Zealand (RNBZ) upgraded its forecasts.

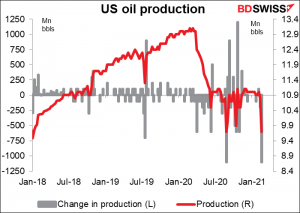

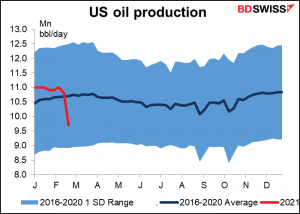

Oil gained even though the Dept of Energy confirmed the American Petroleum Institute’s assessment that oil inventories rose in the latest week ( 1.3mn bbl), a far cry from the 6.5mn bbl decline in inventories that had been expected. But the rise in inventories was outweighed by a 1.1mn barrel plunge in output to 9.7mn barrels a day, the lowest for the US since September of last year. This was the biggest drop in production on record (going back to Jan 1983), at least in absolute terms if not in percentage.

For now oil (and CAD) may be supported by the bad weather in the US. We’ll have to watch next Thursday’s OPEC meeting to see whether the group will bring back enough production to the market to replace the missing US barrels. There’s talk that Saudi Arabia will announce a rollback of its unilateral 1mn b/d oil cuts in April, which could upset the supply/demand balance and push CAD lower, at least relative to the other commodity currencies.

EUR/CHF continued to gain, breaking through the 1.10 level for the first time since December 2019, but the upward momentum in the pair faded as Bund yields failed to pick up substantially.

Today’s market

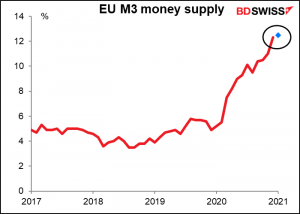

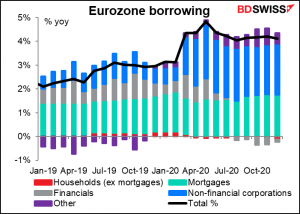

The day starts out with EU money supply data. I don’t know why there’s such interest in this, as the European Central Bank (ECB) long ago gave up targeting money supply.

Maybe people are looking for the bank lending data. Lending continues to grow, but the pace of growth has slowed – it was 4.8% yoy in May and 4.1% in December. Weak bank lending growth could force the European Central Bank (ECB) to take further steps to prod banks to lend – although under current circumstances, my guess is that the slowdown is caused by a lack of people or companies interested in borrowing, not by a reluctance on the part of banks to lend.

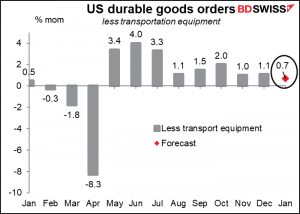

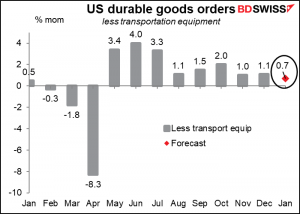

When the US opens for business, January durable goods orders will be the first thing on the menu. The headline figure should be boosted by a big order for Boeing

aircraft…

…but even excluding that, orders should be up by a decent amount. That could be encouraging for the US markets.

The second estimate of US Q1 GDP is interesting but not that important, unless it’s massively revised, which I would doubt. The market is looking for it to be revised up a little.

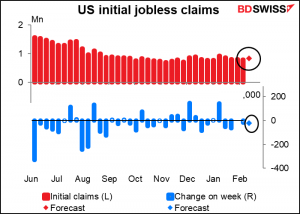

That brings us to the big event of the day; the weekly US jobless claims. These have confounded forecasters recently. Last week, initial jobless claims they were expected to fall 23k to 770k, instead they rose 68k to 861. But hope springs eternal, or so they say, and this week the market is looking for initial claims to drop by 36k, a bit more than what they expected last time. We’ll see. Given the terrible weather in the US recently, I kind of doubt it.

In any case, the jobless claims figure is quite unpredictable because a) the situation in general is unpredictable, and b) the seasonal adjustment factors that are applied no longer apply – hiring & firing is no longer following the usual seasonal pattern, but rather is being whipped around by the virus levels.

Even if claims do fall as expected, that would only bring them down to the level of September/October, which means there’s still a long way to go before the Fed can say they’ve made “substantial further progress…toward the Committee’s maximum employment and price stability goals.” On the contrary, they’ve hardly made any progress at all recently.

I think this figure would be disappointing to the market, as even if it does fall this much, it’s such a small fall as to be insignificant.

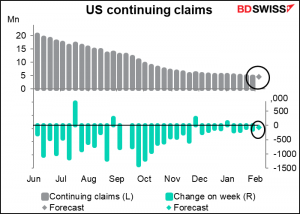

Continuing claims are expected to be down by a pitiful 34k.

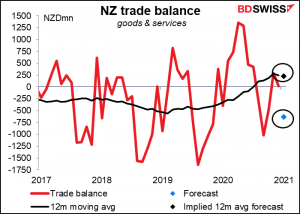

The New Zealand trade balance is expected to fall into deep deficit as both imports and exports fall, but exports fall a lot more than imports. The figures aren’t seasonally adjusted though, so I prefer to look at the 12-month moving average. The market consensus forecast would mean only a slight fall in the 12-month average to a surplus of NZD 225mn a month from NZD 245mn, which I don’t think is significant. I therefore think the data would be neutral for NZD.

Japan announces most of the usual end-month indicators today, except for the employment numbers, which will be released the following week.

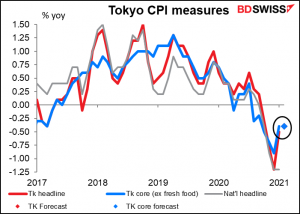

Consumer prices in Tokyo are expected to remain in deflation. No change there. No impact on the market likely either as everyone is waiting to see what the Bank of Japan comes up with in its review of its monetary policy, which it’s planning on releasing at the next meeting (March 19th).

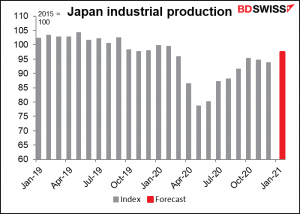

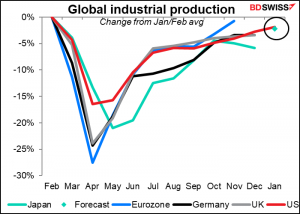

Industrial production is expected to be up a relatively healthy 3.8% mom. Even so, that would leave Japan’s IP still 2.2% below pre-pandemic levels.

Still, that would put it exactly in line with US performance, so maybe that’s par for the course at this troubled time.

Source: BDSwiss