PREVIOUS TRADING DAY EVENTS – 04 Oct 2023

- New Zealand’s central bank decided to hold rates unchanged, with OCR at 5.5%, as reported on Wednesday with policymakers considering that rate hikes so far are sufficient to fight inflation.

The Reserve Bank of New Zealand (RBNZ) suggested though that further increases are still in play.

“Interest rates are constraining economic activity and reducing inflationary pressure as required,” the central bank said in a statement.

“We see this statement as more dovish than our expectations,” said Westpac NZ chief economist Kelly Eckhold. “We anticipated the RBNZ would craft a statement that broadly endorsed current market pricing for around a 50/50 chance of a 25 bp rate rise in November. This statement suggests that view was too hawkish.”

It was stated that interest rates will need to remain at a restrictive level for the foreseeable future to ensure consumer price inflation returns to its 1% to 3% target range. New Zealand’s annual inflation is currently running at 6.0%, just below a three-decade high of 7.3% (June 2022) with expectations that it will return to its target band within the next two years.

“The Bank appears content to wait for restrictive policy settings to fully feed through to the real economy,” analysts at Capital Economics in a note.

Source:

https://www.reuters.com/markets/nz-central-bank-holds-rates-steady-says-past-hikes-tempering-inflation-2023-10-04/

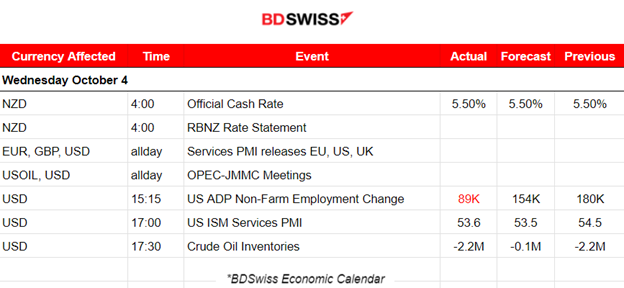

- The ADP Report, jointly developed with the Stanford Digital Economy Lab, was published ahead of the release on Friday of the Labor Department’s more comprehensive and closely watched employment report for August. It showed that private payrolls rose by just 89K jobs last month beating expectations that private employment would rise by 153K.

The data point out that the labour market is gradually easing due to interest rate hikes from the Fed. However, it is known The ADP report has not been a reliable gauge in trying to predict the private payroll count in the employment report.

According to a Reuters survey of economists, the Bureau of Labor Statistics is expected to report that private payrolls increased by 160K jobs in September. Including government employment, total nonfarm payrolls are forecast to have risen by 170K jobs last month after increasing by 187K in August.

Source:

https://www.reuters.com/markets/us/us-private-payrolls-growth-slows-sharply-august-adp-2023-08-30/

______________________________________________________________________

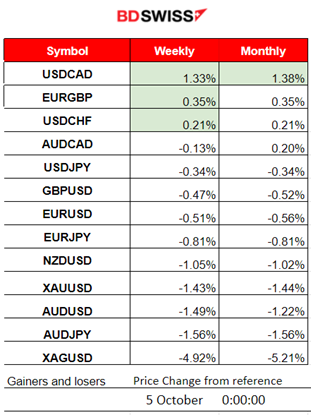

Winners and Losers

USDCAD remains on the lead with 1.33% gains so far this week. Crude is falling rapidly this week affecting the FX Market causing CAD depreciation, thus the rise.

News Reports Monitor – Previous Trading Day (04 Oct 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

The RBNZ decided to keep the Official Cash Rate (OCR) at 5.50%. Current rates are constraining economic activity and reducing inflationary pressure. Demand growth in the economy continues to ease. However, the near-term risk is that inflation is not slowing down as anticipated. The NZD suffered depreciation against other currencies. NZDUSD dropped sharply, nearly 50 pips at the time of the release and retracing soon after.

- Morning–Day Session (European and N. American Session)

Let’s see the Services PMI first:

Services PMIs give a somewhat better picture regarding business conditions overall. Some figures are in the expansion area or better than the previously recorded figures.

Eurozone:

The Spanish service sector returned to expansion during September as per the PMI shows, 50.5 points. New business volumes, but activity rose only just. Higher employment and confidence in the future was again positive.

In Italy, the services sector experienced a fall in activity, unchanged business levels and weak demand conditions in September. The PMI remained fractionally below the 50.0 no-change mark in September at 49.9, little-changed compared to 49.8 in August.

The French services PMI remains low at 44.4 signalling that French services activity is falling and in fact at the sharpest pace since November 2020. Business activity levels shrunk for the fourth consecutive month, output fell at the sharpest rate since November 2020 and is also suffering from further deteriorating demand for services. Business confidence slumped to its lowest level in almost three years.

The German service sector shows improvement in business conditions as the PMI was reported in the expansion area just a little above the 50 points threshold. Business activity improved following a notable decline the month before. Sharp and accelerated drop in new business affected demand levels as well negatively. Employment fell, and for the first time since mid-2020 as firms’ expectations towards future activity weakened.

The Eurozone economy continues with contraction, entering the 4th Quarter now, as demand falls at the quickest pace in almost three years. The services PMI was reported devastating again at 43.4 points. Output volumes across both the manufacturing and service sectors were affected negatively by deteriorating demand conditions driven by the fall in new orders and in new business received by service providers.

United Kingdom:

The U.K.’s Services PMI reported in the contraction area, at 49.3 points, not far from the 50-point threshold. Still, it is indicating the weakest service sector performance for eight months in September. Hopes of a further moderation in inflationary pressures are rising. However, service providers reported a renewed fall in employment, in part due to cost considerations.

United States:

The PMI figure shows that the U.S. services sector experienced stable business activity amid weak demand conditions, reported to be 50.1 points, in the expansion area. Broadly unchanged levels of business activity stemmed from a second successive monthly drop in new orders, arising from weaker domestic and foreign client demand

According to the ISM Services PMI report, economic activity in the services sector indeed expanded in September for the ninth consecutive month with its PMI index at 53.6. Compared to other regions, the U.S. is clearly doing better. The USD gained some appreciation at the time of the release.

The ADP report for the U.S. showed a surprisingly low employment change figure. US companies added the fewest number of jobs since the start of 2021 in September and pay growth slowed. The effect on the market was minimal.

General Verdict:

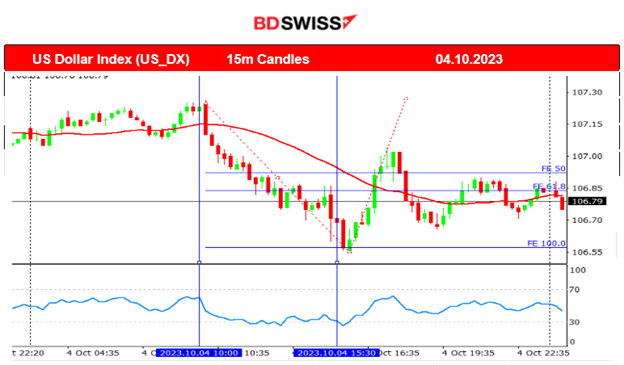

- Volatility is higher than usual due to the Services PMIs and the ADP report.

No major shocks but steady movements with retracements and around the mean paths.

- The USD lost value overall. The DXY started to fall early and remained on the downside until the end of the trading day.

- The U.S. Stock market reversed yesterday showing more and more volatility as NFP approaches.

- Crude kept diving but Gold remained near the support, moving sideways.

____________________________________________________________________

FOREX MARKETS MONITOR

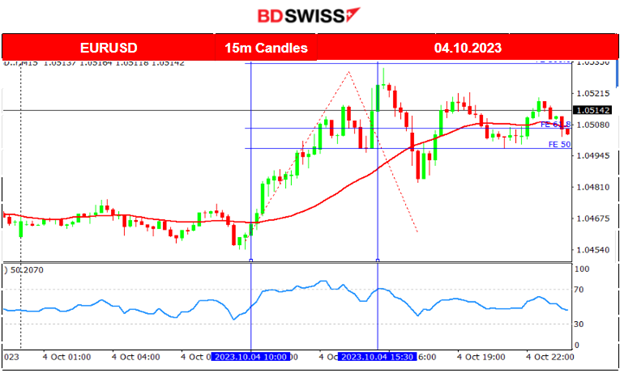

EURUSD (04.10.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The EURUSD started early to move to the upside since USD, the main driver of the pair, was depreciating steadily. The pair found resistance near 1.05300 and then it started to retrace back to the 30-period MA. Volatility levels dropped and so it followed a sideways path after that around the mean. A mirror of the DXY chart above.

___________________________________________________________________

CRYPTO MARKETS MONITOR

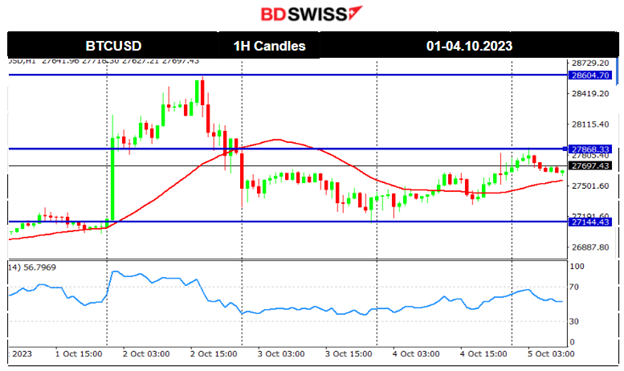

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

A sudden jump on the 2nd of October caused Bitcoin to move upwards more than 900 USD after breaking the resistance at 27300. The market calmed down after that, moving to lower levels. No other important movement was recorded recently, and the path keeps the sideways direction. It remains in a relatively small range moving sideways.

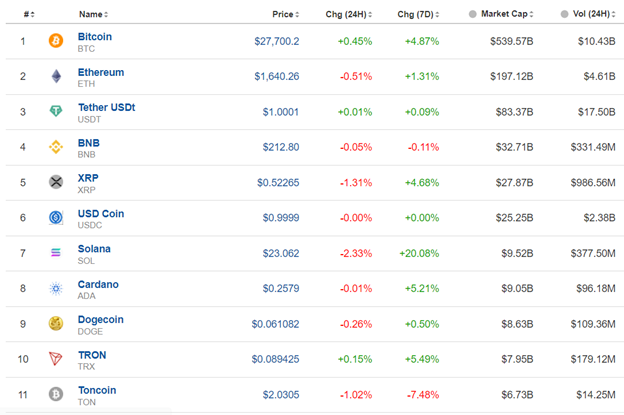

Crypto sorted by Highest Market Cap:

The 7 Days Change is still green and with roughly the same figures apparently meaning that indeed the crypto market has not experienced significant movements in general.

The last 24 hours seem grim for crypto as most of them experience negative gains but are rather small. Bitcoin is gaining some ground though instead.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

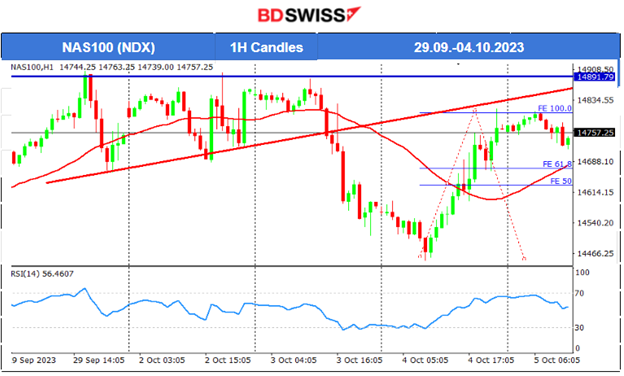

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 3rd of October, the index eventually broke the triangle formation that was formed and mentioned in our previous report. After that breakout the index dived, reaching the support at near 14450 before starting to retrace. Retracement reached almost 100%. This was a clear reversal, while the price crossed the 30-period MA on its way up, almost reaching the starting point of the initial drop.

Related Analysis on TradingView:

https://www.tradingview.com/chart/NAS100/FE8YJPav-NAS100-Retracement-Set-05-10-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude oil is showing signs of further price decline. Oil settled down more than $5 on Wednesday. A bleaker macroeconomic outlook and fuel demand destruction came into focus following a meeting of an OPEC panel, grouping the Organization of the Petroleum Exporting Countries and allies led by Russia. The OPEC ministerial panel made no changes to the group’s oil output policy, and Saudi Arabia said it would continue with a voluntary cut of 1 million barrels per day (bpd) until the end of 2023, while Russia would keep a 300,000 bpd voluntary export curb until the end of December. The latest data also showed a sharp decline in U.S. gasoline demand that could explain the dive now in the short term.

Source: https://www.reuters.com/markets/commodities/opec-panel-unlikely-tweak-policy-saudi-keeps-oil-cuts-sources-2023-10-04/

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold is on the sideways path. There is no significant data to suggest that there will be a reversal unless important support or resistance levels break. The RSI shows a bullish divergence formation with its higher highs. However, the news is probably going to distort this formation. However, a break of the depicted range to the upside might cause the price to jump even during news.

______________________________________________________________

News Reports Monitor – Today Trading Day (05 Oct 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

The Construction PMI showed a lower figure this morning indicating contraction, 45 versus the previous 50.8. This could be the reason why the GBP depreciated steadily since the release.

The U.S. unemployment claims are expected to be reported to be 211K. Not much of an expected change. However, we have seen that the labour market is resilient despite the low private sector employment increase that was reported yesterday as shown from the ADP report figure. Increased volatility instead of a shock is more probable for the USD pairs at the time of the release.

General Verdict:

- Volatility is moderate, FX pairs show unusual movement with relatively big deviations around the mean.

- The U.S. indices reversed yesterday. Will this be the start of an upward movement? Waiting for the NFP to give a good picture of what to expect.

______________________________________________________________

Source: BDSwiss