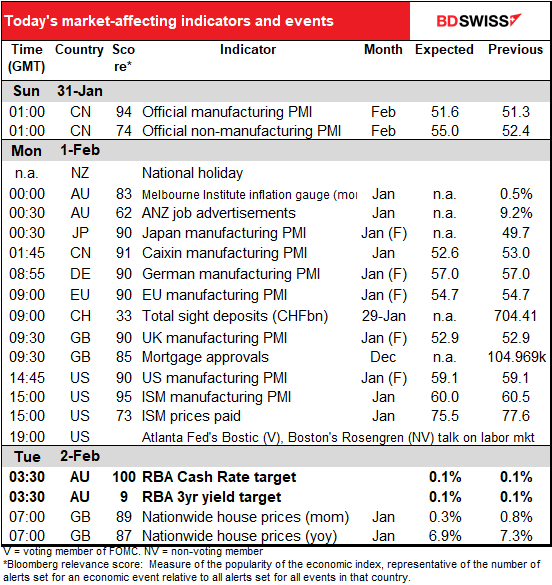

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

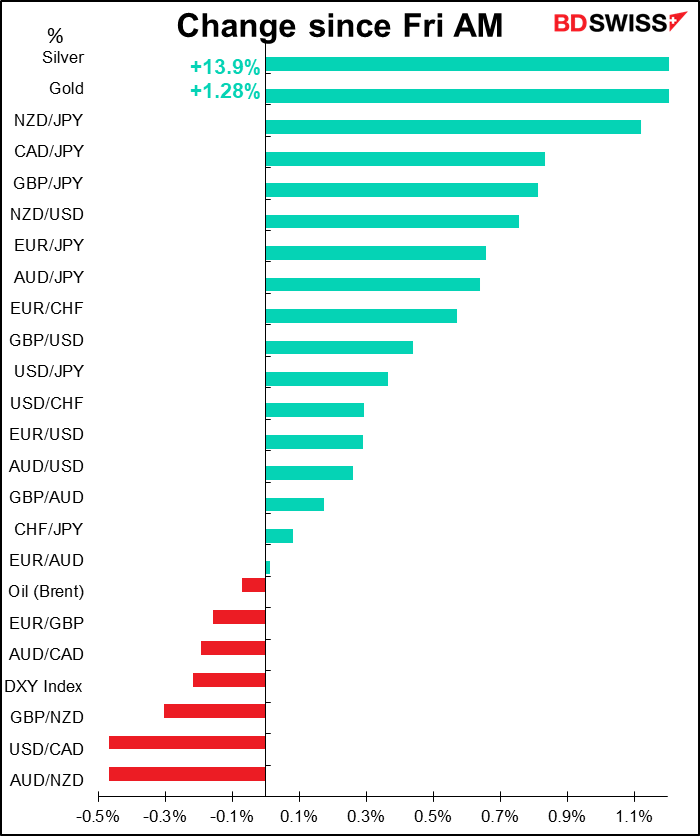

The focus this morning is in silver, which gapped higher at the opening on retail buying interest from investors reading the market tips on wallstreetbets. I’ve put out a separate piece on silver, explaining why I don’t think the fundamentals justify a sharp increase in the price. Of course that doesn’t preclude a speculative run-up, it just means that the fundamentals probably won’t support a much higher price indefinitely. Please read that piece for a more detailed analysis of the issue than I can fit into this daily comment. You can access it by clicking on the links, or it’s posted in the “Market Insights” section of our website.

Although stocks in New York closed sharply lower (S&P 500 down 1.9%, NASDAQ off 2.0%), the mood in Asia this morning is much improved – TOPIX is up 1.2%, the Hang Seng 2.3%, and KOSPI 2.7%. The S&P 500 is indicated opening 0.5%.

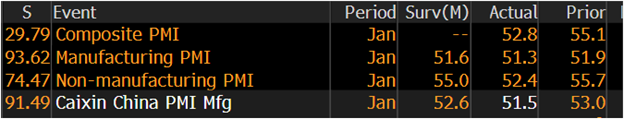

It’s a little odd that a run-up in precious metals – usually a sign of “risk-off” – has sparked a rally in equities, but that seems to be the case. Certainly it wasn’t the Chinese data – China’s purchasing managers’ indices (PMIs) all missed expectations substantially. Manufacturing PMIs for other countries in the region remained relatively stable though.

The underlying idea must be that investors are buying metals not because they’re worried about financial Armageddon but on the contrary, they’re assuming a continued favorable background for risky assets and perhaps higher inflation. In other words, they’re playing silver as a risky asset, not a safe haven (except maybe a hedge against inflation, which many people still expect to arise from quantitative easing despite the fact that it failed to happen after the 2009/10 Global Financial Crisis and hasn’t happened in Japan for decades).

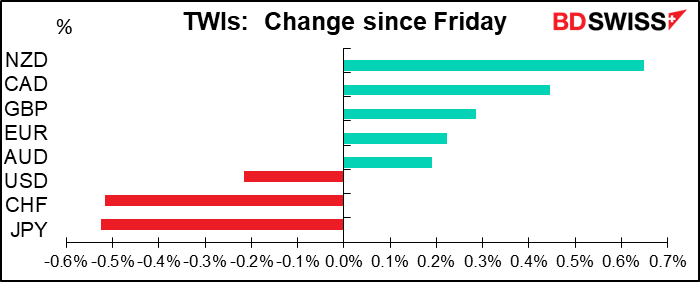

That’s helped to engender a “risk-on” mood in the FX market, with the commodity currencies higher and JPY & USD lower. AUD was lower on a trade-weighted basis, but that’s only because NZD outpaced AUD – both were higher vs USD.

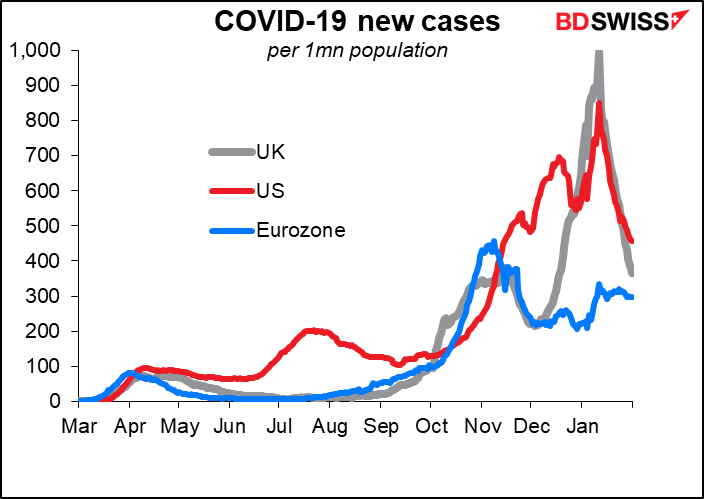

The mood has also been helped by some good news on the virius front. The numbers indicate that the pandemic may have passed its peak for now in the US and UK. GBP in particular rose on expectations that the UK will confirm all residents at eligible care homes have been offered a vaccine shot.

On Friday a group of Republicans made a counter-offer on President Biden’s $1.9tn fiscal support package. They’re offering $600bn after eliminating such Democratic priorities as the hike in the minimum wage to $15. I think the Democrats will listen politely out of a desire to be seen as emphasizing bipartisan comity, but at the end of the day they’ll reject it as wholly inadequate – after all, they have to please their voters more than the opposition. Nonetheless we should watch these negotiations carefully as any indications that the package may be pared back or delayed could be negative for risk.

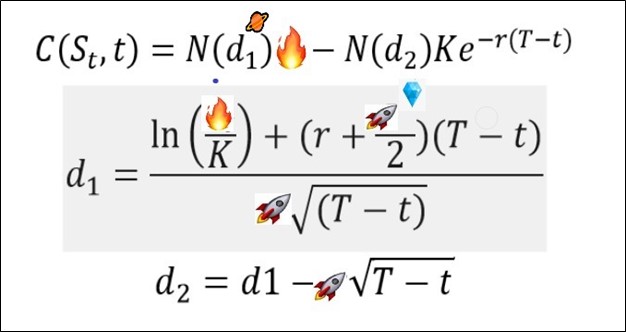

How people are pricing options on GME and other hot stocks

Some people may be wondering what is justifying the valuations on various hot stocks and particularly the huge number of call options being sold on these stocks (double the volume of the same month a year ago). Luckly, someone published on Twitter the amended version of the Black Scholes option pricing formula that people are now using to price options on certain hot stocks that are “going to the moon.” It goes like this:

(Some people will think this is funny. I admit though that others, even others with a good sense of humor, may disagree.)

Nothing to do with FX, but…

The Scotsman reported that Members of Scottish Parliament will be asked to vote this week on whether the Scottish Government should pursue an Unexplained Wealth Order (UWO) to investigate the source of financing for Donald Trump’s Scottish resorts, which he bought for GBP 35mn in cash. Apparently Scotland’s First Minister Nicola Sturgeon was not eager to pursue this line of questioning while Trump was in office, but now that he’s out, perhaps she’ll change her mind.

Today’s market

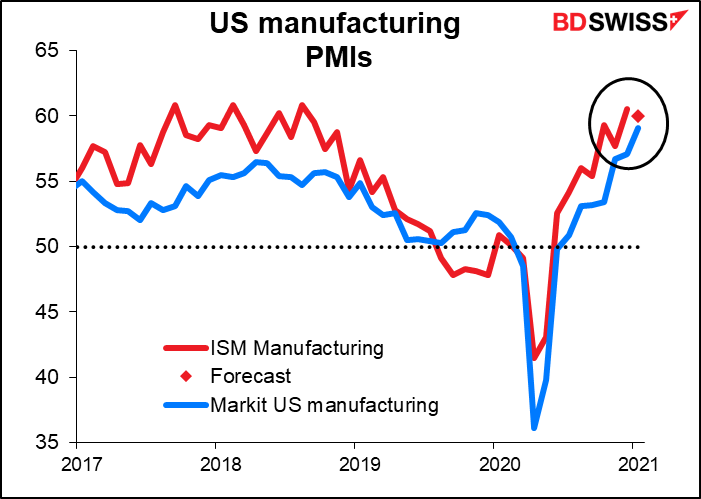

Today everyone will be watching the final manufacturing purchasing managers’ indices (PMIs) for those countries that have initial versions and the one-and-only version for those countries that don’t.

In the US, the Institute of Supply Management (ISM) version of the manufacturing PMI is expected to fall slightly, which would be in contrast to the 2-point rise in the Markit version of this index. However the actual numbers are quite close so I’m not sure the different direction is significant – either way, US manufacturing remains in expansion.

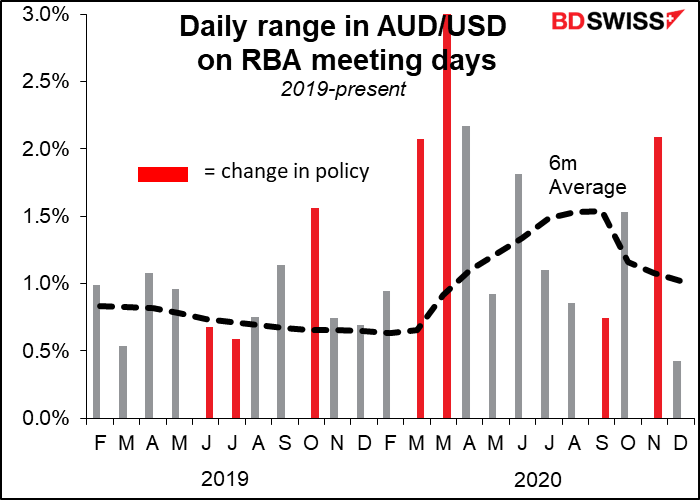

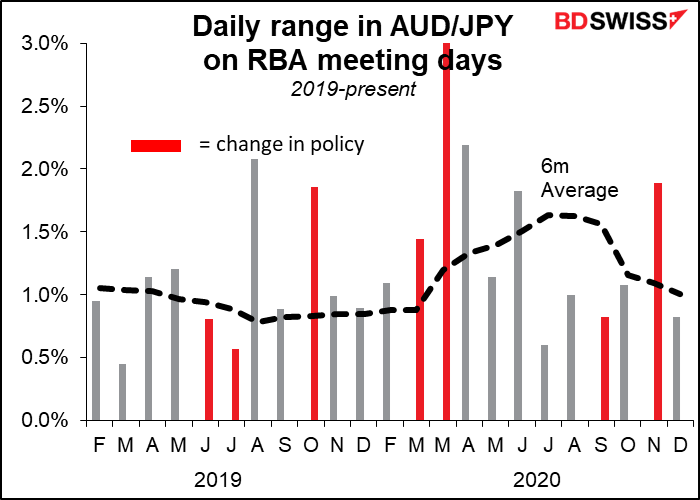

Aside from that, the big thing will be the Reserve Bank of Australia (RBA) meeting overnight. I discussed this in great depth and detail in my Weekly Outlook, so I’ll just summarize that here.

In brief, I expect the RBA to stand pat and not make any major changes in its statement, although it could – like the Bank of Canada, European Central Bank and Bank of Japan – tinker with its forecasts, downgrading the near-term outlook somewhat but upgrading the longer-term outlook. The details of that will come out Friday, when the new Statement on Monetary Policy is released.

I think any significant changes in policy are likely to be announced Wednesday, when Gov. Lowe makes a speech titled “The Year Ahead.” He made speeches with the same title at this time in both 2019 and 2020. Last year (Feb. 5) was an outlier of course but the Feb. 6 2019 “Year Ahead” speech was substantially more dovish than the post-meeting statement that the RBA had released only a day before. He’s likely to use this year’s speech as well to set out a road map for policy that could be more important – perhaps more optimistic — than the meeting the day before.

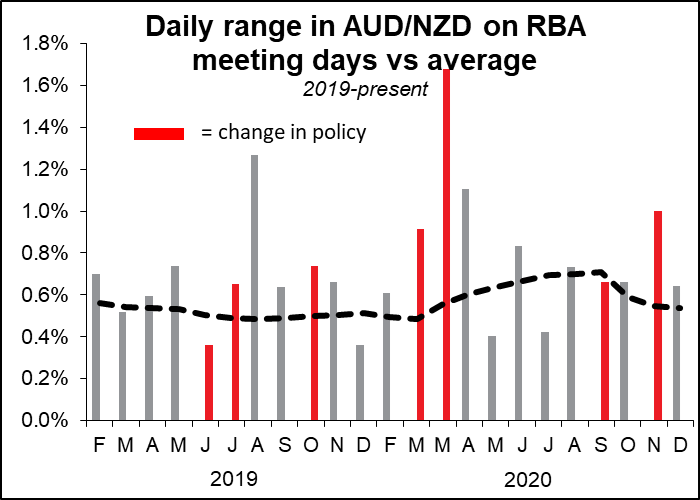

Recently, RBA days with no change in policy (rates or lending facility) have seen below-average volatility. On the other hand, days when they did change their stance have usually seen significantly above-average volatility, particularly in AUD/USD.

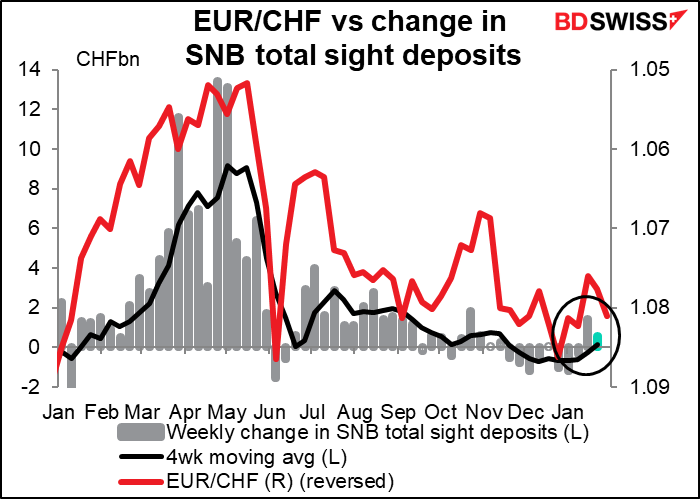

The other indicators include the weekly Swiss National Bank sight deposits. Last week they rose slightly – not much, but the second consecutive week. Looks like back to normal after the end-year shopping season distortions.

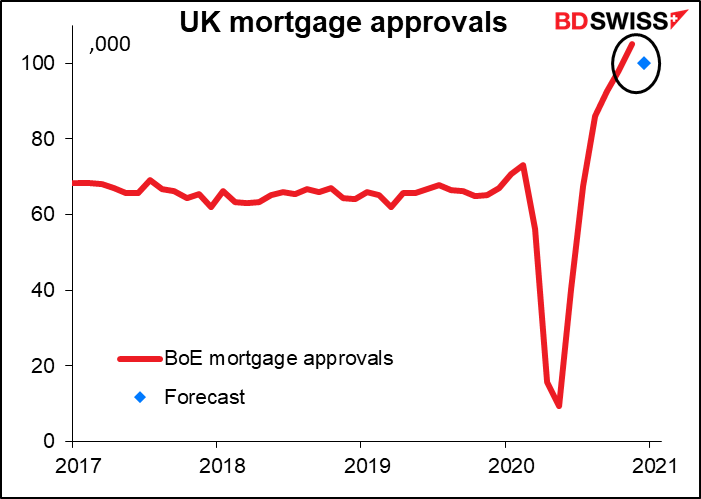

UK mortgage approvals are expected to be lower, but only in comparison to the surge in the previous month.

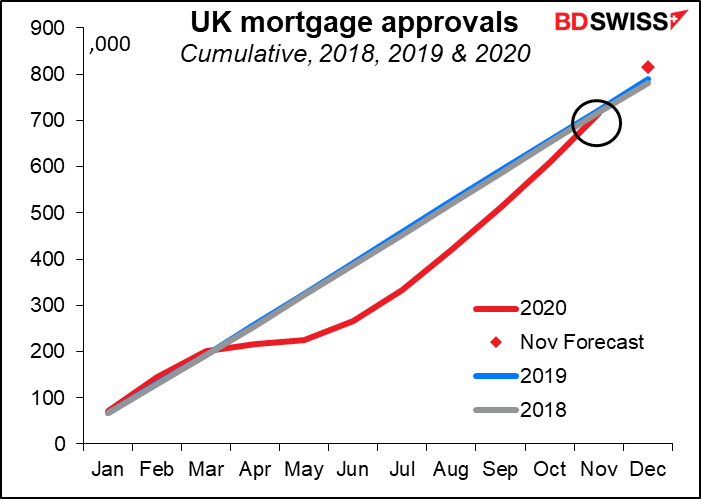

That would still put 2020 comfortably above the previous two years.

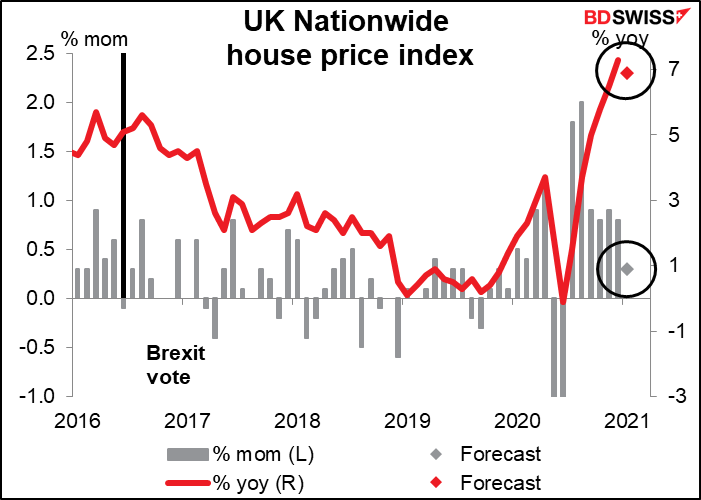

Then we wait till dawn, when the watchman’s cry will ring out across London with news of the Nationwide house price index. That’s Nationwide as in the Nationwide Building Society, although they do seem to cover house prices across the UK. House prices are expected to rise, although not as much as in recent months.

Source: BDSwiss