Bitcoin made a powerful leap up after assurances from the owners of the largest crypto exchanges, Binance, Kraken, KuCoin and AAX, that they do not intend to block the funds of individual Russians. However, the head of Kraken warned that they would abide by the regulator’s decision if it comes.

Overnight, the United States noted that they would stop attempts to use cryptocurrencies to circumvent personal sanctions. So, retail clients of large crypto exchanges are not yet afraid for their funds. This probably explains the latest growth momentum.

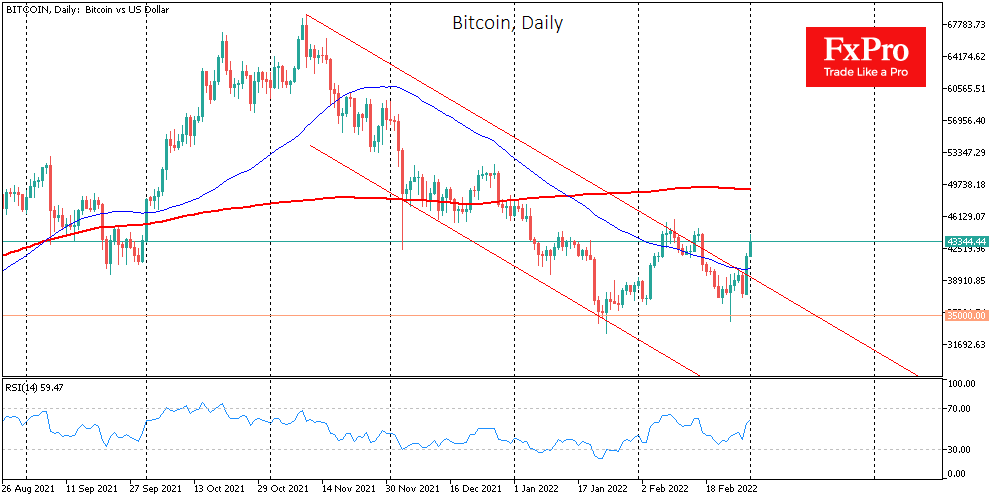

Technically, Bitcoin broke through the upper limit of the four-month descending channel at the close of the month. Moderate optimism of Asian and US indices is also on the side of buyers.

February was confirmed to be a growing month for bitcoin. However, March is not so favourable. Over the past 11 years, BTC ended this month with growth only in two cases.

Disabling Russia from SWIFT will have a positive impact on the cryptocurrency market, says Jiang Zhuer, CEO of the BTC.TOP pool. In his opinion, Russia can use various methods to circumvent restrictions, including digital assets, to make payments.

Bank of America does not see the prerequisites for a large-scale crypto winter, as evidenced by the dynamics of the movement of cryptocurrencies between private and exchange wallets. The level of acceptance of crypto assets by users is also growing, as well as the activity of developers.

Bitcoin jumped 10.8% on Monday to $41,600, the highest gain in five months. On Tuesday morning, the momentum continued with a jump to $44,000 at the start of the day. At the time of writing, prices have stabilized around $43,200. Ethereum added 7.9%, while other top-ten altcoins rose from 6.3% (XRP) to 15.3 % (Terra).

The total capitalization of the crypto market, according to CoinMarketCap, grew by 11% over the day, to $1.9 trillion. The Bitcoin dominance index has risen to 43% due to the smaller strengthening of altcoins.

The crypto-currency fear and greed index soared 31 points to 51 on the day, moving out of fear into neutral territory.

Although Bitcoin showed negative dynamics for most of the month, the shocking growth at the end of it allowed BTC to end February with strengthening ( 8.6%) after three months of decline.

Source: FXPro