Previous Trading Day’s Events (30.04.2024)

- Eurozone inflation held steady as expected in April. The ECB is expecting a rate cut on June 6, provided there is no surprise in wage or price developments, and Tuesday’s data remained consistent with the path. Inflation in the 20 countries sharing the euro currency was reported at 2.4% in April, the same as in March and matching expectations.

Core inflation, a key measure watched by policymakers to gauge the durability of price pressures, slowed to 2.7% from 2.9%. Rapid wage growth, the key component in services costs, remains a concern. Inflation has fallen quicker in the past year than the ECB had hoped though.

Potential rate cuts have dominated the discussion for months now, even if policymakers say they are still looking for more reassuring data, especially on wages.

Source: https://www.reuters.com/markets/europe/euro-zone-inflation-steady-april-reinforcing-ecb-rate-cut-case-2024-04-30/

- U.S. consumer confidence deteriorated in April according to the report released on the 30th of April, falling to its lowest level in more than 1-1/2 years amid worries about the labour market and income. The CB consumer confidence index fell to 97.0 this month, the lowest level since July 2022, from a downwardly revised 103.1 in March.

“Confidence retreated further in April as consumers became less positive about the current labour market situation and more concerned about future business conditions, job availability, and income,” said Dana Peterson, chief economist at the Conference Board in Washington.

“According to April’s write-in responses, elevated price levels, especially for food and gas, dominated consumer’s concerns, with politics and global conflicts as distant runners-up.”

Source: https://www.reuters.com/markets/us/us-consumer-confidence-deteriorates-april-2024-04-30/

_____________________________________________________________________

Winners vs Losers

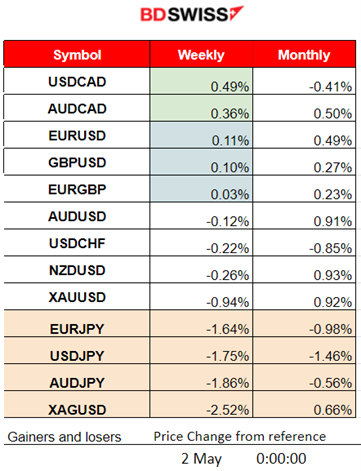

USDCAD is on the top of the list for the week with 0.49% performance. No significant dollar weakness so far. CAD is losing ground. JPY pairs (JPY as quote currency) still remain low.

______________________________________________________________________

______________________________________________________________________

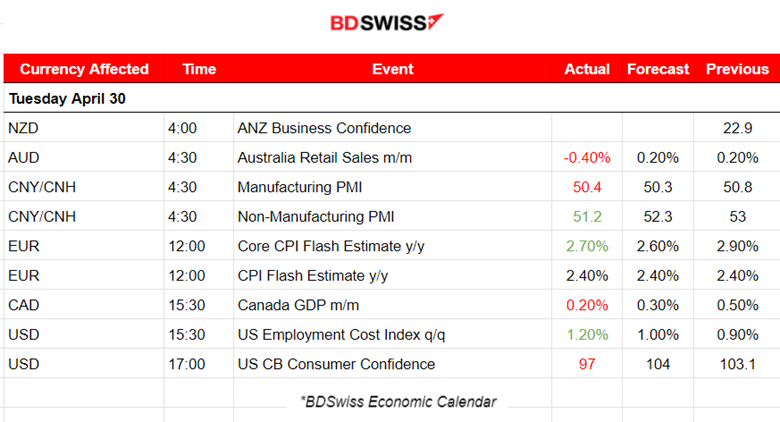

News Reports Monitor – Previous Trading Day (30.04.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

Australian retail sales are growing at the weakest pace on record outside of one-off economic shocks. The PMIs for China came out relatively soft affecting the CNH negatively and causing also AUD depreciation. The AUD/USD suffered a bearish blow causing it to drop near 50 pips so far. EURUSD jumped near 30 pips.

- Morning – Day Session (European and N. American Session)

The Eurozone CPI flash estimate figures were released at 12:00. Headline inflation annual calculation was unchanged at 2.4%, while core inflation declined slightly but less than expected. That should be enough for the ECB to keep the view of a June rate cut. Moderate EUR appreciation took place at the time of the release.

Canada’s GDP figure release took place at 15:30 and showed a growth decline to a monthly 0.2% figure from 0.5%. A simultaneously released measure of U.S. employment cost pushed the dollar higher. CAD depreciated heavily to the USD post-data. USDCAD jumped near 50 pips at that time.

The CB Consumer Confidence report released at 17:00 showed that U.S. consumer confidence dropped to its lowest level in nearly two years. Though inflation has cooled from the highs of two years ago, it’s reaccelerated over the past few months with growing expectations of more delays for cuts and worries about the labour market and income.

Second possible market intervention from the BOJ after the FOMC news. USDJPY dropped 450 pips after 23:00 on the 1st of May.

General Verdict:

- Moderate volatility with moderate shocks during the news. The USD has appreciated significantly especially while the EUR lost some ground due to the inflation report news that showed a favourable lower figure.

- Gold dropped heavily after a triangle breakout.

- Crude oil suffered a sharp drop.

- U.S. indices fell sharply after an upward price path slowdown.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (30.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

EURUSD was mainly driven by the USD. Early USD appreciation was driving the pair downwards until the start of the European session. At the time of the Eurozone inflation figure release, the EUR appreciated causing a jump in the pair and reversal soon after finding resistance. The U.S. employment cost index figure was reported higher causing USD strengthening and a sharp drop of the pair. It continued to lower and lower until the end of the trading day after those figures even though the consumer confidence figure was reported lower. Consumers’ inflation expectations were reported unchanged.

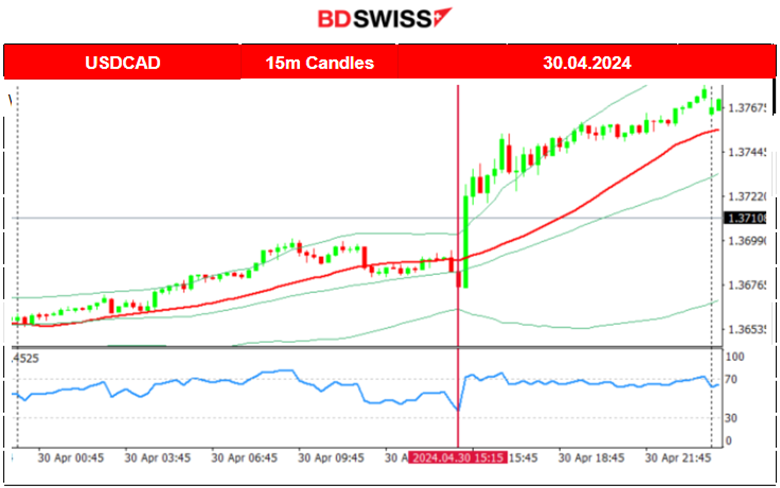

USDCAD (30.04.2024) 15m Chart Summary

USDCAD (30.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Due to USD strengthening the USDCAD pair was driven mainly to the upside. The news for the U.S. at 15:30 in combination with the lower growth figure for Canada’s GDP pushed the pair further upwards.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

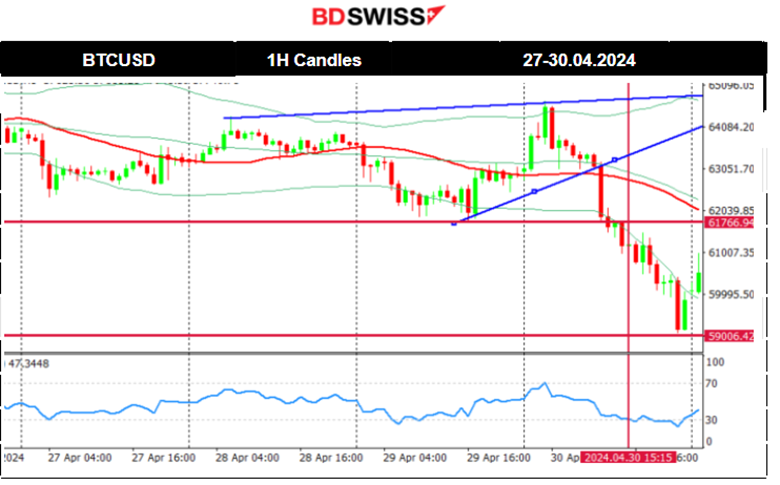

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

A triangle formation was breached on the 29th of April to the downside causing further Bitcoin price decline. The price reached the support near 61,700 USD before reversing fully to the upside. Moving to the next day, the 30th of April, the price crossed the MA on its way up and moved aggressively to the resistance at near 64,700, signalling the end of the downtrend, before retracing to the 30-period MA again. However, that was a false signal as the price eventually dropped below the MA and critical support at near 61,760 USD. That caused a sharp drop to the next support at 59,000 USD before retracement took place.

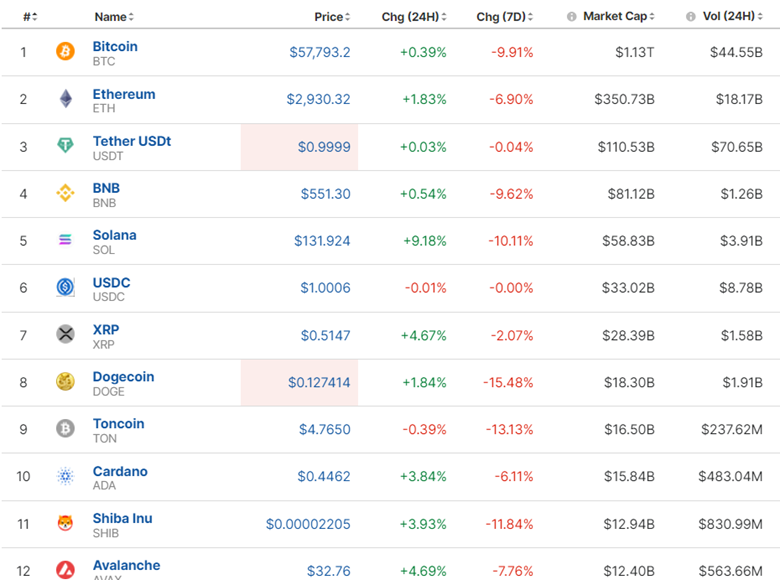

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market does not see improvement. Bitcoin dropped to 59K USD on the 30th of April. For a 7-day period, we see losses.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 25th of April, the market experienced a sudden plunge causing the index to drop to the support near 4,990 USD before eventually reversing heavily to the upside. It crossed the 30-period MA on its way up and reached remarkably back to the 5,100 USD level. On the 26th of April, stocks moved higher but the rapid movement to the upside seems to slow down. As mentioned in our previous analysis, a bearish divergence was in place on the 30th of April the index fell sharply after the triangle breakout reaching a support near 5,023 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 25th of April, the resistance of 83.5 USD was broken and the price reached higher. On the 26th of April, this breakout even helped the price reach near 84 USD/b. Now an upward channel is apparent indicating the highly volatile market conditions that Crude oil is facing at the moment. The price was moving around the 30-period MA with deviations from the MA up to nearly 1 dollar. On the 29th of April, the price moved to the downside with a channel breakout and reached the 82 USD/b level as mentioned in our previous analysis. Retracement followed back to the MA. On the 30th of April, the price dropped below the support at 81.7 USD/b reaching the next support at 80.7 USD/b before retracement took place at 61.8% of the movement downwards remaining close to the intraday mean.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 24th of April, the price remained stable. An apparent upward channel was formed with 15-20 dollar deviations from the 30-period MA taking place. The proposed range is 2,300-2,340 USD/oz. It would be unlikely to see a jump to 2,400 USD/oz. For that to take place we should see an unusual increase in demand for metals. A breakout of the channel and triangle formation to the downside occurred causing the price to gain momentum and reaching the first support at near 2,312 USD/oz. The path continued to the downside at near the support level of 2,280 USD/oz before retracement took place.

______________________________________________________________

______________________________________________________________

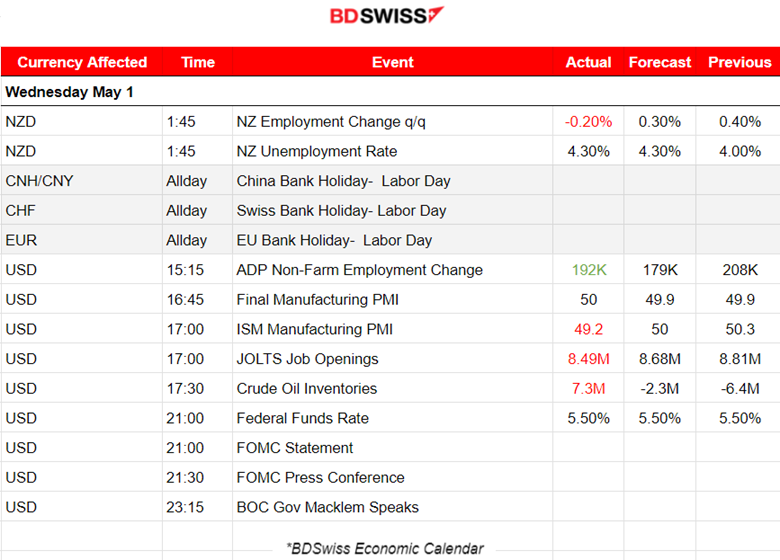

News Reports Monitor – Today Trading Day (01 April 2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

New Zealand’s unemployment rate jumped more than expected putting the Reserve Bank of New Zealand closer to cutting interest rates before the U.S. Federal Reserve. The employment change for the quarter turned to a decline of 0.2%. NZD experienced moderate depreciation with the NZDUSD only to drop sharply near 13 pips before reversing to the upside.

- Morning – Day Session (European and N. American Session)

At 15:15 the ADP report showed that U.S. private payrolls increased by 192K in April, more than expected for a resilient labour market. According to the JOLTS report, Job openings continued to decline, falling to their lowest level since early 2021.

The Institute for Supply Management (ISM) revealed in its report on Wednesday that the United States Manufacturing Purchasing Managers Index (PMI) decreased to 49.2% in April from 50.3% registered in March. There was no significant impact on the U.S. dollar at the time since the market was waiting for the more juicy FOMC news at 21:00.

U.S. Crude inventory increased by 7.3M barrels last week and caused the price to drop heavily starting after the release at 17:30.

FOMC: the Fed kept policy steady: rate hikes remain “unlikely” despite lack of inflation progress. Huge volatility with ups and downs. A strong indication of uncertainty. It was widely expected to leave the policy rate at 5.25%-5.50% but the Fed signalled it is still leaning towards eventual reductions in borrowing costs. I expect volatility levels to reduce with the dollar eventually settling sideways. Prob for a cut in June is minimal and even for July is low according to FedWatch Tool. 105.50 will be critical support for the dollar index. However, if the index falls below that level it could be a strong indication of a downward short-term trend and Gold’s chance for a re-bounce to the upside.

General Verdict:

- Huge volatility in the FX market. The U.S. dollar eventually closed lower.

- Gold moved to the upside overall.

- Crude oil fell during the U.S. oil inventory report and remained on the downside path closing lower.

- Near flat closing for U.S. indices on the 1st of May. After the FOMC and Fed Rate decision news the U.S. indices jumped, found resistance and fully reversed soon after.

______________________________________________________________

Source: BDSwiss