PREVIOUS TRADING DAY EVENTS – 27 April 2023

Announcements:

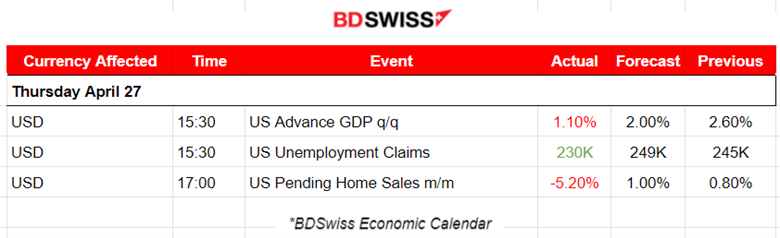

- Real Gross Domestic Product (GDP) increased at an annual rate of 1.1% in the first quarter of 2023, as per the Advance GDP Q/Q figure that was reported yesterday. However, it was less than expected. This increase is attributed to increases in consumer spending, exports, federal government spending, state and local government spending, and non-residential fixed investments.

The figure is lower than the previous one, showing that U.S. economic growth slowed down more in the first quarter. This was due to businesses liquidating inventories in anticipation of weaker demand later this year amid higher borrowing costs.

“Leaner inventories mean second-quarter GDP is on a solid foundation,” said Chris Low, chief economist at FHN Financial in New York. “Of course, what is built on that foundation depends on many things, including job and income growth as well as confidence and credit availability.”

The Fed is expected to raise interest rates by another 25 basis points next week. It will probably be the last hike. There is currently a tight labour market, characterised by a 3.5% unemployment rate.

“A U.S. recession is likely to start in the second half of this year,” said Gus Faucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania. “It should be mild, however, as consumer balance sheets remain strong, and the tight labor market will discourage layoffs.”

Source: https://www.reuters.com/markets/us/strong-us-consumer-spending-seen-driving-economy-first-quarter-2023-04-27/

- U.S. weekly Initial Jobless Claims declined to 230K versus the expected 248K figures. The number of unemployed people is an important signal of overall economic health. In the week ending April 22, the advance figure for seasonally adjusted initial claims showed a decrease of 16,000 from the previous week’s revised level.

The U.S. job market has remained healthy. This shows that Americans are still utilising substantial job security despite rising interest rates, economic uncertainty and fears of a future recession.

Source: https://www.reuters.com/markets/us/strong-us-consumer-spending-seen-driving-economy-first-quarter-2023-04-27/

______________________________________________________________________

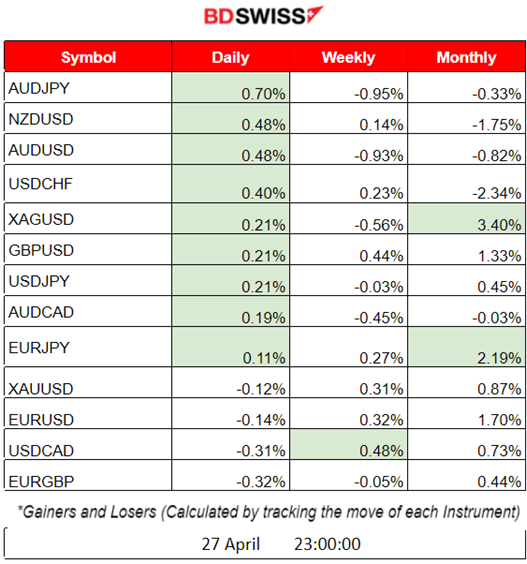

Summary Daily Moves – Winners vs Losers (27 April 2023)

- AUDJPY took the lead yesterday with a 0.70% gain.

- This week, pairs haven’t moved much in one direction. USDCAD is still leading with just 0.48%.

- Silver and EURJPY are on top of the winners’ list this week with 3.40% and 2.19% respectively.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (27 April 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements or significant scheduled releases.

- Morning – Day Session (European)

At 15:30, the release of the U.S. Advance GDP and Unemployment Claims figures caused the USD to appreciate and the EURUSD to experience a more than 26 pips drop.

The Pending Home Sales figures released at 17:00 did not have much impact.

General Verdict:

- Not many important scheduled releases. Low volatility until 15:30 when the USD pairs were affected greatly. The DXY rebounded after 17:00 moving upward.

______________________________________________________________________

FOREX MARKETS MONITOR

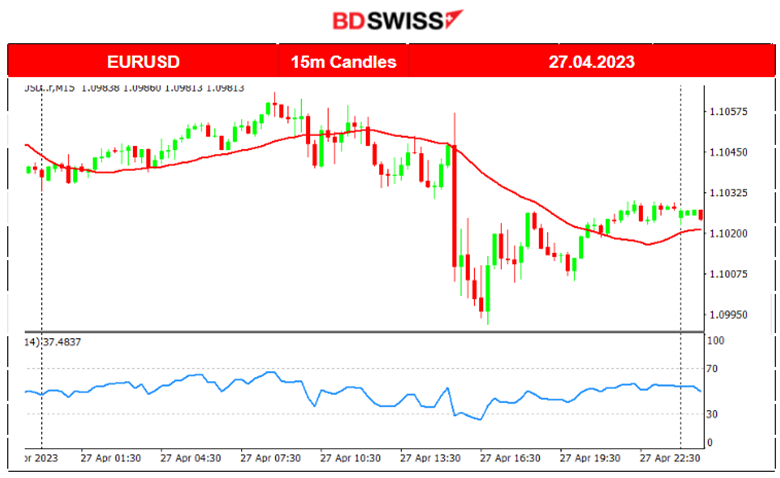

EURUSD (26.04.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

EURUSD was moving with low volatility until 15:30 when the important figure releases regarding U.S. real GDP and Jobless claims took place. At that time, EURUSD dropped and then retracted back soon after continuing its less volatile and sideways path.

____________________________________________________________________

EQUITY MARKETS MONITOR

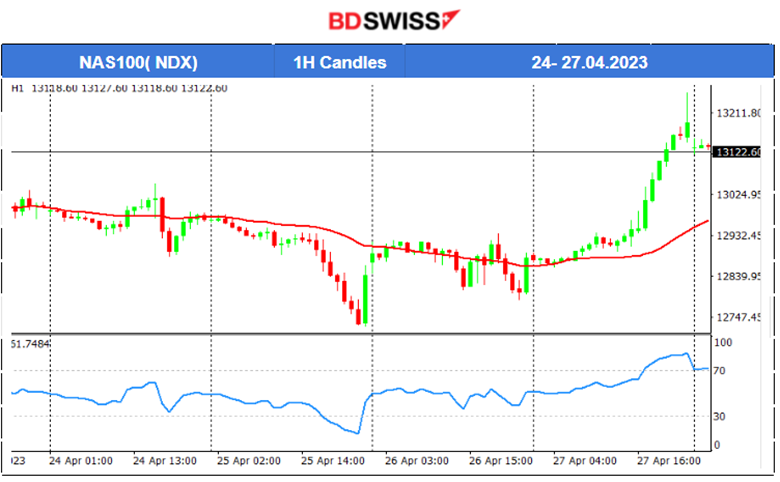

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

While the index showed a clear downward trend, it rose unexpectedly yesterday moving above the 30-period MA and gaining momentum. This shows how strong the stock market is and how resilient it is to current fears of a new recession.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude fell significantly after breaking important support levels on the 26th of April. It is now testing the support near 73.96 USD/barrel. A further downward movement is less probable to happen. The recent U.S. inventory figures show fewer and fewer barrels in inventories.

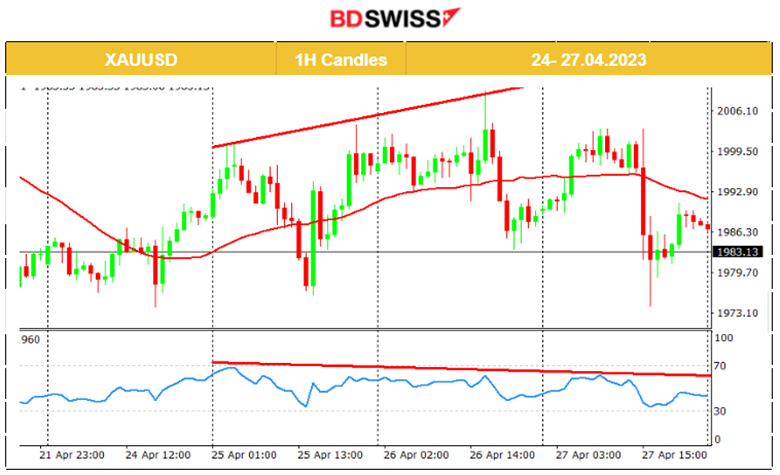

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold is moving around the 30-period MA for days testing the resistance levels near the 2000 USD level. Yesterday, it dropped significantly at 15:30 with the release of the GDP and unemployment claims figures. It is expected to continue its volatile movement but it shows no clear directional trend yet.

______________________________________________________________

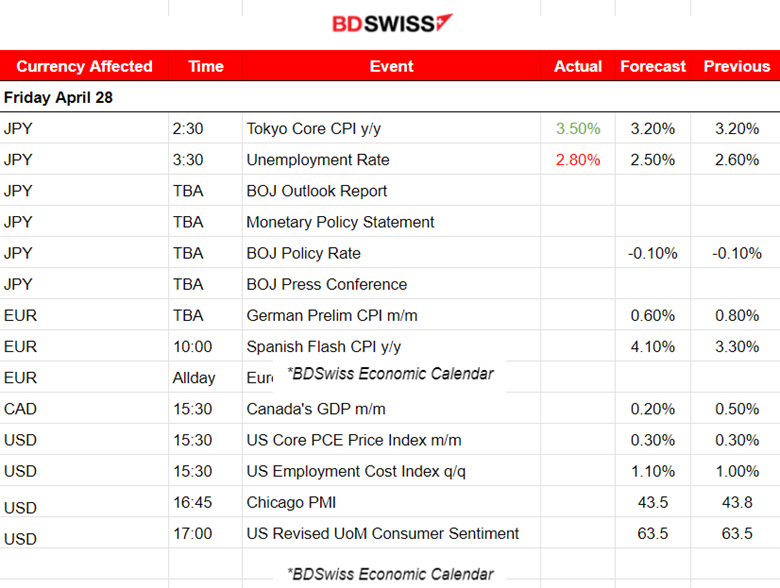

News Reports Monitor – Today Trading Day (28 April 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

At 2:30, the Tokyo Core CPI figure was released, a change of 3.5%, more than expected but did not have much impact.

The Monetary Policy Statement was released at 7:00 and that caused high depreciation of the JPY. USDJPY moved upwards rapidly, more than 100 pips.

BOJ Policy Rat remained unchanged at -0.10%.

- Morning – Day Session (European)

At 15:30, Canada’s GDP might cause a small intraday shock to CAD pairs. The same will happen with the U.S. Core PCE Price Index and U.S. Employment Cost figures, causing a shock for the USD.

General Verdict:

- Higher than normal volatility for most pairs. USD pairs will be affected greatly at 15:30.

- JPY pairs were already affected by the BOJ monetary policy statement and rate with high depreciation for the JPY.

______________________________________________________________

Source: BDSwiss