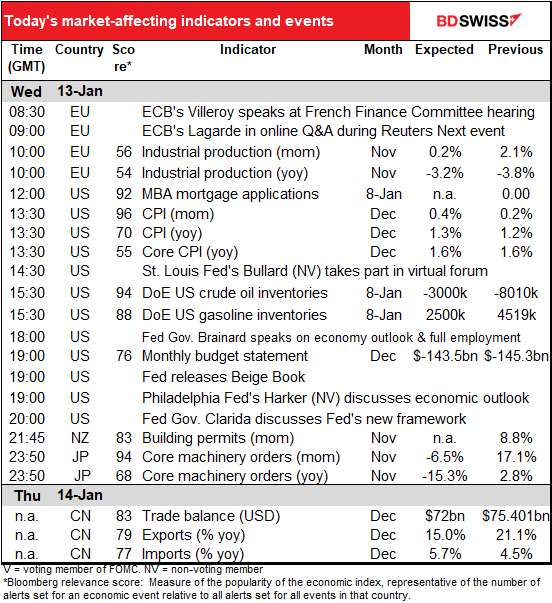

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

US politics

I thought that with the Electoral College vote over, we could forget about US politics for a while and go back to worrying about inflation and unemployment and Fed bond purchases, normal things like that insofar as the FX market is concerned. Boy was I wrong!

I can’t believe what’s going on in the US. Illegal campaign contributions, cozying up to Russia, putting children in cages, using US foreign relations to get at his political enemies, cheating on his taxes…none of this bothered the Republicans, but now that corporate donors are talking about withholding donations, they’re starting to bail. After VP Pence refused to trigger 25th Amendment proceedings to remove Trump from office, the Democrats are going ahead with the resolution to impeach him again. Five Republican representatives have said they’ll vote to impeach, and many more are expected to do so. Notably, the Republican leadership is not taking any steps to encourage people to vote against it. It’ll pass.

As for the Senate vote, there’s some question about whether they can convict him* after he leaves office – the Senate is now in recess and won’t return until the 19th, so unless they recall the Senate it’s impossible for them to vote before President-elect Biden takes over on the 20th. Be that as it may, the New York Times reported that “Senator Mitch McConnell is said to have told associates he thinks impeachment will make it easier to purge President Trump from the party.” (McConnell is the leader of the Republicans in the Senate.) A leak like that is not accidental – it’s probably meant to send a message to Trump. It takes a two-thirds majority in the Senate to convict, so they would need 17 Republican Senators to go along – difficult but not impossible.

(*How impeachment works: the House of Representatives votes on whether to impeach the President. If the bill passes the House, then the Senate votes on whether to convict him or her of the charges.)

The US attorney for the District of Columbia said that people will be shocked when they learn what happened in the Capitol. Top congressional leaders have no doubt been briefed what they’ve found. One hint: Rep Mikie Sherrill said some US Representatives led groups through the Capitol building on a “reconnaissance” tour the day before the riot. CNN is reporting that one of the organizers of the demonstration, Ali Alexander, said he was getting help from three members of Congress. There’s a rumor that the FBI and the Department of Justice are looking into the money that funded the demonstration. That could be a big hit to Republican fundraising.

Meanwhile, Republican representative Peter Meijer explained why a lot of his colleagues voted not to certify the election even though they believed Trump did indeed lose: “there’s an assumption that people will try to kill us” if we vote against Trump, he said.

No doubt Trump’s advisors are advising him to resign, but I wonder if Trump is capable of admitting to himself that he did anything wrong. Regardless, the odds of him fleeing the country have increased, although where will he go? Officials in Scotland are digging in their heels against him coming there, and the airport near his Scottish hotel has now confirmed that they are not expecting him to arrive.

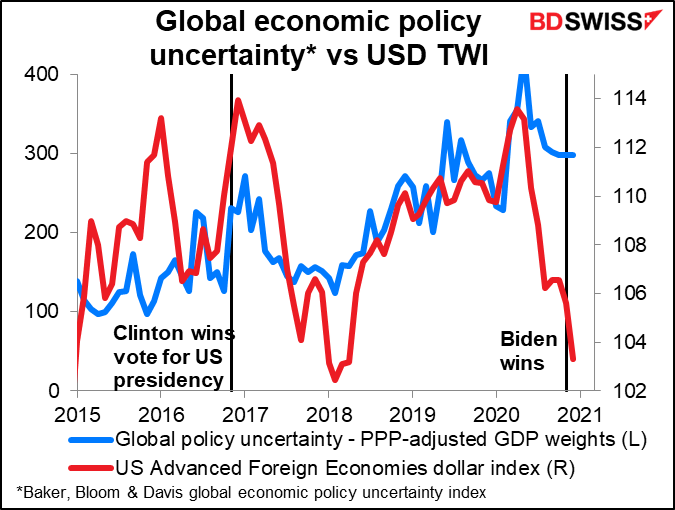

Why this matters for the FX market: there was a big “Trump Premium” in the dollar, due to the uncertainty that this erratic individual injected into US policymaking. His threat to run for office again in 2024, unbelievable as it is, would at least keep him as a force in US politics for the next year or two. That would give him some power over the Republican Party even after leaving office and continue to affect US policy. But if he’s cut off from ever running for office again, as would happen if he’s impeached and convicted, then his sway over his followers will be greatly diminished (does anyone care what former Presidents Bush, Clinton or even Obama say any more?) That would permanently remove the “Trump premium” from the dollar and allow the currency to weaken further.

One positive result from all of this: it may make it easier to pass increased COVID-19 payments. Axios reported that Sen. Marco Rubio (R-Fla.) urged President-elect Joe Biden to call on Congress to pass $2,000 stimulus checks for the American people as a sign of congressional unity. Republicans may be in a better mood to be generous if they’re worried that their jobs – or their lives – may be on the line.

Market recap

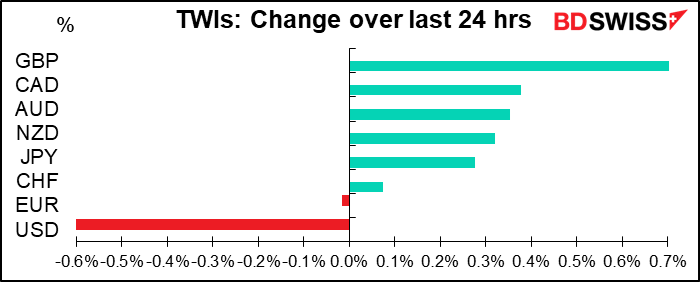

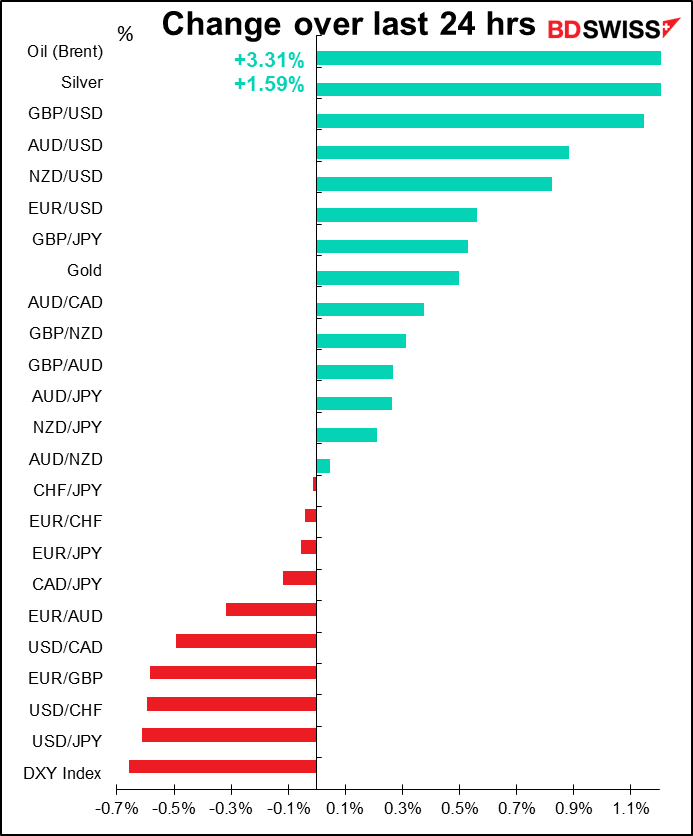

Now can I get back to doing what I’m qualified to do, namely discuss the FX market? The notable move yesterday was the sudden decline of the dollar.

A day after stories appeared in the press about — well, see the headline above from yesterday’s FT — the dollar suddenly took a steep dive. That’s because the sell-off in Treasuries and Treasury yield curve steepeners, both popular trades recently, went into reverse yesterday.

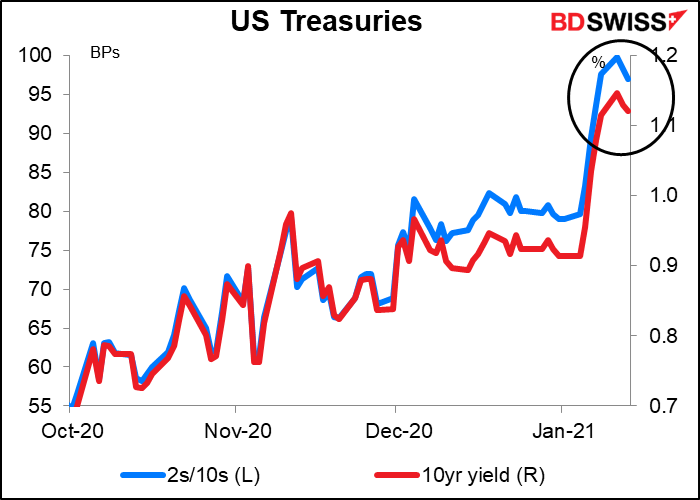

The steepening trade is based on the idea that the Fed will hold short-term interest rates low while higher inflation plus supply pressures from the Democrats’ more expansionary fiscal policy converge to puish long-term rates higher.

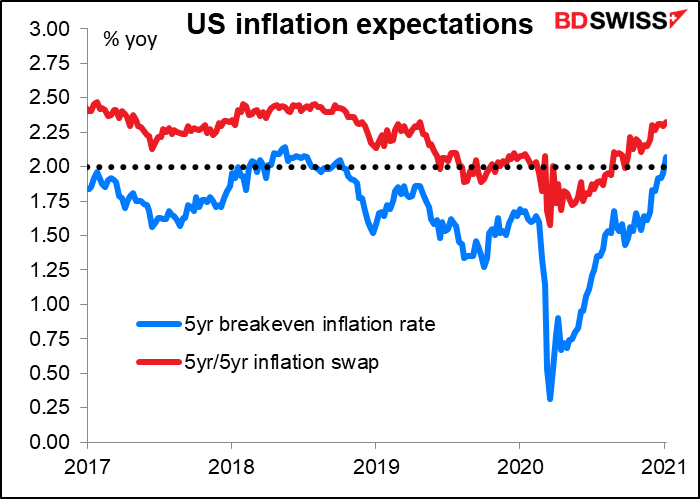

Inflation expectations as measured by the 5yr breakeven inflation rate had risen to the highest since 2018, when the US was cutting corporate taxes into an economic upcycle. Given the deflationary effects of the pandemic, these inflation expectations seem unrealistic to me.

Moreover, remember that the Fed has consistently argued that monetary policy alone can’t support the economy and consistently called for support from fiscal policy as well. In his press conference in December, Fed Chair Powell said it over and over again. “The case for fiscal policy right now is very, very strong…,” he said. “…there is a need for households and businesses to have fiscal support…I certainly would welcome the work that Congress is doing right now.” In that case, I expect the Fed to continue with its bond purchase so long as the US budget deficit is being stretched, so that it can absorb any excess supply and thereby keep real interest rates in check. I believe this is the Fed’s current position and is unlikely to change until “substantial progress has been made” towards economic recovery, especially with regards to the unemployment rate.

The Treasury market may be coming to the same conclusion. Early in the trading day yesterday, US 10-year yields had climbed a further 4 bps to 1.19%, their highest level since March, before dropping nearly 6 bps to finish the day down almost -2 bps at 1.13%. The decline in yields halted the relentless steepening of the yield curve that we’ve seen recently: the 2yr/10yr slope dropped -1.5bps on the day after initially rising intraday above 100 bps for the first time in more than three years.

The reversal in the recent trend was due to a) a better-than-expected 10-year auction yesterday and b) comments from regional Fed Presidents George (NV), Bullard (NV) and Rosengren (NV) pushing back on the idea that tapering was imminent. (This comment is getting a little long so I won’t repeat what they said, just click on the links if you want to see it for yourself.)

I think the Treasury sell-off and the steepening trade may well have run their course for now. For them to continue, either inflation expectations will need to rise further or the Fed will have to limit its commitment to hold down real rates. Neither seems likely to me any time soon. In that case, the dollar can resume its decline. In this context, today’s US consumer price index and comments from Fed Vice Chair Clarida will be major events for the dollar (see below).

The other feature of the day was the recovery in the pound. This came after Bank of England Gov. Bailey pushed back against recent speculation over negative interest rates. Several BoE Monetary Policy Committee members have made comments indicating that they would support the idea of a negative Bank Rate, but Bailey said “there are a lot of issues” with negative rates, particularly their impact on bank profitability. The market now sees Bank Rate turning negative in June, vs May on Monday.

I think the Brexit chaos will prove to be a bigger factor and they’ll have to cut rates further, probably to negative. For example, Reuters reports that after the months and months of negotiating about fishing rights – one of the three major obstacles that held up the negotiations until the last minute — French buyers are suspending orders from Britain due to post-Brexit red tape that delays deliveries. The law of unintended consequences is coming back to bite them! Former Labour leader Tony Blair is now talking about starting up a one-issue “Rejoin EU” party. I suspect he may have some success with this, but not enough and not quickly enough to support the pound for now.

Today’s market

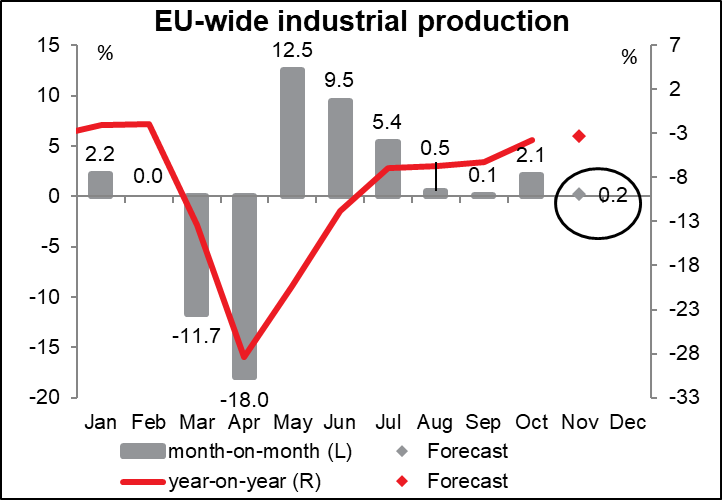

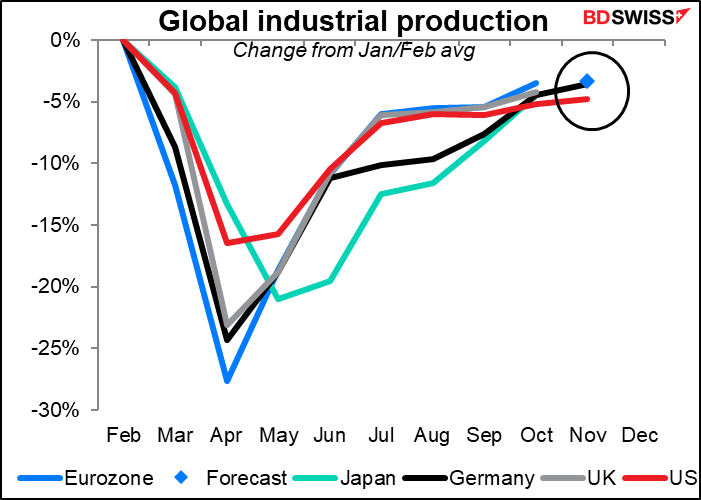

EU industrial production is expected to slow further. It bounced back strongly after the initial decline, but since then it hasn’t done very much.

Nonetheless it’s doing OK relative to the other major industrial countries – a bit better than the others, in fact. No surprise that it’s almost exactly in line with Germany.

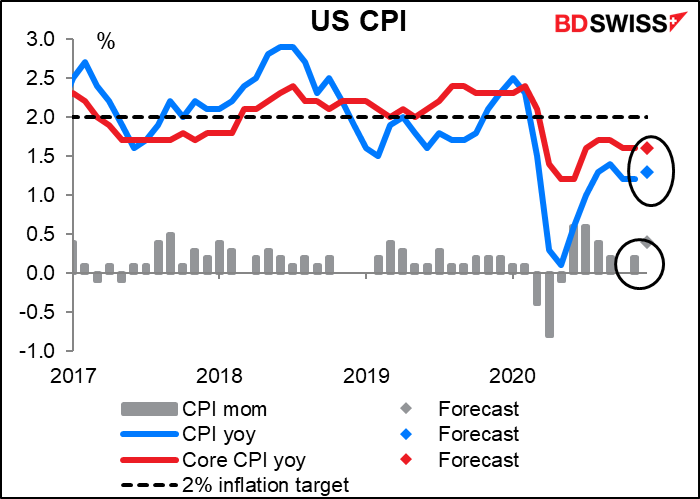

The US consumer price index (CPI) used to be the main event of the second week of the month, but nowadays people aren’t so excited about inflation. First off, inflation is dormant –deflation seems to be more of a concern than inflation. Secondly, since the Fed has shifted to average inflation targeting, inflation isn’t going to trigger any reaction from the Fed until it gets much much higher, and the minutes to the December FOMC meeting showed that the Committee’s members don’t see much danger of that happening any time soon.

Nonetheless, with bond yields rising sharply recently on expectations that the Fed will begin to taper off its $120bn-a-month bond-buying program sometime in the second half of the year, people will still watch it to see if the economy is making “substantial progress” towards the Fed’s 2% inflation goal. The market consensus forecast is for a fairly sharp mom increase in CPI, which could add to the Treasury sell-off and push US rates higher. Under the current circumstances that might be positive for the dollar.

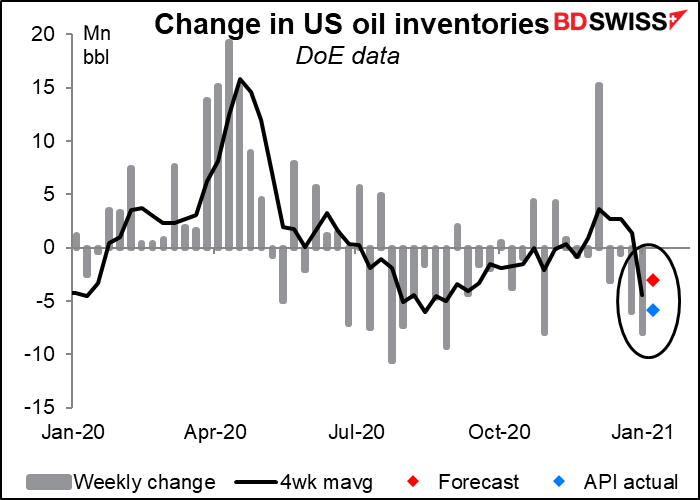

Crude oil inventories are expected to be lower this week, as confirmed by the American Petroleum Institute (API) data overnight. The news about oil product inventories however wasn’t as encouraging. Last week, the big story was a huge rise in inventories of distillate fuel oil, which rose 6.4mn barrels according to the DoE and 7.14mn bbls according to the API. The API this week reported another large increase of 4.43mn bbls.

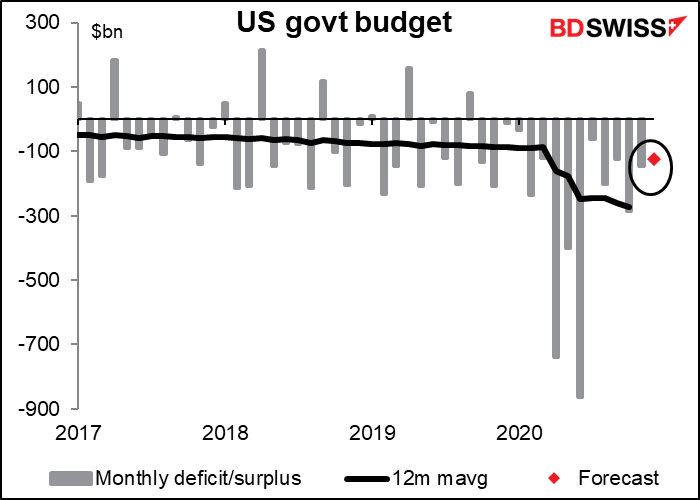

The US budget deficit for December is expected to be a bit smaller than in November (although “small” for a negative number should mean more negative, but you understand what I mean. Really, I should say “wider” and “narrower” in talking about deficits, but no one does.) In any case it would bring the deficit for the year to an astonishing $3.3tn. As soon as President-elect Biden takes over, get ready to hear a lot from the Republicans about “concern about the deficit” and the need to cut spending, comments that you never, ever heard when they were in office and cutting taxes for the billionaires who finance their campaigns. We’re hearing such comments from the UK too recently, even though gilts yields are negative out to six years.

The Fed releases the “Summary of Commentary on Current Economic Conditions,” aka The Beige Book (which actually looks green to me, at least the version you can buy in the store) as always two weeks before the next FOMC meeting. It’s significant for the market because the first paragraph of the statement following each FOMC meeting tends to mirror the tone of the Beige Book’s characterization of the economy. The book doesn’t have any number attached to it that quantifies its contents, but many research firms do calculate a “Beige Book index” by counting how many times various words appear, such as “uncertain” or “improving.” In any case, the book is largely anecdotal so you’ll just have to watch the headlines as they come out.

There are also several Fed speakers today. Everyone will be listening closely to hear what they have to say on the topic of when the Fed might begin “tapering” its $120bn-a-month bond purchases. Gov. Clarida last week said “not this year,” but several others have said “maybe in the second half, if the vaccine rollout goes OK.” Let’s hear what Gov. Brainard says, also whether Clarida repeats his comments from last week.

That’s it until the new day dawns in Asia, bringing with it what another day has always brought, plus the chance of catching a deadly disease from a total stranger who’s not even near you, but never mind that.

New Zealand building permits have a high Bloomberg relevance score but don’t seem to be relevant for the FX market, so I just include them in the table.

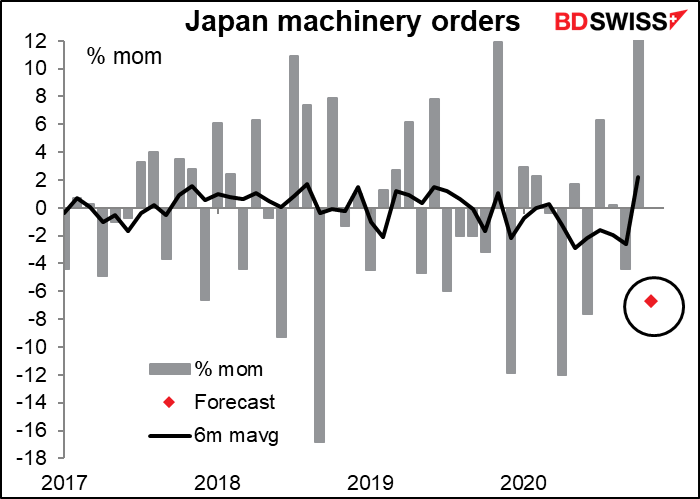

Japan’s machinery orders are one of the most widely watched indicators from that sceptered isle, that demi-paradise. I don’t know why. They seem to be a random walk to me. I’d say they’re the opposite of the Eco Watcher’s Survey, a little-noticed indicator that I think is very important. Machinery orders are closely watched but I don’t think they’re that important, namely because they don’t seem to trend. I tried putting a six-month moving average in there so I could discern some possible trend, but when the six-month average flips from positive to negative on a month-to-month basis, it’s impossible to say where orders are headed.

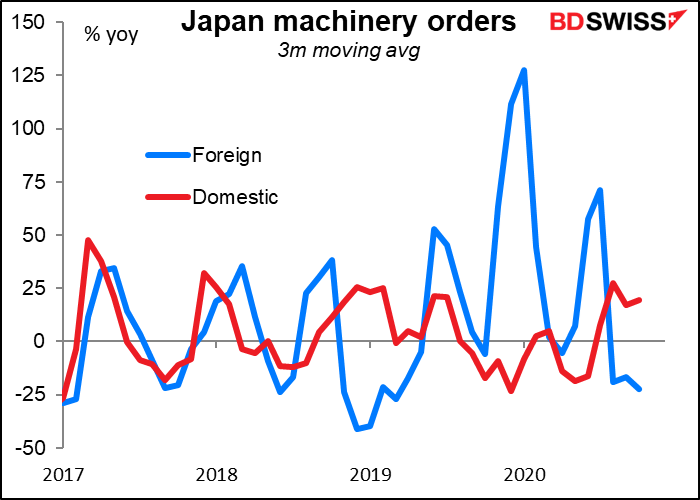

That may be because about one-third of orders are foreign, and sometimes (2017 & 2018) they move in synch with domestic orders, sometimes (like now) they move in the opposite direction.

Getting back to this month’s figure, it’s expected to be a fairly steep fall, partly in reaction to the stunning 17.1% mom rise in October (the biggest since October 1996 and the second-biggest ever in data going back to 1987) and partly due to a further slowdown in foreign orders. That could prove disappointing to the stock market and therefore spark a “risk-off” sentiment in the JPY market.

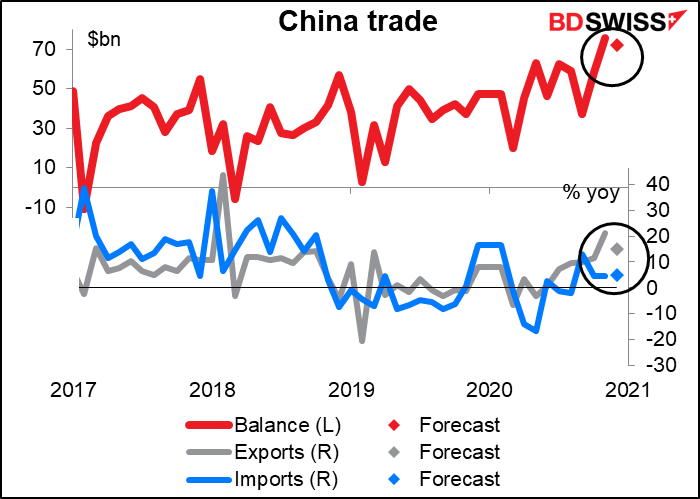

China’s trade surplus is expected to fall slightly from the record $75.4bn of November as the pace of growth in exports slows while the pace of growth in imports accelerates a bit. Nonetheless the near-record surplus and continued high growth of both imports & exports should counteract any “risk-off” mood engendered by a weak Japan machinery orders figure and help AUD and NZD to gain.

Source: BDSwiss