These indices have been under increased pressure in recent weeks, getting maximum pressure this week. On Tuesday, major Chinese indices fell fastest since March 2020, rewriting multi-year lows.

Market support from officials came a day after the release of upbeat macro data, indicating a jump in retail sales and industrial production. At the same time, stock market dynamics fundamentally diverged from the economy, and there was a near point where stock volatility was already causing material disruption to the economy.

The China H-shar gained support today after sinking to the lows of late 2008, losing more than half of its price in just over a year of steady decline.

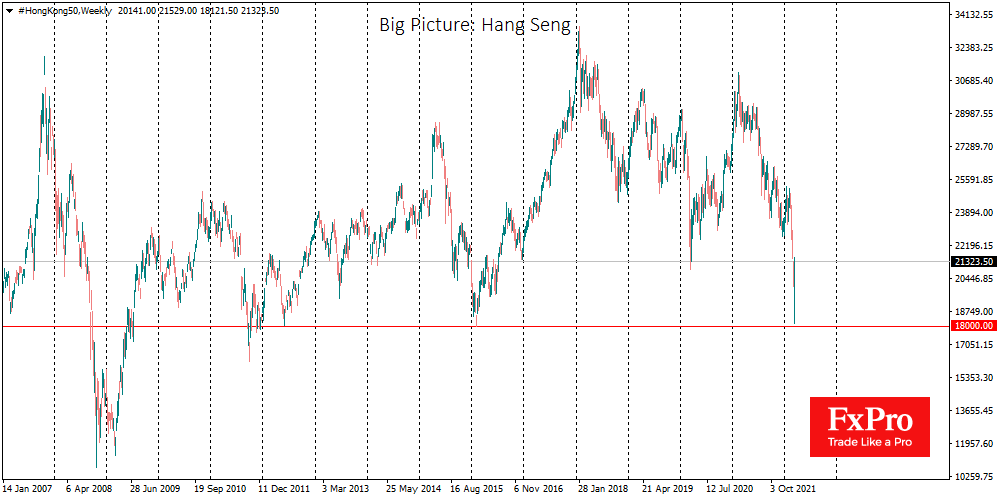

The Hans Seng index touched lows since 2016 and areas of market support in 2012 at the peak of Tuesday’s decline.

However, Chinese policymakers have worked hard to prevent the sell-off from turning into a self-sustaining spiral over the past two days. Yesterday’s China-US talks saw a positive reaction from the sides, forming a more than 4.5% bounce for the Hang Seng during the European trading session. This momentum was boosted on Wednesday morning after Vice Premier Liu He indicated that China is considering a package of measures to support the economy and financial markets. Soon the People’s Bank of China stated that it would help the stock market with other agencies.

Such words send a message to the market that the levels reached yesterday are a pain point for the Chinese authorities, from where they are ready to step up efforts to support the markets.

Yesterday we likely saw the bottom of the Chinese indices for many months to come, despite potentially negative for stock prices rate hikes by the Fed and other major central banks for the equity market. There seems to be too much pessimism and wariness embedded in Chinese valuations after more than a year of declines.

Source: FXPro