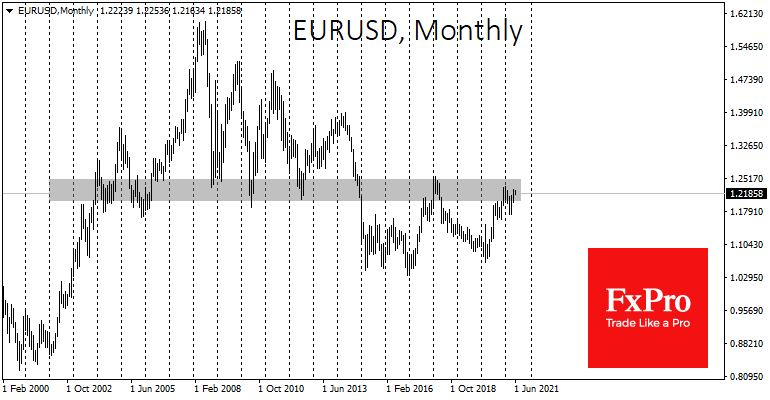

The level of 1.2250, where the EURUSD encountered significant resistance earlier last month, is the centre of the crucial pivot range in the 1.20-1.25 area, where the most pivot points since 1998 are concentrated.

We have seen that a strong break-up of this area opens the way for a solid multi-year move. On the other hand, a reversal could lead to a strong rebound that would set the pair back from this area for many months.

Earlier this year, EURUSD pulled back from above 1.2000, the second unsuccessful attempt to storm the critical resistance level since 2018.

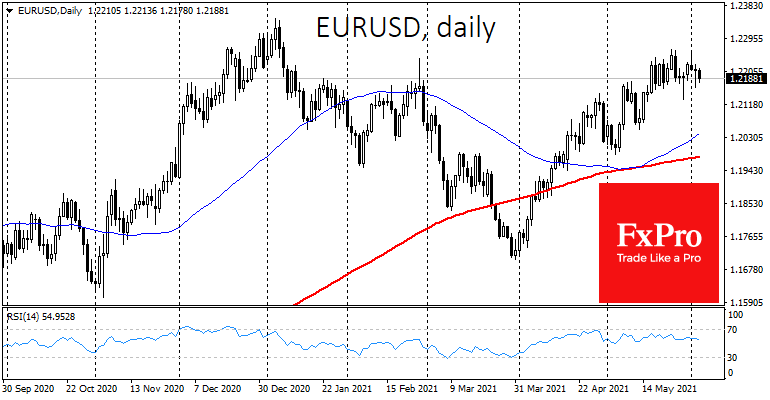

In April and May, EURUSD rallied quite briskly but slowed sharply at levels above 1.2000, losing all impulse on the way to 1.2200. Such slippage in this crucial area may reflect that the market is not ready to switch to a prolonged weakening dollar trend.

On the other hand, short-term indicators suggest that we may now see a tactical retreat of the EURUSD bulls. The RSI on the daily charts has moved away from the overbought area at the end of April. The 200- and 50-day moving averages are below the price line, marking bullish dominance.

However, the short-term tactical balance of power can be deceptive when multi-year trends are on the scales. Investors and traders also must deal with the fundamentals behind the multi-year trends.

A reversal in Fed policy rhetoric averages a 6-month upward trend in the dollar as it moves from easing to tightening. And this makes the focus on the Fed’s actions and moves a defining direction in EURUSD for many months to come.

With no indication that the Fed is preparing to wind down its bonds and mortgage-backed securities purchases on the balance sheet, the dollar will get a strong downside signal, potentially flying EURUSD past 1.2500 and aiming for 1.4000 before the end of next year.

If the US Central Bank takes a proactive stance and starts winding down balance sheet purchases as early as summer, EURUSD could spend the rest of the year under pressure, risking not only a rewrite of year lows at 1.1700 but also heading for a test of 1.1000 in the coming quarters.

Source: FXPro