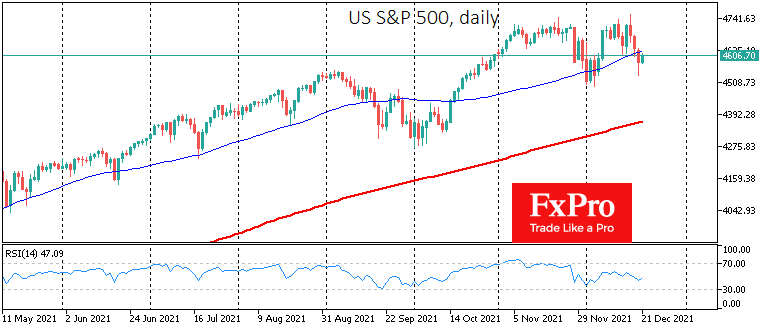

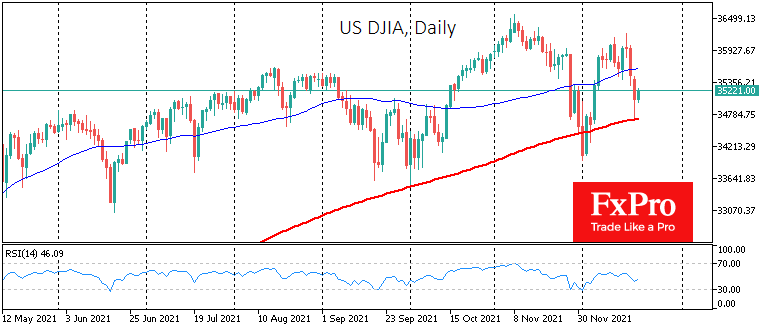

Earlier this year, some commentators, including us, have repeatedly pointed out that this year, the bottom of the month is very often near the 20th. Often there are expirations of monthly and quarterly futures and options around that date.

And around the last ten days of the month, we regularly see capital inflows into the markets. We saw exceptions in January and November, but then the S&P500 index was near all-time highs, and there was profit-taking in the last few days of the month. September was also an exception, when the bounce in the indices lasted only two days, finding support only with the start of the new month.

The current momentum looks like this year’s typical case: Indices were well away from the highs by Monday, and we saw buyers’ interest at the end of the day yesterday. The positive sentiment also extended into the Asian session and the start of the European session.

Although the European indexes lost much of their early day gains and traded near opening levels, they are still clinging to growth territory. In addition, Bitcoin and Ether, meaningful indicators of risk demand, are up 4%, indicating that bullish sentiment prevails in the markets. A moderately weaker dollar also helps, showing year-end risk traction.

These sentiments may well persist until the end of the year. 2021 was not a quiet or particularly delightful year for US equity markets, but they managed to add around 20% on the Nasdaq100 and S&P500 indices, putting it in the top 10 best years since the turn of the twentieth century. History suggests that a strong year comes with a strong ending.

Beyond that, it is worth looking at the performance of the various sectors in these final days of the year. In the last two weeks, the list of leaders and outsiders can shed light on the year’s trends ahead.

Source: FXPro