PREVIOUS TRADING DAY EVENTS – 21 July 2023

- The change in the total value of inflation-adjusted sales at the U.K. retail is estimated to have risen by 0.7% in June 2023. The reported figures were higher than expected in June despite continued high inflation. Inflation is at nearly 8%, which is the highest of any large economy.

“Overall, we expect retail sales volumes to moderately tick up over the rest of the year, but a greater rebound will have to wait until the economy improves more broadly, which probably won’t be until the second half of 2024,” said Thomas Pugh, an economist at accountants RSM UK.

Other analyst views:

“With the full drag on activity from higher interest rates yet to be felt, we still think the economy will tip into recession in the second half of this year,” said Ashley Webb at Capital Economics.

Source: https://www.reuters.com/world/uk/british-retail-sales-rise-07-june-2023-07-21/

- The Canada Retail Sales figures were reported lower than expected in May and the Core Retail Sales figures — which exclude gasoline stations, fuel vendors, motor vehicle and parts dealers — were unchanged in May, suggesting a slowdown in economic growth that would allow the Bank of Canada to leave interest rates unchanged.

“This data suggests that the economy is slowing in line with the Bank of Canada’s forecasts,” Tiago Figueiredo, an economist at Desjardins, said in a note. “As such, Canadian central bankers will view this as part of the process and will likely not see the need to raise rates further this year.”

This month, the Bank of Canada (BOC) hiked its policy rate to a 22-year high of 5.0%, its tenth-rate increase since March last year. It will not hesitate to hike again to ensure that it will reach the desired 2% target.

“The Canadian consumer looks to be losing some wind beneath its wings in the face of still-elevated inflation,” Shelly Kaushik, an economist at BMO Capital Markets, said in a note.

The BOC has projected inflation to remain around 3% over the next year before dropping to the central bank’s 2% target by mid-2025.

Source: https://www.reuters.com/business/retail-consumer/soft-canadian-retail-sales-data-point-slowing-economy-2023-07-21/

______________________________________________________________________

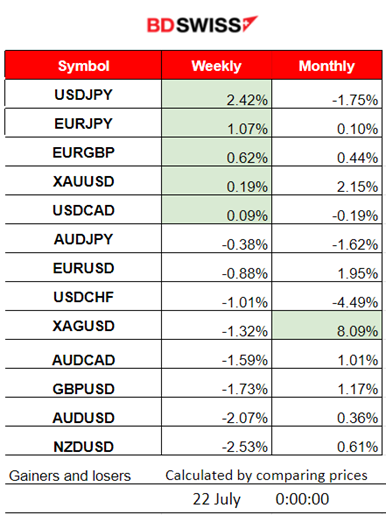

Winners vs Losers

- USDJPY managed to remain on the top of the winners’ list for this week with 2.42% gains.

- Silver (XAGUSD) is still on the top this month with gains at 8.09%.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (21 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any major scheduled releases.

- Morning – Day Session (European)

The monthly U.K. Retail Sales figures released at 9:00 suggest that they are estimated to have risen by 0.7% in June 2023, with increases across all the main sectors; which is higher than expected. Retail Sales volumes rose by 0.4% in the three months up to June 2023, compared with the three months up to March 2023. The GBP appreciated at that time causing the GBP pairs to experience an intraday shock that lasted only a little. GBPUSD jumped near 25 pips.

At 15:30, the Canada Retails Sales figures show that retail sales increased by 0.2% to $66.0 billion in May. That’s significantly lower than expected and the CAD depreciated moderately against other currencies during that time.

General Verdict:

- Friday mood with more volatility observed after 9:00, especially for FX pairs.

- DXY moved higher as the dollar gained significant strength for the second consecutive trading day.

- U.S. stocks are still high but show signs of reversing. Next week, will be interesting as the Fed decides on rates and is expected to proceed with the pre-announced hike.

____________________________________________________________________

FOREX MARKETS MONITOR

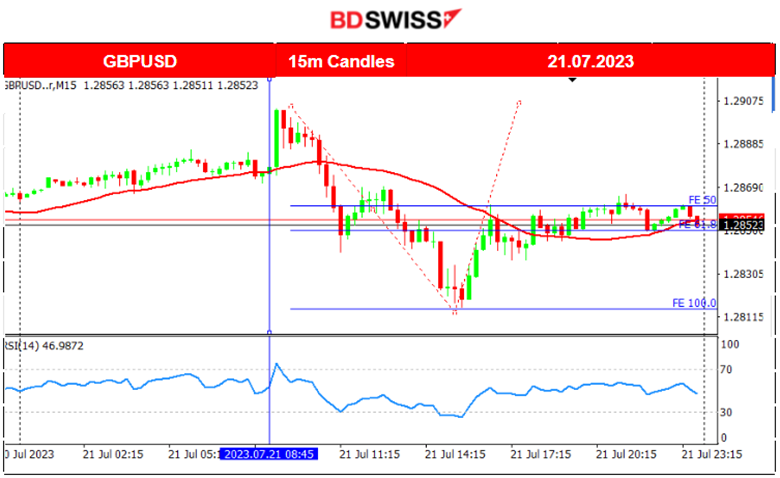

GBPUSD (21.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Due to the fact that it was Friday, less volatility and a sideways path with retracements were more possible to happen. Due to the retail sales figures released at 9:00, the pair jumped after GBP appreciation before the price reversed significantly. After the reversal, the pair dropped and crossed the 30-period MA on its way down. It deviated more than 50 pips from the mean but eventually found strong support that forced the pair to retrace back to the MA. It remained on the sideways path with low volatility until the end of the trading day. Most of the downward move was USD-driven since it appreciated greatly during the European session.

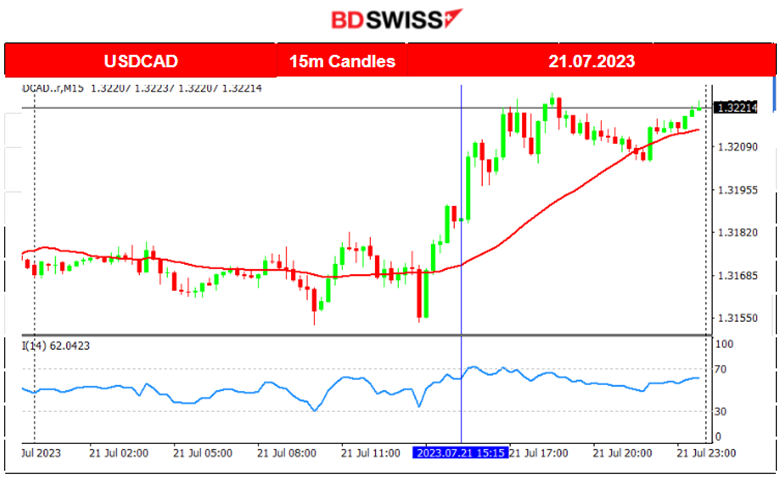

USDCAD (21.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair was moving with low volatility until the European session started. It continued the sideways path around the 30-period MA until it started to climb at 15:00, since the USD experienced appreciation against other currencies. At 15:30, the Retail Sales figures for Canada were reported lower than expected causing the CAD to depreciate and the pair to move further upwards. It found resistance at near 1.32260 before retracing back to the mean.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 19th, the index moved early upwards but during the N. American Session it dropped heavily, sometime after the NYSE opening. On the 20th of July, the index fell surprisingly fast, especially after the start of the European session. After the reversal, on the 21st of July, the index retraced but it now keeps testing the next support levels. If the important supports at near 15429 USD/oz break, then it is expected that it could dive to 15390 USD at least. The RSI, though, shows a slowdown and signals bullish divergence.

Trading Opportunities

Our latest analysis on Tradingview:

https://www.tradingview.com/chart/NAS100/J9hEbeqc-NAS100-Reversal-21-07-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

We can identify the breakout of the important resistance near 76.80 USD/b. The market has not pushed the price rapidly upwards. Resistance to the upside is apparent. An upward wedge is visible, as Crude continues the upward movement steadily with lower volatility as days pass. It is currently moving above the 30-period MA as it is on a short-term uptrend. Considering the recent path, it is not expected that we will see high deviations from the mean, at least until the Fed’s Rate Decision on Wednesday, 26th of July.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold eventually reversed downwards rapidly on the 20th of July, moving out of consolation, breaking the support levels near 1971 USD/oz and crossing the 30-period MA on its way down. The Dollar is currently gaining strength and that is a major driving factor. The downward movement continued while the index was below the MA the next day as well, on the 21st of July, and remained on that path. The RSI shows signs of bullish divergence with higher highs. Will this be enough to safely forecast a reversal to the upside? Let’s see.

______________________________________________________________

News Reports Monitor – Trading Day (23 July 2023)

No important news announcements, nor any major scheduled releases except that it was election day for Spaniards. They went to the polls on Sunday to cast their ballots in an early general election called by Prime Minister Pedro Sanchez. With nearly all votes counted, no political party or likely coalition has won enough seats in the Congress of Deputies to declare victory.

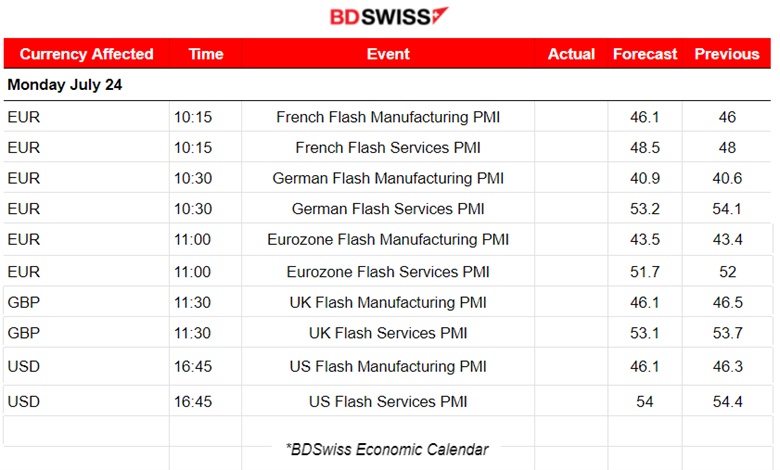

News Reports Monitor – Today Trading Day (24 July 2023)

Server Time / Timezone EEST (UTC 03:00)

PMI day. Release of both the Services and the Manufacturing sector PMIs for all major regions.

- Midnight – Night Session (Asian)

No important news announcements, nor any major scheduled releases.

- Morning – Day Session (European)

More volatility than that of a normal Monday is expected because of the PMI release. Shocks might take place at the time of the releases. High deviations from the MAs would take place probably during the German PMI and U.S. PMI release.

General Verdict:

- Monday is usually slow with no big deviations. However, these PMI data are expected to light up the picture for the recent economic activity of both sectors.

- Some shocks are possible for major pairs during the time of the releases.

- Significant moves are usually observed early during the start of the European session.

______________________________________________________________

Source: BDSwiss