Previous Trading Day’s Events (09.04.2024)

______________________________________________________________________

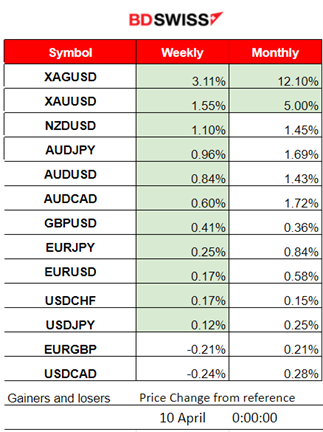

Winners vs Losers

Silver and Gold remain on the top of the week’s winners list with 3.11% and 1.55% gains respectively. Silver gains reached 12.10% this month.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (09.04.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figures to be released.

- Morning – Day Session (European and N. American Session)

No important announcements, no special scheduled figures to be released.

General Verdict:

- Absence of important figure releases. The dollar was affected mid-day but it overall remained stable. The dollar index closed almost flat, recovering from the downside.

- Gold experienced a volatile path and closed again higher.

- Crude oil moved lower.

- U.S. indices experienced high volatility after the exchange opening moving downwards but eventually reversed fully until the end of the trading day.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (09.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

After the start of the European session, the pair started moving to the upside. This was due to the USD weakening and causing the pair to reach the resistance at 1.08830. After 16:30 the dollar gained strength again causing a EURUSD huge drop. At the same time, U.S. stocks plunged just right after the stock market opening.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 02:00)

Price Movement

As mentioned in our previous analysis the price of Bitcoin was forming an upward wedge that eventually broke to the upside. This caused the price to jump to 72,700 USD resistance level. After that, the price eventually reversed to the downside. It seems that this drop is quite aggressive as it crosses the 30-period MA and stays below it giving a strong signal that the uptrend has stopped. A sideways path is currently in place with Bitcoin remaining below 70K USD.

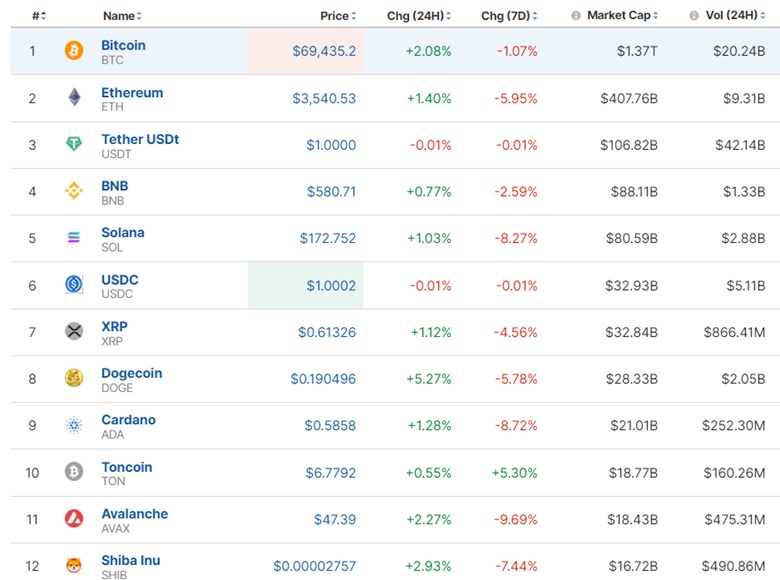

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Despite some positive moves recently, the market remains on the downside.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 4th of April, the index continued upwards but at some point after 19:00 it experienced a rapid drop. Retracement was quite probable that it would take place as mentioned in our previous analysis. It did not happen immediately but was only completed after the NFP report took place on the 5th of April. The index moved back to the upside crossing the 30-period MA on its way up and eventually remaining close to the MA until the end of the trading day. On the 8th of April, the market saw a sideways movement with volatility levels to be extremely low. On the 9th of April, the U.S. Indices yesterday after the market opening (exchange opening at 16:30 server time) had similar paths. First downwards and soon after, a full reversal closing the day near flat. Market participants are expecting the inflation report, in order to react greatly and probably cause a breakout of the triangle formation as depicted below. The important resistance level is 5,230 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 02:00)

Price Movement

The level 84.15 USD/b serves as an important support. Volatility levels are lowered and a triangle formation is apparent. Breakout to either direction would potentially lead to a rapid movement to either the mentioned support or resistance level. The price of Crude is currently settling near 85 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The win-win Gold continues to help bulls perform. After the NFP, it moved significantly higher, the USD depreciation helped, however. While the technical was suggesting an uptrend halt with the price moving below the 30-period MA, it continued with another uptrend, deviating significantly from the MA to the upside. Gold currently remains above the 30-period MA and is on another uptrend amid the U.S. inflation report. The report will probably affect the dollar greatly and the market is waiting for a future dollar weakening that could push Gold higher. During the time of the report release though, it might be the case that inflation is reported higher than expected and that could cause a sudden drop in the price of Gold as the dollar appreciates. It’s all about those CPI figures.

______________________________________________________________

______________________________________________________________

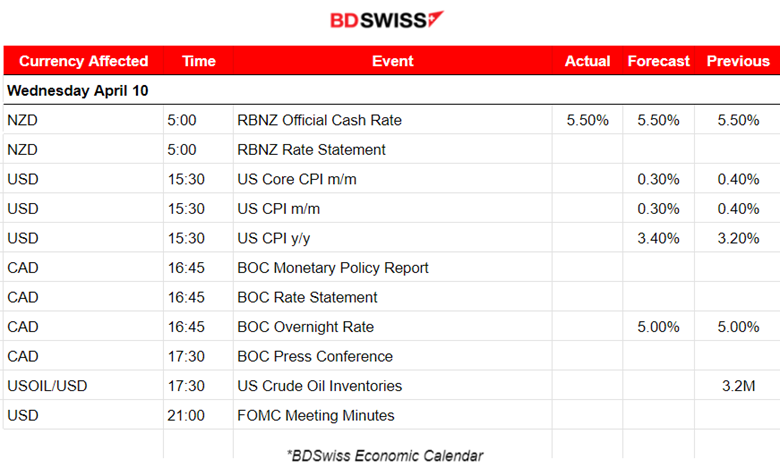

News Reports Monitor – Today Trading Day (10 April 2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

RBNZ held the OCR at 5.50% in hopes of the return of the CPI inflation to the 1% to 3% target in 2024. NZD was affected by an overall appreciation of the currency. NZDUSD moved near 20 pips upwards.

- Morning – Day Session (European and N. American Session)

The U.S. inflation data releases (CPIs) take place at 15:30 with expectations for a higher annual inflation rate to be in place. Monthly figures are expected to be reported lower though. It would be logical to expect that inflation will be quite sticky currently, a view that coincides with the NFP report. Probably the expectation of a higher inflation figure is correct and the USD will probably be affected positively upon release.

The Bank of Canada (BOE) is expected to keep rates unchanged as well, and the decision release takes place at 16:45. Canada’s economy has recorded strong job numbers recently and a larger than expected 0.6%MoM increase in GDP for January. But at the same time, inflation has brought us to the downside and the unemployment rate has increased. The release though should have a moderate impact on the CAD pairs, especially during the press conference at 17:30.

General Verdict:

- The market is preparing for the U.S. inflation data. The dollar is not affected. Calm FX market.

- Gold moved higher already, and Crude oil as well.

- U.S. indices continue on the sideways with low volatility.

______________________________________________________________

Source: BDSwiss