PREVIOUS TRADING DAY EVENTS – 05 June 2023

Announcements:

- The U.S. Institute for Supply Management (ISM) services PMI fell sharply to 50.3 against expectations of a slight increase to 52.6. Tight credit conditions, pandemic savings and the U.S. banking crisis are finally hitting the services sector.

PMI’s reading above 50 indicates growth in the services industry, which accounts for more than two-thirds of the economy. The latest figure is just over 50 and is a figure that shows weakness rather than improvement, raising fears and risks of a recession.

There have been 500 basis points worth of interest rate increases from the Fed since March 2022 and the U.S. have been indeed experiencing lower inflation. Lower business activity is expected and it is good news for the U.S. central bank’s efforts to bring inflation down to its 2% target. Services prices tend to be stickier and less responsive to rate hikes.

“Momentum had been very strong in the services sector since the reopening process began, but the sector is clearly cooling down now,” Thomas Simons, U.S. economist at Jefferies, wrote in a note.

Sources:

https://www.reuters.com/markets/us/us-services-sector-slows-may-prices-paid-gauge-falls-three-year-low-ism-survey-2023-06-05/

______________________________________________________________________

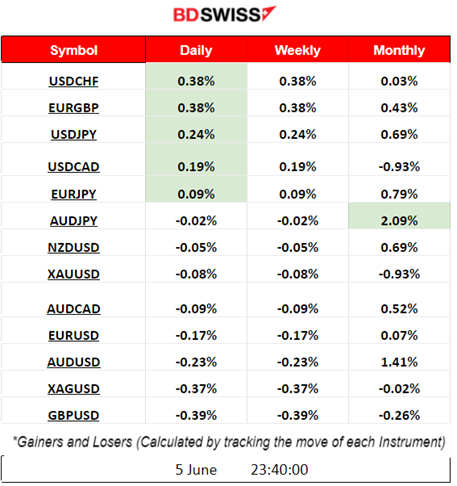

Summary Daily Moves – Winners vs Losers (05 June 2023)

- USDCHF reached the top alongside EURGBP yesterday with 0.38% gains each.

- The month finds AUDJPY at the top so far, having a 2.09% price change.

______________________________________________________________________

News Reports Monitor – Sunday (04 June 2023)

OPEC-JMMC meetings took place on Sunday. The influential Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC , on Sunday, made no changes to its planned oil production cuts for this year. OPEC also announced in a statement that it will limit combined oil production to 40.463 million barrels per day over January-December 2024. The Crude market opened higher on Monday and retraced during the trading day.

News Reports Monitor – Previous Trading Day (05 June 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

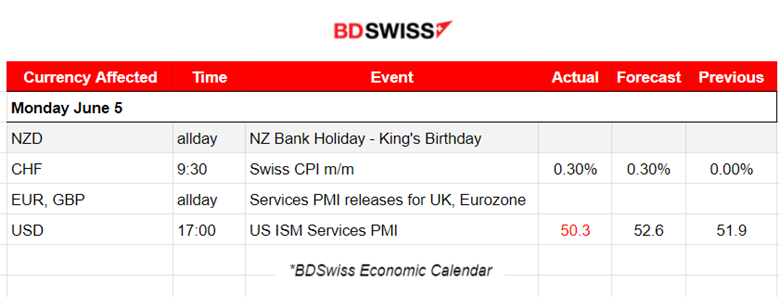

Switzerland’s CPI monthly change was released at 9:00. There was no significant impact on CHF pairs. The change was at 0.3% as expected.

PMI data for the Services sector was released during the trading day.

Services PMIs in general remain above 50, in the expansion area but they are weakened. Lower PMI data for the Eurozone but not so low. The U.S. services sector softened.

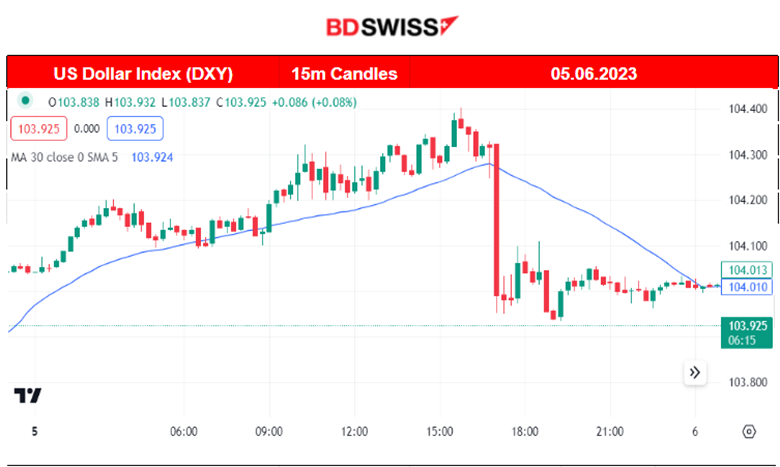

The release of the ISM Services PMI figure for the U.S. showed that economic activity in the services sector expanded in May for the fifth consecutive month, showing a 50.3 index level. However, it also shows signs of no improvement. The headline balance fell to 50.3 from 51.9 (consensus 52.6). The USD had depreciated greatly at the time of the release as USD pairs experienced an intraday shock.

General Verdict:

- PMI releases had no significant impact.

- High intraday shock took place during the U.S. ISM Services PMI released at 17:00 as USD depreciated greatly. DXY moved lower overall. Gold moved higher, Oil lower.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (05.06.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

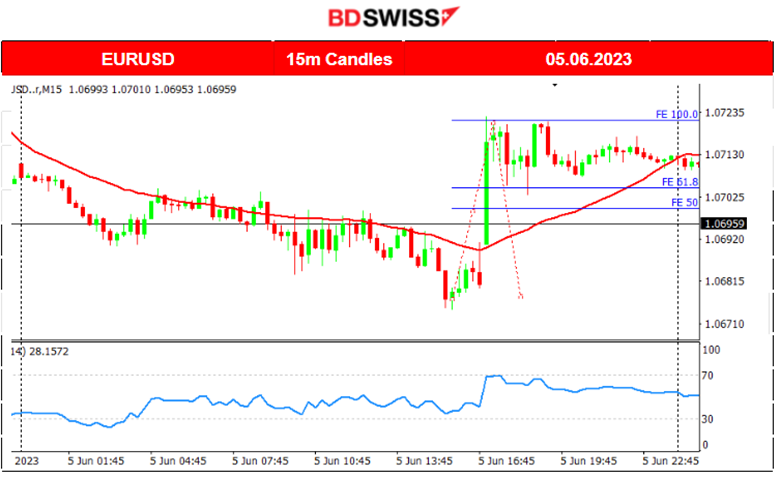

EURUSD was moving steadily downwards while being below the 30-period MA. The PMI services data seem to have a slight effect on the pair. The pair jumped when the ISM Services PMI figure was released. It was reported lower than the previous figure, even in the expansion area still. The market reacted with great USD depreciation.

Trading Opportunities

The Jump was stopped by strong resistance levels near 1.07220. At the end of the shock, the Fibonacci expansion tool could help us find the retracement level 61.8, the level at which the pair would eventually, at least, come back.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The index was climbing for days after finding resistance at 14670 USD. The RSI with lower highs was indicating that a bearish divergence was forming and that the price would fall. It did. Kind reminder, that the index is not representing the U.S. stock market’s general path. The Dow Jones (US30) has been steadily falling on the 5th of June since the beginning of the European session.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude has been experiencing an upward trend lately. Since the 1st of June, it moved above the 30-period MA and remained on an upward path. On the 4th of June, the OPEC-JMMC meetings took place, with OPEC announcing that it will limit combined oil production greatly in 2024, more than was expected. On the 5th of June, the market opened higher as depicted on the chart but the price soon reversed.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Until the 2nd of June, the Gold price was moving higher with high volatility. After the NFP report and the high USD appreciation, its price fell rapidly reversing and crossing the 30-period MA, finding support at near 1938 USD/oz. On Monday, 5th June, the U.S. ISM Services PMI figure was released causing the USD to depreciate greatly, thus the Gold price to jump. With that boost, it crossed the MA and moved further upwards, settling at nearly 1960 USD/oz.

______________________________________________________________

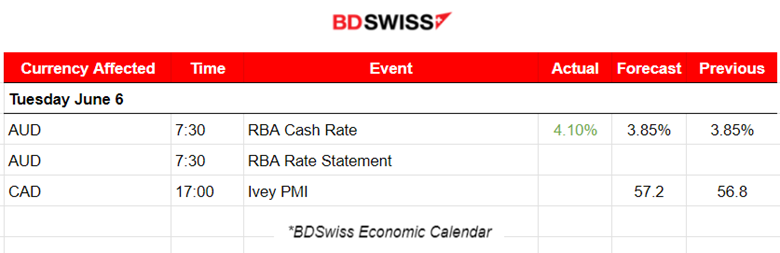

News Reports Monitor – Today Trading Day (06 June 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

A surprise rate increase of the RBA was announced at 7:30. The Cash Rate was set to 4.10%, more than the expected 3.85%, causing AUD to appreciate greatly with this shock. AUDUSD jumped more than 50 pips at that time.

General Verdict:

- Low volatility with no intraday shocks, other than the RBA rate decision event that already took place.

- Retracements and sideways paths around the mean are more probable.

_____________________________________________________________

Source: BDSwiss