PREVIOUS TRADING DAY EVENTS – 10 Oct 2023

______________________________________________________________________

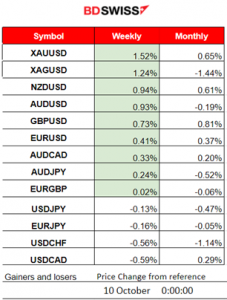

Winners and Losers

Metals climb higher. This week Gold reached higher levels of 1.52% gains while being the month’s leader. Silver follows with 1.24% gains this week so far.

News Reports Monitor – Previous Trading Day (10 Oct 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

No scheduled special figure releases.

Markets affected by Israel-Gaza violence. Metals climbed to high levels. U.S. Stocks also.

General Verdict:

- Volatility for FX pairs was low yesterday.

- Gold reached new higher levels.

- The U.S. stock market rose in value again.

- The DXY formed a downward wedge. Weakening in general these couple of days.

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (10.10.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The EURUSD moved around the 30-period MA but leaned more towards the upside. Since the USD was the main driver, it created an upward wedge formation. Breakout of the bands of that formation could cause rapid price movement in one direction. The U.S. CPI data reports tomorrow at 15:30 will affect the pair with a probable shock breaking those levels.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Recently we observed a drop in the price of bitcoin. The USD was not the driver of the fall. It keeps on falling breaking support levels steadily every day but experiencing retracements on the way down. The next level is near 27000.

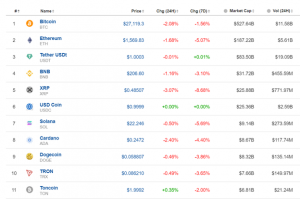

Crypto sorted by Highest Market Cap:

Bitcoin experienced weakness again and it seems that this holds for the above also. The 24-hour column is indeed still red. XRP lost the most, having almost 9% these past few days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

After the NFP release the NAS100 index moved to the downside but soon reversed and got out of the range with a breakout to the upside instead reaching to near 15000. All benchmark indices experienced similar paths. Later the U.S. stock market picked up momentum and caused the indices to move to higher levels. The Israel-Hamas conflict has affected the markets greatly and the NAS100 is now on an uptrend. Currently, the RSI shows a slowdown with lower highs, however, this does not give a signal for a retracement yet.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude oil jumped on the 9th Oct due to the events happening in Israel. The Hamas-Israel conflict erupted into a war affecting oil prices. It is currently in consolidation and if the resistance is broken it is expected to move into higher levels. The consolidation seems to hold for 2 full days now. Let’s see if it breaks today. On the downside, the breakout could cause rapid movement until the 82 USD/b level corrected from the nearly 4-dollar jump that happened at the start of this week.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold broke the consolidation and moved rapidly to the upside. The fundamentals are currently at work. The Hamas-Israel conflict started to push prices to new higher levels for a couple of days now. Currently, the trend upwards is clear. The price broke the 1865 resistance level with an upward momentum at the moment.

______________________________________________________________

News Reports Monitor – Today Trading Day (11 Oct 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

The U.S. PPI data are inflation-related and very important data for the Fed at the moment. The Labor market showed remarkable resilience. The NFP was reported way higher than what was expected. Demand could kick in in the future creating sticky prices, thus making it more difficult to bring inflation down to desired levels. We could see shocks today for the USD pairs. It would be moderate though as the market waits for the CPI figures reported tomorrow.

General Verdict:

- The absence of special releases keeps FX volatility at relatively low levels. However, the PPI data could shake the markets, especially the USD pairs.

- Gold climbs and Crude oil is still in consolidation.

- S. indices seem to follow a steady upward trend.

______________________________________________________________

Source: BDSwiss