We saw a similar reaction about a month ago when unexpectedly weak job growth supported stocks and weakened the dollar. At that time, the markets thought that the economic recovery had slowed sharply, which would prevent the Fed from even beginning to discuss a withdrawal of stimulus in the coming weeks. This time, early labour market indicators suggest a likely substantial gain in employment.

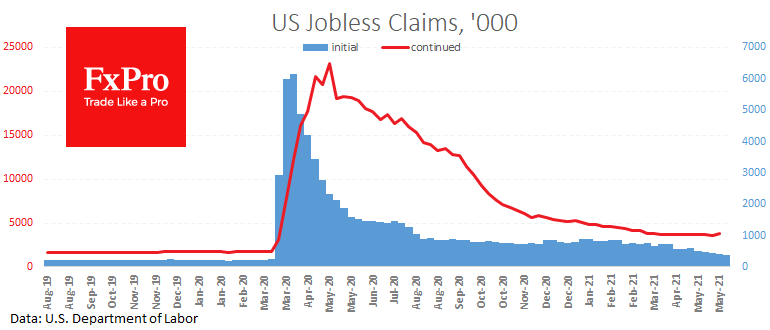

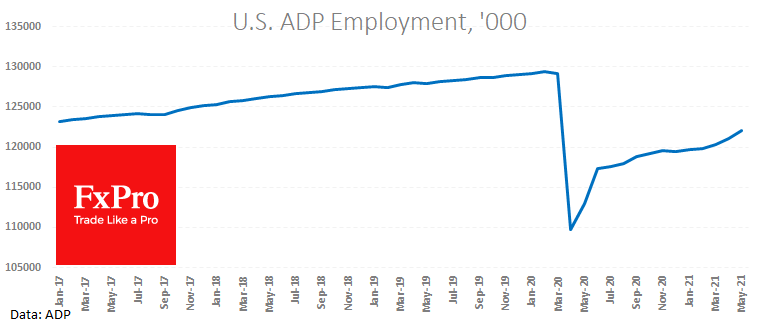

Initial jobless claims fell to 385k last week, markedly below the expected 400k. And before that, the ADP reported that they estimated that the private sector added 978k jobs in May after 654 a month earlier. However, the markets did not anticipate an acceleration in hiring on average.

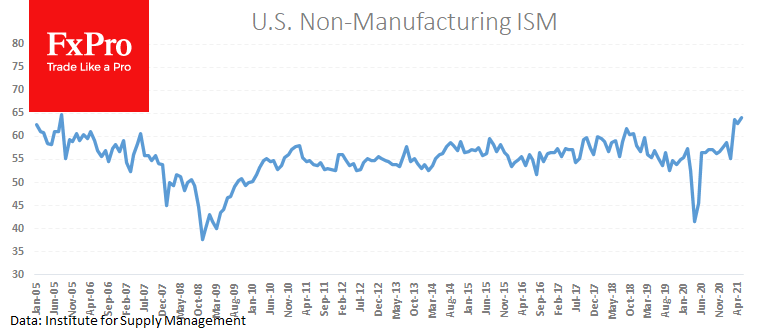

Later the ISM reported a record PMI for non-manufacturing industries at 64. But, again, business activity, orders and price developments provided the biggest drag on the index. In contrast, the employment component shows a cooling of growth.

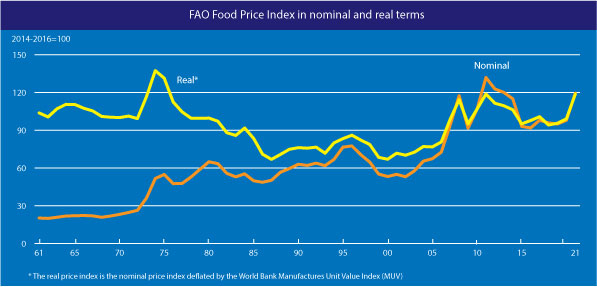

The question becomes relevant, will the markets withstand further positivity, coming mainly from the price area? Equity prices, not to mention the costs of food commodities and metals, are highly heated by logistical problems.

The Food and Agriculture Organization (FAO) price index is rising at its fastest rate since 2011, adding 36.1% over the same month a year earlier and in real terms at its highest level since the late 1970s. That said, data from stock exchanges indicate that much of the growth in the most popular sectors is due to speculative rather than actual demand.

Another issue is that the real economy and labour market are quite far from the global peak, just as some commodities and stock markets. Still, central bankers can only cool things down once.

This means that stock market bulls should be wary of solid labour market data later today. Strong employment growth will unleash the Fed’s inflationary spiral, which will be a blow to equities and risk crashing commodity markets as well as putting the dollar back on the upside.

Alternatively, weak indicators will create hopes of extending the status quo in Fed policy, which will be suitable for markets and return moderate pressure on the dollar.

Source: FXPro