Rates as of 05:00 GMT

Market Recap

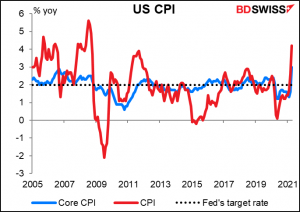

A bad, bad day for risk assets. European stocks closed somewhat higher on optimism about economic reopenings and the commodity boom, but the mood changed after the US consumer price index (CPI) came out far above expectations at 4.2% yoy ( 3.6% yoy expected, 2.6% previous), the fastest pace of increase since 2008.

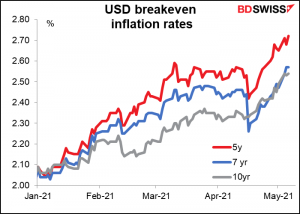

As a result, US breakeven inflation rates moved ever-higher, particularly the 5-year rate, which is where attention is focused nowadays.

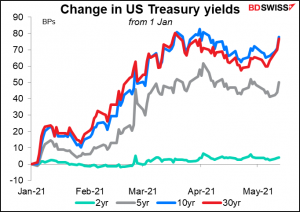

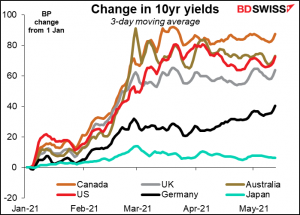

And bond yields moved higher across the curve (although they closed below their highs after a successful 10-year auction).

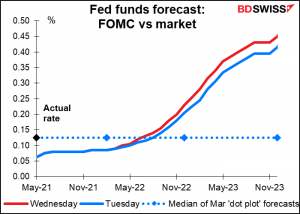

With yields moving higher and inflation expectations becoming increasingly un-anchored from 2%, expectations grew that the Fed might have to start normalizing monetary policy earlier than previously expected.

Of course, Fed officials speaking yesterday pushed back on this idea. Fed Vice Chair Clarida said he was surprised by the steep rise in the CPI but nonetheless expected “inflation to return to – or perhaps run somewhat above – our 2% longer-run goal in 2022 and 2023,” an outcome that would be “entirely consistent” with the Fed’s new flexible average inflation targeting (FAIT) framework. He did say though that “we would not hesitate to act” to bring inflation down if necessary.” Similarly, Atlanta Fed President Bostic (V) said he was surprised by the figure but that he was “expecting a lot of volatility at least through September” in the inflation data as transitory and base effects gradually work through the data. “Then we will have to see what is happening with the supply chain disruptions and the commodities prices and those sorts of issues.”

The Fed might be patient enough to wait until September, but will the market? I doubt it. There’s going to be a real struggle for control of the narrative between the Fed and the market for the next few months.

With bond yields and rate expectations surging, stock markets fell sharply as a result — the S&P 500 closed off 2.1%, with the NASDAQ down an even bigger 2.7%. Ouch! After hitting a record high Friday on the nonfarm payrolls miss, the S&P 500 has fallen every day this week and is now down 4% from its high. The NASDAQ is down almost 8% from its record high in April.

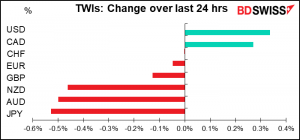

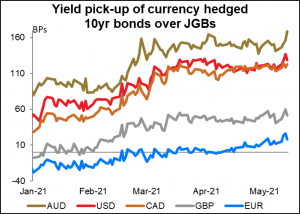

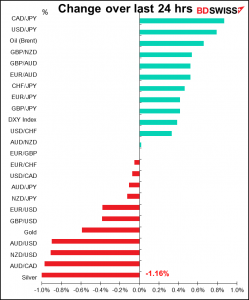

In this “risk-off” environment a stronger USD is a given but then why is JPY, the other main “safe-haven” currency, at the bottom of my table today? It’s probably because of the widening yield gap between Japanese bonds and other nation’s bonds. With the Bank of Japan’s yield curve control policy keeping Japan’s 10-year yields pegged at ±25 bps around 0.00%, Japan’s bonds have nowhere to run to, while yields elsewhere are going higher and higher.

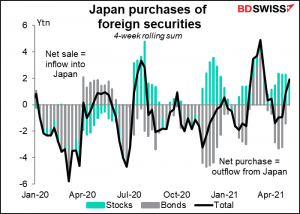

Japanese have actually been net sellers of foreign securities recently, including a small net sale of foreign bonds over the last four weeks in total. Generally speaking, Japanese investors are trend followers -they sell into falling markets and buy into rising markets.

But with bond yields rising further and the gap between Japanese and other markets widening, the market assumes that soon it’ll be attractive enough for Japanese investors to get involved in foreign markets again.

CAD on the other hand benefited from both higher oil prices and Canadian yields that are slightly higher than US yields. With commodity prices still on a run, I’m still bullish CAD.

The S&P 500 index is indicated up 0.2% at the time of writing. I think we could have a calmer day in the market today after yesterday’s panicked reaction. AUD and NZD are likely to recover somewhat today on “mean reversion,” in my view. That may mean further declines for JPY.

Today’s market

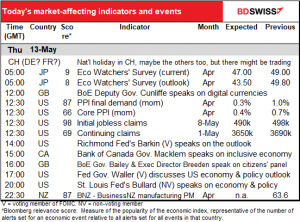

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

I’m unsure about the holidays today. Switzerland is definitely on holiday. The lists of national holidays I found on the internet say that Germany and France are on holiday today too, but Bloomberg insists that those countries follow the TARGET2 calendar for trading and therefore it’s not a holiday. Anyone in Germany or France want to tell me if the stores are open?

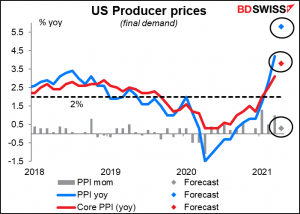

Following yesterday’s stunning US consumer price index (CPI), today’s US producer price index (PPI) will be closely watched as another inflation indicator.

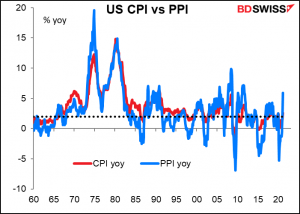

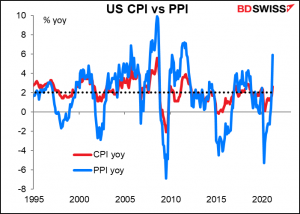

What’s the relationship between the CPI and the PPI? They both measure the price of a basket of goods and services, but the baskets are different. According to the Bureau of Labor Statistics (BLS), which calculates the two, the PPI includes the entire marketed output of US producers. This excludes imports. The CPI on the other hand includes goods and services purchased for personal consumption by urban US households, including imports.

There are several measures of the PPI that take goods at different stages of production. The most commonly used one, the one we look at, is the one for finished goods. Although consumer goods are finished goods, the PPI and CPI two don’t measure a comparable basket. First off, the PPI includes capital equipment, which individuals don’t buy (unless you want an oil rig in your backyard, for example). Meanwhile, the CPI includes services, which aren’t included in the PPI. And of course, even when the same thing appears in both baskets, the weightings are different.

One might think that higher producer prices will eventually feed through to higher consumer prices, but it ain’t necessarily so. As the BLS says,

Some assume that a price change recorded in a particular component of the PPI will eventually and directly be seen in the same or most similar component of the CPI. In reality, it is difficult to project whether, in what magnitude, or when an increase in the PPI will “pass through” to the CPI. An increase in the price paid to a producer for a good may not be passed on by a retailer if, for example, competitive conditions in the retail market preclude such an action. Alternatively, the retailer may increase the selling price for the good in question, but not by the full extent of the increase in the price paid to the producer. In this case, for example, the retailer may be realizing efficiencies in operations which allow a shrinkage in markup. This particular example also illustrates that, because of the possibility of change in the costs to transport wholesale or retail products, the CPI for a given component may change even though there has been no change in the PPI for the same component.

In fact, the causality isn’t all one-way. Some studies have shown that they both drive each other, especially when rising, “signifying the existence of both demand-pull and the cost-push nature of inflation.”

The link between the PPI and CPI is getting weaker because of globalization. They used to be quite closely correlated but then started to diverge after 2001, when China joined the World Trade Organization (WTO). According to researchers at Columbia University, this is because of the increasing length and complexity of global value changes. There are now more stages in the production process and more intermediate goods, so the impact of one on the other is muted.

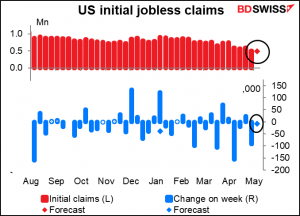

Aside from the PPI, the US initial jobless claims are expected to continue their decline. They’ve averaged a decline of 61k a week for the last month, but really, it’s quite volatile – there was one week of -156k and one week of 24k. This week it’s expected to be down only 8k, but at least it would be down. I don’t think down 8k would get anyone excited, though.

Source: BDSwiss