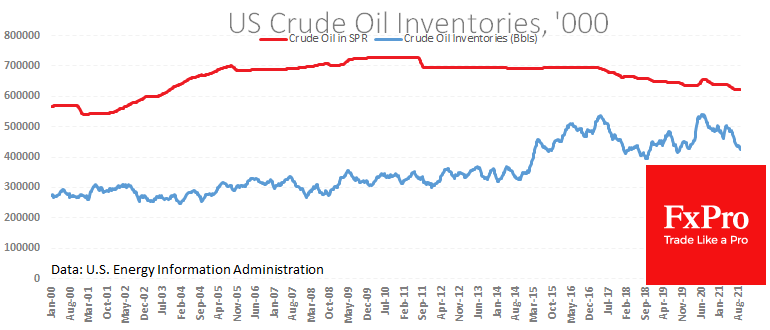

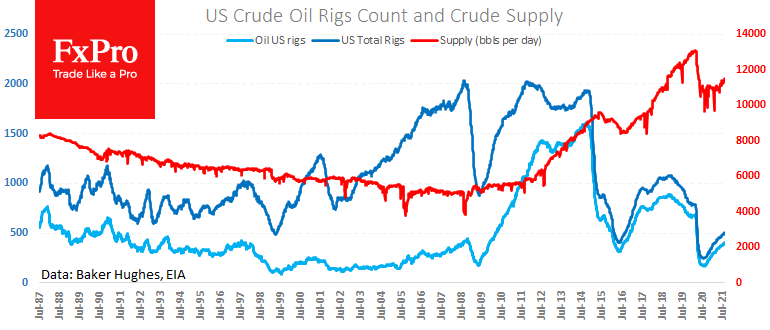

Interestingly, at the same time, the US has brought production to 11.5M BPD, a new high since May 2020, and the strategic oil reserve has fallen slightly. All of this reflects rising consumption in the states, which would be good for the price if not for two factors.

Earlier on Wednesday, OPEC confirmed a further 400 BPD production increase from September. At the same time, Russia’s representative indicated that it would be possible to increase production above the quota, causing a 2% drop in Brent prices to $70.30.

The second factor is the planned sale in September of 20M barrels from the US government’s 621M Strategic Petroleum Reserve. This is unlikely to be the last such sale in the coming months.

Source: FXPro