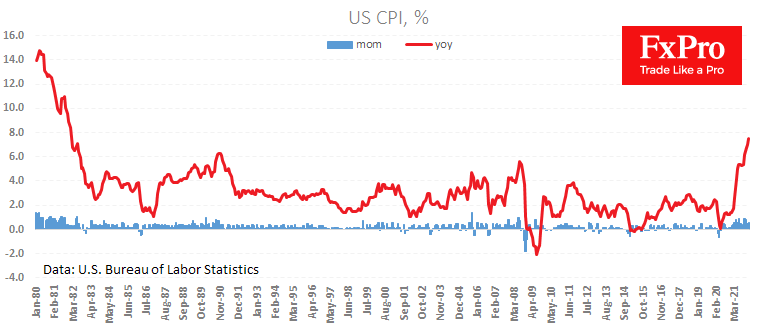

The price index for January rose 0.6% to an annual rate of 7.5%. The report dashed hopes that the monthly price increase was slowing, as analysts expected a slowdown to 0.4% after December’s 0.5% jump.

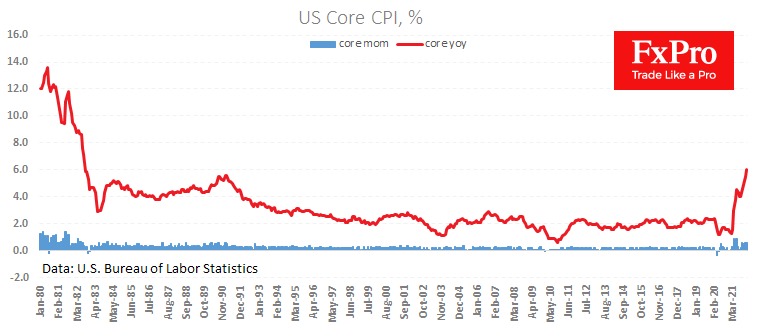

The core index added another 0.6% last month, accelerating to 6.0% y/y, the highest level since August 1982.

Thus far, there are few signs of a slowdown in inflation which requires the Fed to take active steps to tighten monetary policy. As might be expected, the stronger-than-expected rise in prices caused a sell-off in US equity futures, with the Nasdaq100 losing 2% and the S&P500 1.3%.

The dollar index immediately gained 0.4%. For the dollar, the current inflation report could be the starting point for a new upward momentum as it virtually unleashes the Fed for a high-profile first move with a key rate hike of 50 points in five weeks.

Source: FXPro