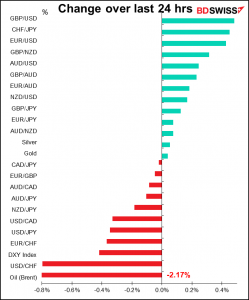

Rates as of 05:00 GMT

Market Recap

Markets – or investors, I should say – just can’t make up their minds. After a big “risk-off” day on Wednesday, Thursday was a substantial “risk-on” day, with both equities and credit rallying. The S&P 500 closed up 1.1% with tech outperforming – NASDAQ up 1.8%.

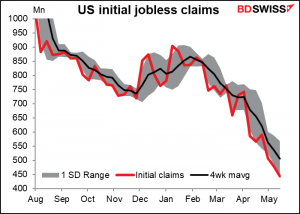

The cause of the good spirits was a better-than-expected initial jobless claims figure, down 29k to 444k vs expectations of 450k. This week was particularly important as it’s the week when the survey for the May nonfarm payrolls (NF) is taken. It raises hopes that the disappointing April NFP report was just a blip, not the start of a trend, and that there will be “substantial further progress” in the labor market.

Note that the initial jobless claims have been running below their 4-week moving average since early April. That indicates an accelerating pace of decline.

Oddly enough, despite the good news on the labor market, Treasury yields declined, with the 10-year yield down 3.4 bps this morning from yesterday morning’s level. At 1.628% it’s now below the 1.644% of Wednesday morning. It’s therefore recovered all of the “taper tantrum” that occurred on Wednesday following the release of the minutes of the April meeting of the rate-setting Federal Open Market Committee (FOMC), which showed that indeed the Committee has begun “thinking about thinking about” tapering down its bond purchases. The fed funds market also slightly repriced fed rate expectations, which fell by 2 bps or so in the long end. It’s hard to say what caused the move in rates – perhaps it was the poorly received auction of 10-year Treasury Inflation Protected Securities (TIPS), which caused increased demand for nominal bonds. Or maybe it was the poor data on continuing jobless claims, which in contrast to initial claims, rose (3751k from 3655k, decline to 3620k expected).

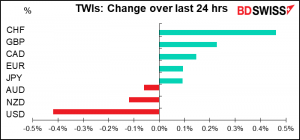

There were several anomalous movements on the day that I can only ascribe to general USD weakness, rather than any currency-specific factors.

#1 was the strength of CHF on a risk-on day. EUR/CHF (blue line) gained at around the London opening when there was little news to push it around. It could’ve been because of the decline in Bund yields (red line) around then, but EUR/CHF just kept declining even as Bund yields rose later in the day.

#2 was the strength of CAD despite a day when oil declined. Iranian President Hassan Rouhani said that negotiators in Vienna have taken a “major step” and that “the main agreement has been made,” according to Iranian state TV. This will enable the US and others to lift sanctions on Iran, including those affecting oil as well as banking and shipping. Oil fell over 2% as a result.

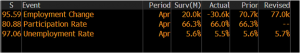

#3 was the continued support for AUD (AUD/USD moved higher) despite weaker -than-expected labor market data. Weaker

It looks to me like the market is in a “sell dollars” mood. That may be the theme going into the weekend, especially if the preliminary EU PMIs come out as expected (see below).

Today’s market

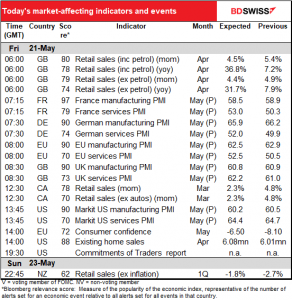

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

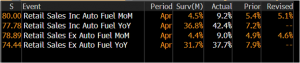

UK retail sales are already out. They were much better than expected – about double the forecast growth. That should add to the “Britain is recovering” narrative and boost GBP.

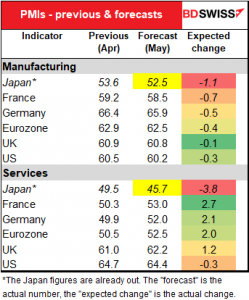

After that, the main thing today is the preliminary purchasing managers’ indices (PMIs) for the major industrial countries. They’re already pretty strong; the April Eurozone composite PMI was at 53.8, the highest since July, while the US composite PMI was a record-high 63.5. This month they’re expected to show small declines on the manufacturing side but continued increases for services, which should lead to further rises in the composite PMIs (not shown). PMIs don’t go up indefinitely so a slight decline from the current high levels of manufacturing is to be expected. Further increases on the services side, which is the side that’s been really battered, would be welcome, especially in Germany, where the service-sector PMI is expected to poke its nose back over the 50 line again. So, all in all I’d rate these figures good.

Of course, the question nowadays is, is good good? That is, figures suggesting a continued robust expansion could be taken to be further confirmation of the “demand-pull” inflation story, which might be seen as negative for the markets

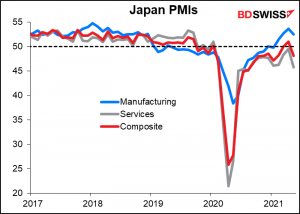

There’s one exception. Japan’s PMIs are already out. They were dreadful. Of particular note was the abysmal services PMI. Unlike the other countries, Japan’s service-sector PMI hasn’t yet returned to the 50 line since the pandemic began. This sharp decline is dreadful. The composite PMI, which had finally gone back above 50 in April, fell back below the line this month.

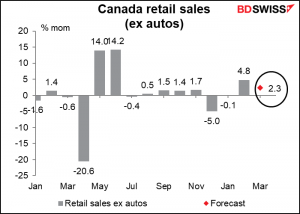

Canadian retail sales are expected to be up a strong 2.3% mom in March even after February’s very strong 4.8% rise. That’s an impressive gain that could help to strengthen CAD.

Finally, existing home sales are expected to be about unchanged, while next week’s new home sales are forecast to fall a bit. But really, they’re both going sideways as rising house costs are offset by low mortgage rates, thereby keeping US homes affordable and keeping the housing boom going.

Source: BDSwiss