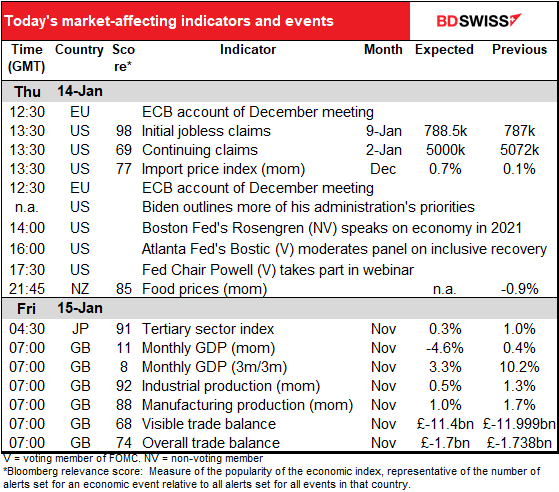

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

US & European politics

Trump impeached again! The US House of Representatives voted to impeach Trump. That just means that the Senate will now have to vote on whether to kick him out of office, and since that vote probably won’t take place until he’s out of office already, it won’t make much difference. However if they do vote to give him the boot (which has to be a 2/3rds majority vote) they can then vote to ban him from office permanently (which only has to be a majority). That would prevent him from running again in 2024, as he’s threatened to do. Together with being banned from Twitter, I think that would hasten his disappearance from Republican politics, which would be a good thing IMHO. Let’s just hope that enough Republican senators agree that they can get the necessary votes.

The interesting point to me was not that Trump was impeached, but that after what he did, only 10 Republicans voted to impeach and 197 voted against. What would he have to do to get all of them to vote against him? Maybe I should cut them some slack though. Apparently many Republicans “fear for their lives” because of texts & emails that they’ve received threatening to kill them & their families if they vote for impeachment. This is what US politics has come to.

As VOX said:

The Capitol Hill attack was, in large part, a success.

The violent seizure of the Capitol demonstrated to legislators that crossing Donald Trump puts them in the literal crosshairs. This was explicitly part of the point for some…

Convincing Congress to install Trump for another presidential term was always an unattainable goal. But influencing legislators to vote differently in the future, in ways more congenial to the Trumpist movement, was not…

…Far-right demonstrators in both DC and state capitals are using both threats and actual violence to coerce members of their own broad political faction, the Republican Party, to toe their line. In a country where firearms are omnipresent and easily attainable by legal means, legislators have good reason to take such threats seriously.

Speaking of dysfunctional democracies, the Italian government was plunged into crisis after three ministers from the ruling coalition resigned in protest against the government’s economic response to the coronavirus pandemic. The departures put the future of PM Giuseppe Conte’s coalition in doubt. Italy being the third-largest economy in the Eurozone, this could in theory hurt sentiment toward the euro, although I suspect that investors are so used to the Italian government collapsing that it won’t have much impact.

Meanwhile, elsewhere in Europe, the German paper Bild reported that Logistics giant Schenker pulls the Brexit emergency brake “According to BILD information, Schenker AG (76,000 employees, present in 130 countries) will no longer accept goods for transport to the United Kingdom.” The problem is paperwork – “only around 10% of the shipments commissioned from DB Schenker have complete and correct papers,” they said. “Just a few days ago, DB Schenker announced under the heading “Brexit? No problem! ”There is optimism that the movement of goods can continue to flow freely if the customs declaration goes smoothly.” However the CEO of DHL, another German logistics company, yesterday said transit times between Germany & the UK are returning to normal. “I would expect regular shippers to be back to where they were and understanding the paperwork in a matter of days.” I expect that Brexit teething problems will continue to weigh on GBP and to affect Bank of England thinking, which may also be to the detriment of the currency.

Market recap

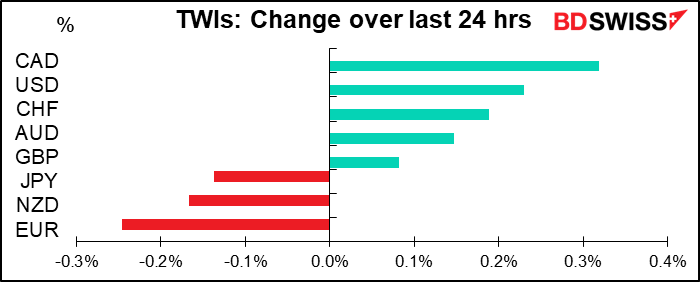

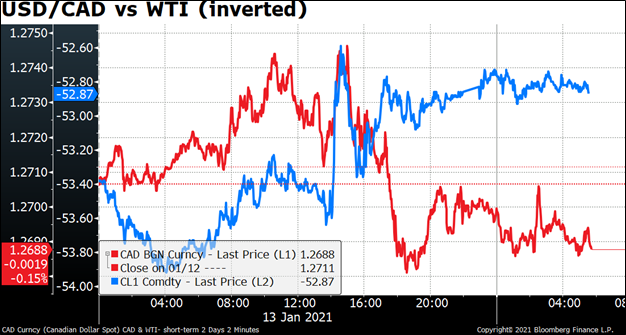

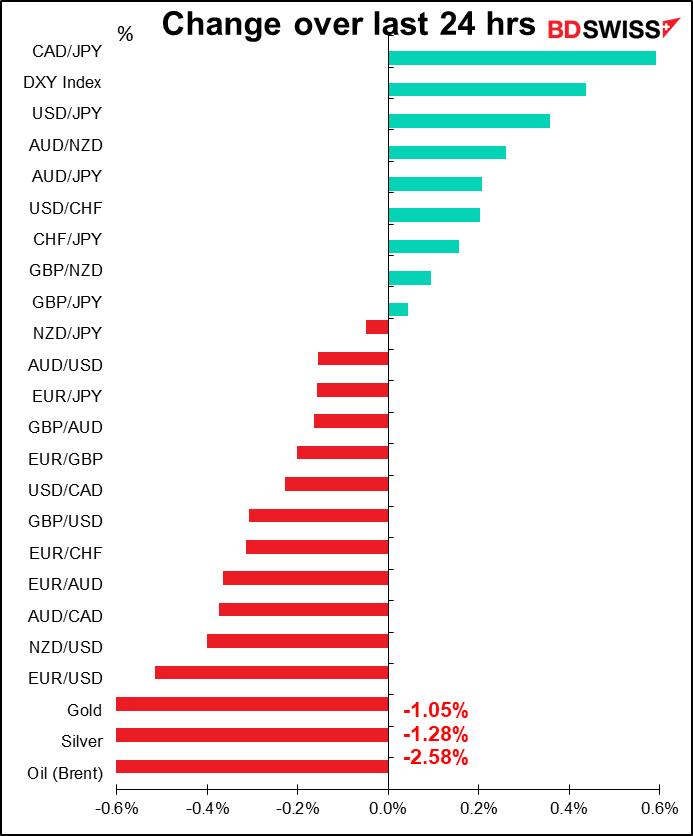

CAD was the biggest winner overnight and once again I’m stumped to find a reason. There were no major Canadian economic indicators out on the day. Oil was actually lower on the day, so for once the usual reason doesn’t hold water.

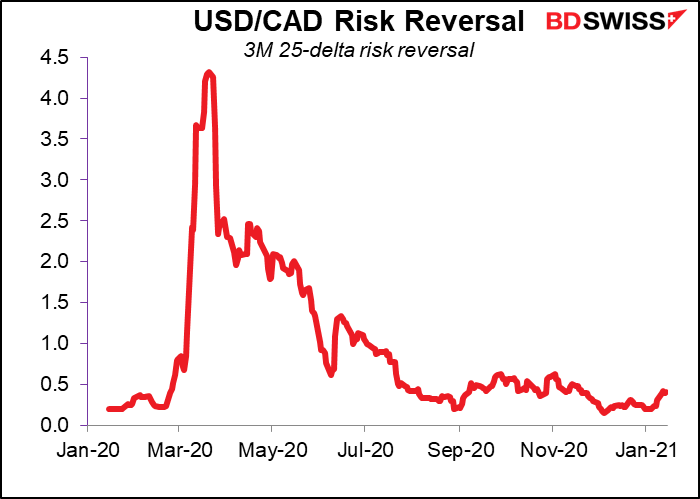

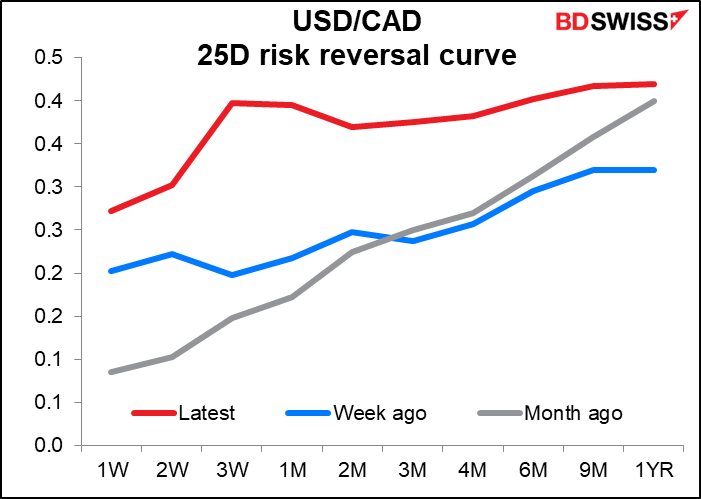

And while it was reported that there was increased demand for USD/CAD puts ahead of next week’s Bank of Canada meeting, that’s not what I see from the risk reversals, which have on the contrary been turning higher (i.e., more demand for calls than puts).

The move may simply have been technical as the drop below 1.2700 brought in momentum sellers. EUR/CAD also fell. Or it could be related to Tuesday’s cabinet shuffle, when PM Trudeau moved around a few ministers after the Industry Minister resigned to leave politics. The shuffle leaves Trudeau in a better position to call & win an election later this year if he wants to.

It’s puzzling to me that the three-week USD/CAD risk reversals are so much higher than the rest of the term structure. That’s when the next Canadian employment data comes out. Perhaps people are hedging against a negative surprise then? Note though that the one-week RR is the lowest even though that covers next week’s Bank of Canada meeting on Wednesday. That suggests people are not expecting any further loosening moves next week.

In any event, I’ve been expecting CAD strength as commodity currencies should benefit from increased US fiscal stimulus, and none more than Canada, whose economy is linked closely to that of the US.

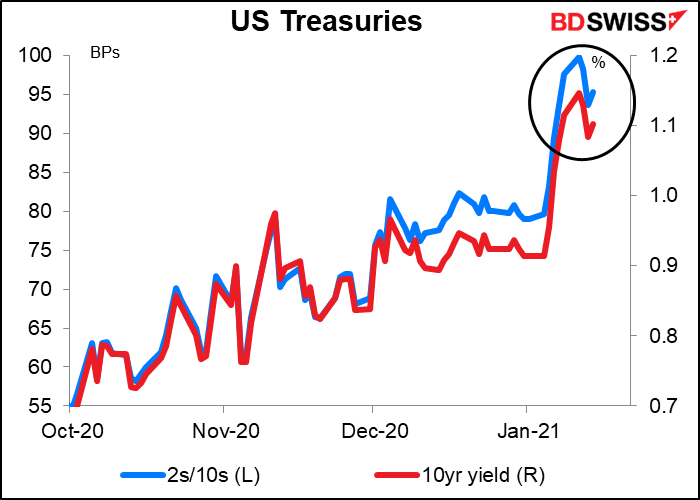

As for USD, once again the US Treasury market continues to rule the FX market. Initially US yields moved lower, as strong demand at the auction of 30-year bonds helped to push yields down across the curve (10-year yields falling 4.6 bps on the day). However the move reversed in late trading (10yr yields up 2.4 bps from the close) on a report from CNN that President-elect Biden will today unveil a plan for a $2tn stimulus package. “The Biden team is taking a “shoot for the moon” approach with the package,” the report said. Perhaps Treasury yields will shoot for the moon, too.

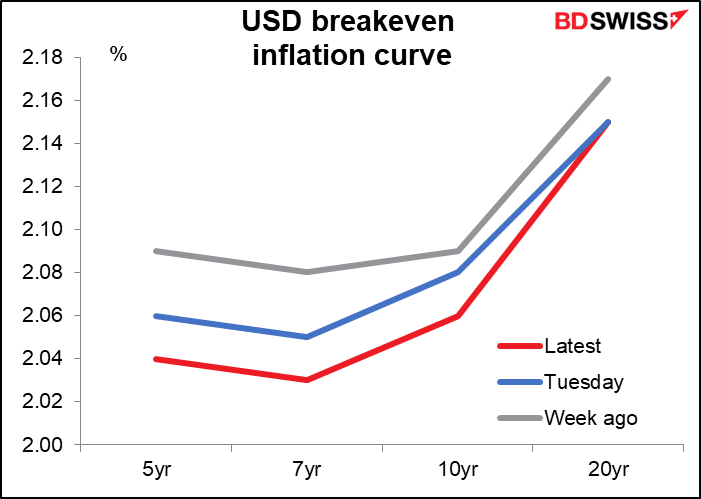

At the same time, US breakeven inflation rates fell for the third time in the last four days as more Fed speakers spoke out against the idea of tapering down their bond purchases any time soon. On the contrary, Fed Gov. Brainard said bond purchases were likely to continue at the current pace “for quite some time” and noted that they could even increase if necessary.

Fed Chair Clarida said the Fed wasn’t likely to raise rates “until we get 2% inflation for a year.” That’s not impossible, but it hasn’t happened very much in the last 20 years.

Today’s market

Nothing of major interest during the European day.

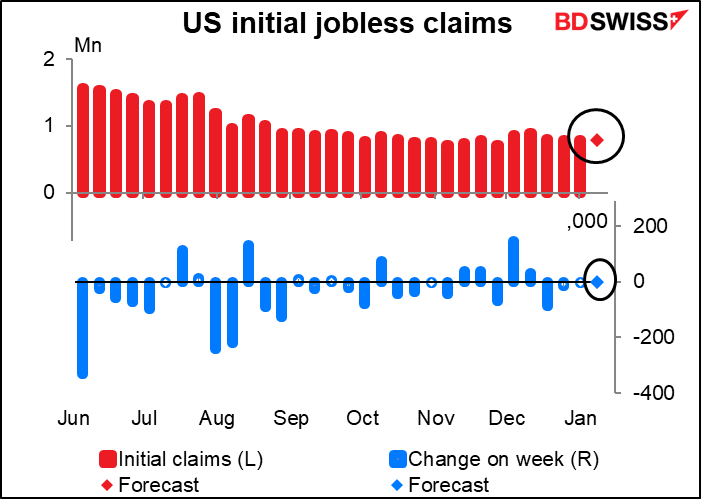

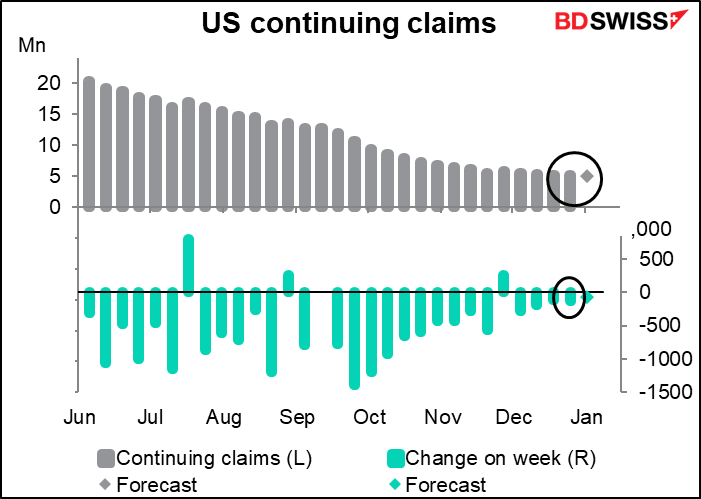

When the US day starts up, the dreaded weekly US jobless claims will set the tone. They’re expected to rise by 1.5k, which wouldn’t be much different from the -3k decline of the previous week. I’d say this would be effectively unchanged and therefore neither here nor there for the markets. However, it could have some psychological impact because although the numbers aren’t big either way, it’s still up this week vs down last week. That could be disappointing, given the perilous and parlous state of the labor market (see last Friday’s fall in the nonfarm payrolls).

(Actually, last week’s NFP wasn’t as bad as it looked. Sure the 123k fall in jobs was a shock, but that includes a fall of nearly 500k in leisure and hospitality jobs, which was undoubtedly related to the worsening pandemic. If we take out that sector, payrolls increased by nearly 360k, which is decent.)

Continuing claims are expected to be down 72k, less than the previous week’s -126k.

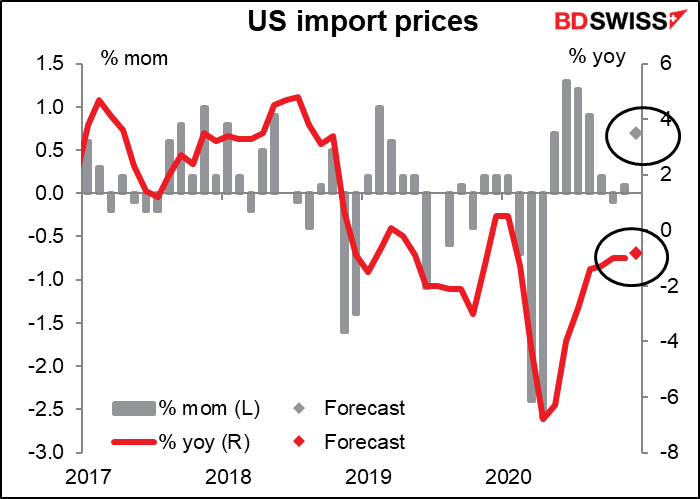

US import prices will be announced at the same time, but since no one is particularly worried about inflation at this time, I don’t think this is going to be particularly important. In fact if I had anything else to write about I probably would’ve skipped it, but I don’t, so here it is.

After that we can sit around waiting for Fed Chair Powell to speak. There’s a lot of interest in what he’s going to say, because recently a division has opened up among the Committee members on how long the economy will need to be on life support. The main issue is when the economy will have made “substantial further progress” toward the Fed’s goals of price stability and maximum employment and the Fed can therefore start reducing, or “tapering,” its monthly purchases of bonds –it’s currently committed to buying “at least” $80bn of Treasuries and $40bn of mortgage-backed securities every month. Some members of the rate-setting Federal Open Market Committee (FOMC) have said in the last week or so that they think the economy will be in good enough shape in the second half of the year that they can start tapering then. Others have said “not so fast…”

Which way does Powell lean? He tends to be cautious – my guess is he’ll come down on the “not so soon” side. That could result in a rally in Treasuries and a weaker dollar.

Powell will be chewing the fat with Markus Brunnermeier, Director of the Princeton University Bendheim Center for Finance. You can watch the event on their website.

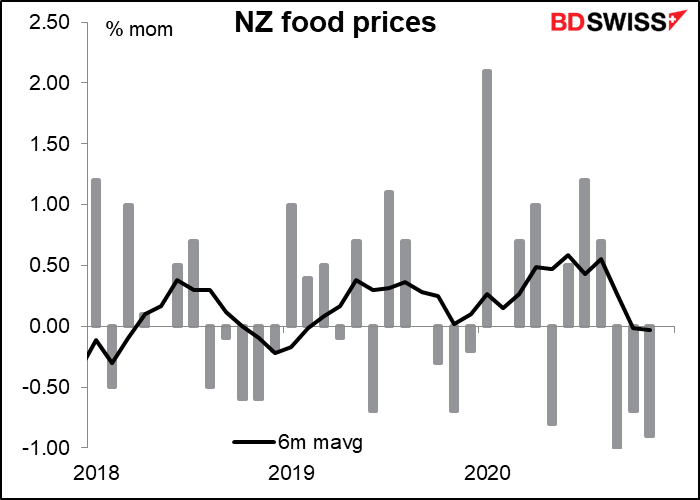

Overnight the New Zealand food prices are kind of like the US import price, I’m not sure it affects the market but it has a high Bloomberg relevance score so I include a graph anyway. No extra charge!

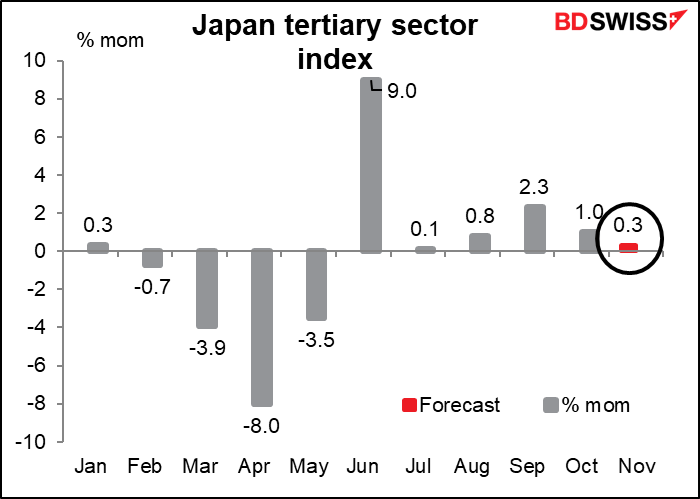

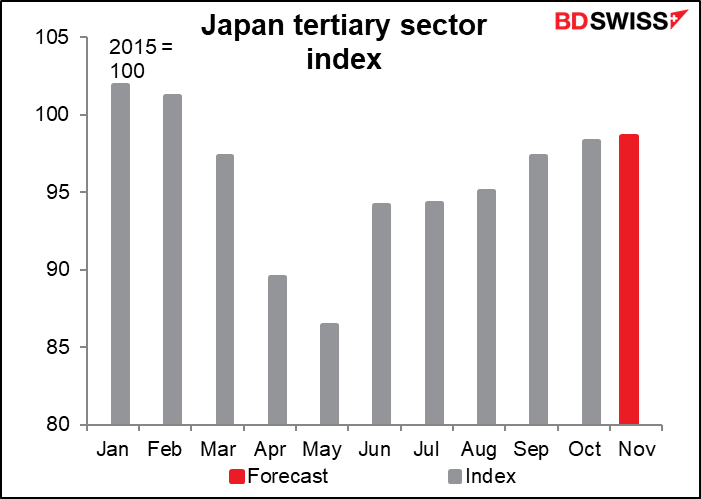

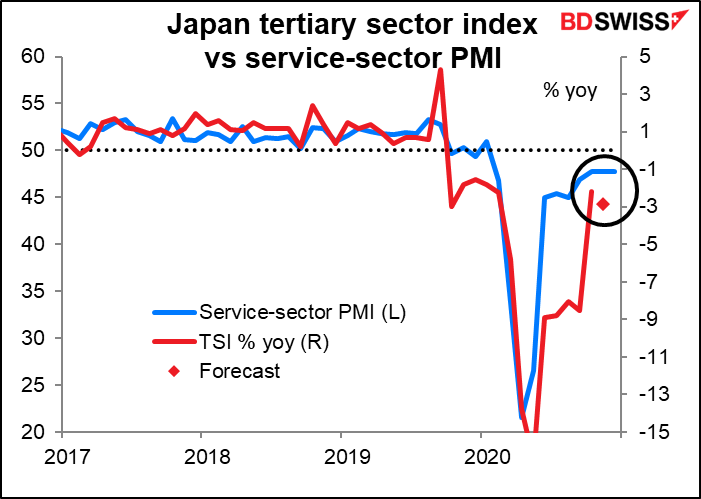

Japan’s tertiary sector index is expected to be up just slightly. The tertiary sector is the service sector, which is at the heart of the decline in activity nowadays, so this is a key indicator of activity.

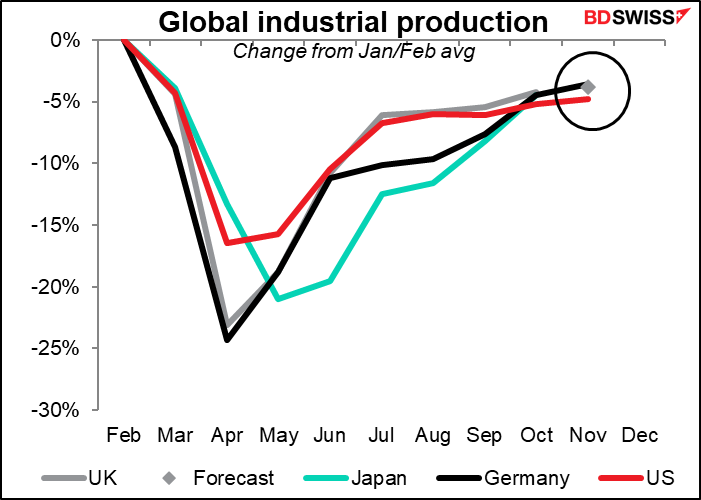

This would put it 2.9% below the average level of January & February.

This is a little worse than what would be expected from looking at the service-sector purchasing managers’ index (PMI), but then again the tertiary sector index has a higher rating than the PMI does, so perhaps it’s the PMI that’s wrong, not this index.

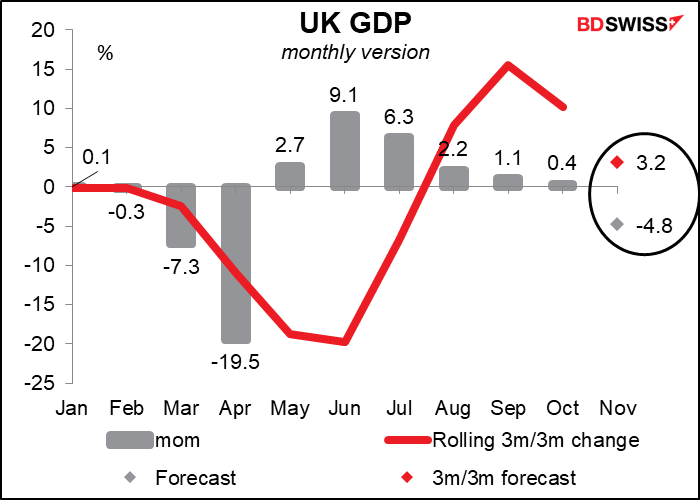

Anyway after all that excitement you should get to bed ASAP because soon you’ll have to get up for UK short-term indicator day, when the Office of National Statistics hits the market with monthly GDP, industrial & manufacturing production, and international trade all at once.

This is one time I don’t defer to the Bloomberg score; I think the GDP data is the most important. It’s expected to be brutal – plunging on a mom basis as England went into lockdown again from Nov. 5th. And December and January are likely to be even worse as the UK as a whole went into an even stricter lockdown.

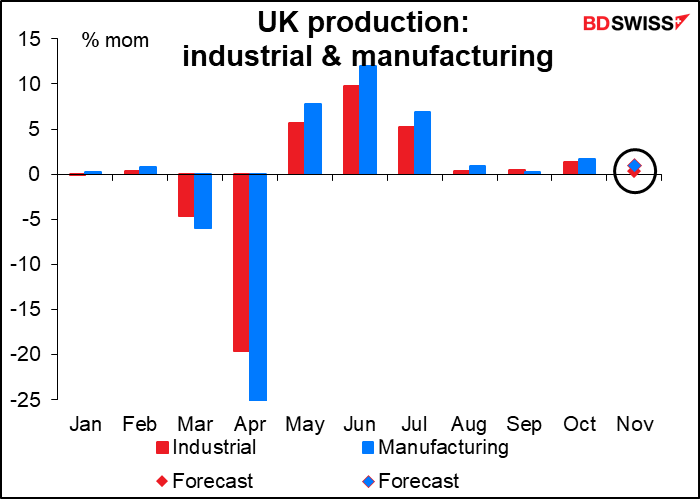

UK industrial and manufacturing production are expected to be up slightly during the month, however.

And in fact UK industrial production isn’t doing badly – it’s expected to be about where Germany and the US are, so pretty much in line with the global trend. Apparently it’s the service sector that’s lagging, as it is everywhere.

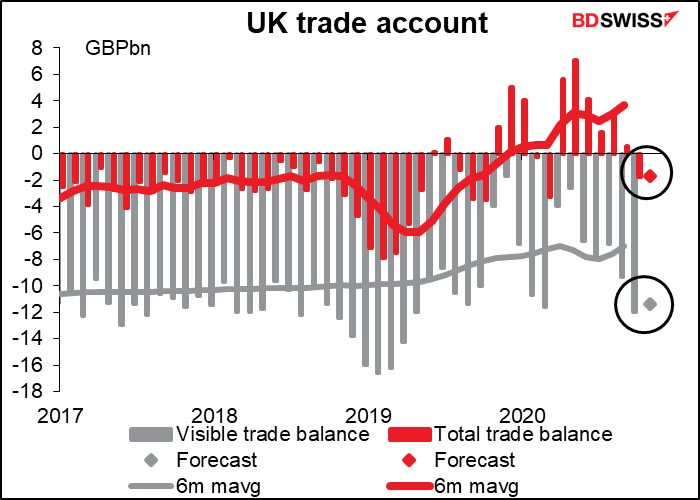

The visible trade deficit and overall trade deficit are expected to be little changed from the previous month, but that’s going to be totally ignored, because come January the country’s trade picture will change completely with Brexit. I can’t remember whether they call it a “dog’s breakfast” or a “dog’s dinner” in Britain, but either way the result of the 1,5000-page Brexit agreement seems to be the same: a mess. No one knows precisely what they should do and as a result, many people are choosing not to do anything, such as not buying things from abroad, not shipping things to Britain, not renting trucks to move goods to Britain, etc. The headline in The Grauniad read, Baffling Brexit rules threaten export chaos, Gove is warned – Business groups tell ministers to sort out bureaucratic mess caused by EU trade deal

Ministers must restart trade negotiations with Brussels immediately to sort out the “baffling” array of post-Brexit rules and regulations that now threaten much of the UK’s export trade to the EU, leading business groups have said.

Amid mounting anger among UK firms at cross-border friction they were told would not exist, British manufacturing and trade organisations met Cabinet Office minister Michael Gove in an emergency session on Thursday to discuss problems resulting from the deal…Gove admitted on Friday that there would be “significant additional disruption” at UK borders as a result of Brexit customs changes in the coming weeks.

Thus like so many indicators nowadays, we can’t project a future trend from what we see today, and therefore the significance of today’s indicator is greatly diminished.

Overall though I think the UK news is likely to be negative for the pound. A big drop in GDP with even worse to come, industrial production running out of steam, and exports likely to fall off a cliff… a pretty gloomy picture for sterling, IMHO.

Source: BDSwiss