Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

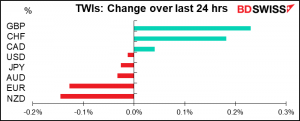

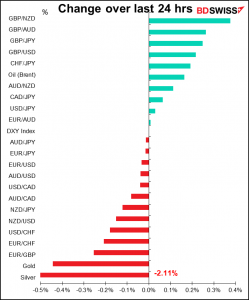

A day of such small changes, it’s barely worth discussing them. This looks like just “Brownian motion” in the FX market – there will always be changes in rates due to order flow: exporters repatriating money, importers buying things, portfolio managers’ purchases, etc. Same with the stock market, where the S&P 500 was virtually unchanged (-0.03%) and NASDAQ not much more (-0.25%). In fact some 60% of the S&P 500 stocks were higher, but some of the big names in the tech industry, such as Tesla (-5.3%) were lower as more cyclical industries such as energy and semiconductors came into fashion.

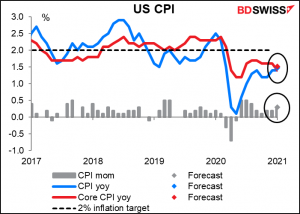

Perhaps it’s a “dog that didn’t bark” day* – the most interesting thing was something that didn’t happen. The dollar was little changed overall despite a weaker-than-expected core US consumer price index (unchanged mom vs 0.2% mom expected, and with the previous month’s figure revised down). The year-on-year rate fell to 1.4%, the slowest pace of increase since last June.

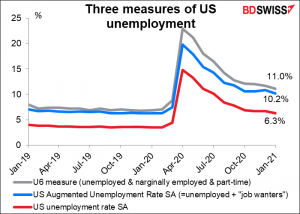

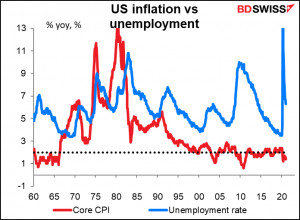

There was also a lot of dovish talk by Fed Chair Powell in his speech to the Economic Club of New York. He said the labor market is “still very far” from strong, it’s important for policy to be “patiently accommodative,” and he put the real unemployment rate in January closer to 10% rather than the headline figure of 6.3%. He also noted that the pandemic continues to hit younger workers, women, low-income earners and minorities particularly hard, a new theme of the Fed’s.

Powell also weighed in on the debate that’s been going on recently in policy circles (e.g. from former US Treasury Secretary Summers) about whether too large a fiscal package could cause the US economy to overheat. On the contrary, he said it could take “many years” to overcome the scars of long-term unemployment and that the overall size of fiscal support should be left to the President and Congress. He also noted that there were few signs of inflation last year at this time even with the unemployment rate at 3.5%, the lowest it had been in some 50 years.

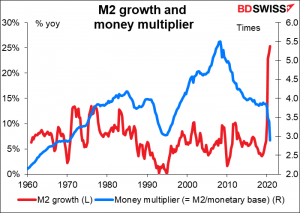

My explanation for why there hasn’t been any increase in inflation – yet — is because although the government has pumped up the money supply dramatically through its quantitative easing, the money multiplier – the amount of money that that new money creates — has plunged.

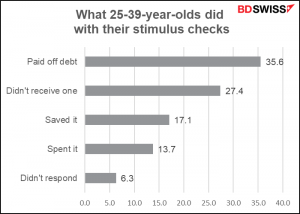

That may be because of the limited opportunities for spending nowadays, combined with how people spend a windfall. If we look at 25-39-year-old people, who should have an extremely high propensity to consume (i.e., they are likely to spend every penny that they get), only about 14% of them said they spent their stimulus checks – 53% either saved it or used it to pay down debt, which is deflationary.

Of course this behavior may change when things get back to normal, but when will that be?

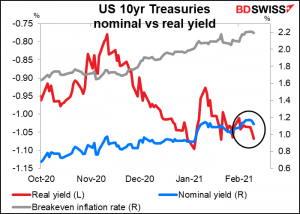

The reports left the dollar unchanged but not the Treasury market. Ten-year yields fell -3.4bps to 1.12%, while market-based inflation expectations fell too — 10yr US breakevens dropped -1.6bps from the six-year high reached on Tuesday. But with nominal yields falling more than breakevens, the real yield on Treasuries declined.

The question I have is, why didn’t the weaker outlook for inflation and rates push the dollar down further? I can only surmise that the FX market hasn’t internalized this outlook yet. Perhaps when it does, the dollar will start to weaken further.

*a reference to the Sherlock Holmes story Silver Blaze:

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

Sic Transit Gloria Mundi – from today’s FT:

People interested in this subject might also be interested in The Digby Jones index: the index of jobs lost through Brexit that Lord Digby Jones said the UK wouldn’t lose. (Apparently in 2016 the esteemed Lord reassured people that a vote to leave the EU would not result in a single job in Britain being lost, even though of course he had no way of knowing whether this was true.)

Today’s market

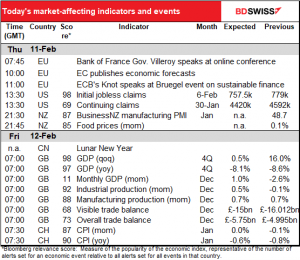

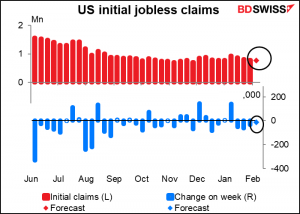

People are still being cautious about the initial jobless claims. Last week they forecast claims would be down 17k; in the event, they fell almost double that at 33k. This week they’re again forecasting only a small drop of 14k.

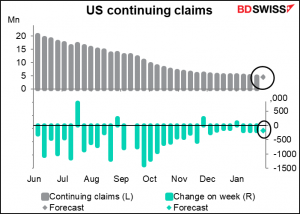

Continuing claims are expected to fall a more substantial 172k, although this would be a smaller decline than in the previous three weeks and so show a deteriorating labor market, or at least a slowing in the improvement.

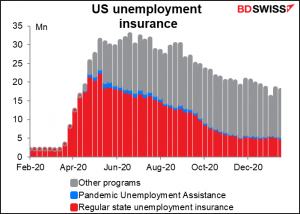

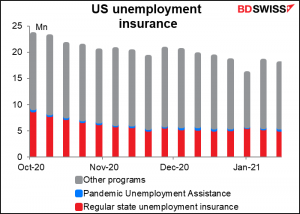

The total number of people receiving unemployment benefits has come down a lot from the early days, but it’s still unusually high – and has been rising again recently.

And that’s about it for today’s indicators!

Then we wait for dawn to break over the St. Bride’s Church in Fleet Street and for the bells to peal out UK short-term indicator day.

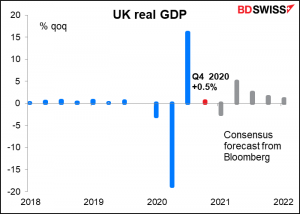

This month the highlight is Q4 GDP. The market expects to be up 0.5%, about the same as the Bank of England, which forecast 0.6% in its Monetary Policy Report. Note though that expectations are that GDP will decline in the current quarter.

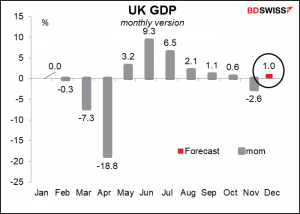

The monthly GDP for December is expected to be up 1.0%.

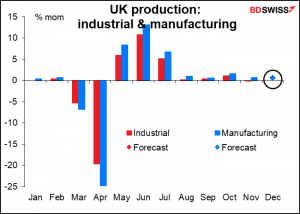

UK industrial and manufacturing production are expected to be up decently.

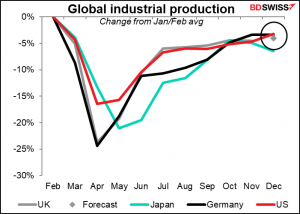

On current forecasts, this will leave them both 3.9% below pre-pandemic levels. That’s about par for the course though; that’s where the US & Germany are, too.

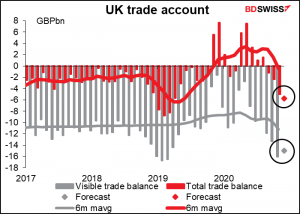

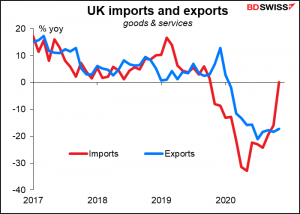

The UK trade balance is expected to worsen, with both the visible and overall trade deficits widening noticeably. But don’t worry, that’s December. In January the new Brexit rules took effect and the bottom will really drop out of UK exports!

As of November, exports were still down 17% yoy, while imports were about back to year-earlier levels. Next month’s figures should be really interesting. Cockles and mussels alive alive oh! (Or dead on the non-compliant pallet, more likely.)

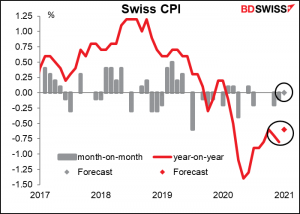

We also get Swiss inflation, but no one is under any illusion that that will actually move CHF, which is much more affected by global risk tolerance than by Swiss economic fundamentals.

Source: BDSwiss