Rates as of 05:00 GMT

Market Recap

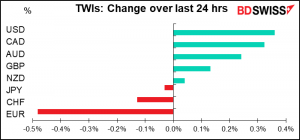

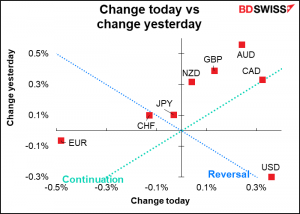

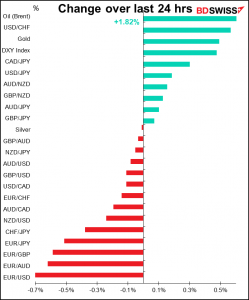

It was a good day for USD and a bad day for EUR (or a good day I suppose, if you’re on the European Central Bank’s Governing Council). EUR/USD broke through what was expected to be support at 1.14.

There was no obvious catalyst for the move down in EUR/USD, which came several hours after ECB President Lagarde, speaking in the EU Parliament, reiterated that a rate hike next year is “very unlikely,” contrary to what the market thinks, and also several hours after the Empire State manufacturing index blew past estimates (30.9 vs estimates of 22.0, previous 19.8). Rather the pair just disintigrated during the day, first gradually and then rapidly.

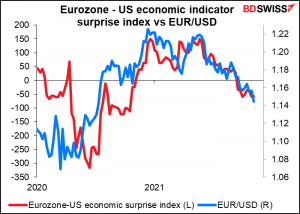

Behind the erosion in confidence in EUR is the disappointing performance of the Eurozone economy relative to that of the US, which has been surprising on the upside more than the Eurozone has been.

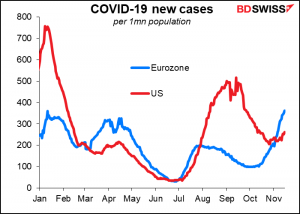

Also the virus is surging again in Europe, which is causing some countries to contemplate lockdown again. In contrast, it seems to have stabilized for the time being in the US.

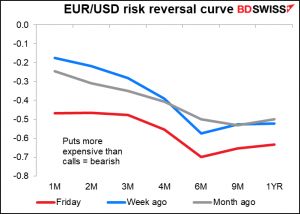

As a result, the market is getting increasingly nervous about the euro – as am I.

Oil prices fell on further indications that US President Biden (how I love writing that!) might release oil from the Strategic Petroleum Reserve (SPR), the US government’s 650mn-barrel oil tank. Apparently the government is thinking of releasing 18mn-30mn barrels. Since the US uses some 17.5mn barrels a day (including exports), this would be just one or two days’ worth of oil, not really a game-changer by any means, especially on a global scale.

CAD managed to gain despite the fall in oil prices, probably because of an article that Bank of Canada Gov. Macklem wrote for the Financial Times in which he said, “For the policy interest rate, our forward guidance has been clear that we will not raise interest rates until economic slack is absorbed. We are not there yet, but we are getting closer.” This is a good example of how the market can move when an official says something that they’ve said before and everyone is well aware of anyway.

Elsewhere, US equities were little changed as once again the focus was on the bond market. US breakeven inflation rates moved up further. Bond yields moved up too, but not as much, meaning that real yields fell (which may be what’s supporting the stock market in the face of higher expected inflation.) Yields also moved higher in Europe. Bonds were hit by a Washington Post article from former Treasury Secretary Larry Summers, On inflation, it’s past time for team ‘transitory’ to stand down, in which he argued that an overheating US economy and high inflation need to be “acknowledged and addressed,” i.e. the Fed should hike rates. That was followed by testimony from the ever-cautious Bank of England Gov. Bailey, who said that he was “very uneasy about the inflation situation” (we already knew that, Andy. So what are you going to do about it, and when?)

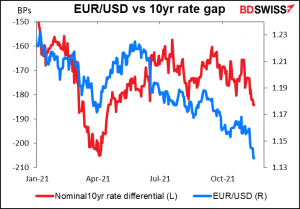

The widening rate gap between the US and Europe may be another reason why EUR/USD is falling.

Today’s market

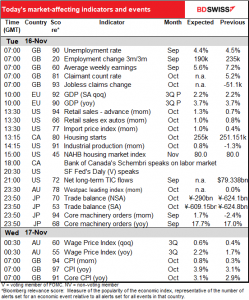

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

We already discussed the UK employment data yesterday.

After that it’s the second estimate of EU 3Q GDP, which no one cares about because it’s seldom revised and even if it is, the revisions are usually minor.

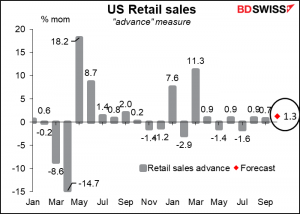

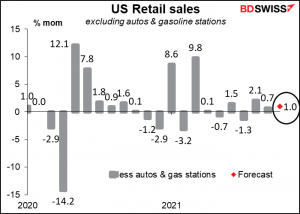

So we then wait for what’s probably the big US indicator of the week, US retail sales. They’re expected to be up significantly as auto sales did well during the month.

Even without autos though it’s expected to be up by more than the previous month. Remember, this is the data for October – the first month that the special pandemic unemployment benefits were finished. The fact that retail sales can rise even after these special payments stop is an encouraging sign of resilience in the US economy. USD

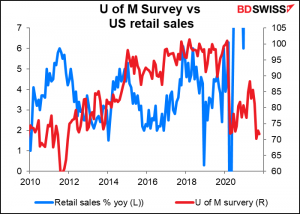

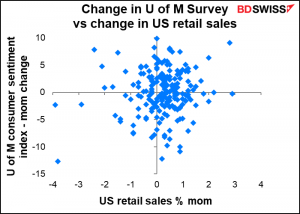

Although there was a lot of concern about Friday’s U of Michigan consumer sentiment survey, I don’t see much of a connection between that indicator and the real world.

Changes in the U of M survey have no discernable connection to changes in retail sales. (I also tried to see if changes in sentiment affected sales a month later or two months later, with similar results.) I therefore don’t understand why people pay so much attention to this indicator.

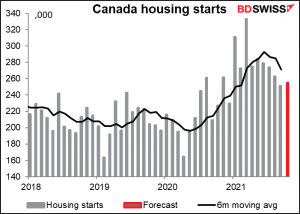

Canadian housing starts are expected to rise a bit following stronger permit issuance but it still won’t be enough to lift the six-month moving average.

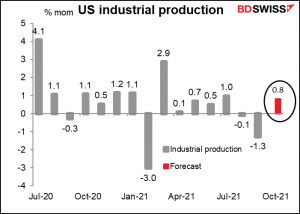

US industrial production is expected to rise after two months of decline. Together with healthy retail sales, this too indicates continued strength in the US economy, which would be positive for the dollar.

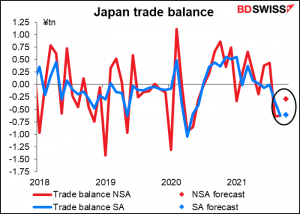

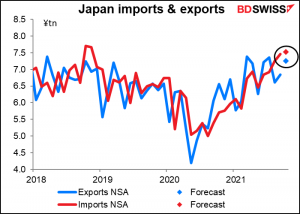

Overnight, Japan announces its trade balance. The country is no longer the export-driven economy that it used to be. The trade account is expected to be in deficit for the third consecutive month on an NSA basis and fifth consecutive month on an SA basis.

Both imports and exports are expected to rise, but imports are rising at a much faster pace than exports.

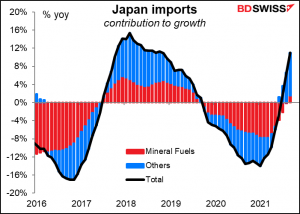

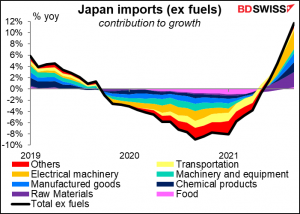

You might assume that it’s because of rising energy costs, but you’d be wrong, so far at least.

The rising prices of other raw materials seem to be the main culprit, along with electrical machinery = semiconductors?

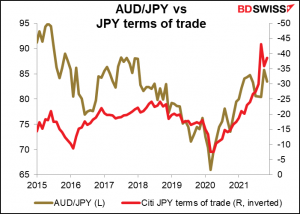

Looking at the correlation and beta between various cross-currency pairs and Japan’s terms of trade, AUD/JPY seems like the pair most likely to benefit as Japan’s terms of trade move against it.

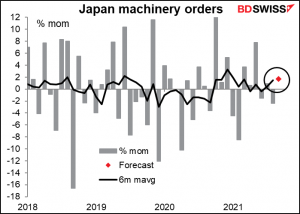

OK that’s enough about Japan, although I do have to include a graph of the machinery orders, which many people who follow Japan care deeply about but not me.

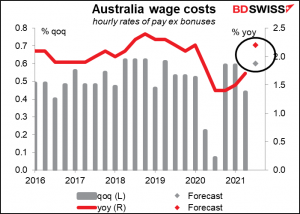

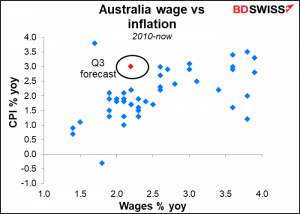

Australia’s wage price index will be important for the Reserve Bank of Australia (RBA), one of the three central banks that I know of that have a “dual mandate” to maximize employment as well as control inflation (along with the US and New Zealand). Their forward guidance reads,

The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time.

Accordingly, wage growth is now one of the major indicators for Australia. It’s expected to rise, which is good news for AUD.

Although looking at the historical relationship between wages growth and inflation, 2.2% is probably not enough to generate the kind of inflation that would get the RBA to move. They would probably want to see it above 2.5% yoy for some time before they’d be convinced. So it’s good but not great.

Then Wednesday morning at 7 o’clock as the day begins, Britain announces its consumer price index (CPI). This is of course more important than the employment data for gauging inflation. It’s expected to soar. This should be no surprise however. The Bank of England’s November Monetary Policy Report said:

CPI inflation is expected to be close to 4% in October and then around 4½% in November, remaining around that level until the end of Q1. Reflecting further rises in wholesale gas prices since August, which are expected to feed into retail gas and electricity prices in April, CPI inflation is projected to rise to around 5% in April 2022.

Source: BDSwiss