Rates as of 05:30 GMT

Market Recap

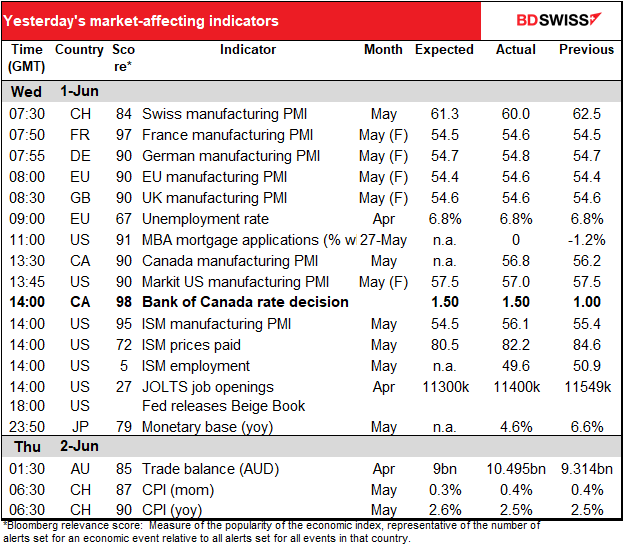

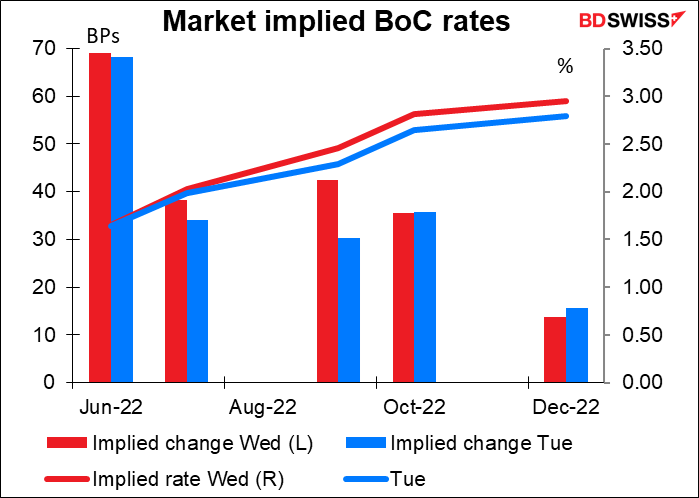

The Bank of Canada (BoC) hiked 50 bps again, as was widely – almost unanimously – expected (only one person out of 30 surveyed by Bloomberg said 25 bps and that was a guy working for a Thai bank in Bangkok so maybe not the best insights into the Canadian economy.) Moreover, they ratcheted up their forward guidance, hinting at further rate hikes to come.

Their forward guidance after the April meeting read:

With the economy moving into excess demand and inflation persisting well above target, the Governing Council judges that interest rates will need to rise further…The timing and pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target.

This time though they changed it to read:

With the economy in excess demand, and inflation persisting well above target and expected to move higher in the near term, the Governing Council continues to judge that interest rates will need to rise further… The pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation, and the Governing Council is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target. (emphasis added)

Note too what was left out: no longer is the economy seen to be “moving into excess demand.” On the contrary, they specifically said earlier that “Canadian economic activity is strong and the economy is clearly operating in excess demand.”

The role of the central bank then is to bring down demand by hiking interest rates. As a result the market increased its expectations for rate hikes at the next two meetings and added 15 bps or about half a rate hike to the expected tightening this year.

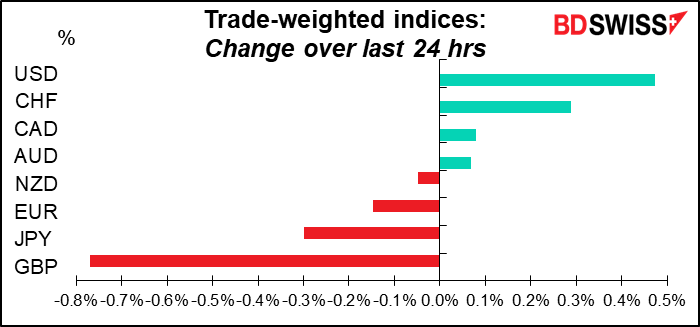

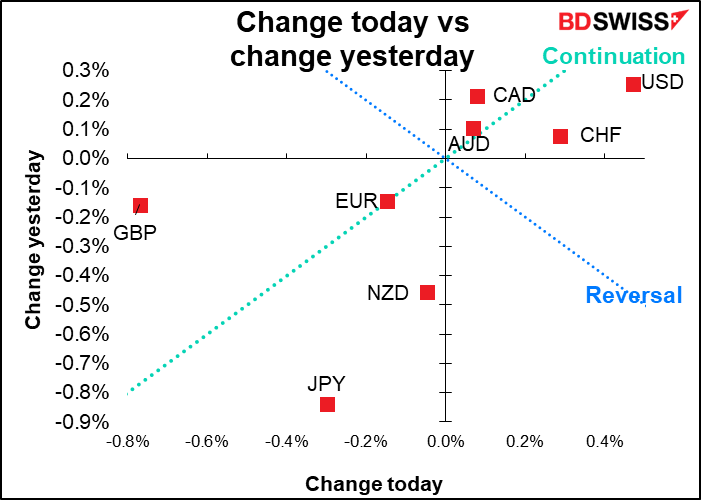

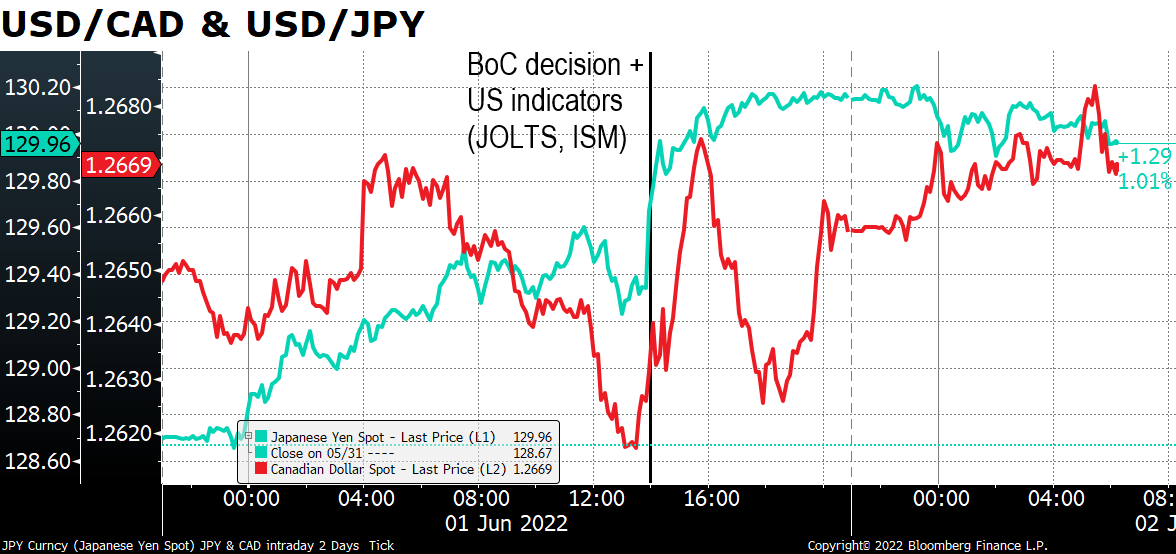

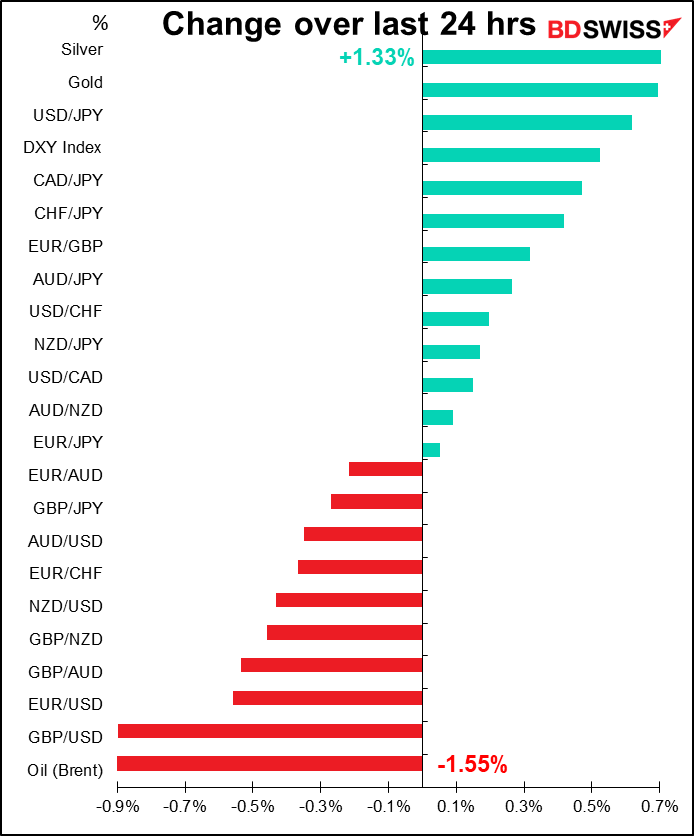

Nonetheless, CAD failed to make much headway. On the contrary it fell slightly against the much stronger US dollar. CAD appreciated ahead of the announcement but then started to come off a few minutes before. Several US indicators came out at the same time as the BoC announcement, including a better-than-expected manufacturing purchasing managers’ index (PMI) from the Institute of Supply Management (ISM) and job openings in the Job Openings and Labor Turnover Survey (JOLTS). That sent the dollar up overall, as you can see from the reaction with USD/JPY in the chart.

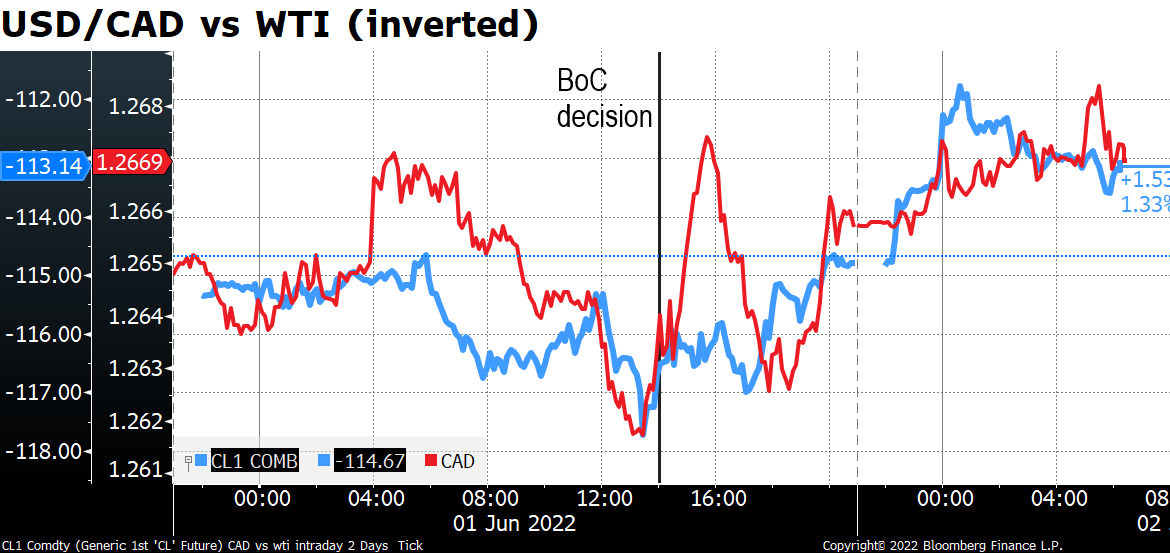

Amazingly, CAD may well have been swept along by lower oil prices. It’s surprising to think that the effect of volatile oil prices would be more important for the market than longer-lasting monetary policy, but this graph does suggest that by around 4 ½ hours after the Bank of Canada meeting, the oil price became the dominant factor pushing USD/CAD around.

Oil fell on a Financial Times story that read…well, you can read the headline yourself.

“Saudi Arabia is aware of the risks and that it is not in their interests to lose control of oil prices,” said one person briefed on the kingdom’s thinking…Saudi Arabia’s view is that while the oil market is undoubtedly tight, which has buoyed the rise in prices, there are not yet genuine shortages…But that could change as the global economic recovery from Covid-19, including the reopening of major cities in China, boosts demand, while the likelihood of Russia’s oil output declining substantially has increased.

The story noted that not only has the EU banned seaborne cargoes of crude from Russia, but also agreed with the UK insurance market Lloyd’s of London to bar the insurance of ships carrying Russian oil later this year. That’s likely to severely curtail Moscow’s ability to redirect oil to other regions.

We’ll be waiting to hear what if any announcements come out of today’s OPEC meeting. I don’t expect any at this time. (See below).

GBP was the main loser of the day. I think that had more to do with the better-than-expected US indicators rather than any revelations about Britain. As you can see, the timing of the decline and the angle were pretty much the same as with EUR, suggesting that it was largely a dollar move rather than a EUR or GBP move. Probably there was more closing out of positions in GBP thanks to the long holiday to celebrate the Queen’s Jubilee, which would account for the steeper decline.

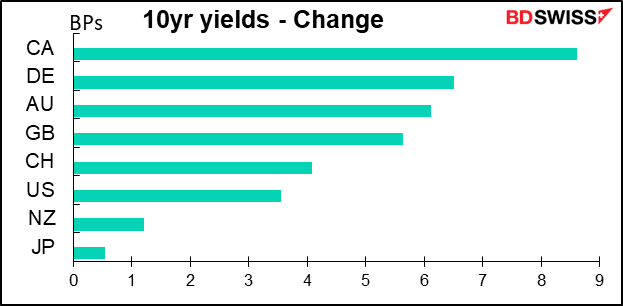

The better-than-expected US data sent bond yields higher, with Canada leading the way thanks to the Bank of Canada decision.

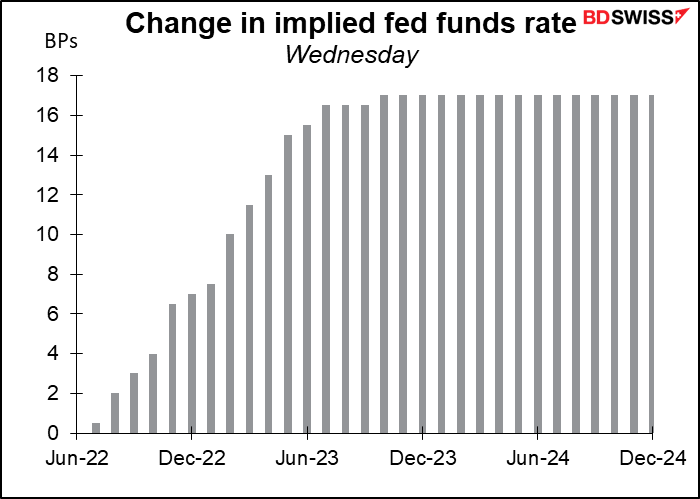

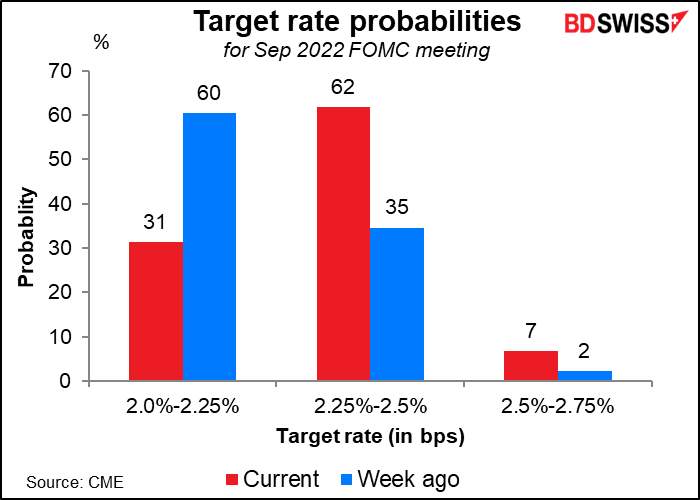

The data also sent US rate expectations higher.

The odds of a 50 bps hike at the September meeting hit 62%, while the market’s estimate for the peak rate that fed funds would reach moved back above 3.1%. Noted hawk St. Louis Fed President Bullard and noted dove SF Fed President Daly, typically at opposite ends of the policy spectrum, both re-emphasized the need to tighten policy expeditiously to get at least to a neutral rate of interest in light of high inflation. Expectations of faster & higher Fed tightening are likely to support the dollar further.

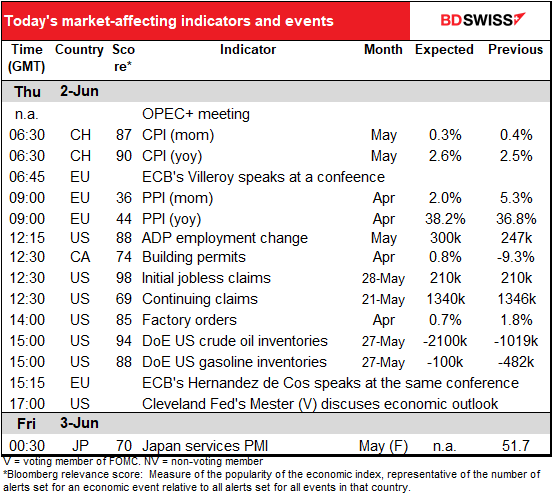

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

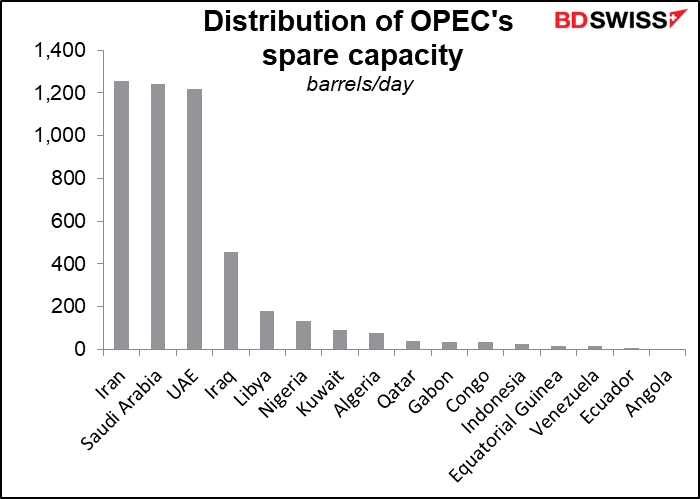

There’s an OPEC meeting today. For those who might not be familiar with it, OPEC is a loose coalition of the 13 members of the Organization of the Petroleum Exporting Countries (OPEC) and 10 other countries that are oil exporters but not members, such as Russia, Kazakhstan, and Mexico. OPEC accounts for around one-third of the world’s oil supply; the other members of OPEC bring it to slightly below 50%.

Before Tuesday, all the press reports agreed that the group is simply going to continue with its existing plan to increase output by 430k barrels a day (b/d). That’s actually a fiction because they don’t have the spare capacity to do so and will be lucky to increase production by half that amount. (The group’s rules say that all the countries have to stick to their quotas. If one country can’t pump all the oil it’s allowed to under its quota, other countries can’t pump more than their quota to take up the slack.) Only four OPEC countries have any significant spare capacity at all, and of those four, Iran can’t sell all the oil it can produce anyway.

However, Tuesday the Wall Street Journal set the cat among the pigeons when it reported (as I said in yesterday’s comment) that some OPEC members are exploring the idea of exempting Russia from the OPEC quota system because sanctions undercut Moscow’s ability to pump more. If Russia were outside the agreement, then OPEC could reallocate the quotas or redo the entire agreement, paving the way for Saudi Arabia and other countries with spare capacity to pump more.

The big question then whether this issue will come up at today’s meeting or whether it will be discussed discreetly among ministers first before making a formal agreement at next month’s meeting or some other time. That, and not the change in the quotas (which are not being filled anyway) will be the main point for the markets from this meeting.

Today’s indicators

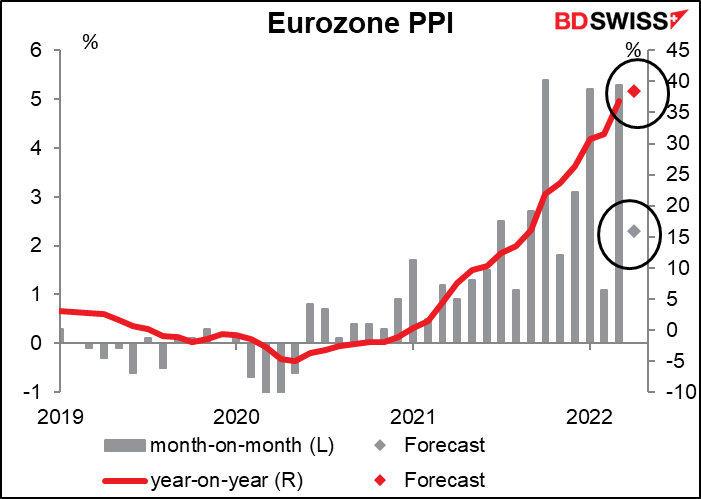

I don’t usually cover the Eurozone producer price index (PPI) as it doesn’t have a high enough Bloomberg relevance score to make the cut, but inflation is the key concern nowadays so this indicator is suddenly thrust into the spotlight. Producer prices are expected to be up an astounding 38.4% yoy, although the mom rate falling back to “only” 2.3% might be considered somewhat of a victory. Nonetheless this is not going to calm down anyone on the ECB’s Governing Council. EUR

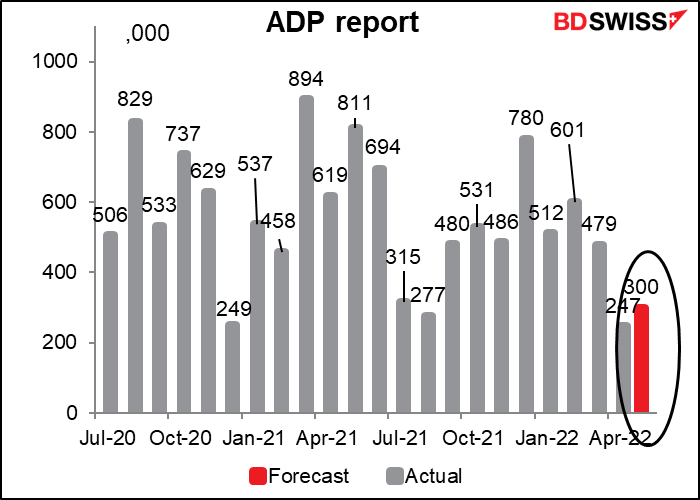

The main point of interest today for some bizarre reason is the ADP employment report. Automated Data Processing Inc. (ADP) is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole. It’s therefore watched closely to get an idea of what Friday’s US nonfarm payrolls (NFP) figure might be.

One point to note: the ADP adjusts its figures to match the final estimate of the NFP’s reading on private payrolls. It is therefore two steps removed from the headline figure that everyone focuses on, which is the initial figure for total payrolls, including government workers. So while it’s one of the few guides to the NFP that we have, it’s not perfect by any means – in fact, neither is the NFP figure itself, since it’s always revised.

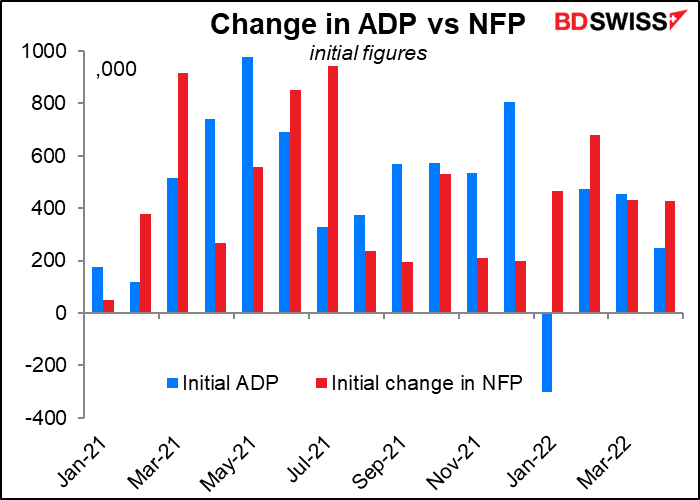

In fact, the ADP report is a totally unreliable guide to the NFP, but that doesn’t stop people from treating it as if it’s something worth watching. As you can see from this graph, the two can and do diverge substantially, and with no good pattern. The best example was in January, when the initial ADP report was for -301k and the initial NFP was 467k (they were later revised to 512k and 504k, respectively, so quite close after revision.)

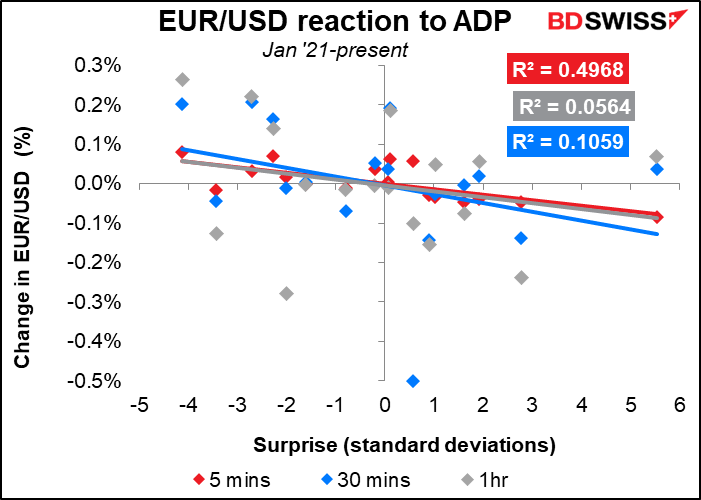

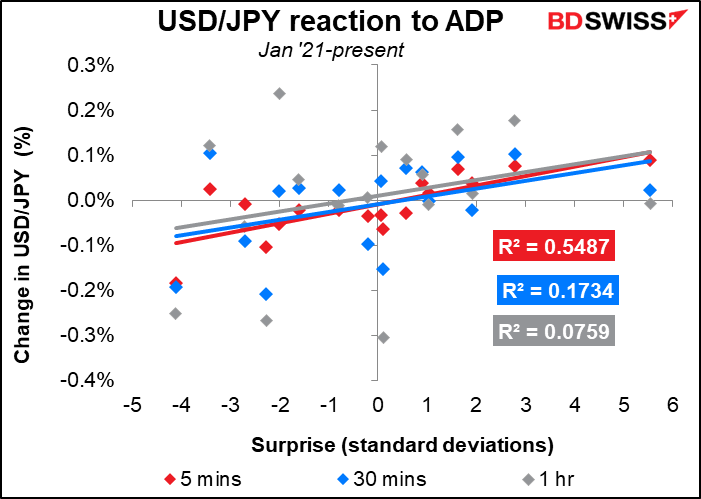

The ADP report does have a strong and immediate impact on currencies, although the impact seems to fade rather quickly.

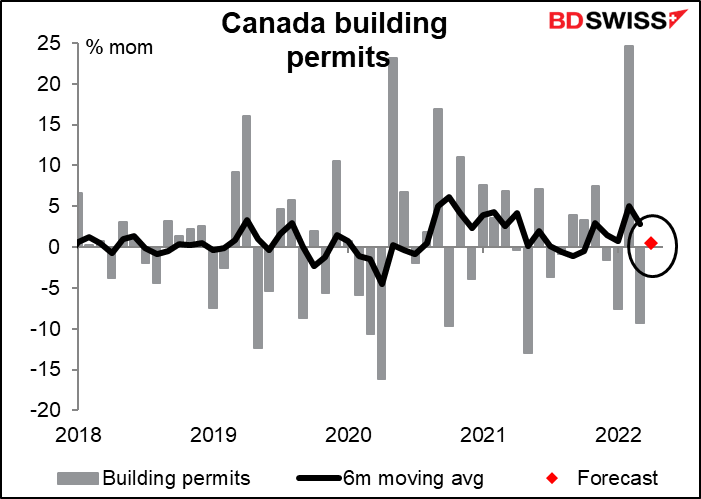

Canadian building permits are expected to be almost flat month-on-month. This would agree with what the Bank of Canada said after its April meeting, that “Housing market activity, which has been exceptionally high, is expected to moderate.”

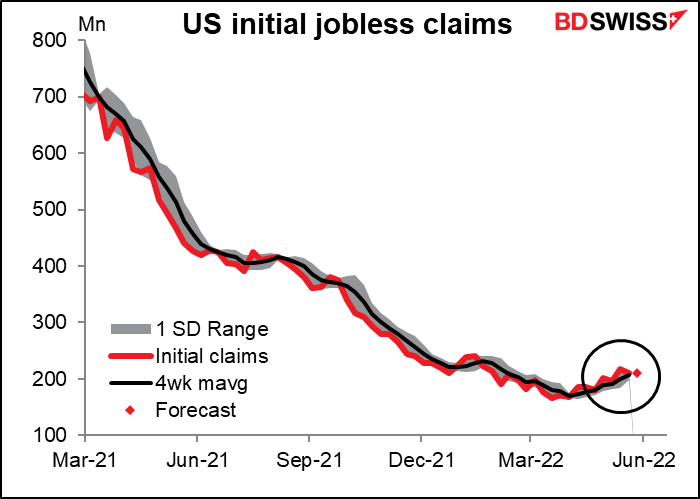

Initial jobless claims are expected to be unchanged. They’ve been trending upward recently so this would be a welcome change.

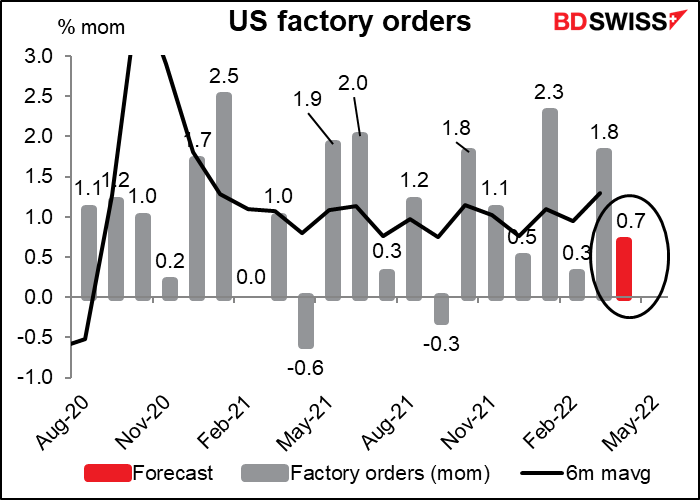

US factory orders have a fairly high Bloomberg relevance score, but they’re pretty predictable from durable goods orders – there’s a 92% correlation between the two series. So I don’t pay much attention to them, since durable goods come out earlier.

Source: BDSwiss