Rates as of 05:00 GMT

Market Recap

The first day of November…last January I posted my “New Year’s Resolutions” on my wall facing my desk to remind me of them. The bad news: it’s now pretty much a mathematical impossibility for me to meet them. The good news: I won’t have to write another set next January.

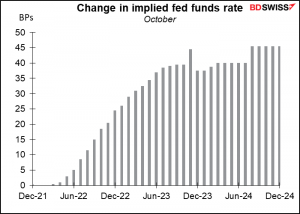

A lot has been written about the inconsistencies of financial markets nowadays: how Wall Street can be doing so well while Main Street suffers, etc. October as a whole and last week in particular were both perfect examples of these inconsistencies. During October, the fed funds market priced in one more rate hike in 2022 and another in 2023. This was not because of improved economic fundamentals but rather because of higher inflationary expectations. Yet October was the best month so far this year for stocks (S&P 500 5.7%, NASDAQ 6.4%). Whatever happened to the stock market adage “follow the fed”?

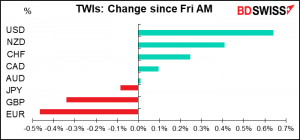

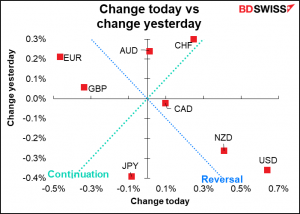

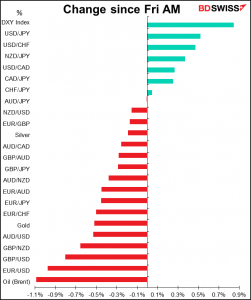

The dollar was the big winner Friday and the euro the big loser. The euro has now given up all the gains it made after the ECB meeting, which took it from 1.1594 (approximately) to a high of 1.1692. This morning it’s 1.1559.

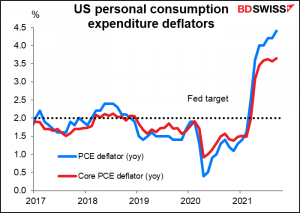

The reason as usual is hard to discern. The inflation data in the US Friday was largely as expected, with the personal consumption expenditure (PCE) deflator, the Fed’s preferred inflation gauge, rising to 4.4% yoy from 4.3% and the core PCE deflator, which the Fed prefers even more, unchanged at 3.6% yoy vs expectations of a small rise to 3.7%.

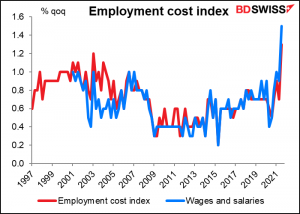

Perhaps it was because of the employment cost index, which rose at a record 1.3% qoq (data back to Q4 1996), much higher than the expected 0.9% qoq, with wages and salaries rising an even faster 1.5% qoq. The high rates of increase confirm the tight US labor market regardless of what the payroll figures show and make it more likely that the Fed will declare the US has reached “maximum employment” and start to raise interest rates.

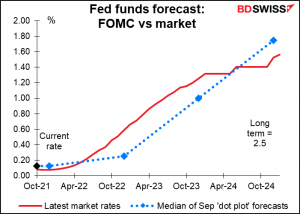

That may be one reason why investment bank Goldman Sachs Friday pulled forward its forecast for the Fed’s first rate hike by one full year to July 2022, shortly after tapering is scheduled to conclude. They expect a second hike in November 2022 and two hikes per year after that. Even so, GS is still behind the market.

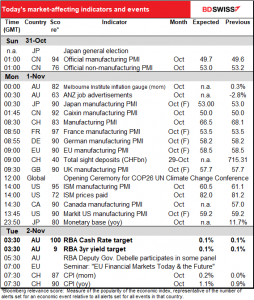

JPY was falling this morning as the election returns bolstered the ruling Liberal Democratic Party (LDP). The LDP surprised many pundits by winning a majority of seats in the Lower House on its own (261 out of 465 in the Lower House). Not that the result was in any doubt; even if they hadn’t won a majority by themselves, they would’ve had a majority with their semi-permanent coalition partner, the Komeito, and their 30-some-odd seats. The results pushed up Tokyo stocks (TOPIX 2.2%) and thereby increased risk-taking sentiment, which results in a lower JPY.

Commitments of Traders (CoT) Report

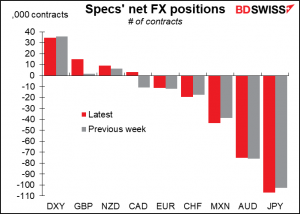

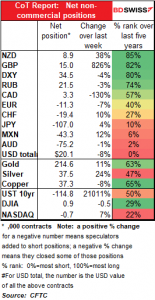

Specs cut their long USD position a bit last week, mostly by flipping from short CAD to long CAD and increasing their small GBP longs to something more substantial. On the other hand they increased their long JPY. Other moves were pretty small.

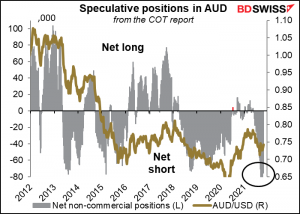

Specs trimmed their short AUD positions for the third week in a row, but they’re still extremely short. That could change suddenly if the RBA surprises us tonight – which I don’t think will happen, but I have been known to be wrong before (only once or twice though).

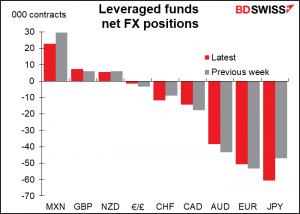

Hedge funds cut their long MXN position and trimmed their short AUD & CAD while increasing their short JPY and CHF. So going from the safe havens to the risk-sensitive currencies.

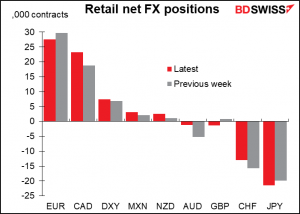

Retail too – they doubled their small NZD position, went more long CAD, and trimmed their AUD shorts considerably while increasing their JPY shorts. However they trimmed their CHF shorts a bit.

Precious metals: Specs increased their long gold and silver positions.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The big thing during the European day today will be the start of the UN Climate Change Conference UK 2021, aka COP26. Today and tomorrow is the World Leaders’ Summit. Quoting from the summit website: Welcoming world leaders to COP to put forward high level ambition and action towards securing global net zero and keeping 1.5 degrees in reach; adapting to protect communities and natural habitats; and mobilising finance. You can watch the proceedings live on their website. You can also get daily web coverage, daily reports, and a summary and analysis of COP 26 meetings at the Climate Action Network, the International Institute for Sustainable Development, and the Third World Network.

I have to say I don’t expect much from this conference. As the Washington Post put it:

At the upcoming U.N. climate summit in Glasgow, Scotland — COP26 for short — countries will face pressure to make more ambitious pledges to cut greenhouse gas emissions with the goal of keeping average global warming below 1.5 degrees Celsius, or 2.7 degrees Fahrenheit, compared to preindustrial levels.

An analysis of national climate pledges by Climate Action Tracker, an independent international collaboration of climate scientists, shows the policies of many countries are inconsistent with their public pledges to cut greenhouse gases.

Those pledges, in turn, are mostly too weak to collectively meet the goals forged as part of the 2015 Paris agreement: to keep global warming “well below” 2 degrees Celsius, or 3.6 degrees Fahrenheit, and, if possible, stop at 1.5 degrees Celsius.

But given the strong link between oil prices and inflation expectations it could conceivably have a roundabout impact on currency markets – at least on CAD and NOK. For example, if countries pledge to reduce coal consumption, that would likely mean increasing oil consumption, which could push up the price of oil.

By the way, in what must be one of the most ironic events ever, a lot of delegates flew into London and planned to take a train up to Glasgow. However all trains to Glasgow have been suspended due to bad weather, meaning hundreds of delegates to a climate conference are stuck in Euston train station because the UK’s infrastructure isn’t resilient to climate change.

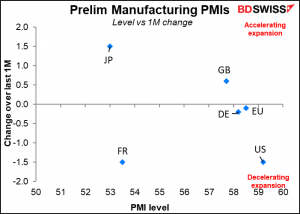

As for the indicators, the main feature is the manufacturing purchasing managers’ indices (PMIs), as usual the final ones for the major industrial economies ((Japan, Eurozone, UK, US) and the first-and-only versions for other countries. The preliminary PMIs for the major industrial economies were released about a week ago. They are often slightly revised, but the revisions are usually not enough to be market-affecting. The focus then is on the other countries and the general tone: how many countries saw an improvement and how many are backsliding?

Looking at the preliminary manufacturing indices, four of the six were below the previous month, showing some slowdown in the rate of expansion.

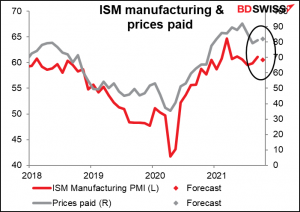

In the US, the focus will be on the Institute of Supply Management (ISM) version of the manufacturing PMI. It’s expected to fall slightly (-0.6), which would not be surprising at all since the Markit version of this index also fell (-1.5). In fact if it fell by less than the Markit version did that might be seen as a good thing. On the other hand, the prices paid index is expected to rise further, which will only confirm everyone’s fears that inflation is running wild in the US.

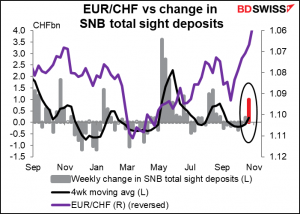

Swiss sight deposits are getting interesting! They’ve increased two weeks in a row, last week by a fairly substantial CHF 988mn, the largest since Aug. 13. What happened back in August was that EUR/CHF fell to 1.0750 and the Swiss National Bank (SNB) came in two weeks in a row and clobbered it. This time they let it get to 1.0730 without intervening, but the week of Oct. 15th they apparently came in to try to keep it above 1.07, and then the week of the 22nd they really came in as it dropped to 1.0670. The rate this week we’re looking at now it was 1.0580 so I’m expecting that they’ll have been in even more. Either that, or look out below!

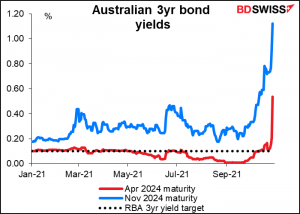

Then overnight it’s time for the Reserve Bank of Australia (RBA) to make its intentions clear. As I mentioned last week, they suddenly decided on Thursday not to defend their 0.10% target for the three-year benchmark bond, which set off a cataclysm around global financial markets – it started a wave of speculation about central banks giving up on the idea that inflation is just “transitory” and starting to tighten in response to higher inflation. The RBA also refused to defend the target on Friday.

Doesn’t this graph look like the bond market is giving the finger to the central bank? Effectively that’s what it was doing.

You can read my full analysis in my Weekly Outlook, but in any case I’ll summarize it here.

The RBA is among the most dovish of the central banks. Its forward guidance says:

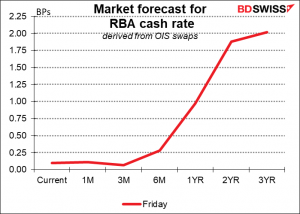

(The Board) will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The central scenario for the economy is that this condition will not be met before 2024.

The market however disagrees. It believes inflation is already sustainably over 2% and expects the first rate hike around six months from now. By 2024, when the RBA says it will just be starting its hiking program, it expects rates to be at around 1.9%, not the current 0.10%. That’s an unbridgeable difference.

I expect the RBA to officially terminate its YCC program and to adjust its forward guidance. However, I can’t see it jumping all the way from 2024 to 2Q 2022 in one leap. Therefore I expect it will remain behind the market and be perceived as dovish, which is likely to be negative for AUD.

We may hear some explanation of the RBA’s thinking later in the day when RBA Deputy Gov. Guy Debelle appears on a panel at the Impact X Sydney Summit, although this is a climate summit and has to do more with clean energy, decarbonization & climate resilience than with monetary policy.

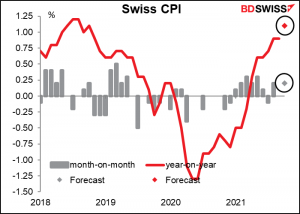

Then early in the European day we get the Swiss consumer price index (CPI). Really I don’t know why the SNB is worried about too-low inflation in Switzerland. Prices are ridiculously high for everything (mostly because the currency is ridiculously overvalued). By any rights they should have deflation. In any case, inflation is expected to rise but not to any level that would suggest the SNB can back off of its FX intervention. I don’t think this indicator will make a whole lot of difference to the market.

Source: BDSwiss